Accelerate looks to sell Eden Meander for R521 million (JSE: APF)

The buyer is Sasol Pension Fund

Accelerate Property Fund has an ambitious strategy in most of its portfolio and this is a risky time to be following that route. To free up some capital, the fund has decided to sell the Eden Meander Shopping Centre in George to Sasol Pension Fund. I’m a little surprised by that move, as George is growing quickly. It shows how badly they need to sort out the balance sheet, as this reduces the loan-to-value by 300 basis points.

The property was valued at the end of March at R521.7 million and the purchase price is expected to be a minimum of R521 million, based on a 7.5% net income yield capitalised for 12 months from 1 December 2023.

Accelerate bought the property in 2016. I don’t understand why they don’t mention the original purchase price in this announcement, which was R376.9 million at a yield of around 9%. I haven’t dug through to see if they spent more on the property since then, but the yields alone suggest that they’ve done well in terms of timing the acquisition and subsequent disposal.

If the disposal yield was 9%, the price would only be R438 million.

Adcock Ingram grows, but perhaps less than I thought (JSE: AIP)

Was it just my own poor health this year, or was this a serious flu season?

Adcock Ingram needs people to get sick in a normal way, not a Covid-or-nothing kinda way. This winter featured the good ol’ fashioned flu, including the immensely dangerous strain known as man flu. This is good for Adcock Ingram.

On that basis, I was a bit surprised that revenue only increased by 5% and gross profit by 4%. That’s pedestrian to be honest, with trading profit up 6% because the company kept costs under control. At least the operating environment is better overall, giving the company confidence to increase the total dividend by 17% year-on-year despite HEPS only increasing by 12%.

If we dig a bit deeper, we find that the flu season was indeed the primary source of growth. The OTC segment grew by 11% and the consumer segment grew 6%. The prescription and hospital segments could each only grow by 2%. Yet despite this, the prescription segment put in the best performance in terms of trading profit, up 16%.

Perhaps the biggest challenge for this business is that the price of medicine is regulated. The single exit price was only granted a 3.28% increase in January 2023, with a 1.73% adjustment recently allowed as well. This is clearly well below inflationary pressures on costs.

Based on HEPS of 561.3 cents, the Price/Earnings multiple is just below 9.9x and the dividend yield is 4.5%. The share price closed 3.4% higher on the day.

Bidcorp just keeps growing (JSE: BID)

Can anything derail this story?

In the period leading up to the pandemic, Bidcorp wasn’t exactly the fastest growing story on the JSE. The unbundling from Bidvest had been at a significant valuation and the share price wasn’t really rewarding shareholders.

That was then and this is now, with a pandemic in the middle that crushed earnings temporarily.

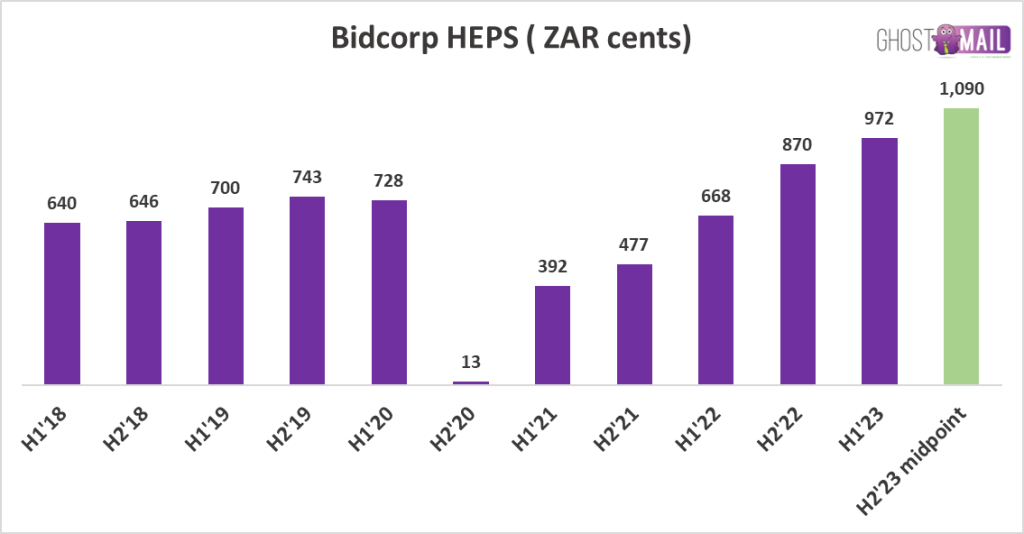

In a trading statement for the year ended June, Bidcorp has flagged HEPS growth of between 32% and 36%. I’ve used the midpoint of the full year range of 2,030.6 cents and 2,092.1 cents as the inspiration for my chart of the day:

It makes for rather impressive viewing, doesn’t it?

The share price has also been on a rampage since the depths of the pandemic, as evidenced by this chart:

DRDGOLD was saved in this period by the gold price (JSE: DRD)

HEPS growth of 13% is masking the production story

DRDGOLD has released results for the year ended June 2023 and they reflect growth in revenue of 7% and HEPS of 13%. At first glance, that sounds really good. If you look deeper though, you’ll see a drop in production of 8% and a jump in cash operating costs of 16% per kilogram.

