Accelerate Property Fund needs another rights offer – but there are positive signs (JSE: APF)

This is a good example of a company that is shrinking into prosperity

Bigger isn’t always better. In some business models, scale is your friend and is practically a necessity for survival. In others, scale adds limited benefit and can quickly become a disaster if the building blocks aren’t in place.

Accelerate Property Fund falls into the latter bucket, with the fund having gotten itself into all kinds of trouble under previous management. This has led to significant property sales (R700 million done and R1.2 billion still to go) to reduce debt and get the balance sheet under control. There was also a R200 million rights offer recently. The company has just announced the need for another R100 million rights offer, so the equity injections aren’t over yet.

Is there light at the end of the tunnel? There might be, provided that Fourways Mall makes the shift from white elephant to prize beast. The fund brought in Flanagan & Gerard and the Moolman Group in a last-ditch attempt to address the large vacancy rate in the mall. It’s down from 19.0% to 13.4%, so the strategy seems to be working. The mall had a decent increase in sales at the end of last year. R144 million in capital expenditure has gone into improving the mall, with further projects including a roof on the upper level parking deck and a new solar plant.

The headroom for these projects has been created by a reduction in debt from R4.4 billion to R3.7 billion, along with asset disposals that are in process and the rights offer of R100 million that will take place soon. As a show of support for the strategy, the commercial lenders have renewed Accelerate’s entire debt book for two years.

Once all is said and done, they expect the loan-to-value to be below 40%. If they can get the metrics at Fourways Mall right, then this could be a pretty lucrative deep value play in the local property sector. Is this dog finally going to have its day?

AECI is looking to sell its public water division (JSE: AFE)

The deal is too small to be categorisable under JSE rules

AECI has entered into a binding memorandum of agreement to sell Improchem’s public water business. Improchem is a wholly-owned subsidiary of AECI. The buyer is a B-BBEE investment entity owned by Nsukutech and Tanzanian group Junaco Limited. Junaco supplies water treatment chemicals and equipment across Eastern and Southern Africa and has partnered with AECI for 15 years, so the parties know each other well.

There are various regulatory hurdles that need to be overcome. You won’t see much more in the way of detail on this transaction, as it falls below the categorisation thresholds in JSE rules. These are the thresholds that trigger more detailed disclosure. AECI technically didn’t need to announce anything at all, so at least they gave the market a few details on a voluntary basis.

This disposal is part of the strategy to focus on core businesses at AECI.

Separately, the company announced that the disposal of Much Asphalt has now been completed. The final price was in line with the guidance of R1.1 billion. Remember, many deal structures allow for the final price to vary based on changes to working capital in the business while the deal is being implemented.

ArcelorMittal is deferring the decision to shut the Long business (JSE: ACL)

The IDC is coughing up to kick the can down the road

ArcelorMittal is in a difficult position. Viewed purely through a profit lens, the Long business should’ve been gone ages ago. Viewed through a social lens, it would be a complete disaster for the small towns that rely on this business. ArcelorMittal needs to try and manage being a good corporate citizen and not letting its shareholders down.

After extensive engagement with government (and I suspect plenty of examples of calling each other’s bluff), we finally have an update that sees the Long business stay open for at least another 6 months. This is being made possible by the IDC putting in a R1.68 billion facility. Government has also provided a Temporary Employee Relief Scheme (TERS) grant. ArcelorMittal hasn’t disclosed the value thereof.

Now, if this sounds to you like good money being thrown after bad, you’re on the right track and I share your sentiment. Our country has plenty of examples of people living off the taxpayers and we don’t need to create corporate examples as well. The good news is that these relief measures are accompanied by promises for structural changes, like the preferential pricing system and tariffs. My understanding is that cheap steel being exported by China is the problem, so government also isn’t in an easy situation right now. We aren’t exactly making friends and influencing people in the West right now, so upsetting our biggest partner in the East isn’t a great approach either.

For shareholders in ArcelorMittal, it’s hard to say for sure whether this is good news or not. The IDC facility is debt, so what is essentially happening here is that operating losses are being funded by a debt package that would never be provided by commercial banks due to the risks involved. Will any structural improvements in the industry more than offset these costs?

ArcelorMittal is about as speculative a play as you’ll find anywhere.

Emira seems happy with performance thus far this year (JSE: EMI)

A pre-close update indicates that they are on track internally

Emira Property Fund released a pre-close update based on numbers for the 10 months to 31 January 2025. There are still challenges for landlords out there, evidenced by ongoing negative reversions on leases – albeit to a lesser extent than before. This has improved from -6.8% to -4.2%.

