Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Accelerate confirms the terms of the proposed sale of Eden Meander (JSE: APF)

Shareholders will be asked to vote on this transaction

Accelerate Property Fund (JSE: APF) is in my bucket of property funds that I wouldn’t invest in. There have been some strategies followed by the company that have ruled it out for my own money. The share price is down 20% this year and down more than 80% over five years.

As part of an effort to improve the balance sheet, Accelerate identified Eden Meander for a potential disposal to the Sasol Pension Fund and a couple of other investors. This was first announced in August 2023. After a successful due diligence, terms have now been announced to the market.

The property is being sold for just over R530 million, so this is a Category 1 transaction under JSE rules that will result in a detailed circular being sent to shareholders as a precursor to a shareholder vote. Keep an eye out for further announcements in this regard if you are a shareholder.

The announcement irritatingly doesn’t indicate the book value of the property as at the last reporting date. I trawled through the reporting to find it. As at 31 March 2023, the fair value of Eden Meander was disclosed as R522 million. With a sale achieved slightly above book value, I genuinely don’t know why they didn’t highlight this fact in the announcement.

AECI grows group revenue and EBIT by 10% for the nine months to September (JSE: AFE)

But the German business is going from bad to worse

If you’ve been following AECI, you’ll know that AECI Schirm Germany has been a headache. Within group EBIT (not a typo – this is Earnings Before Interest and Taxes) of R1.895 billion for the nine months to September, we find the German business with a loss of R230 million.

Despite this knock, revenue and EBIT both increased by 10% thanks to solid mining explosives sales volumes, a weaker rand and generally improved profitability thanks to new contracts. AECI Mining is the biggest part of the business and grew revenue by 15% and EBIT by 30%.

There were also negatives in places other than the German business, like AECI Agri Health with EBIT down 23% and AECI Chemicals down 18%.

The balance sheet has been well contained, with net working capital down 3% despite the growth in revenue. This is a great example of using creditors to fund debtors and inventory. Also, capital expenditure was 4% lower at just over R1 billion. But due to debt in AECI Schirm and of course higher interest rates overall, net finance costs jumped by 92% to R425 million.

There is still decent coverage here of EBIT to finance costs, but the trajectory isn’t good.

Will things get better in Germany? Despite a turnaround plan that was showing promise, trading conditions have deteriorated even further and AECI isn’t expecting a short-term recovery.

If you would like to dig deeper into this company and review the capital markets day presentation, you’ll find it here.

enX posts strong earnings from continuing operations (JSE: ENX)

The HEPS story looks very different if all operations are included, but this isn’t the most useful view

enX Group operates businesses that produce and market oil lubricants and greases, design and diesel generators, distribute industrial engines, offer cleaner power solutions and import and distribute plastics and speciality chemicals. They are even involved in conveyor belting fabric.

In other words, enX is firmly an industrials play, which has been a better choice this year than being in a consumer vertical. Not all industrial models have worked well though, as Eqstra Fleet Management is being sold by the group for strategic reasons.

Focusing on continuing operations for the year ended August, revenue increased 26% thanks to demand for power solutions and related services, along with the various other products offered by enX. Operating profit is up 31%, despite once-offs in the base period and the current period. HEPS from continuing operations increased by 16%.

Within continuing operations, I have to highlight New Way Power as a major winner in load shedding. Revenue jumped 72% and profit before tax shot up from R10 million to R101 million. That’s what happens when a business suddenly achieves scale, helped by the entry into the provision of solar PV systems back in 2021.

HEPS from total operations is down 38%, but this isn’t because of a poor performance by Eqstra. Instead, it’s because of discontinued operations in the base period that weren’t in this period. enX has been through a period of significant restructuring, so focusing on HEPS from continuing operations is sensible.

After closing some major asset disposals in the past couple of years and paying substantial distributions along the way, there is still excess capital on the balance sheet. enX has declared a special distribution of R1.00 per enX share. The group has been structuring recent distributions as a reduction of capital rather than a dividend for tax purposes.