It would’ve been a very ugly outcome had the average gold price not done good things for the company, up 16% year-on-year. This was entirely due to rand weakness, as the dollar price was flat.

The production issues included challenges like load shedding and depletion of high-volume reclamation sites.

The company expects throughput for the next financial year to be higher than this year, although cash operating costs are expecting to rise from R697,382/kg to R770,000/kg. All commodity companies live and die based on the price of the underlying commodity, but DRDGOLD is particularly sensitive to the rand gold price. This is why the share price has increased by 72% over the past 12 months.

Harmony Gold has delivered a big jump in HEPS (JSE: HAR)

The company met the upper end of production guidance

When the gold price is doing useful things, miners need to make sure that they deliver on production targets. For the year ended June 2023, Harmony achieved production at the upper end of guidance and achieved an all-in sustaining cost below R900,000/kg.

It says something about the outlook and recent performance that no impairment was recognised in this period after write-downs of R4.4 billion in FY22.

HEPS is expected to be between 747 cents and 850 cents, a jump of 50% to 70%. The share price closed nearly 11% higher on the day at R73.06.

RCL gives tighter guidance on the earnings drop (JSE: RCL)

A special levy by the sugar association has been anything but sweet for shareholders

In the initial trading statement released in July, RCL Foods guided that HEPS would be at least 30% lower for the year ended June 2023. The group has now released more accurate guidance, which has unfortunately deteriorated even further.

The drop in HEPS is now between 39.3% and 46.0%, which means a range of between 64 cents and 72 cents for this period. With a share price of R11, this puts RCL Foods on a Price/Earnings multiple of roughly 16x.

There were various reasons for the drop, ranging from the special levy by the South African Sugar Association through to unrecovered feed costs and the impact of load shedding.

The investment in The LiveKindly Collective (a plant-based eating business) has suffered a R127.4 million negative fair value adjustment.

Rebosis agrees to sell R7bn worth of properties (JSE: REA | JSE: REB)

Two distinct disposals have been announced

The first portfolio that has been sold by Rebosis in the business rescue process is called the CBD Disposal Properties portfolio and the price is just over R3 billion. In a separate transaction called the Hanger 18 Disposals, there’s a deal with two separate components and a total value of R4 billion.

The buyers are various private companies and there are various regulatory and other conditions that need to be fulfilled to finalise the transactions. This is likely to include the Competition Commission so it won’t happen overnight.

The disposals are very close to the independent valuations performed in April 2023, which came out at just under R7.2 billion vs a selling price of R7 billion.

The announcement doesn’t make it easy for anyone to figure out what is still coming in the process. Based on previous announcements, it’s likely that further disposals related to other bank disposals will be announced soon. These properties would be part of the Nedbank-related portfolio based on communicated timelines in previous announcements.

RMB Holdings makes some progress with Integer (JSE: RMH)

Atterbury is causing many headaches but at least there is progress elsewhere

RMB Holdings is in the process of trying to realise its various property investments and return the proceeds to shareholders. It’s easier said than done I’m afraid, as evidenced by the ongoing issues with Atterbury around repayments of loans.

Aside from Atterbury, RMB Holdings also holds 50% in Integer Properties. Integer holds 33.3% in Milanick Properties and has agreed to sell those shares and the related loan account to another shareholder of Milanick for R50 million. This is in line with the property valuation as at the end of March.

The amount is expected to be received during September and Integer will apply these proceeds towards repaying RMB Holdings a portion of the shareholder loan account.

As useful as this is, the disposal only represents less than 5% of RMB Holdings’ market cap. Still, it’s a step in the right direction.

Sasol’s HEPS increased by 13% this year

The inclusion of impairments tells a different story

For the year ended June 2023, Sasol faced many of the same headwinds as other mining companies, like a drop in commodity prices and the ongoing challenges with local infrastructure. Sasol is a complicated beast, so the earnings are also highly impacted by valuations of derivative contracts.

To show you how much difference those valuations can make, there was a positive move of R6 billion this year vs. a loss of R17.6 billion last year. On an operating profit number of R55.4 billion before impairments, that’s a very big difference.

Within impairments, the most significant negative move was in the Secunda liquid fuels refinery unit, which has now been fully impaired. This is based on lower volumes as part of emissions reduction plans and other pressures like higher electricity prices and lower gas selling prices.

With all said and done, HEPS increased by 13% despite EBIT (Earnings Before Interest and Taxes) dropping by 65%. This is because HEPS excludes impairments and EBIT includes them.

The total dividend for the year was R17, a 15.6% increase vs. last year when there was no interim dividend.

Little Bites:

- Director dealings:

- The company secretary of Oceana (JSE: OCE) has sold shares worth R382k.

- The CEO of AECI (JSE: AFE) has bought shares worth R210k.

- An associate of Des de Beer has bought another R55k worth of shares in Lighthouse (JSE: LTE).

- A director of Mantengu Mining (JSE: MTU) has sold shares worth R37k.

- Lewis (JSE: LEW) announced that Global Credit Ratings affirmed its national scale issuer rating of A+(ZA) with a stable outlook. This says a lot about the quality of the company in this macroeconomic environment.