The retail portfolio has almost gotten rid of negative reversions, coming in at -0.9% vs. -4.0% by the end of the interim period (September 2024). The office portfolio can’t say the same, but at least reversions are headed in the right direction, improving from -9.6% to -5.8%. This is despite the office portfolio being strongly skewed towards high quality properties. As for the industrial portfolio, there’s a nasty trend in reversions that saw them deteriorate from -7.9% to -10.8%.

The residential portfolio is spread across 3,389 units, with a low vacancy rate and high collections vs. billings. They sold 386 units in this period, unlocking disposal proceeds of R312.9 million.

Looking at other capital allocation strategies, the US portfolio is down from 12 properties to 11 and saw an uptick in the vacancy rate based on the bankruptcy of a retailer. Over in Poland, Emira’s shareholders recently approved the tranche 2 subscription option that will take Emira’s stake to 45% in DL Invest. The Polish portfolio is mainly logistics or industrial in nature (67% by value).

The loan-to-value ratio has decreased to 34.1% as at February 2025. That’s a meaningful improvement from 42.0% as at the end of September 2024. They expect to finish at between 36% and 37% as at the end of March.

Although it’s clear that there are still difficulties in the market, Emira is making progress and is pleased with how the financial year has gone.

enX sells West African International (JSE: ENX)

Don’t be fooled by the name – this is the Southern African chemicals business

As confusing names go, this one has to take the cake. West African International is the chemicals segment of enX and it operates in South Africa. West of what, exactly? Australia?

Either way, enX has found a suitor for the business. Trichem South Africa will subscribe for a 25% stake in West African International and will have the option to acquire the remaining 75%. If they don’t, they have the right to sell the 25% to enX (this takes the form of a put option).

Assuming the deal goes ahead and the put option isn’t exercised, enX would look to return surplus cash to shareholders. The initial subscription for shares is based on the NAV of West African International and that money would stay in the business going forwards, so that’s a red herring. The bit that enX shareholders care most about is the price for what would be the remaining 75% in the enlarged company. This will be calculated as 95% of net asset value, plus 75% of profits over the period between the first subscription for shares and the exercise of the ownership option.

The deal value for the initial subscription for shares and the subsequent purchase of 75% is capped at R450 million. I doubt it will get anywhere close to that number, as the NAV of the segment was R283 million as at August 2024. Profit after tax was R84 million for that year.

Unless the business is busy falling over or had an unusually great time in 2024, I’m not sure why they would want to sell it at what looks like a P/E multiple of under 4x.

Ethos Capital sold down a portion of Optasia (JSE: EPE)

This does wonders to prove the valuation

Ethos Capital’s largest and arguably most impressive asset is Optasia, a fintech group that contributed 48% of Ethos’ net asset value (NAV) per share as at 31 December 2024. Optasia is focused on under-banked individuals and SMEs in frontier markets, so that’s the kind of growth opportunity that gets venture capitalists excited.

An existing shareholder in Optasia has bought a further 13% in the group. Ethos Capital sold 0.81%, or approximately 11.1% of its 7.3% economic interest. This valued Optasia at an enterprise value of $1 billion, which is a 12.8x EV/EBITDA multiple. Welcome to startup valuations!

A valuation on paper is one thing. A valuation based on an arm’s length deal is quite another. This deal is a 13% premium to the value at which Optasia was recognised in the financials at the end of December. That’s great news for Ethos. Further positive news for shareholders comes from management’s intention to either reduce debt or return the proceeds to shareholders, rather than deploy it into new opportunities.

Jubilee Metals blames lower chrome prices for the latest results – but is that right? (JSE: JBL)

The interim results aren’t good news for shareholders

Jubilee Metals released its interim financials for the six months to December 2024. Although revenue was up 51%, EBITDA fell by 6.8% as it was “impacted by softer chrome prices” in this period. Well, that’s what the highlights section of the SENS announcement says.

In reality, the chrome business in South Africa improved its revenue per tonne of chrome concentrate, so I don’t know what they are getting at here. In the section dealing with PGMs, they even talk about how they focused on chrome recoverability in the first quarter to capitalise on those market conditions.

Sure, market prices for chrome may have dipped, but they still sold chrome at a more favourable price than before. Clearly, the EBITDA pressure didn’t come from the chrome business.

So, what was to blame? The average cost per tonne of chrome concentrate was up 30.3%, so the strategy to get the stuff out the door is putting margins under pressure.

They also had a tough time in the copper business, although this wasn’t based on market conditions. Revenue was up 5.1% and gross profit fell 88%, with the stoppage of the Roan operations due to power interruptions not helping at all. They’ve now addressed the power issues. Major changes have been made at Roan that are showing promising signs.