Exemplar REITail reports a 6.5% drop in the dividend (JSE: EXP)

A large insurance claim in the base period has skewed the results

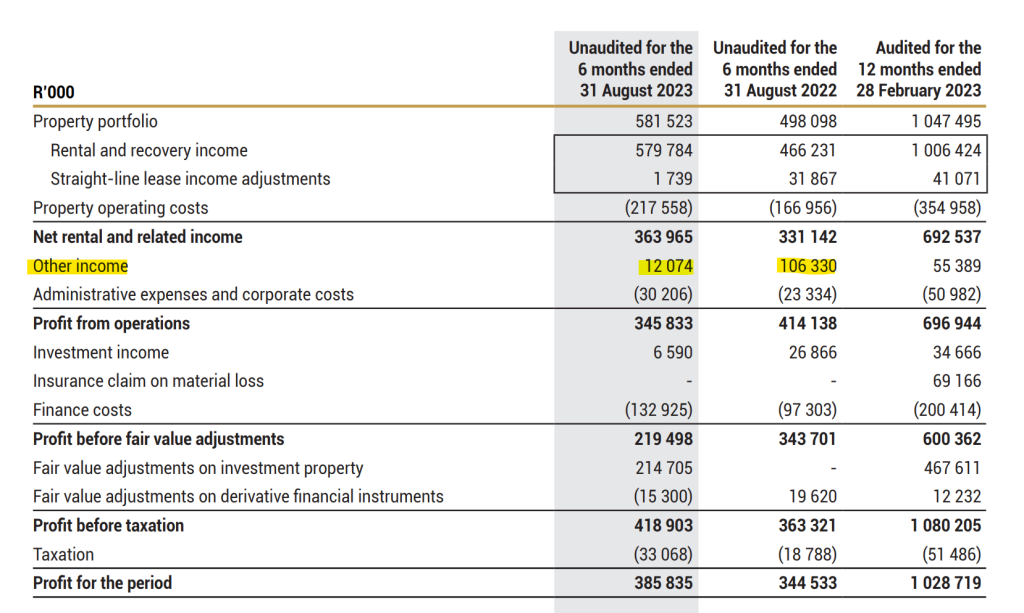

Whenever you are assessing the financial performance of a company, you need to scan the numbers for anything unusual. Here’s a perfect example from Exemplar REITail:

Net rental and related income has moved higher, which is good. The next line your eyes should’ve moved to (in the absence of highlights) is profit from operations, which shows a big negative move. The “other income” line is clearly where the negative shift happens. If you read the notes to other income, you find that R69 million in insurance proceeds were recognised in the base period. Although it doesn’t explain the entire move, it goes a long way towards doing so.

Why isn’t this insurance claim on the line that is literally called “insurance claim on material loss”? Well, if you look in the final column, you’ll see that it was classified there for the full year reporting.

I don’t make the accounting rules. I just try hard to navigate around their weirdness at times.

You may also want to take note of the big jump in finance costs from R97 million to R133 million. This issue is plaguing property funds at the moment, as leverage is a huge part of the business model.

Investors care most about the dividend (down 6.47%) and the net asset value per share (up 13.81% to R14.34). The share price closed at R10.10.

Hyprop achieved the R500 million target for the dividend reinvestment programme (JSE: HYP)

In fact, the reinvestment alternative was oversubscribed

Real Estate Investment Trusts (or REITs) try to find ways to retain equity capital. This is because the REIT rules mean they are always on a treadmill, having to distribute most of their profits to shareholders.

One of the ways to retain capital is a dividend reinvestment programme, which in some respects works like a miniature rights offer. Hyprop has used this with great success in the past and has done it again, retaining R500 million in equity capital through shareholders electing to reinvest at R24 per share. For reference, the current price is R26.76, with the discount used to encourage this election.

Holders of 68.5% of shares chose the reinvestment alternative, which would’ve meant retention of R730.6 million were it not for the self-imposed R500 million limit. This means that each shareholder who elected this alternative will reinvest a pro-rata amount.

MTN Rwanda is moving firmly in the wrong direction (JSE: MTN)

Even East Africa, once a hotbed of potential, isn’t safe from these conditions

As a quick recap on MTN:

- MTN Nigeria could win a game “bad things happening to me” bingo

- MTN Ghana is growing, but below inflation (only just)

- MTN Uganda is doing really well, with earnings growth way ahead of low inflation in the country

This brings us neatly to MTN Rwanda, which is an unfortunate story. EBITDA could only limp 4.7% higher, with EBITDA margin unwinding by 390 basis points to 44.9%. Capital expenditure increased by 11.5%, so pressure on the balance sheet (a feature of telecommunications businesses) is clear to see.

