Accelerate flags a drop in earnings per share (JSE: APF)

Despite this, the share price increased by 8%

When most companies execute a dividend reinvestment plan (the ability for shareholders to receive more shares in lieu of a cash dividend), there’s a reasonable take-up that doesn’t result in materially more shares being in issue.

Not so at Accelerate Property Fund, where the pricing of the reinvestment plan was such that 80% of company shareholders elected the reinvestment plan. We are dealing with some crazy numbers here, as this led to a huge increase in the number of shares in issue by 26.5%!

Of course, this has hit distributable income per share, as the number of shares is so much higher. In a trading statement for the year ending March 2023, Accelerate has flagged a drop in distributable earnings per share of at least 15%.

Ringing the Bell on better-than-expected earnings (JSE: BEL)

A further trading statement gave another boost to the Bell Equipment share price

After navigating a massively tricky period for Bell Equipment and its relationship with the Bell family, the management team has managed to deliver a really good set of numbers. Much like we saw with Master Drilling earlier this week, conditions have been favourable for suppliers to the mining industry.

For the year ended December 2022, Bell’s HEPS will be between 58% and 65% higher. This is considerably better than the guidance in the initial trading statement that envisaged an increase of between 40% and 43%.

This means that Bell’s HEPS will be between 465 cents and 485 cents. The share price closed at R15.80, implying a Price/Earnings multiple of around 3.3x at the mid-point of that range. The market is clearly putting a cyclical multiple on this business, so there’s an opportunity here if you think the cycle still has some way to go.

There’s a new Cell-C-EO in the hot seat (JSE: BLU)

Douglas Craigie Stevenson is gatvol and on his way

Blue Label Telecoms remains a risky play because the management team loves to take a punt at all kinds of things, not least of all Cell C. Just as things were starting to look more settled, the CEO of Cell C has upped and left.

Brett Copans has been appointed as the interim CEO of Cell C, having served as Chief Restructuring Officer at Cell C since April 2022. He has plenty of experience in investment banking, which tells you that Cell C is still more of a financial turnaround story than a telecoms play.

The Blue Label share price closed over 8% lower.

Equites locks in a decent IRR on two properties (JSE: EQU)

Importantly though, the sale was at a price below NAV

Equites has sold two distribution centres for an approximate total of R1 billion. There is an interesting shift in the portfolio here that is worth spending some time on.

Firstly, the focus at Equites is clearly on the weighted average lease expiry (WALE). These distribution centres had remaining lease terms of 5.4 years and 6.3 years, way below the UK portfolio WALE of 15.6 years. So, a benefit of this deal is that the WALE will increase.

Secondly, the money is coming home. Equites will reinvest the cash in the development pipeline in South Africa that has been pre-let with blue chip clients. The company is looking for yield and growth here, something that is harder to come by in the UK.

Equites did well on these distribution centres, realising an IRR of over 13% since acquiring them in 2018. Remember, that’s a hard currency return.

The concern in the market is around the price relative to the valuation in the books. The price is a 7.95% discount to the carrying value of the assets as at August 2022. Does this suggest that the rest of the book might also be due a downward revaluation?

Remgro inches higher in this environment (JSE: REM)

I have serious questions about the capital allocation strategy though

We find ourselves in an environment where it’s better to be a banker than a shareholder, with only a handful of exceptions on the JSE where companies are showing returns that beat the cost of equity.

Remgro is an example of just how tough it is, with the intrinsic net asset value (INAV) up by 5% in the six months to December 2022. This is a director valuation of the portfolio and it equates to R223.86 per share. Remgro is trading at roughly R131 per share, a discount of around 41.5%. Remgro’s share price has fallen by 12.4% over 12 months, so the discount has increased rather than decreased.

With just 5% growth in the INAV, you would’ve been better off with your money in the bank over the past year even if the traded discount to NAV had remained consistent.

