Absa is a solid bank these days

This really has been an impressive story

Very few people use “Absa” and “high performance” in the same sentence, yet the post-Barclays reality for the bank has been something to behold. Released from the shackles, the bank may be red but the results have been green.

For the year ended December 2022, headline earnings per share (HEPS) is expected to increase by between 10% and 15%. There are major macroeconomic headaches in Ghana, without which normalised HEPS would’ve been up by more than 20%. This gives a good indication of how the rest of the group is performing, as the exposure to sovereign bonds in Ghana is an isolated (and annoying) issue.

Revenue increased by mid-teens in 2022, with non-interest revenue (NIR) growth as a major contributor. This is always terrific news for a bank, as it drives Return on Equity (ROE). When ROE is higher, the bank trades at a better Price/Book multiple. In other words, shareholders make money.

Pre-provision profit growth is expected in the mid-20s (which is brilliant) and the cost-to-income ratio is dropping to the low 50s. The bank is becoming more efficient relative to its revenue.

Critically, the credit loss ratio is expected to be similar to the interim level of 91 basis points, excluding charges related to the Ghana sovereign bonds.

ROE is expected to be slightly below 17% including Ghana, or 18% without it. Either way, that’s well in excess of the cost of equity, so Absa is doing all the right things for shareholders. With the dividend payout ratio going up as well, this is an excellent performance even with the pain in Ghana.

Aveng drops after a trading statement

Normalised earnings have decreased sharply

For the six months ended December, Aveng managed to increase group revenue by 16%. McConnell Dowell in Australia was a helpful contributor here with revenue growth of 22%. In South Africa, Moolmans is experiencing a drop in revenue based on project timing vs. the prior period. Revenue at Trident Steel (the business being sold) is up 58%.

The pipeline (measured by “work in hand”) has increased by 64% since 30 June 2022.

Despite the efforts of the Australian business, group operating earnings are expected to be lower by 13% to 17%. Without any normalisation adjustments, headline earnings per share (HEPS) is expected to increase dramatically from 14 cents to between 59 cents and 64 cents. The problem is that once normalisation adjustments are included, the earnings aren’t nearly as rosy.

Normalised earnings are expected to be 44% to 52% lower in this period.

Detailed results are due on 21 February, so investors won’t have to wait long to get the details.

Barloworld: heavy on the narrative

Light on the numbers

Hot on the heels of Zeda’s excellent update the previous day, Barloworld has updated the market on trading conditions for the four months ended January 2023. Remember, Zeda (the mobility business – car rental etc.) was unbundled by Barloworld at the end of 2022.

In Barloworld’s update, there’s a LOT of commentary and not much in the way of numbers, so we need to read carefully and figure out what the most important points are.

In the Equipment southern Africa business (and yes, they use a small “s”), demand from the mining sector has driven solid revenue numbers in both machine sales and aftersales parts. They make more profit on the latter, so a shift in mix towards machine sales has resulted in a slightly lower operating margin. With a strong order book for the rest of the year, there has been investment in working capital. You can expect to see that impact on the balance sheet.

Notably, things are looking up in the DRC, where the Bartrac joint venture is posting profits and is expected to continue to do so.

In Equipment Eurasia, Mongolia is doing well and Russia is performing ahead of expectations. The Russian results are obviously down from the prior period (which happened to be a record), but Barloworld is trying to find a way to operate responsibly. Remember, with our political affiliation to BRICS, this isn’t the situation that faced US companies who were forced to pull out of Russia almost overnight. In Mongolia, the business was positively impacted by the opening of borders in China, allowing products and commodities to flow freely.

Overall, Mongolia is expected to be up year-on-year on all metrics and Russia is less of a drag than expected.

The Ingrain business (which you may recall was acquired from Tongaat Hulett) achieved “strong” revenue growth and “EBITDA at similar levels” to the prior period, which means margins contracted. Here’s a fun excerpt telling us that things are so bad in South Africa that we don’t even bother with the alcohol and coffee anymore, we just head straight for the chocolates drawer:

Barloworld is very good at balance sheet management. For me, they were the stand-out performer in the pandemic in terms of managing a crisis and coming out even stronger. I’m not surprised that the group is happy with the state of the balance sheet.

Look out for a pre-close update closer to the end of March.

Blue Label Telecoms is still hard to understand

Even accountants struggle with this one

Blue Label Telecoms is one of the trickiest companies on the JSE to get your head around. They are masters of doing highly complicated deals that usually end up disappointing shareholders. A share price that is down 58% over five years is proof of that.

In complexity though, one finds opportunity. Over three years, the share price has more than doubled. This is a highly volatile stock, which is why traders like it. There isn’t much excitement for traders in focusing on a company that trades in a tight range and goes up 7% every year.

The latest update is perfectly on brand for Blue Label Telecoms, because hardly anyone understands it. The share price dropped 5% in frustration, with group earnings down spectacularly. Even core headline earnings per share was down between 92% and 96%.

There were huge losses recognised on the Cell C investment, including the impact of the restructuring of the business. If we casually ignore that, then HEPS would be up 14%.

