Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Accelerate’s rights offer is going ahead (JSE: APF)

The company will raise R200 million in equity

Accelerate Property Fund needs to raise equity to improve its balance sheet. The mechanism to do this is a rights offer, through which the company will raise R200 million in equity by issuing 500 million shares at R0.40 per share.

This is going to be highly dilutive for any shareholders who don’t follow their rights, as the issue ratio is roughly 38.60 shares for every 100 shares held. The offer is renounceable, so shareholders can sell their letters of allocation in the market. If you ignore this completely and neither follow your rights nor sell the letters, it’s going to be an unpleasant time for you.

All necessary shareholder and board approvals have been obtained and the rights issue will now go ahead. This is a fully underwritten offer, with the underwriter receiving R10 million as an underwriting fee (5% of the amount to be raised).

Anglo American suddenly has a plan, which includes demerging Anglo American Platinum (JSE: AGL | JSE: AMS | JSE: KIO)

There’s zero doubt that the BHP discussions have accelerated this plan

The approach from BHP has clearly lit a fire under the you-know-whats of the Anglo American directors. One wonders how long it would’ve taken them to get to this point without the BHP plan

The way Anglo American sees it, they should focus on copper (obviously – this is the best part of the group), iron ore and crop nutrients. The crop side of things will go slower than before, as Anglo also wants to deleverage the balance sheet.

For all the complaining about BHP requiring Anglo to demerge certain assets, the group has now acknowledged that this is the ideal way forward with or without BHP. You’ll notice that there’s no mention of platinum or diamonds in that focus list.

Aside from a potential sale of steelmaking coal and nickel (or the placement of nickel – a battery metal! – on care and maintenance), the big news here is an “orderly” demerger of Anglo American Platinum and a potential demerger or sale of De Beers.

Why are they wanting to sell off De Beers at a time when the diamond market has so many question marks? Remember that this is the same group that literally gifted Thungela to shareholders. Timing isn’t a strong point over at Anglo. Of course, they explain this timing as being a result of the progress in finalising the sales agreement with the government in Botswana.

The other big news is that they want to keep Kumba Iron Ore, which is one of the things that BHP didn’t want. At Anglo level, this means they would also keep Minas-Rio in Brazil.

If they do this, EBITDA margin would increase from 31% to 46%. They would have less than 1.5x net debt to EBITDA and they could maintain the 40% dividend payout ratio.

Management is now firmly on the back foot in trying to convince shareholders not to accept other offers. Any argument along the lines of the buyer requiring extensive restructuring now falls flat, as Anglo is taking that route themselves (and frankly an even more difficult one that includes the sale of unlisted assets, not just the demerger of listed assets).