Thanks to the muted EBITDA performance and a sharp increase in net finance costs, profit after tax fell by 25.2%.

The inflation rate is 17.2%, so I think we can all agree that negative real growth is particularly worrying here. As we are seeing elsewhere in the business, another worry is US dollar-denominated expenses, with the company trying desperately to stay ahead of the curve when earning local currency.

MTN Group got down to R90 before turning higher to R97. Let’s see what the share price does when group results come out, as the market usually does a fairly poor job of watching the African results as a pre-cursor to the group performance.

NAV growth and a dividend at Redefine (JSE: RDF)

And perhaps most importantly, a more positive outlook

Redefine is a typical example of a large local REIT with a diversified portfolio. In these conditions, that isn’t necessarily a good thing. Being a focused REIT with a small portfolio does have its perks.

To give you an idea of the spread, 65% of Gross Lettable Area (GLA) is in Gauteng, 14% is in the Western Cape, 6% is in KZN and 8% is spread across the rest of South Africa. The remaining 7% is international.

There’s significant exposure to office property, with R22.2 billion worth of office property out of a total property portfolio of R78.8 billion.

Despite the broad exposure and numerous challenges in the property sector at the moment, the SA REIT GLA vacancy rate improved from 6.8% for the year ended August 2022 to 6.6% for the year ended August 2023.

Loan to value has moved higher, from 40.7% in 2022 to 42% in 2023. Including foreign currency debt and derivatives, the cost of debt has increased by 110 basis points to 7.1%. For those who haven’t had experience with balance sheet structuring and yield curves in different countries, you’ll find it interesting to compare the ZAR cost of debt (8.7%) to the EUR (2.6%) and USD (5.3%) denominated loans.

Focusing on the returns to shareholders this year, the dividend was 1.9% higher at 43.80 cents and the NAV per share has increased by 6.4% to R7.6596. The share price is R3.59, so Redefine is trading on a yield of around 12.2%.

In the outlook section, Redefine has some optimism that the property cycle has bottomed out. The guidance for distributable income for FY24 is between 48.0 and 52.0 cents vs. 51.53 cents in FY23. In other words, sideways or slightly down is still the expectation for the next 12 months, but the worst seems to be behind the sector.

Sibanye strikes a wage deal at Kroondal (JSE: SSW)

The average increase over five years is 6.4% per annum

Sibanye-Stillwater has been having an incredibly tough year thanks to plummeting PGM prices and inflationary pressures in costs. This has driven a need for some restructuring and retrenchment activities at certain mines, which perhaps sends a signal to the unions across the group.

The Kroondal PGM wage negotiation has been concluded without any disruptions. AMCU and the NUM have agreed to a five-year deal with inflation-linked increases similar to those agreed at Rustenburg and Marikana during 2022.

The average increase over the five-year period is 6.4% per annum.

Little Bites:

- Director dealings:

- Here’s an interesting one: the CEO of Capitec (JSE: CPI), Gerrie Fourie, has sold shares worth R11.5 million.

- A director of a major subsidiary of Super Group (JSE: SPG) sold all the shares that vested under a share appreciation rights scheme, coming in at R1.95 million. Where an executive sells all the shares rather than enough to cover just the tax, that’s a genuine sale in my books.

- Speaking of sales related to share awards, the selling by Truworths (JSE: TRU) executives continues. The company secretary has sold R1.4 million worth of shares, with part of the reason being a rebalancing of his investment portfolio.

- Des de Beer has bought R1.4 million worth of shares in Lighthouse Properties (JSE: LTE)

- A director of a major subsidiary of Bell Equipment (JSE: BEL) has bought shares worth R99k.

- Go Life International (JSE: GLI), one of the most obscure companies on the JSE, is changing its name to Numeral Limited provided shareholders approve the change.

In RDF’s presentation are shown different LTVs

FY20 – 49.7%

FY21 – 42.4%

FY22 – 40.2%

FY23 – 41.1%

Hi! Will try and find time to go have a look. Sometimes the funds calculate it in different ways, even within the same set of results. This is particularly the case when there are complicated debt structures in the business.