AB InBev can drink to these numbers (JSE: ANH)

Normalised EBITDA grew in line with target levels

In the year ended December, AB InBev grew revenue by 11.2%. This was assisted by volume growth of 2.3%, so most of the growth came from pricing increases. Normalised EBITDA was up by 7.2%, so you can see some margin compression in that result. The margin fell by 80 basis points to 33.7%.

At HEPS level, growth was much stronger because impairments in this period are reversed out for HEPS purposes. This metric was 46.7% higher, though the management team places all the emphasis on normalised EBITDA rather than HEPS.

Net debt to EBITDA is lower, which shareholders are generally happy to see. This important ratio came in at 3.51x for this period vs. 3.96x at the end of 2021.

With a 2023 outlook that expects normalised EBITDA to grow by between 4% and 8%, the board felt confident enough to declare a dividend of 0.75 EUR per share.

The Capital & Regional final dividend is back (JSE: CRP)

The UK-focused REIT is looking a lot healthier

In the year ended December, Capital & Regional managed to improve its loan-to-value from 49% to 41%. That’s really important, because it means that the balance sheet can support a return to paying final dividends in addition to the interim dividend declared earlier in the year.

Positive reversions of 34% on new lettings is quite something to see! With 16.9% growth in net rental income, the stronger balance sheet was made possible by a 58.5% increase in adjusted profit and a return to profitability on an IFRS basis (i.e. as reported).

Curro needs more bums on seats (JSE: COH)

This business is all about operating leverage

In the year ended December, Curro reported a strong jump in profitability. Revenue was up 17.3% and EBITDA was up 17.4%, an outcome that didn’t see any real improvement in operating margins despite the growth in revenue.

There are major expenses incurred in operating a portfolio of schools, particularly in terms of utility costs and pressures from load shedding. In that context, it’s arguably quite impressive that EBITDA margins went slightly in the right direction.

More bums on seats will definitely help here, as average learner numbers were only up by 6%. There’s plenty of excess capacity in the schools and filling that capacity drops almost straight to the bottom line. The incremental cost of another learner in the school is negligible, so this is practically an airline economics business.

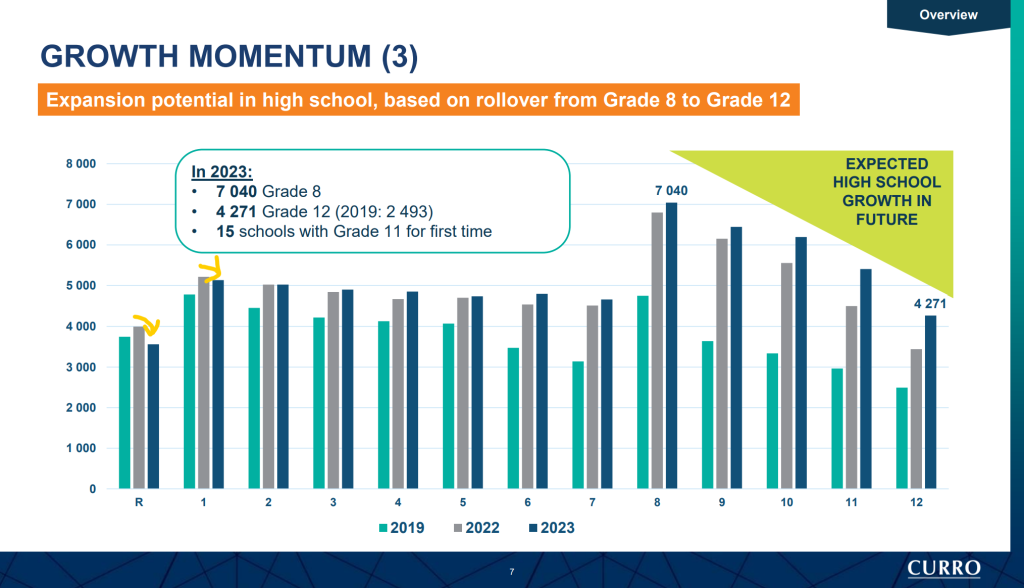

If you dig into the earnings presentation, you’ll find something that worries me as a Curro shareholder:

If you look carefully at my arrows, you’ll see that student numbers fell in Grade R and Grade 1. That’s the exact opposite of what I want to see as an investor in schools with excess capacity.