Blue Label is trading at the same levels as during the aftermath Global Financial Crisis. For those of you who are too young to remember, that was in 2008/2009. Whilst I can understand why traders try hard to get on the right side of these spectacular upswings, this management team’s track record with capital allocation is truly horrible. I wouldn’t have a long-term investment here.

Dis-Chem reports uninspiring retail sales numbers

On a like-for-like basis, consumer pressures are showing

With a drop in the share price of around 2.3% after releasing this announcement, the market has spoken. Dis-Chem trades on a high earnings multiple and that makes it vulnerable to any slowdown in performance.

For approximately the 5 months to the end of January, the group achieved revenue growth excluding COVID-related products (like vaccines) of 8.7%. That sounds ok, but like-for-like revenue growth in the retail side of the business was only 4.4% and that isn’t ok. An important difference between those numbers is the acquisition of Baby Boom, which was rebranded to Dis-Chem Baby City.

The company highlights vitamin C and zinc sales in the base period as a factor in the slower retail sales growth. They wouldn’t strip those out as being purely COVID-related, as as these products were accelerated by COVID but not entirely reliant on it. This is part of why growth is lower. Still, it seems incredible that those two products can have such an impact at group level.

Dis-Chem doesn’t suffer as much from load shedding as retailers with cold chains, but the diesel expense was still 54% higher at R36 million over this period.

The wholesale business is doing well, with external customer revenue up by 18.7% and overall wholesale revenue up by 8.6%. The Local Choice (TLC) franchise stores achieved revenue growth of 21% and there are now 165 of these stores.

Discovery pretends that interest rates don’t exist

“Normalised” earnings look great, at least

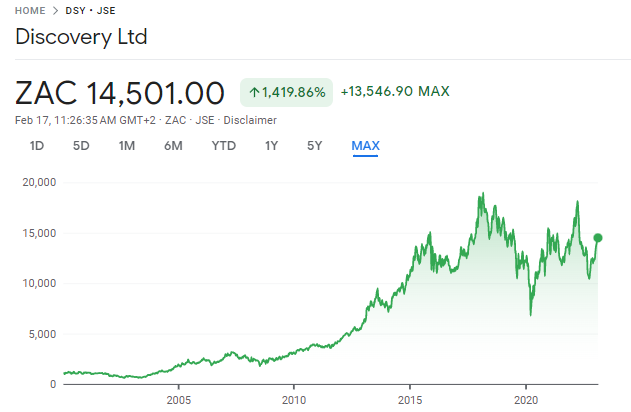

If you bought shares in Discovery in October 2015 and ignored your broking account for 7.5 years, what would your gain on your Discovery shares be?

Zilch. Nada. Nothing.

The dividends don’t cut it, I’m afraid. After Discovery won huge market share and became a household name in South Africa, the returns stagnated and things got a lot harder. Check out this share price chart:

If this investment was on Vitality, it would be Blue Status. There wouldn’t even be a discounted smoothie.

With headline earnings for the six months ended December expected to decline by between 7% and 12%, it doesn’t seem to be improving. There’s always something causing an issue. But on a “normalised” basis, the growth is magically between 27% and 32%.

POW! Straight to Diamond Status you go, thanks to a few adjustments. The market is smarter than that, with a small positive share price move based on this announcement.

The normalisation is driven by adjustments for the effects of interest rate changes. These apparently have no impact on the operations, yet they can swing a drop in headline earnings into an increase of potentially over 30%.

No impact indeed. I think we can all agree that interest rates can’t just be ignored.

Looking through the noise, what do investors need to know?

There isn’t a huge amount of detail in this trading statement, but we do know that Discovery Bank is performing in line with the plan. The group aims to bomb 10% of normalised operating profit on new initiatives, with the numbers running close to this level. As for whether investors will ever see a return on Discovery Bank, the jury is still out.

The other important news (and a contributor to negative earnings in this period) is that the lifting of zero-COVID lockdowns in China has led to waves of infections. Ping An Health Insurance has taken a conservative approach to provisions here, although claims have been limited thus far. The investment returns in China also took a knock in this period, though lifting of lockdowns should help with that as Chinese equity markets have rallied considerably.

Steinhoff: ugly, but fair

Sadly, life just isn’t fair

The agreement that Steinhoff is trying to implement with its creditors is a hideous outcome for shareholders. It remains beyond me why anyone is buying shares in Steinhoff at the moment. Nevertheless, it is still trading at 35 cents per share.

Although there really isn’t much left for shareholders in this structure, the reality is that the situation is “fair” to shareholders in the financial sense. EY was engaged to provide a fairness opinion and has made various assumptions in the process, mainly around the lack of meaningful restructuring alternatives for Steinhoff.

On that basis, the proposed restructuring has been found to be fair. If you’re curious, you can read the opinion here.

Little Bites:

- Director dealings:

- The directors of Jubilee Metals certainly bought the dip this week. The CEO put R535k behind the company, the independent chairperson bought R646k worth of shares and the ex-chairperson was good for R408k. With the share price under serious pressure in recent days, the market liked this.

- Jonathan Ackerman has taken early retirement as an executive director of Pick n Pay, marking another step that the family has taken away from the retailer. Having said that, he will stay on the board in a non-executive role.