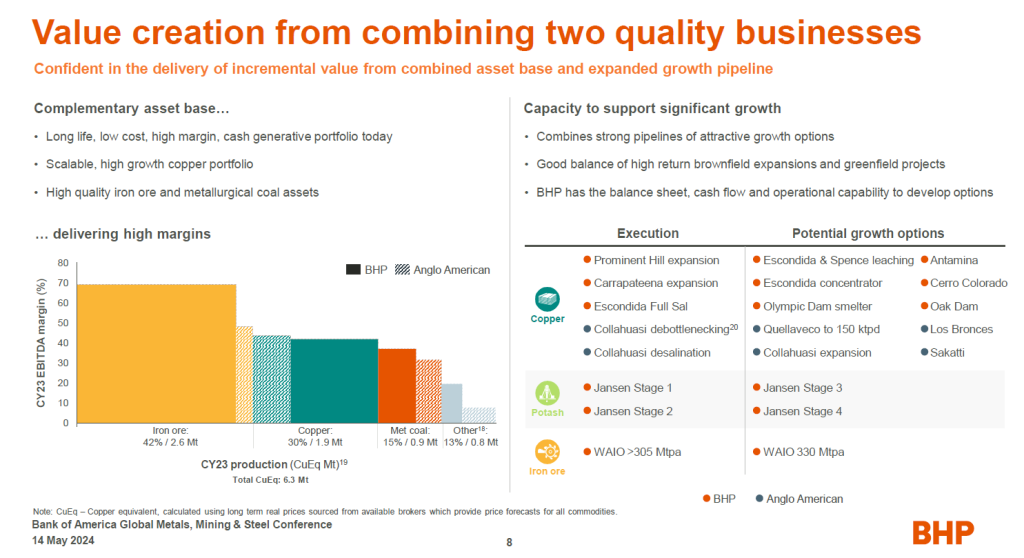

BHP presents at a mining conference – and there’s an Anglo slide in there too (JSE: BHG | JSE: AGL)

This gives a good visual idea of what the combined businesses would look like

Although Anglo American has now given BHP the cold shoulder twice, this hasn’t stopped BHP from continuing to tell the story of what the combined businesses could look like. At a presentation at the Bank of America Global Metals, Mining & Steel Conference 2024, the CEO of BHP talked through a slide deck (find it here) that included this view on the combined businesses:

Anglo American looks small next to BHP in this context, but you need to remember that BHP is only interested in certain parts of the Anglo American business and would require the company to demerge certain assets (Anglo American Platinum and Kumba Iron Ore) as the precursor to a deal. This is one of the sticking points for Anglo, although the latest plan from the company weakens that argument (as discussed above).

Delta Property Fund enjoyed a strong day on the market (JSE: DLT)

This is what happens when the market was pricing in a disaster that didn’t come

Before all hell broke loose on the Delta Property Fund share price (in a good way), it was trading at R0.18 per share. Late in the morning, the company announced a disposal of two properties for combined net proceeds of R19.3 million, which would reduce the loan-to-value ratio from a very broken 61.4% to an almost-as-broken 61.2%.

This announcement wasn’t enough to excite the market.

Around lunchtime, thing got much juicier with the release of a trading statement. Distributable earnings per share would increase by between 49% and 68% from the base of 11.12 cents in the 2023 financial year. This implies a range of 27.67 cents and 29.78 cents, which is particularly ridiculous in the context of a share price that started the day at 18 cents.

As the market read the announcement and saw the narrative around increased recoveries, reduced administrative costs and ongoing management efforts to improve things, the fireworks started. The share price eventually finished the day 27.8% higher at 23 cents a share, which is still a multiple of less than 1x vs. distributable income per share. It got as high as 29 cents a share in afternoon trade.

Dipula Income Fund’s dividend is going backwards (JSE: DIB)

Expense growth is running well ahead of revenue growth

With revenue growth for the interim period of 9%, you would expect Dipula Income Fund to be telling a positive story in distributable income. But alas, property expenses were 15% higher, so that caused challenges. Efforts to reduce overall operating costs helped drive a 6% increase in net property income, but distributable earnings per share still moved 5% lower. This wasn’t helped by the increased number of shares in issue after the dividend reinvestment programme.

The dividend followed suit, down 5% to 24.57634 cents per share.

The net asset value per share moved ever so slightly higher to R6.60, with the share price of R3.90 reflecting a 41% discount to net asset value. As you’ll see with Octodec further down in Ghost Bites today, this is because the market focuses on yield rather than net asset value unless a fund is actively recycling capital and returning value to shareholders.

Dipula is on an annualised yield of 12.6%.