The share price fell 2.2% on the day and I suspect that this chart was part of the reason.

FirstRand remains the ROE superstar (JSE: FSR)

Return on equity of 21.8% is 170bps higher year-on-year

FirstRand’s target is to generate return on equity (ROE) of between 18% and 22%, so this result for the six months ended December is right at the top of that range.

With HEPS up 15% and the dividend up 20%, an increase in the payout ratio is a strong signal that management is happy with the current situation at the bank. The key revenue drivers both performed well, with net interest income up 13% and non-interest revenue up 11%.

Operating expenses are a focus area, up 9%. This is above inflation but below revenue growth, so margins are still heading in the right direction for now. Still, it would be better to see expenses come back towards inflationary growth levels.

Performance varied across the different segments, with Wesbank up just 6% and RMB jumping by 28%. FNB is the largest contributor of group earnings (61% of the total) and grew by 17%.

The credit loss ratio increased from 64 basis points to 74 basis points. If you exclude the UK, it actually fell from 79 basis points to 75 basis points. This is a really impressive outcome when you consider the underlying earnings growth.

Don’t tell your friends who emigrated to London, but FirstRand expects the trend in credit losses in South Africa to be better than in the UK!

In terms of outlook, FirstRand expects earnings growth in the second half of the year to be in line with the interim period.

Grindrod’s year to remember (JSE: GND)

Driven by record volumes, the share price is up 76% over the past 12 months

For the year ended December, revenue jumped by 58%. With record volumes handled by the Port of Maputo and the drybulk terminals, 2022 really was Grindrod’s time to shine.

The container business also recovered very strongly after the flooding in KZN. It’s hard to forget those images on the news of displaced containers from the depot, swept away by the force of the water.

The sale of Grindrod Bank was closed on 1 November 2022, so results have been presented on the basis of Grindrod Bank as a discontinued operation in both 2022 and the 2021 base period.

Although headline earnings from continuing operations increased by 37%, we can’t ignore impairments and fair value losses on the KZN north coast property loans and the private equity portfolio. That loss of R335.9 million is not included in the earnings from continuing operations, where it would’ve had a major impact on the headline earnings number that came in at just over R1.05 billion.

The growth in the final dividend is modest relative to the earnings story, up by 10.4% to 22.20 cents per share. If you look at the full year dividend of 95.3 cents, be careful: you need to remember that the sale of Grindrod Bank triggered a special dividend of 55.9 cents per share that won’t be repeated.

Implats was (almost) saved by rand PGM pricing (JSE: IMP)

Key metrics within the company’s control mostly deteriorated and the dividend is down 20%

Whether you look at the safety records, production numbers or unit costs, Impala Platinum mostly headed in the wrong direction for the six months ended December. There are some positive numbers of course, but it was really the PGM pricing (in rands at least) that saved the day.

Dollar revenue per ounce was down by 9%, but rand revenue per ounce increased by 5%. This was enough for headline earnings to be 1% higher, with HEPS down 2% due to the number of new shares issued to acquire Royal Bafokeng Platinum shares in this period.

I quite enjoy the way they split out capex, with a category called “stay-in-business spend” that was 15% higher at R3.2 billion. Replacement capital was up 88% to R1.1 billion and expansion capital of R0.7 billion was 191% higher. Overall, capital expenditure was 39% higher.

Despite free cash flow being 27.4% lower at R11 billion, there was enough liquidity in the system for the board to declare an interim dividend of 420 cents per share. This is 20% lower than the comparable period.

