Another banking exec crosses the floor (JSE: SBK | JSE: ABG)

This time, Absa gets a new CEO at the expense of Standard Bank

The banking industry seems to be playing quite the game of musical chairs at the moment! Fairly recently, we saw Absa lose Jason Quinn to Nedbank as he switched out his red tie for a green one. Now, Kenny Fihla will pack away his blue tie and get a red one out, as he leaves the role of Deputy Chief Executive of Standard Bank Group (and Chief Executive of Standard Bank SA) to take the role of CEO of Absa Group.

This comes after 18 years of service to Standard Bank, so that’s a massive amount of institutional knowledge that is being lost by Standard Bank. This is quite the coup for Absa and pretty much every comment I saw online was very complimentary of Fihla.

As Standard Bank now looks for a replacement, we have to wonder whether the other banks should make sure they lock their doors at night! Internal succession planning seems to have fallen by the wayside in this industry.

Hulamin signs off on a rough year (JSE: HLM)

The share price is down over 22% in the past year

Hulamin has released results for the year ended December 2024. Rolled Products volumes were up just 2% and they had a fire that impacted higher margin export products, so that sets the scene for a period in which normalised EBITDA fell by 12%.

If you want to see a particularly shocking number, then take a look at cash flow from operating activities. It fell from R363 million to R46 million. Free cash flow (i.e. after capex) was much more frightening, coming in at negative R512 million. Net debt ballooned from R867 million to R1.35 billion.

The debt : equity ratio has increased from 24.5% to 35.6% and this is definitely worth keeping an eye on. I know it was a tough year, but operating cash flow of R46 million vs. stay-in-business capex of R274 million isn’t what you want to see. At least growth capex of R295 million is a strategic decision that can be tweaked. The same can’t be said for the other type of capex.

The constant currency vs. reported earnings gap at MTN remains huge (JSE: MTN)

Will the macro story ever improve?

When Standard Bank released earnings recently, they talked about an expectation for the African currency situation to improve in 2025. MTN shareholders will certainly hope that this plays out, as the gap between constant currency and reported earnings really does make for painful reading.

Simply, it doesn’t help much if you achieve a high growth rate in a country with a rapidly depreciating currency. Sure, the percentage looks fantastic expressed in local currency, but it doesn’t equate to much once you report it in a stable currency.

To give you an idea of the difference, MTN group service revenue was up 13.8% in constant currency, yet it fell 15.4% on a reported basis. To show you the difference, fintech revenue (which is still growing quickly in the stable economies, not just the problematic ones like Nigeria) was up 28.5% in constant currency and 11% in reported currency. You can therefore see how the more traditional telecom services suffer even more than the new-age stuff. This is a direct result of the product mix across the different markets.

With all said and done, EBITDA margin fell 890 basis points to 32% on a reported basis. It was only 80 basis points lower year-on-year on a constant currency basis, coming in at 38.2%. Again, the more difficult economies offer structurally higher margins.

By now, you get the idea of the theme here. HEPS fell by 68.9% to 98 cents, so shareholders have seen things go the wrong way thanks to the macroeconomic realities in Africa. The highlight is the ordinary dividend, up from 330 cents to 345 cents. This has been supported by a number of corporate actions at group level that have improved the balance sheet.

There has also been a process of localisation in the African subsidiaries in which in-country shareholders are brought onto the register. For what it’s worth, I think localisation is the right strategy in these countries as it creates a shared outcome rather than an “us and them” situation.

As a final comment, it’s not just the macroeconomic picture that is hurting them. Conflict in Sudan also had an impact on earnings, albeit to a far lesser extent than the currency issues in Nigeria.

RFG Holdings hurt by international markets (JSE: RFG)

Pain and pineapples (or lack thereof)

RFG Holdings released a trading update dealing with the five months to February 2025. The regional (i.e. local) segment did pretty well, with revenue up 5.6% thanks to an 8.7% increase in volumes that more than offset pricing and mix pressures. Alas, the international segment can’t say the same thing.

Due to volatile offshore markets, a number of deciduous fruit contracts were not honoured by customers. This forced RFG to redirect them to other markets, which had a negative impact on pricing and sales volumes due to delayed shipments. Even more irritatingly for investors, volumes were further impacted by lower pineapple volumes based on drought conditions in the prior year. The net result is a 19.1% decrease in revenue in the international segment, with price down 1.5% and volumes down a nasty 15.4%. Even forex misbehaved, contributing a 2.1% decline.

This certainly took the shine off the regional result, leading to group revenue being 2.1% higher for the five months. At least the international segment is much smaller than the regional segment – and certainly a lot smaller than it was before.

Sadly, due to the pressure in the international segment, the group doesn’t expect to meet its operating profit margin target for the interim period. Looking ahead, they expect momentum to continue in the regional segment (with a strong caveat around consumer spending pressure) and revenue in the international segment to start recovering from March onwards. This implies a recovery in volumes, with inventory levels expected to normalise by the end of the year as they catch up on missed shipments.

Interim results are due for release on 21 May.

Thungela: dividends, buybacks and deals (JSE: TGA)

This is a great way to learn about capital allocation

Thungela has been keeping SENS pretty busy lately, with deals announced to get the other investors in Ensham (the Australian coal business) out of that structure. They had to do it at two levels, as there were minorities directly in Ensham as well as in Thungela’s Australian subsidiary.

