Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Absa’s share price is as red as its branding (JSE: ABG)

A voluntary trading update resulted in a 6% drop in the share price

The market really didn’t like this one. When a company updates its guidance to reflect return on equity “somewhat lower” than last year, that’s not great.

Starting at the top, revenue growth in 2023 at Absa is expected to be high single digits, driven by net interest income as we’ve seen at the other banks as well. The second half of the year has been slower due to base effects, which is also in line with what we’ve seen elsewhere.

The credit loss ratio is expected to exceed the through-the-cycle target range of 75 to 100 basis points. It’s better in the second half of the year, but is still above target.

Operating expenses are up by high single digits, which means the cost-to-income ratio has deteriorated from 51.2% last year. This is negative jaws, which isn’t what we’ve seen at the other banks where margin is improving. I’m sure this is one of the major reasons for the drop in the share price.

Pre-provision profit will only increase by mid-single digits.

The group’s B-BBEE deal became effective on 1 September and will reduce 2023 earnings by 1%.

When all of this is combined, return on equity (the key metric for banks) is lower than 16.4% last year but above the cost of equity of 14.5%. As mentioned earlier, the wording “somewhat lower” suggests that it has moved quite a bit towards the cost of equity, which isn’t great.

The overall flavour here is that South African earnings have decreased and the African earnings have increased, despite the tough situation in Ghana. This is why a bank like Standard Bank is doing so well, as it earns nearly half of its earnings in Africa.

Absa expects to maintain a full year dividend payout ratio of at least 52%.

Anglo American’s SENS announcement talks about unlocking value (JSE: AGL)

The market had a different idea, slashing the share price by over 13%

When a company tries to drive the narrative in the heading of a SENS announcement, you know they are expecting a tough response. This isn’t just an “operational update” from Anglo American. No, this is “Anglo American unlocks value through operational, cost and capital discipline” – except the market is smarter than that, even if many media houses are too lazy to read past the headline.

The CEO of Anglo American kicks off the announcement by claiming that the prospects for mined products have rarely looked better. That’s a rather interesting introduction to a story that features cyclical weakness in PGMs and diamonds, forcing Anglo American to cut its business support costs.

The group gives high-level guidance all the way out to 2026, expecting production to fall in 2024 and 2025 before picking up again in 2026. The guidance for capex is also lower than before, which doesn’t exactly tie in with the prospects looking so great.

It’s sad to see them talking about “aligning to logistics” at Kumba. That simply means that they are having to adjust production based on how utterly useless Transnet is. Refer to the specific update on Kumba in Ghost Bites for more details.

They do make the point that PGM prices reflect an “aggressive consensus” on the pace of decline in internal combustion engines. Although not referenced in this report, I know that Ford is slowing down its global investment in EVs based on worries about demand. Comments like that from the automotive manufacturers don’t seem to be reflected in PGM prices, which suggests some upside for the local mining houses.

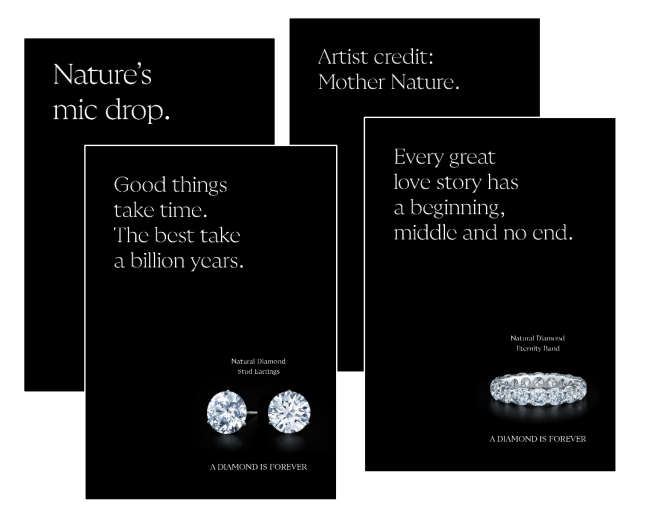

At De Beers, they are scrambling to reposition mined diamond to fight the onslaught of lab-grown diamonds. I’ve written extensively on this topic and I quite liked these adverts from the Anglo presentation (which you’ll find at this link).

Much of the good news at Anglo American lies in the copper business and crop nutrients, believe it or not. These are both focus areas going forward.

Anglo American Platinum reduces its production and capex outlook (JSE: AMS)

This is how mining cycles work

When commodity prices drop, the producers of those commodities must respond to the drop by pulling back on production. Over time, the lower supply should lead to higher prices, which in turn drives a period of investment to meet demand at better prices. This is why mines are always referred to as being cyclical businesses and why you have to time your entry very carefully to avoid buying at the top of the cycle when it’s all sunshine, rainbows and dividends.

We definitely aren’t in sunshine and rainbow territory in PGMs at the moment. Prices are depressed and so are shareholders. In response to the price pressures, Anglo American Platinum has announced that production over the next few years will be lower than previously guided. Capital expenditure will also be lower, accompanied by a plan to reduce costs. It should be noted that part of the reduction in refined PGM production is because some relationships will transition to toll arrangements.