MultiChoice: a blue Sky strategy for Africa (JSE: MCG)

The grand plan for Showmax has been revealed

This is really big news for MultiChoice, as the company puts forward a growth strategy beyond DSTV, a business that is firmly in sunset territory among higher income customers.

With a footprint in 50 markets in sub-Saharan Africa, MultiChoice is the obvious partner of choice for content businesses looking to tap into this market. The ongoing investment by Canal+ in recent times has raised a few eyebrows along the way, with many wondering what plans could be in the pipeline.

The latest announcement features Comcast ($CMCSA), not Canal+, with the exciting news that MultiChoice will be partnering with NBCUniversal and Sky to build Showmax into the leading streaming service in Africa. Of critical importance here is access to live English Premier League football, with sport as the Achilles’ Heel of most streaming offerings.

The new Showmax Group will be 70% owned by MultiChoice and 30% owned by NBCUniversal, with the holding company domiciled in the UK. The technology will be based on NBCUniversal’s Peacock platform, which has over 20 million paying subscribers in the US.

This looks like an exceptionally good move by MultiChoice, particularly because so much of the content is already being produced for the satellite TV business. This shouldn’t be the cash burn strategy of Netflix and Disney+ for example, but rather gives MultiChoice a long-term business model that looks far more sustainable than DSTV in its current form.

Pricing for the “new” Showmax hasn’t been announced yet.

Nedbank’s post-COVID plan is ahead of schedule (JSE: NED)

The bank took advantage of favourable conditions in 2022

As I wrote about at the start of last year, conditions looked favourable for local banks. Interest rates were clearly on the up and balance sheets for corporates and individuals were getting larger because of inflation. With more debt out there at higher rates, banks make money.

As you’ll see in the Sasfin update further down, that only applies if the credit loss ratio is kept under control. Nedbank appears to have had no such issues, with HEPS for the year up by between 17% and 22%.

The bank’s diluted HEPS result is higher than what was originally targeted for 2023, so earnings are running one year ahead of schedule. With detailed results due on 7th March, we will get a better sense of the underlying drivers of this performance.

Prosus looks to exit OLX Autos (JSE: PRX)

A slowdown in the second-hand car market has spooked Prosus

In case you’re wondering, the best time to sell a business is when it is growing strongly and you can maximise the exit. The second-best time to sell a business is while you still have a business.

Having missed the opportunity for the former, Prosus is choosing the latter with OLX Autos. A slowdown in the second-hand car market due to macroeconomic factors has impacted the business across its global markets.

Prosus plans to sell OLX Autos, a move that would improve the profitability of the classifieds business as a whole. The rest of the classifieds business is apparently profitable, free cash flow positive and fast growing.

Sanlam goes sideways (JSE: SLM)

Despite a strong rally this year, the 12-month view paints a different picture

Sanlam has rallied over 20% this year as part of a general equity market recovery. Insurance companies are exposed to broader asset values as investment returns are firmly part of the story. We can see this come through in the 2022 numbers, which were flat overall thanks to good news on one hand and bad news on the other.

The positive story in the earnings came from lower mortality claims as COVID retreated from our lives. The negative story was in the investment returns, which suffered in a year that was shocking across equity and fixed income markets. Looking deeper, the Indian operations put in a strong performance but the South African underwriting experience was weaker.

This is what happens when a group is highly diversified: there are juicy parts and ugly parts. Over time, you hope that the good stuff will outweigh the bad stuff.

In 2022, things came out pretty even. Diluted HEPS will be between -5% lower and 5% higher than in the prior year. The share price is down around 9% over the past 12 months.

Santam wishes it had gone sideways (JSE: SNT)

The KZN floods were the largest catastrophe in 104 years

We have so many disasters and sources of stress in South Africa that the timelines become a little hazy. The floods in KZN happened in April 2022, so that impact is firmly in Santam’s 2022 numbers. As the largest catastrophe faced by the insurer in 104 years, the net impact of R567 million is a reminder that insurance is a risky business.