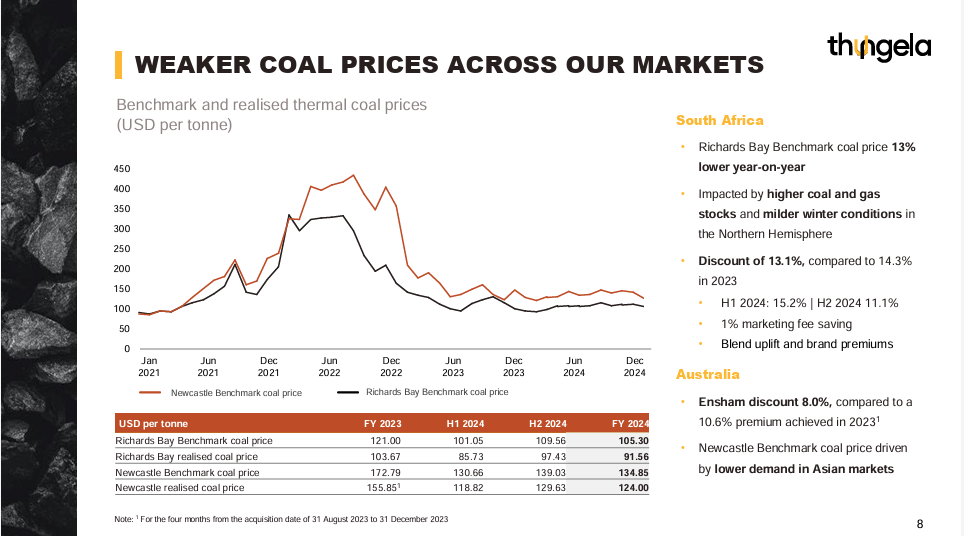

Now, the company has released results for the year ended December 2024. It wasn’t a pleasant year in the cycle, with revenue up 16% and yet HEPS down 27%. This is because prices came down year-on-year, so they had to work much harder to achieve that revenue and the margin impact is clear to see.

It’s incredible that on this chart, you can barely see the year-on-year impact, such was the peak in prices during the pandemic:

From a cash generation perspective, the downturn in profits obviously had an impact on cash coming into the group. Net cash from operating activities came in at R5.3 billion, well down from R8.5 billion in the prior year. Capex was R4.6 billion, so the difference between cash from operating activities and capex (i.e. free cash flow) wasn’t enough to offset the impact of paying dividends and executing buybacks during the year. The net cash balance therefore ended at R8.7 billion vs. R10.2 billion the prior year.

This won’t stop them from further dividends (the full year dividend is R13 per share, of which the final dividend is R11 per share) or share buybacks for that matter, with a programme of up to R300 million announced. This is in addition to the Ensham deals and other major capex projects.

Looking ahead, the numbers will be positively impacted by a higher proportion of Ensham being attributable to investors in Thungela. Although Ensham runs at a considerably higher cost per export tonne, it is also in a far more dependable country (the trains actually work in Australia) and has better proximity to key Asian markets. The benchmark export prices are very different, making up for a chunk of the gap in costs of production across the two markets.

Nibbles:

- Director dealings:

- You guessed it – another purchase by Des de Beer of shares in Lighthouse Properties (JSE: LTE), this time to the value of R2.86 million.

- A director of the South African subsidiary of Sappi (JSE: SPP) bought shares worth R190k.

- Montauk Renewables (JSE: MKR) is pretty light on liquidity, so it’s not uncommon to see large moves in the share price on a single day. While a 17.9% drop on the day of earnings looks like a clear message from the market, it actually happened in the morning and results were released in the afternoon! The numbers weren’t pretty though, with revenue only up 0.5% for the year to December 2024 and HEPS down by 27%.

- For the budding geologists among you, AngloGold Ashanti (JSE: ANG) released a presentation that was delivered at a recent site visit to the Obuasi mine in Ghana. It focuses on the pathway to 400koz in annual production and is full of some very impressive graphics that will mean absolutely nothing to you unless you have mining experience. If that sounds like you, then enjoy it here.

- Emira Property Fund (JSE: EMI) announced that its shareholders approved the proposed transaction that sees Emira subscribe for further shares and notes in DL Invest, increasing its stake to 45%. There are call options running around in this structure as well. This is also of relevance to Castleview Property Fund (JSE: CVW) shareholders, as Emira is a 57.88%-owned subsidiary of Castleview.

- Anglo American Platinum (JSE: AMS) announced that three non-executive directors have stepped down from the board. Before you panic, this is related to the planned demerger from Anglo American (JSE: AGL) and the need to have an independent governance structure.

- Here’s something you won’t see every day: Pepkor (JSE: PPH) announced that the SARB has blocked any trade in the shares held by Ainsley Holdings. That name probably won’t mean anything to you. How about Ibex? How about Steinhoff? Makes more sense now, doesn’t it? The 13.7% in Pepkor that is held by Ainsley is the legacy investment of Steinhoff (now held by a structure called Ibex) and the authorities are continuing with their investigations. Pepkor just happens to be caught up in this, as Pepkor shares are the asset in question. This doesn’t impact Pepkor itself.