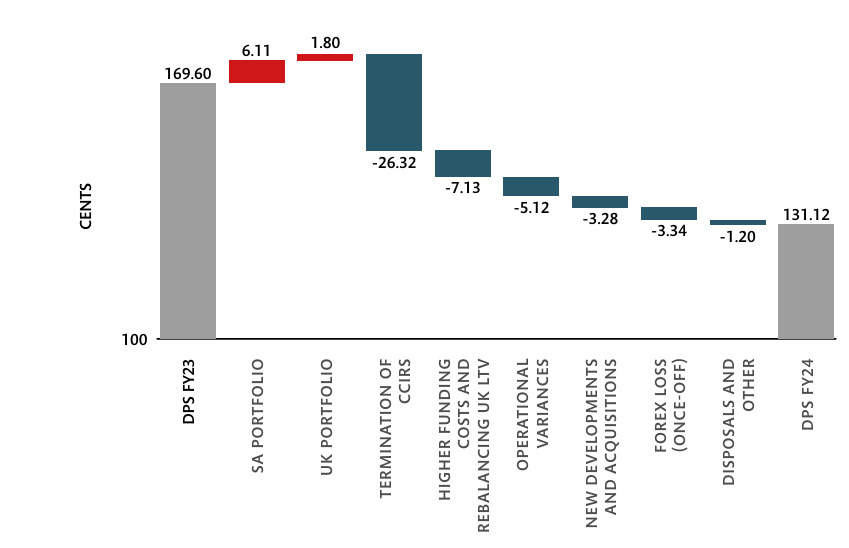

Equites Property Fund reports a 22.7% drop in the dividend (JSE: EQU)

The main reason is that cross-currency interest rate swaps have been settled

Equites has reported numbers for the year ended February 2024. The properties are performing in line with expectations operationally, with like-for-like rental growth in South Africa of 6.4% and in the UK of 5.0% (in GBP). The loan-to-value ratio has improved ever so slightly from 39.7% to 39.6%. The net asset value is up 3.0% to R17.14, assisted by an upward move in valuations both in SA and the UK.

So, why the 22.7% drop in the dividend per share? There were a number of contributing factors as shown in this chart, with the largest being the settlement of cross-currency interest rate swaps (CCIRS) and thus the income from the swaps no longer being included in distributable income:

Technically, this creates a cleaner set of numbers that are more reflective of the underlying properties and the distributions they can support.

The share price closed 4.4% higher at R13.13.

The pressure continues on the MTN share price (JSE: MTN)

It’s not like the market wasn’t warned here

I sometimes wonder about the level of attention that the market pays to even the larger stocks on the local market. MTN releases its subsidiary results before the group results came out, yet the MTN share price barely reacted to all the bad news at subsidiary level. Only once group numbers came out did the share price react, down 8.5% for the day.

The group numbers tell a tough story, as there’s a vast difference between the reported performance and the constant currency performance. The currency risks in Africa are so baked into the investment case that I would largely ignore constant currency here. It really doesn’t help to keep growing subscribers in Nigeria if the capex is exposed to USD and the naira is falling off a cliff.

The market response seems to be in line with this approach as well, punishing the share price for an 18.8% drop in group service revenue and a 28.7% decrease in group EBITDA, with margin contracting by 580 basis points to 37.9%. Concerningly, the EBITDA margin in South Africa also contracted (admittedly by only 120 basis points), so even the most stable business is struggling.

The group net debt to EBITDA ratio is 0.5x, very well within loan covenant limits of 2.5x. Net interest cover of 5.6x is also fine. The thing to watch for is cash getting stuck in subsidiaries and causing heartache at holding company level, with holding company leverage moving higher from 1.4x at December 2023 to 1.7x.

Capex deployment for 2024 has been revised downwards to R28 to R33 billion, reflecting lower planned spend in MTN Nigeria as they look to reduce exposure to USD-denominated outflows in that business. The previous guidance was capex of R35 to R39 billion, so that’s a major pull-back in spend.

Fun fact: the average prepaid subscriber in South Africa consumed 3.3GB per month and the average contract subscriber consumed 21.9GB, with mobile users at 12.9GB. And therein lies the problem for the telcos: the days of super profits based on voice calls are long over.

It’s important to mention the fintech revenue as well, which is where the telcos have been focusing to try and make up the gap. It increased 25% on a constant currency basis, which is reasonable consumer adoption but also not a thrilling growth rate. Transaction volumes increased by 18.3%.

