Listen to the latest episode of Ghost Wrap here:

Absa’s HEPS could only inch forwards (JSE: ABG)

The strong share price rally over the last three months looks to be fading

Absa’s share price is up around 12% over the past 12 months, mainly a function of its relative valuation and some relief in the pain of load shedding. It closed as high as R189.45 at the end of July, with that price point as a rapidly diminishing memory with the price closing at R177.76 on Monday after the release of results.

With operations in 15 countries, Absa is a meaty operation. It also has complications like various African exposures, some of which have bitten the group recently as currency and fiscal volatility plays out in the region.

For the six months to June, HEPS on a normalised basis (adjusting for the separation from Barclays, which is a sensible adjustment) only increased by 2.7%. This is despite total income increasing by 12.8% and the cost-to-income ratio improving from 51.2% to 49.8%.

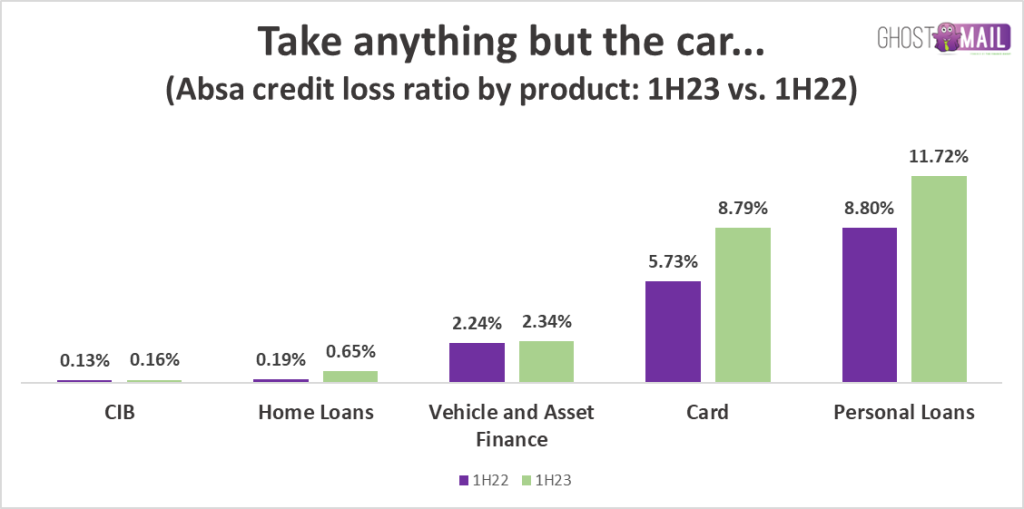

The only explanation can therefore be the credit loss ratio. Sure enough, it has jumped from 0.91% to 1.27%. This means that impairments were 60% higher at a whopping R8.3 billion as the group made provision for these economic conditions. Pre-provision operating profit was up 16%. It’s tempting to think that this tells you what would’ve happened in a consistent economic environment, but this level of growth is also a function of a higher rates environment. You can’t have higher rates without a deteriorating credit outlook.

Return on equity has fallen from 17.5% to 16.7%.

Unsurprisingly, loans to CIB (corporate and investment banking) customers were up 11%, which is higher than growth in loans and advances in the retail and small business books. Corporate balance sheets are in much better shape at the moment than individual borrowers.

To give an idea of just how bad it is getting out there, home loan impairments were up 258% as the credit loss ratio jumped from 0.19% to 0.65%. If you could accurately mark-to-market your property investment right now, I’m quite sure your share portfolio would be the last thing keeping you out at night.

The pain in the property market hasn’t even begun yet. Watch this space.

And if you’re wondering about other products, here are some credit loss ratios to put it all in perspective:

Hulamin: does it ever generate free cash flow? (JSE: HLM)

Earnings don’t help if the cash doesn’t reach shareholders

For the six months to June, Hulamin managed to grow normalised HEPS by 94% to 70 cents. That sounds delightful, especially on a share price of R2.92 (down 7.89% for the day).