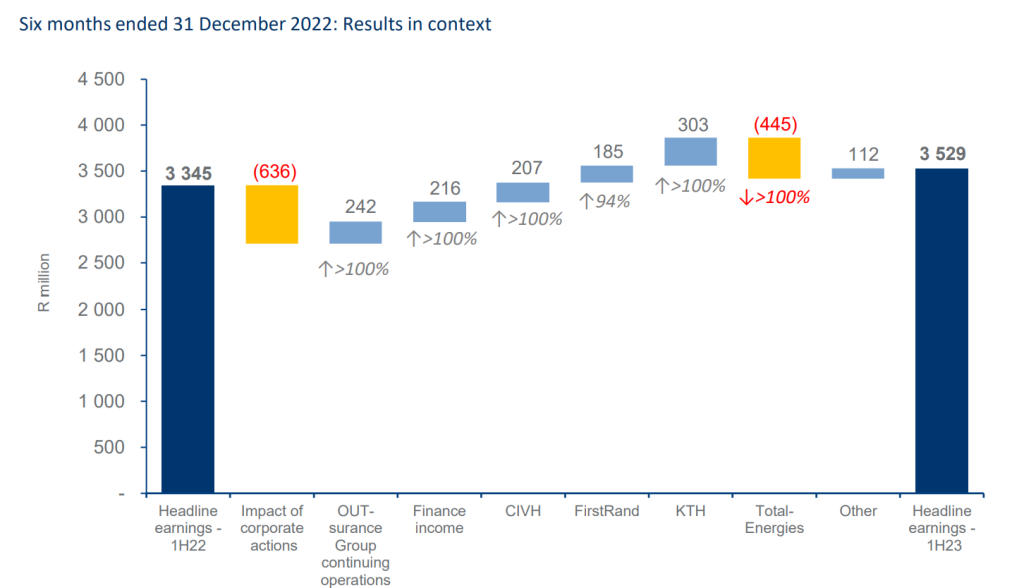

There were a number of positive stories in the underlying portfolio, most of which were offset by a huge negative swing at TotalEnergies. The contribution to headline earnings was R301 million in the base period, but this investment registered a loss of R144 million in this period. Although headline earnings isn’t the best metric to assess the performance of Remgro, this waterfall chart is really helpful in understanding how severe the impact of TotalEnergies was in this period:

One thing that Remgro has no shortage of is cash at the centre, with nearly R14 billion in cash of which R7.3 billion is invested in money market funds. I was informed on Twitter that the underlying corporate actions have something to do with the relative lack of buybacks, with only R274 million invested in buybacks in the six months to December. That’s barely a rounding error.

It looks even stranger in the context of the dividend, which has jumped 60% from 50 cents per share to 80 cents per share. Again, at such a big discount to NAV, surely the best use of cash is buybacks rather than cash dividends? The finance textbook would tell you that cash dividends should be zero here. Based on that, I think we can safely conclude that Remgro isn’t run purely with the minority shareholders or finance textbooks in mind.

The discount shouldn’t be a surprise, then.

Like all property companies, Resilient is investing in solar (JSE: RES)

The dividend is higher year-on-year if you adjust for the Lighthouse shares

I like the way Resilient describes its strategy: investing in dominant retail centres with at least three anchor tenants and let predominantly to national retailers. If you skip to the prospects section of the latest announcement, you’ll find a note that Resilient plans to right-size department stores (i.e. make them smaller) and increase exposure to grocery retailers. This is a defensive strategy that says a lot about the economic climate.

Resilient has largely lived up to its name, with a dividend that would’ve been 3.8% higher were it not for the unbundling of the Lighthouse shares. But because Resilient no longer receives the dividends on those shares, the dividend declared by Resilient for 2022 is 3.2% lower than the preceding 12 months.

I also quite enjoyed this paragraph, which is a perfect example of why listed companies shouldn’t be running around making silly little portfolio investments in other companies:

Bluntly, companies shouldn’t be allocating capital where they have little or no influence. The last thing I need to do is pay a management team to be negatively surprised on my behalf!

Looking at the numbers, the South African property portfolio grew net property income by 6.0%, but earnings from France were lower than forecast. Despite this, the French portfolio enjoyed a positive revaluation.

At December 2022, Resilient produced 14.6% of its electricity consumption. This is expected to increase to 25% by December 2023.

With energy supply as such a difficult variable and uncertainty around the dividends that Resilient will receive from its listed investments, Resilient has deferred its distribution guidance. Again, what value is the management team adding to these listed investments that introduce even more uncertainty to an already tricky environment?