Octodec’s earnings are down, but the dividend is stable (JSE: OCT)

Things need to improve or the dividend will take a knock at some point as well

For the six months to February 2024, Octodec grew revenue by 4.7%. Sadly, due to expense and finance cost pressures, distributable earnings per share fell by 6.4% to 82.47 cents.

Despite this pressure on earnings, the distribution per share was maintained at 60 cents. They do have some headroom there in the payout ratio, but the challenges for earnings will at some point flow down into the dividend.

The loan-to-value ratio of 38.5% is slightly down on 38.8% a year ago, but has increased from 37.7% at the end of the last financial year.

The net asset value per share has dipped by 0.5% to R24.11. The share price at R9.56 is at a massive discount to net asset value, but the annualised yield is 12.6% and even that isn’t really exciting enough for the risk here. The net asset value doesn’t mean much in this case unless the company is recycling capital at those prices.

Santam is doing well overall, with no shortage of challenges (JSE: SNT)

The underwriting result is within the 5% to 10% target range

Santam has released an operational update for the quarter ended March. It sounds positive overall, with a few areas causing them headaches, like the property book.

In the conventional insurance business, net earned premium growth was 7% and gross written premium was up 10%, with timing differences explaining the mismatch (and expected to reverse during the year). Even if the MTN update further up didn’t have much good news, at least Santam has a positive story to tell about the telco. New business written through the MTN partnership is ahead of expectations. Another highlight was MiWay, which grew gross written premium by 7%.

One of the challenges in conventional insurance has been delayed crop planting due to weather conditions, putting pressure on growth in that type of insurance.

At Santam Re, there was a double-digit increase in gross written premium, but a decrease in net earned premium due to timing differences in unearned premium reserves.

Although South Africa is never short of a disaster or two, the group underwriting margin was within the 5% to 10% target range. This is despite the Western Cape storms and fires in April 2024 with an estimated loss to Santam of R300 million net of reinsurance, which is within the catastrophe and large loss budget for the year.

It helps that yields in the market are still nice and high, allowing Santam to earn 2.3% of the net earned premium in investment returns.

The Alternative Risk Transfer business reported “solid” operating results, but no numbers are given.

The underperformance in the property book is the main issue at Santam, with various management interventions in process like geo-coding and higher excess amounts.

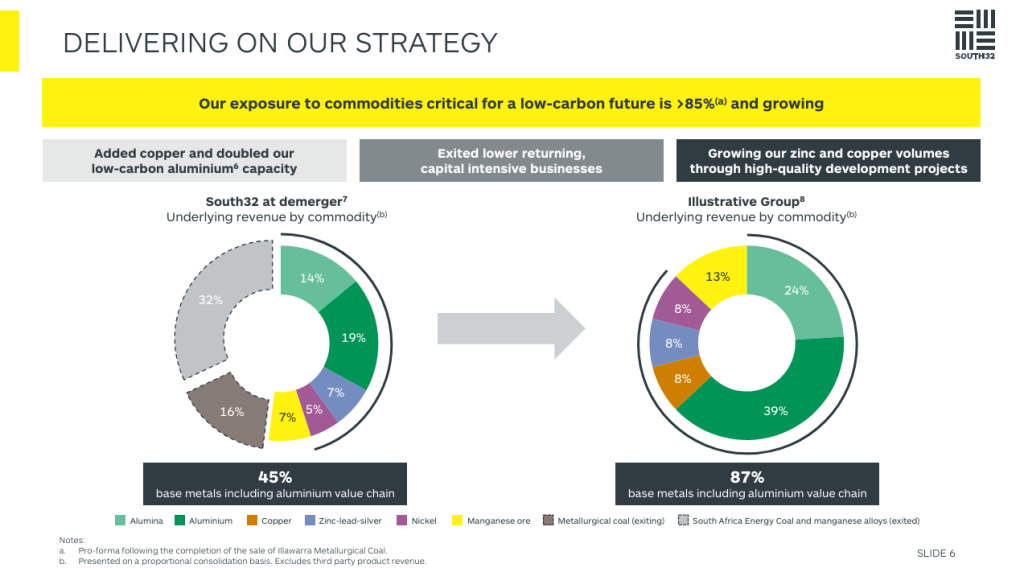

A useful overview of South32’s strategy (JSE: S32)

If you enjoy the mining sector, these conference presentations are useful

South32 also delivered a presentation at the Bank of America Global Metals, Mining & Steel Conference 2024, with the highly detailed slide deck available in all its glory at this link.