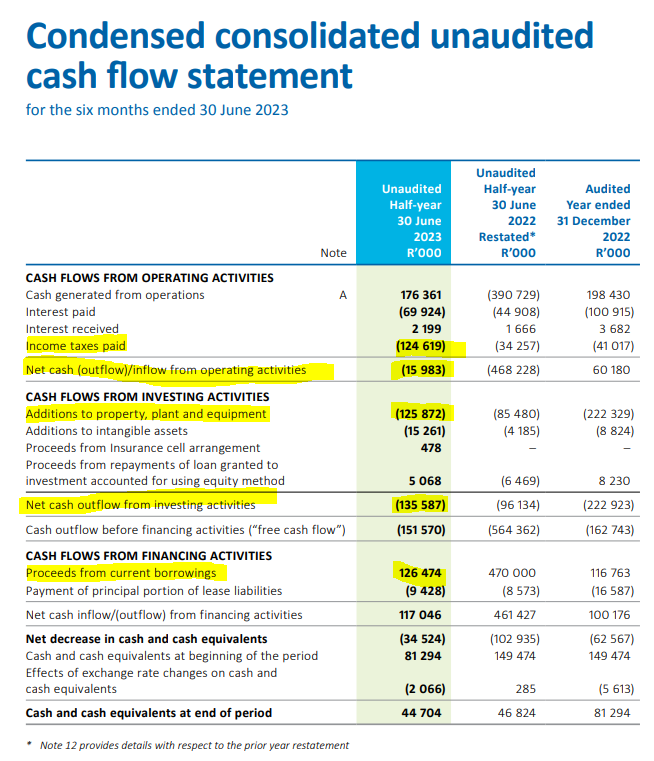

Why did the share price drop sharply? The answer can be found on the cash flow statement.

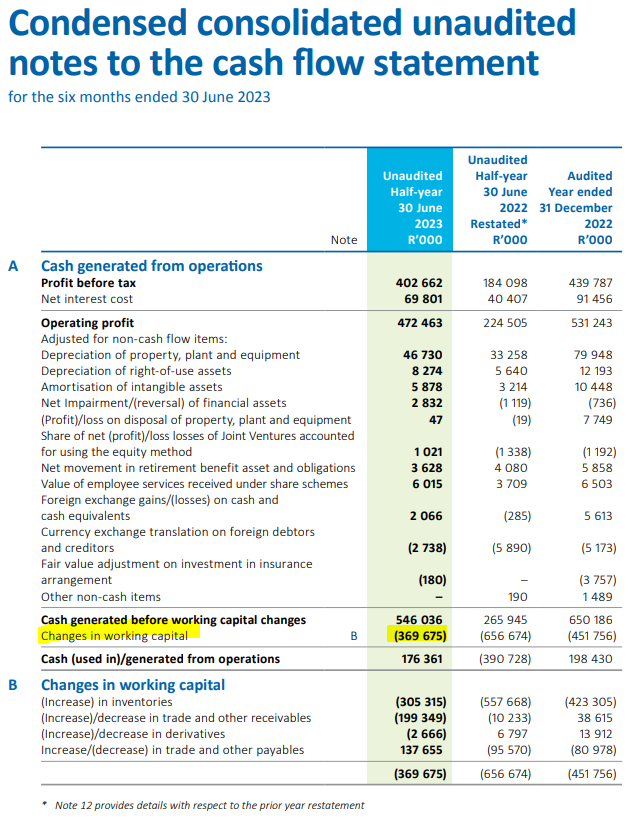

The first problem is the big jump in working capital, which eats up a big chunk of cash from operations:

The next problem is that once you take off tax, there isn’t even a positive balance before we deal with capital expenditure of R125.8m. This is why the group keeps funding its growth using current borrowings rather than internally generated cash flows:

If you look carefully, that issue isn’t unique to this period either. With no dividend declared for this period and a clear issue in how the business is funding its growth, I’m not surprised that the market got spooked by the release of detailed results.