Schroder’s property valuations fell this quarter (JSE: SCD)

The NAV as at 31 December 2022 has been announced

Schroder Real Estate Investment Trust’s NAV fell by 3.4% between September and December 2022. This was driven almost entirely by a 3.3% decline in the value of the portfolio.

The gearing in the portfolio is manageable (18% net of cash and 30% gross of cash), so this is hopefully just a bump in the road.

An interim dividend of 1.85 euro cents per share has been declared.

Looking for a flood? Ask Sibanye-Stillwater (JSE: SSW)

The universe has a cruel sense of humour with this name

The obvious irony of the name is just incredible: Sibanye-Stillwater has a knack for being on the receiving end of flooding. After too much water caused havoc at the US PGM operations, the latest news is that the company has agreed to provide A$30 million in support to New Century Resources because of flooding in North Queensland.

With suspension of operations for 2 – 3 weeks, the ability of New Century to continue as a going concern has been called into question. Mining is no joke, particularly groups that are completely exposed to a single location.

In case you’ve forgotten, Sibanye is in the middle of a takeover bid for the company that the board of New Century had recommended to shareholders. It’s too late now to run away, as Sibanye already holds 87.64% of the company based on offer acceptances and on-market purchases. Based on this, I suspect that the remaining shareholders will be only too happy to take Sibanye’s offer.

Steinhoff: the choice between zero and probably zero (JSE: SNH)

Surprise! People choose to die later rather than die now

Is there any equity left in Steinhoff? Probably not. Is there a tiny chance that there will be some equity at a future point in time? Sure! There’s always a chance.

The proposed settlement with creditors that would’ve left equity holders with practically worthless unlisted shares was rejected by shareholders. I guess they agreed with my original assessment that such an unlisted stake would be utterly useless. Instead, the shareholders have chosen to give themselves a sliver of hope that perhaps there will be some equity left once the lenders have finished eating the Steinhoff carcass.

Personally, I still think it’s likely that Steinhoff is worthless. Despite this, speculators are buying this thing at around 31 cents per share. I wish them luck.

Little bites:

- Director dealings:

- The founders of Transaction Capital (JSE: TCP) (Jawno, Mendelowitz and Rossi) pumped another R17.6 million into shares with an average cost of R11.71, helping to drive a substantial rally in the stock of 15%.

- A director and a prescribed officer of FirstRand (JSE: FSR) collectively bought shares worth R10.7 million.

- An executive of Gold Fields (JSE: GFI) has sold shares worth R1.1 million, selling into the recent strength in the gold price.

- An executive of Harmony Gold (JSE: HAR) has also decided that its time to take some money off the table, selling shares worth R717k.

- The chairman of Sibanye-Stillwater (JSE: SSW) has bought shares worth R374k.

- An entity owned by the Sassoon Children’s Trust – and hence linked to the founders of Sasfin (JSE: SFN) – has bought shares worth R159k. Based on the long-term performance of the company, those kids must’ve been really naughty to deserve that.

- A director of Zeda (JSE: ZZD) has bought shares worth nearly R100k.

- A director of KAL Group (previously Kaap Agri) has bought shares worth R79k.

- The CEO of Super Group (JSE: SPG) has bought shares worth over R68k.

- Trustco (JSE: TTO) had its trading suspension lifted by the JSE, as the company now complies with the financial reporting requirements. Nothing happened for hours, until a trade right at the close that took the price 34% higher. I’m not sure that much can be read into that.

- Obscure small cap 4Sight Holdings (JSE: 4SI) released a trading statement dealing with the year ended December 2022. HEPS is expected to increase by between 30% and 40.8%.

- Life Healthcare (JSE: LHC) has renewed the cautionary announcement linked to the group’s interest in AMG, the European business in the group. Life has received several unsolicited proposals for the asset and is engaging formally with the potential buyers. Of course, it’s possible that no deal will happen here. I must remind you that most M&A opportunities end up failing to go through.

- Shareholders of Jasco Electronics (JSE: JSC) should’ve received the circular detailing the offer of 18 cents per share. If you hold shares in that company, make sure you’ve read it.