Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Accelerate pops its Cherry (Lane) (JSE: APF)

The property in Pretoria is being sold

Accelerate Property Fund is still offloading properties to help get the balance sheet back to a sustainable level. The newest sale is Cherry Lane Shopping Centre in Pretoria. The buyer is Chrysoula Sourlis, who is not a related party to the fund.

The sale is priced at R60 million. The property was valued at R65 million as at 31 March 2023, so that’s quite the discount. The vacancy rate has spiked from 32.3% to 47.8% since March, so a drop in the valuation is understandable.

I decided to dig back into the archives to see what the property was worth when Accelerate bought it. I found the abridged pre-listing statement for Accelerate in 2013, reflecting a value for the property of R102 million.

A lost decade, indeed.

African Rainbow Capital gives a portfolio update (JSE: AIL)

There are many companies in the portfolio, so they focus on the most important and interesting ones

African Rainbow Capital Investments has a diverse portfolio of assets ranging from boring financial services businesses through to exciting startups. I’ve been vocal with my views on how they treat shareholder capital and how the fee structure historically worked, with the market sharing many of my concerns – as evidenced by the share price. This is no reflection on the underlying portfolio, which includes some very good businesses.

The announcement starts with rain, which continues to meet its monthly financial targets. They also mention that take-up of rainOne (the all-in-one connectivity package) is increasing steadily.

The news is less positive at Kropz, where the Elandsfontein project faced localised flooding due to heavy rains. Rain is clearly a theme at African Rainbow Capital. The fund injected another R290 million worth of capital into this project in the period between 30 June and 30 September.

I’m going to jump to the financial services portfolio now, as TymeBank is too important to push further down. There is now an annual revenue run rate of R1.8 billion in TymeBank and R100 million in GoTyme. Across South Africa and the Philippines, the business is growing at 450,000 new customers a month, with 200,000 being in TymeBank South Africa. The local business now has 8 million customers since launching in February 2019. GoTyme in the Philippines has a customer base of 1.6 million customers and is growing at 250,000 customers per month (in case your maths is letting you down based on the numbers given earlier).

A Series C capital raise is currently underway at Tyme. The business seems to be marching on towards a separate listing at some point.

At Bluespec, the company is on track to meet the growth budget. It also sounds like they are doing a good job of managing costs while scaling, which is important.

At ooba, performance is tracking budget and conversions into mortgages are going well despite the economic difficulties and higher interest rates.

The efforts in the agri portfolio are progressing well, with the RSA Group highlighted as achieving strong performance in this period.

The operations at Upstream Group tell us about the state of play for South African consumers. Creditors are lending to the same pool of consumers and those consumers are entering the debt review process a lot sooner than in previous years.

At Crossfin, transaction value has come under pressure along with consumer spending. The company has made an early-stage investment in something called Mypinpad.

Capital Legacy group was enlarged by the acquisition of the Sanlam Trust business, with a 26% stake in Capital Legacy going to Sanlam. The management team has been focused on integrating the offerings.

And finally, GoSolr saw a slowdown in the rollout of residential solar in this quarter. This is because load shedding dipped vs. the first half of the year, although perhaps the recent jump to level 6 will remind people that the Eskom show is far from over. Management is working on increasing the run-rate of installations in this business. My viewpoint is that this is a highly competitive space with no obvious moat for GoSolr.

In case this section didn’t make it clear, the most exciting part of the group right now is TymeBank and GoTyme. With management of African Rainbow Capital making various disgruntled comments in the media about the realities of being listed, one wonders if they will maintain the group listing for long enough for investors to get a proper value unlock from a separate listing of Tyme.

A collective sigh of relief at Mondi (JSE: MNP)

The final payments for the Syktyvkar asset have been received

When selling a business to Russian investors at a time like this in the world, I think nerves are unavoidable. Do you really want to launch a court bid as a Western firm to get your money in Russia? No, definitely not.

The good news is that Mondi has been paid for Syktyvkar, with the total cash consideration of RUB 80 billion in the bank (converted to euros, of course).

The net proceeds from the sale of this asset and other Russian assets come to €775 million. This amount is earmarked for distribution to Mondi shareholders, which is a mature capital allocation decision. There will also be a share consolidation to try and make the post-distribution share price as comparable as possible to the pre-distribution share price. That’s unusual and interesting. In fact, it’s a rather clever way to avoid confusion around share price performance!

Southern Palladium released a Mineral Resource update (JSE: SDL)

In junior mining, it’s all about hitting these milestones

If you’re going to try and read these mining exploration updates in detail, then you better have a degree in geology. Without that, you’re going to struggle to understand what is going on.

I certainly have no such qualification, so I always look to the management commentary to see whether things are going to plan.

I do at least understand the importance of Southern Palladium noting that its UG2 Indicated Mineral Resource has doubled, so that’s clearly good news. This obviously doesn’t mean that there are more minerals than before. It means that ongoing drilling work has confirmed that the status of Inferred Mineral Sources can be upgraded to Indicated Mineral Resources. These terms mean something in the world of junior mining, especially when speaking to funders.

The next significant milestone is the planned release of a Scoping Study in January 2024.

Spur is ready to take you to Italy (JSE: SUR)

The acquisition of Doppio Group has now closed

Back in July 2023, Spur announced the acquisition of a 60% stake in restaurant group Doppio Zero, giving access to a portfolio of 37 franchised and company-owned restaurants. I really like this deal, as this is a solid operation. The deal is now unconditional and has been implemented with effect from 1 December.