Italtile is facing a perfect storm (JSE: ITE)

New builds and renovations just aren’t happening in this environment

Much like sector peer Cashbuild (JSE: CSB), Italtile is really struggling in these conditions. Just think logically about your own financial situation and level of confidence in our country right now: are you willing and able to invest heavily in a new property or a major renovation? What about your friends? That’s what I thought.

With massive inflation in basic living costs alongside the impact of higher rates on the cost of debt, disposable income is thin on the ground. To make it worse, Italtile has flagged increased competition from global players as another major challenge.

Despite price inflation of 6.7% in Italtile’s retail business, like-for-like turnover fell by 0.3% in the year ended June. This means that volumes tanked by 7%. On the manufacturing side, sales increased by 4.1% despite volumes dropping. Manufacturing businesses have high levels of operating leverage (fixed costs), so sales growth below inflation will lead to an ugly result in operating profit when full details are released. The final segment is the import business, which suffered a drop in sales of 4%.

Across the group, gross margin fell by 240 basis points. That’s significant.

Against this backdrop, it’s probably a pretty good outcome that HEPS is down by “only” 11% to 16%. This is a range for HEPS of 127.8 cents to 135.3 cents. The share price closed 1.22% higher at R12.40.

Lighthouse is still paying out more than earnings (JSE: LTE)

And once again, there’s a scrip dividend alternative on the table

Lighthouse Properties reported 0.62 EUR cents of distributable earnings per share for 1H23. Despite this, the dividend is 1,350 EUR cents per share, so that’s a payout ratio of 218%. You won’t see that every day.

Despite clearly supplementing the dividend from retained earnings, the distribution is actually down 16.9% year-on-year.

Full-year guidance has been reduced from 2.8 EUR cents per share to 2.7 EUR cents per share, a result of Hammerson (JSE: HMN) reducing its dividend payout ratio. Assuming this is achieved, it would utilise the remaining distributable retained earnings.

MTN announces earnings, with the market’s focus firmly on Fintech (JSE: MTN)

A deal with Mastercard has shone the light on what the Fintech business is worth

The telecoms space has been very tough recently and arch-rival Vodacom has suffered a setback in its bid to become a fibre powerhouse, with the Competition Commission trying to block the deal with Vumatel and Dark Fibre Africa. MTN must be glowing about having such positive news to share against this backdrop.

The good news isn’t to be found in the earnings. Although MTN’s service revenue increased by 16.5% and EBITDA was up by 12%, HEPS could only increase by 7.1% and there is no interim dividend, although I think the market was only realistically expecting a final dividend anyway. MTN has committed to a minimum of 330 cents per share for the full year.

Instead, the good news was firmly in the announced Mastercard transaction, with MTN Group Fintech being valued at $5.2bn. With a group market cap of around R244bn, I’m not sure many people had put a valuation of roughly R100bn just on the Fintech business. It makes a world of sense for both parties, with the market celebrating this news with a 4.9% rally in the share price. The announcement didn’t give any further details and we also don’t know what Mastercard’s stake will be. All we know is that MTN will retain control of its Fintech business.

The balance sheet is becoming a concern again, with holding company leverage up from 0.8x at the end of December 2022 to 1.5x at the end of June. The group level debt isn’t an issue at all. The problem is that MTN cannot get all of its cash out of Nigeria and Ghana, so the problem is where the debt is rather than the overall quantum of group debt.

Without the Mastercard news, the share price would be singing a different tune at the moment.

Nampak needs a R1bn rights offer to survive (JSE: NPK)

Shareholders must wait until 2027 to earn “economic profits”

There’s a lot to unpack here. Let’s start with the debt refinancing.

All but one small lender have now agreed to a debt refinancing package for Nampak, which means they are happy to keep the company alive subject to conditions including an equity capital raise and the disposal of non-core assets. The banks love this because they are the only ones who will actually earn economic profits from Nampak: a return commensurate with the level of risk. Equity holders won’t be so lucky, although it gets even more technical than that. I’ll come back to this later.