I thought that this was a pretty good slide, showing how the group has changed since its demerger in FY15. The focus has clearly been on base metals:

Is Transaction Capital becoming an investment holding company? (JSE: TCP)

This is surely the right accounting treatment going forward

Transaction Capital released a trading statement for the six months to March. Naturally, it starts with a reminder to the market that the company unbundled WeBuyCars to shareholders and raised R1 billion via a placement of shares before the unbundling, with those proceeds used to pay down debt and move to a net cash position at holding company level.

In this period, Mobalyz (which houses SA Taxi) made a core loss from continuing operations. They are running the business to preserve cash rather than generate a profit. Although those two things might sound like they belong together, it’s not quite that simple. Losses can be impacted by non-cash items, like the accelerated impairment in the insurance side of the business due to reduced cover. The funders are in support of this approach.

There’s a clue in this release that Transaction Capital should move from consolidating its subsidiaries to rather accounting for its portfolio as an investment holding company:

“These losses incurred at SA Taxi, its subsidiaries and funding entities, while consolidated in accordance with IFRS at a group level, are not funded by Transaction Capital nor do they impact the equity of Transaction Capital at a holding company level.”

Here’s the even stronger clue:

“As a consequence of the corporate activities in H1 2024, Transaction Capital has achieved its objective of becoming an unencumbered investment holding company with two assets: 100% of Nutun and 75% of Mobalyz (written down to zero) with net cash of approximately R120 million.”

Goodness knows it would be more helpful to understand the movement in net asset value per share of the group in current form than to read about a headline loss per share that is between 22% and 32% worse than the loss in the prior period.

Detailed results are due on 21 May. Perhaps management will talk to the accounting policies going forward at that event.

Little Bites:

- Director dealings:

- The CEO and FD of Pan African Resources (JSE: PAN) have both bought shares in the company using a loan and associate collar structure (put/call options to hedge the position). The shares are pledged with a dividend sacrifice as security. You don’t borrow money to buy shares unless you have a bullish view on them.

- Kore Potash (JSE: KP2) shareholders approved the issuance of shares worth $150k in the company to the chairman. This cash will be used to help keep things going until the EPC contract is finalised.

- Grindrod Shipping (JSE: GSH) has released the circular dealing with the proposed capital reduction that would see the “selective capital reduction” of the company through the buyback of all shares not held by Good Falkirk (part of Taylor Maritime) for $14.25 in cash. The meeting of shareholders for this proposed deal will take place on June 20th. If the deal is approved, Grindrod Shipping will delist from the JSE.

- Eastern Platinum (JSE: EPS) released results for the quarter ended March 2024. Revenue fell 12.9% vs. the restated comparable quarter, yet mine operating income increased by 49.5% to $5.3 million. The group made a slight operating loss and thus a net loss attributable to shareholders of $0.9 million. Costs related to the soft restart of the Zandfontein underground operations contributed to the loss. The company still has a large working capital deficit.

- Sea Harvest (JSE: SHG) announced that the acquisitions from Terrasan have now met all conditions precedent and become unconditional. This makes Terrasan the second largest shareholder in sea Harvest and creates the largest abalone business in the Southern Hemisphere, as well as the largest black-owned diversified fishing business in South Africa.

- Salungano (JSE: SLG), which is suspended from trading, has released a trading statement for the year ended March 2023. Yes, you read that date correctly. At least they are getting closer to catching up on financial reporting backlogs.

- Canal+ is up to a 45.20% stake in MultiChoice (JSE: MCG) after recent purchases of shares between R119.44 and R119.66 per share.