Jubilee is planning to update the market in April regarding guidance. Perhaps by that stage, they will have a better one-liner to explain the results than “impacted by softer chrome prices” – as this clearly doesn’t tell the story at all.

Phil Roux bids Nampak adieu (JSE: NPK)

This comes as a surprise – well, to me at least

Phil Roux was appointed as the CEO of Nampak in April 2023. That’s only two years ago. Having made plenty of progress, he’s decided to step down with six months’ notice.

This feels like a surprise. Roux will retain some involvement in the group at least, remaining on the board in a non-executive capacity and as the chair of a new Strategic Planning and Oversight Committee. The committee has some pretty granular stuff in its mandate, so this doesn’t feel like a traditional non-executive role.

Andrew Hood will take over as CEO from 1 October 2025. He is described as having “extensive experience” within Nampak and he will be appointed as COO from 1 April 2025 so that he can work closely with Roux for the next six months. This makes it even clearer to me that this came as a surprise, as that’s an odd succession structure.

Another solid period for PSG Financial Services (JSE: KST)

This business model really gets the job done

PSG Financial Services operates a strong business that is built around a combination of distribution power and management of assets. The companies on the market that have focused only on the latter have found it really difficult to grow assets. Those with a distribution capability have been doing far better.

The good times have continued for them, with a trading statement for the year ended February 2025 reflecting expected growth in recurring HEPS of between 22% and 25%.

Despite this underlying performance, the PSG share price is down 8% year-to-date. It’s up nearly 18% in 12 months.

Sephaku had a tough end to its year (JSE: SEP)

The GNU has been a disappointment for the cement industry

After much excitement related to the GNU, there’s been very little follow-through for the construction industry. Data suggests that there is limited improvement in demand for building materials and the underlying results of companies in the sector support this view.

Sephaku Holdings has reported that Sephaku Cement experienced a minor increase in profits for the 12 months to December 2024, which is a decent outcome in the context of a 4% dip in sales volumes and an 11.2% decrease in EBITDA. Sephaku Cement had gotten off to a great start in the interim period that was subsequently ruined in the second half by unplanned repairs and an associated drop in production levels. They were lucky to have lower financing costs and depreciation, leading to profit coming out slightly up despite the drop in EBITDA.

At the Metier business, which has a different year-end to Sephaku Cement, volumes are down for the 11 months to February. EBITDA is up at least, benefitting from higher selling prices and cost savings.

Vukile Property Fund has confirmed guidance for the year ended March 2025 (JSE: VKE)

This was a busy period for Iberian acquisitions

Portugal and Spain are the talk of the town in the local property sector. It seems as though this is the new Poland for local investors. Luckily for Vukile, they’ve been early adopters here, with a portfolio in that region that has been a feature of the group for several years now.

Despite all the excitement on that side of things, the South African portfolio generated growth in net operating income of 6.4% in the year ended March 2025. The township and rural segments are doing particularly well, capturing the trend of informal-into-formal retail. Rental reversions are positive, so that’s clearly a highlight that speaks to demand for the space from tenants.

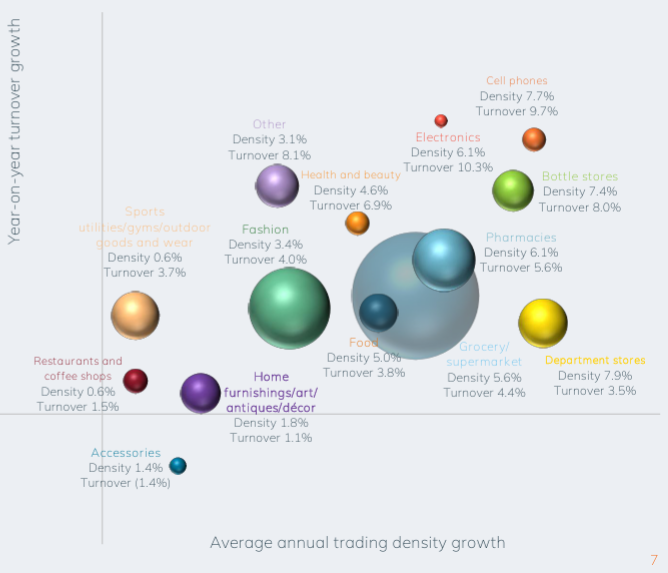

As this excellent chart from the deck shows, shoppers are drinking – just not at restaurants:

Over in Spain, economic growth was well ahead of forecasts in 2024. As South Africans, we can only dream of such things. Portugal also had decent economic growth and both countries achieved record tourist numbers. Still, like-for-like growth in Spanish subsidiary Castellana was only 2%, which is well below what the South African portfolio managed in the past year. Personally, I wouldn’t extrapolate that – the fundamentals in Iberia are clearly better at the moment.