The revised debt structure envisages R5.1bn in debt at Nampak Products Limited and R286m as well as $34.6m at Nampak International. There is also over R1.9bn in debt related to Angola and Nigeria that will be housed in an intermediate holding company. Within this package is a mix of term debt (repaid over an agreed period) and revolving debt (more like an access bond on your home that gives ongoing access to debt). This is important to give Nampak some ongoing balance sheet flexibility.

This is the structure that would be in place after a successful implementation of a rights offer and asset disposal plan. The rights offer is to raise R1bn, which is hugely dilutive on a market cap below R600m. The non-core asset disposal plan is even more ambitious, with plans to sell R2.6bn worth of assets. Even if they get this right, the net debt to EBITDA ratio will be below 3x by FY24 (which is high) and below 2x by FY25 (manageable but still high).

With all said and done, Nampak would be a R10bn revenue business consisting of Bevcan SA, Bevcan Angola and Divfood. EBITDA margin would be between 10% and 12%. Working capital would sit at between 19% and 21% of turnover and the annual capex bill is expected to be R250m although it will be higher in the immediate future based on existing projects.

To get it done, Phil Roux has now been appointed as the CEO. He has a ton of experience in the FMCG sector.

We can now deal with the “economic profits” concept raised earlier, which is a measure of returns generated by Nampak vs. the weighted average cost of capital (WACC). The goal of simply being profitable is reserved for useless state-owned enterprises like SAA. A private company needs to not just be profitable, but generate an attractive return on capital. Simply, if I asked you to invest R1m in a project that makes annual profit of R100, would you do it? Of course not.

Nampak only expects to generate Return on Invested Capital (ROIC) ahead of WACC by FY27. In other words, from a theoretical standpoint, Nampak actually shouldn’t exist as a company until that point.

There’s a final step in this dance. There are many companies out there that can’t beat their weighted average cost of capital. As a result, they trade at a discount to net asset value (NAV), as shareholders aren’t prepared to pay the NAV in exchange for sub-par returns. This means that if the plan works, Nampak should theoretically trade at 1x NAV or higher by FY27. That’s a bit like a pull-to-par concept in fixed income investing.

If you want to have a punt here, make sure you’ve done the proper analysis and that you correctly take into account the huge rights offer on the table. Personally, I’ll wait until after the rights offer to even consider an entry here. If for any reason they can’t raise the capital, Nampak would likely face an existential crisis and that almost never ends well for shareholders.

Northam adds to the woes in the PGM sector (JSE: NPH)

Platinum counters got absolutely smashed on Monday

The bottom 10 of the top 100 shares on the local market was dominated by PGM companies taking the top spots. Impala Platinum closed 9.8% lower, Anglo American Platinum was down 9%, Northam dropped 7.5% and Sibanye took a 6.6% bath, shielded to some extent by gold exposure.

Although PGM prices dipped and that always causes the share prices to follow suit, it’s likely that part of the market capitulation was linked to the release of results by Northam Platinum for the year ended June. Despite a 13% increase in production from own operations and a 16.1% increase in sales revenue despite a 6.9% decrease in the basket price, there was a drop in HEPS of between 2.5% and 12.5%.

The EPS story is incredibly bad, with huge impairments on the investment in Royal Bafokeng Platinum and the Eland operation.

Net debt was R9.4 billion at year-end, with R9 billion received subsequent to year-end from the disposal of the stake in Royal Bafokeng Platinum. In other words, Northam Platinum is ready to tackle the deteriorating cycle with almost no debt on the balance sheet.

That’s just as well, because PGM markets are looking increasingly weak and the market is starting to show signs of panic. Here’s a chart of the three pure-play counters in the sector, showing that what goes up often comes down in mining:

Sanlam needs to unwind its pre-Covid B-BBEE deal (JSE: SLM)

If a deal is going to fail, rather fail quickly

On my birthday in 2019, Sanlam executed a B-BBEE deal and didn’t give me a single share as a present. In the end it doesn’t matter, because the structure isn’t going to work.

The shares were issued at R70 each (a discount of nearly 10% at the time). Sanlam is now trading at R65, with the pandemic and general SA issues having put the structure into a hole that it won’t dig its way out of in time.