Refined production in 2024 was previously guided to be 3.6 to 4.0 million ounces. It’s now between 3.3 and 3.7 million ounces. In 2025, guidance has dropped from 3.3 – 3.7 million ounces to between 3.0 and 3.4 million ounces. Production is 2026 is expected to remain flat vs. 2025.

As noted, capex guidance has dipped by roughly R3.5 billion in 2024, but actually moves higher than guidance in 2025.

The cash operating unit cost per PGM ounce is expected to be R17,800 in 2023 and is anticipated to drop to between R16,500 and R17,500 in 2024.

Kumba continues to be hurt by Transnet (JSE: KIO)

It’s all going wrong “beyond the mine gate”

In case you’ve been living under a rock for goodness knows how long now, infrastructure in South Africa is crumbling all around us. Our economy is heavily influenced by commodity exports, so this is a disaster. Most worryingly, it’s a disaster that just doesn’t seem to be going away.

In Kumba Iron Ore’s update, the company talks about stock levels at the mines increasing to unsustainable levels because the transport infrastructure just doesn’t allow for it to be taken away quickly enough. The only possible outcome is a drop in production, with 2023 production down by roughly 1 million tonnes vs. previous guidance. That might only be around a 3.8% decrease at Sishen, but it has a substantial impact on unit costs per tonne at that mine (up from between R540 – R570 per tonne to R570 – R590 per tonne). As a mitigating factor, unit costs at Kolomela have improved from guidance of R510 – R540 per tonne to R480 – R500 per tonne because of improved production metrics and because production guidance at that mine is unchanged.

The bigger problem for South Africa is lower production in years to come. The production outlook is dropping from 37 – 39 million tonnes in 2024 to between 35 and 37 million tonnes. In 2025, they hoped to increase to 39 to 41 million tonnes, but now the plan is to keep production flat.

Thanks to cost reduction plans, the unit cost is forecast to improve over the next three years despite the flat production. If we actually had a working railway network, they might be talking about creating jobs rather than reducing costs. They also probably wouldn’t be talking about a reduction in capex spend, which certainly doesn’t help our GDP.

There has been a 15% decrease since 2019 in the amount of ore that is being railed. If Transnet doesn’t figure this out, then it’s hard not to have a bearish outlook on the South African economy.

Some good news from Murray & Roberts (JSE: MUR)

The board has given a strong update that a rights issue is not being considered at the moment

Murray & Roberts has been firmly in survival mode, with a broken balance sheet and all kinds of troubles. The market has been concerned that an equity raise might be needed to get it on a sustainable footing. In response to the news that “meaningful progress” has been made on the balance sheet, the share price closed 13.6% higher on Friday!

When something is priced for failure, any good news is cause for a share price celebration. Welcome to speculative investing. Or having a good ol’ punt, as I like to call it.

A big help was the sale of the 50% shareholding in the Bombela Concession Company, which halved South African debt to R1 billion. With the sale of a non-strategic investment in Aarden Solar and the agreement of new commercial terms on one of the group’s largest mining projects in South Africa, debt was further reduced to R770 million over the past three months.

Finally, Cementation Canada has renewed its banking facility with a Canadian bank and will thus pay a dividend of roughly R550 million (excluding withholding taxes) to Murray & Roberts over the next six months to June 2024. This is a classic case of shifting debt from the holding company into a subsidiary. This will take the South African debt down to R350 million.

Based on this, the board does not believe that a rights issue is necessary. The intention is to refinance the remaining South African debt by June 2024. A further bit of good news is that operational costs and overheads have been significantly reduced.

Little Bites:

- Director dealings:

- The CEO of Datatec (JSE: DTC) loaded up on shares in a big way, buying a whopping R46 million in shares on the open market. This takes his total shareholding to 15.5% of the shares in the company.

- The CEO of Invicta (JSE: IVT) and Dr Christo Wiese are still playing matchy-matchy, each buying shares to the value of R88k in the company. These are on-market trades, so I’m not sure what’s going on with these identical orders in the market from these two. Perhaps there’s a bet going on?

- An associate of a director of Huge Group (JSE: HUG) has bought shares worth R36.5k.

- The Tongaat Hulett (JSE: TON) soap opera continues, with three “affected persons” (including the Industrial Development Corporation) giving notice of their intention to oppose the urgent applications that were launched to try and stop the current business rescue plans.

- Astoria Investments (JSE: ARA) has renewed the cautionary announcement related to a potential acquisition. The first cautionary announced was released back in July 2023.

- The joy of being a successful listed company is that you can issue shares to pay for acquisitions. This is exactly what CA&S Holdings (JSE: CAA) has done to acquire a further 5% in Smithshine, one of the existing subsidiaries of the company. The seller is the minority shareholder in that company and that seller was happy to be paid in shares. The issuance is only for around 0.1% of existing shares in issue in CA&S.

- Tiny listed group Nictus (JSE: NCS) released results for the six months ended September. They reflect a significant improvement in profits from a loss of R0.4 million to profit of R3.7 million. No dividend was declared for this period.