The gross exposure was R4.4 billion, which is also a reminder why reinsurance is such an important industry.

The core business grew in 2022, so the 27% drop in HEPS isn’t a result of a demand problem. Conventional insurance gross written premium increased by 8%, with that benefit offset by a deterioration in the net underwriting margin from 8.0% to 5.1%.

I had a chuckle at the comment that MiWay has significant growth potential, but a focus on profitability meant that there was subdued growth. I mean, anything has growth potential if the profits don’t matter! It sounds like the economics in the short-term game in South Africa have become difficult, not least of all because of huge levels of competition.

Despite the pressure on profitability, the final dividend of 845 cents per share is 7% higher than last year.

Sasfin’s return on equity just gets worse (JSE: SFN)

And to be honest, it was already pretty bad

Sasfin has been a major disappointment for investors, having halved in value over the past five years. The company destroys economic value for shareholders, with a return on equity in the six months ended December of just 7.97%. Put differently, shareholders would be better off if Sasfin took their funds and invested them in fixed deposits at other banks!

Yikes. This is especially terrible when other banks have had a fantastic time in 2022, with the likes of Absa reporting return on equity not seen in years at that bank.

The issue isn’t in income growth, which came in at 12.6%. Net interest income grew by 25.5%, with the loan book at healthy margins (before impairments). Non-interest revenue was flat, which isn’t great.

Operating costs were well controlled at growth of 6.9%.

So, where did the story break? Look no further than impairments, where the credit loss ratio blew out from 23 basis points to 130 basis points. Economic challenges have impacted the client base and Sasfin has to raise provisions for those risks.

It’s so bad that the interim dividend is gone, with the directors choosing to preserve capital.

The only bright spot in this result was Sasfin Wealth, which grew operating profit from R21.6 million to R58.8 million. For context, Business and Commercial Banking swung from a profit of R17.2 million to a loss of R31.2 million.

Ouch.

Little Bites:

- Director dealings:

- Directors of Gold Fields (JSE: GFI) are selling shares at pace, with three directors selling over R10.5m worth of shares in total.

- It’s good to see directors of Sibanye-Stillwater (JSE: SSW) buying the stock. The Chairman added roughly R370k in shares and the Chief Regional Officer in the Americas bought ADRs (which trade in the US) worth around $283k.

- After Hudaco (JSE: HDC) directors exercised share options, the CEO kept a substantial chunk of the shares. It’s common to see directors selling enough to cover the tax, but they don’t always keep the “non-tax” piece.

- Christo Wiese sold R52.5 million worth of Invicta preference shares (JSE: IVTP) to his son, Adv. JD Wiese.

- After slipping below R2 in afternoon trade, my warning about the share price of Murray & Roberts (JSE: MUR) seems to have been valid. With the company clearly in trouble at balance sheet level, there is even a consolidation of board committees to try and streamline the group. There are reasons to be worried here.

- There are plenty of opportunistic bids in the market for Jasco Electronics (JSE: JSC) at 12 cents per share. If you’re wondering why, it’s because Community Investment Holdings will be making a general offer at 16 cents per share. These things don’t happen overnight, with various regulatory hurdles to jump through. For those getting it at 12 cents, that’s a 33% return on this deal (assuming it all goes through). The tiny volumes mean that the absolute profit is very small, unfortunately.

- Sebata Holdings (JSE: SEB) is as illiquid as it is obscure. The company was trying to sell its 55% in Freshmark Systems for R24.75 million but that deal has fallen through as the buyer couldn’t put the money together.

- Lebashe Group now holds 22.8% of EOH’s (JSE: EOH) ordinary shares in issue.

- Johan Holtzhausen (of PSG fame and the current chairman of CA Sales Holdings) has been appointed to the board of KAP Industrial Holdings (JSE: KAP) as an independent non-executive director.

- Mantengu Mining (JSE: MTU) announced the resignation of both the CEO and Financial Director, with a new Financial Director named in the announcement.