The external funding party is Standard Bank. If the covenants in the structure are breached, Standard Bank would likely require the structure to dispose of a large block of Sanlam shares, which would be a substantial overhang on the share price. To avoid this, Sanlam is going to buy the preference shares from Standard Bank, effectively turning this into an internally funded structure.

This still isn’t a great outcome for Sanlam shareholders obviously, as Sanlam is effectively investing in itself at an underlying price that made sense a few years ago but not anymore. Still, Deloitte has opined that the deal is fair to shareholders of Sanlam. This was the major condition to the deal as this is a small related party transaction.

Sasol’s HEPS disappointed the market (JSE: SOL)

Sasol hasn’t escaped the broader challenges for the mining sector this year

Practically every mining update in the past couple of months has followed the same playbook: commodity price pressure, some kind of production challenges (usually Eskom), issues with Transnet putting a dampener on sales volumes and inflationary impacts on mining costs that are squeezing margins.

Sasol is no different, with adjusted EBITDA for the year ended June 2023 down by between 2% and 16%. The group always focuses on reporting core HEPS, with that metric down by between 25% and 39%. This implies a range of between R41.14 and R51.14. The share price closed 5.4% lower at R254.50 a share, implying a Price/Earnings multiple of between 5x and 6.2x.

Shaftesbury gives you a UK property debt data point (JSE SHC)

Well, sort of

Shaftesbury owns a solid portfolio of properties in London’s West End. The company has raised 10-year debt funding from an existing lender and this gives us a view on the UK yield curve for property debt. Unfortunately, the company reports a blended rate alongside existing loans that mature in 2030 and 2035, so you would need to go do some digging if you want to really figure out the answer here.

For most of us, it’s just good to know that the blended rate of the new financing package plus the existing debt is 4.7%. If I understood the announcement correctly, the weighted average cost of debt for the entire fund will be 4.2% once the proceeds from this debt will be used to repay an unsecured facility.

4Sight dishes up a dividend (JSE: 4SI)

The share price jumped accordingly – with decent volumes to boot!

Diversified technology group 4Sight Holdings is barely on anyone’s radar. The share price started the year at 25 cents and is now at 39 cents, a juicy 56% return. Every now and then, local small caps pay off.

In the six months to June, revenue jumped by 37.1% and operating profit more than doubled, growing by 121.1%. By the time we reach HEPS, it nearly tripled with a 197.2% increase.

There’s a dividend per share of 2.5 cents, which is a yield of 6.4% on the day’s closing price. Not a bad yield for an interim dividend, is it?

Little Bites:

- Director dealings:

- A founding director of Famous Brands (JSE: FBR) has taken out a loan from a financial institution and has agreed to hedge R11.6m worth of shares in Famous Brands. The put strike price on the collar is R59.54 which is very close to the current price of R60.21. The call strike price is R74.88. Expiry is August 2025. This is known as a collar structure.

- It’s a tiny trade, but a director of Dis-Chem (JSE: DCP) sold shares worth R2.5k.

- Trencor (JSE: TRE) is a legacy structure the directors hope to start winding up after December 2024. The latest net asset value per share has been announced as R8.05 and the share price is R6.80.

- Jubilee Metals (JSE: JBL) is attracting seasoned executives to the business, like Neal Reynolds who has now been appointed as the CFO. He has previously held various senior roles in the sector.

- It seems as though British American Tobacco’s (JSE: BTI) debt tender offer is going well, with the company announcing early results. As part of that announcement, the company announced that the maximum aggregate purchase price was being increased in certain debt pools.

- There’s no liquidity in this stock, so Deutsche Konsum REIT (JSE: DKR) only gets a mention down here to help you compare the numbers to other European property funds you might be holding. In the first nine months of the financial year, rental income increased by 6% but funds from operations fell by 15% because of the cost of debt and inflationary pressures on costs.

ROIC – heavens, I didnt realise that Investec had full rights to this measure?

Hahaha you know, I had to read your comment about 3 times to figure out what had happened. Epic typo. Thank you!