The Doppio Zero group hasn’t sat still in the meantime, which is the benefit of buying a controlling stake rather than a 100% stake. The sellers are still motivated to keep growing it. They have opened Ciccio, a sub-brand of Piza e Vino, with the first one at Melrose Arch. The group also owns an Indian-inspired concept called Modern Tailors, with the second restaurant scheduled to open in 2024.

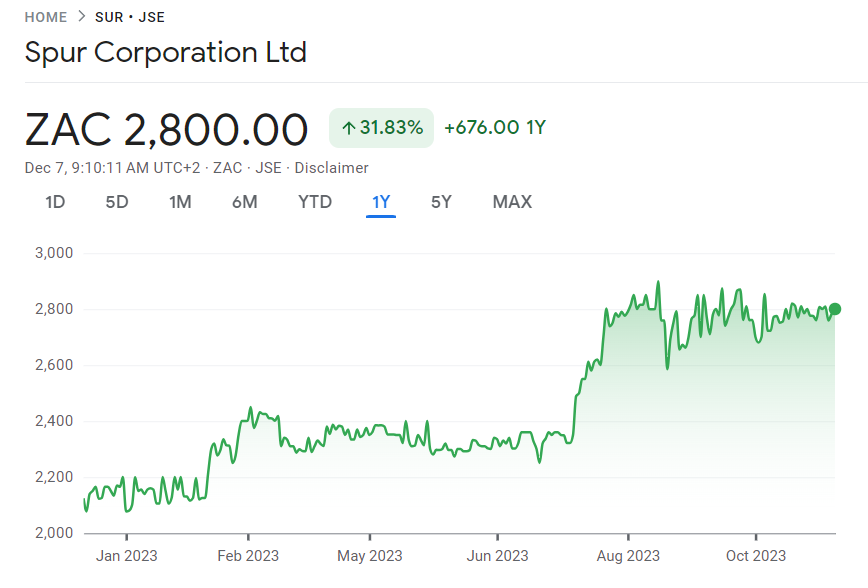

I am a big fan of everything that Spur is doing right now. I keep wishing that the share price would crack so that I can buy at a better valuation, but it seems to be holding onto the recent gains:

No Christmas holiday for Tongaat Hulett’s lawyers (JSE: TON)

The year is ending with a bang

In yesterday’s Ghost Bites, I explained the significant court blow dealt to Tongaat Hulett regarding the company’s attempts not to pay sugar levies while in business rescue. News also broke of two separate court actions that aimed to scupper the upcoming meeting of creditors. The applicants are RCL Foods and the South African Sugar Association.

Unsurprisingly, Tongaat Hulett has announced that it will oppose both court applications. The parties have agreed that pleadings will be exchanged on an urgent basis, such that the urgent application will be heard on 13 December.

To allow for this hearing, the court has ordered the adjournment of the creditor meeting from 8 December to 14 December.

One thing is for sure: any attorneys and advocates who work for these groups and who had booked leave for the next week or so are about to have disappointed families. It’s easy to be jealous of what these people earn, but life as a high-end professional is also filled with sacrifice and tough trade-offs. Been there, done that.

From bad to worse for Wesizwe Platinum (JSE: WEZ)

Employees embarked on an “illegal sit-in”

Things are going really badly for Wesizwe Platinum at the moment, with employees now on an illegal sit-in at the Bakubung Platinum Mine. Essentially, this means that employees chose not to return to the surface at the end of their shift on Wednesday morning.

The employees participating in this labour action have made demands and management is trying to persuade them to return to the surface.

It feels like the platinum sector in South African is gently imploding all over again.

Little Bites:

- Director dealings:

- There’s a very important share purchase by Phil Roux, who has been brought in to achieve a turnaround at Nampak (JSE: NPK). He has bought shares worth just under R4 million. That will definitely help calm some of the nerves in the market – for now, at least!

- Calibre Investment Holdings (related to director Theunis de Bruyn) has bought shares in Ascendis (JSE: ASC) worth R3.5 million.

- As part of the mandatory offer for Brikor (JSE: BIK), a director of the company has sold shares worth R347k.

- Des de Beer has bought another R206k worth of shares in Lighthouse Properties (JSE: LTE).

- A director of Mantengu Mining (JSE: MTU) has bought shares worth R1.2k. I don’t think that’s going to cause too much excitement in the market!

- BHP Group (JSE: BHG) has announced important leadership changes. Vandita Pant is moving from Chief Commercial Officer to the CFO role, having joined BHP back in 2016. The current CFO (David Lamont) will remain in the group until February 2025 in an advisory and projects capacity, reporting to the CEO. Rag Udd is the new Chief Commercial Officer (another internal appointment), Brandon Craig has been appointed to run the Americas business and Johan van Jaarsveld is the new Chief Technical Officer. Those three appointments are also all internal appointments. It always says a lot about a group when new executive-level appointments are internal.

- Shareholders of Kore Potash (JSE: KP2) passed the resolution required for the issuance of shares. The chairman and CEO of the company supported $750k of this capital raise to help get the company to finalisation of its all-important project.

- Buka Investments (JSE: BKI) is taking a long time to close the potential acquisition of Socrati Footwear. The deal was first announced in February 2023. The company has released a further announcement that the deal is still underway. No estimated timing for completion was given.

Hi Ghost. Who does Tymebank compete against in South Africa? I am amazed that there is a market for 200,000 new customers a month.