After a busy period of dealmaking, Vukile is now calming down with no planned acquisitions, equity capital raises or dividend reinvestment programmes. That’s good news in my books. They expect to achieve 6% growth in the dividend per share for the 2026 financial year. No further share issuances will certainly help with this.

And as for the year that just ended, being the 12 months to March 2025, they also expect the dividend per share to be up by 6%. That’s solid.

York Timber had a stronger interim period (JSE: YRK)

But there’s still no interim dividend

York Timber had a much better time of things in the six months to December 2024. Revenue was up 18% and adjusted EBITDA (which excludes the fair value adjustment on biological assets) increased dramatically from R8.3 million to R84.3 million. HEPS jumped from 4.67 cents to 14.31 cents, so at this point you must be wondering if there’s an interim dividend.

The answer is no, there isn’t. HEPS was boosted by the biological asset value increase of 5%, which isn’t a cash inflow. Core earnings per share excluding the fair value movement still reflected a loss, albeit a much smaller one at 0.09 cents vs. a loss of 10.06 cents in the comparable period. And although cash generated from operations achieved a massive swing from negative R7.8 million to positive R45.7 million, it’s also true that debt in the group increased (thanks to the Pine-Valley acquisition) and so did working capital requirements.

This company has always felt to me like a really hard way to make money.

Nibbles:

- Director dealings:

- Among sales by directors of Impala Platinum (JSE: IMP) that were mainly to cover the tax on share awards, it looks like there was one director that sold R5.6 million worth of shares that represented an entire award, not just the taxable portion.

- The CEO of Sirius Real Estate (JSE: SRE) sold shares worth R2.8 million. The company has been on a roll recently with acquisitions, so that comes as a surprise.

- A director of HomeChoice (JSE: HIL) sold shares worth R1.4 million.

- A non-executive director of Shaftesbury Capital (JSE: SHC) bought shares worth R1.2 million.

- A director of Remgro (JSE: REM) bought shares worth R249k.

- Lesaka Technologies (JSE: LSK) hosted an investor day and released four detailed presentations that take you through the business. It took me a little while to find them on the website. You can enjoy the presentations and the webcast at this link.

- OUTsurance Group (JSE: OUT) announced that its Australian business Youi is making some changes to its distribution strategy. They are moving away from a broker distribution channel and will instead focus on direct distribution. This means the end of the distribution relationship with Blue Zebra Insurance, in which Youi holds a 36.9% interest that will be sold to other shareholders. Separately, the company announced that losses from Cyclone Alfred are expected to mostly be within the reinsurance claim window. They do expect residual losses though, coming in at between A$10 million and A$15 million – a reminder of the risks sitting on insurance books when it comes to natural disasters.

- Eastern Platinum (JSE: EPS) has very little liquidity in its stock. They also have a lot less revenue than before, with results for the year ended December 2024 reflecting a 41.5% drop in revenue and a swing into operating losses. The company has a large working capital deficit. There are obviously going concern risks here, with the company clinging to the upside potential of the Zandfontein operations that are being ramped up.

- Kore Potash (JSE: KP2) has released results for the year ended December 2024. They are in the process of raising funding for the Kola project, so the focus at the moment isn’t on what you’ll find in the financial statements. This is common for junior mining companies that are still in project phase. The cash burn in the latest year was $3 million and the group had $1.3 million in cash as at the end of December. They need to raise money this year to meet the going concern test, as they have large payments to make in relation to the development.

- If you are following Merafe (JSE: MRF) closely, you’ll be interested to know that the company has broken down its revenue in Asia in more detail. This is part of the JSE’s proactive monitoring review process. As Asia is the largest contributor to revenue, I guess they wanted to see more disaggregation to give investors granular detail.

- Gold Fields (JSE: GFI) is considering a bond offering. They are looking at issuing 10-year bonds to repay outstanding amounts under the $750 million bridge facilities that were used to fund the acquisition of Osisko Mining in 2024. Global coordinators and bookrunners have been appointed to drum up interest among fixed income investors.

- AYO Technology (JSE: AYO) finally released financials for the year ended August 2024. The headline loss per share jumped from 71.81 cents to 177.09 cents. To give you context to just how bad the income statement is, gross profit was R347 million and operating expenses came in at R648 million.

- Finbond (JSE: FGL) announced that holders of 71.27% of shares in issue (less exclusions) elected to receive cash dividends rather than scrip dividends.