Accelerate Property Fund raised R50 million (JSE: APF)

The underwriter had to take the lion’s share

When a property fund is trading at a huge discount to net asset value per share, you would expect shareholders to jump at a rights offer. After all, it’s the opportunity to buy more shares at a vast discount, especially when the rights offer is priced below the market price.

Not so at Accelerate Property Fund, where the fully underwritten rights offer for R50 million saw the underwriter take up over R38 million worth of shares.

With a share price that has fallen over 86% in the past five years, there isn’t exactly an orderly queue in the market for these particular shares.

Choppy profits at this retailer (JSE: CHP)

Choppies is suffering from margin pressures

Revenue growth of 9%. That sounds lovely, doesn’t it? Sadly, a lot happens between revenue and money landing in the pockets of shareholders.

In the six months ended December, Choppies clearly struggled with margins. Gross margin fell from 21.3% to 21.0% as supply chain costs couldn’t be recovered from customers. It may not sound like a lot, but a 30 basis points deterioration in a retailer is a big deal.

The margin pressure at operating profit level was a lot worse, exacerbated by the opening of new stores that take a while to ramp up to full profitability. Operating profit fell by 22.1% as operating margin contracted from 5.6% to 4.0%.

Remember, by the time we get to operating profit, we haven’t even dealt with interest costs yet. In a higher rate environment, those also went in the wrong direction despite a decrease in net debt over the period.

With all said and done, headline earnings per share fell by 35% and there is no interim dividend.

So much for that revenue growth, huh?

Clientele offers a juicy yield AND growth (JSE: CLI)

Brand ambassador Desmond Dube is clearly doing his job here

Clientele is one of those companies that never comes up as a stock pick. Closing at R10.37 on Monday, the trailing dividend yield is 11.57%. That puts most property companies to shame, plus you must remember that you pay the full income tax rate on a REIT dividend, whereas a Clientele dividend is subject to dividends withholding tax (which is much lower, or zero if you hold the shares through a company).

Now, this isn’t to say that Clientele has been a fantastic investment. The share price hasn’t gotten back to pre-pandemic levels, as evidenced by this chart:

Still, with that dividend yield, you would expect the company to be ex-growth. Instead, we find a business that just grew its HEPS by 14% in the six months ended December. This bodes very well for the next dividend!

Despite Desmond Dube’s best efforts on daytime television, the company is dealing with higher than expected policyholder withdrawals as its customers face economic pressures.

I’m also not sure what the investment funds were invested in, as they somehow achieved an annualised investment return for the period of 12%. Every other insurance company has been complaining about investment returns in 2022.

Looking deeper, the long-term insurance segment remains the largest contributor, with net profit of R180.8 million and growth of 16% in that number. The short-term insurance business (Clientele Legal) recorded a 26% drop in net profit to R45.1 million.

Despite these numbers, the share price fell 0.3%. Volumes are thin here, despite the market cap of nearly R3.5 billion.

This is an interesting, off-the-radar company.

Hulamin: all about the “metal price lag” (JSE: HLM)

The concept of “normalised earnings” gets taken to the next level here

For the year ended December, Hulamin’s earnings as reported will drop by between 49% and 41%. If you apply normalisation adjustments to that HEPS number, then it looks very different.

The major adjustments are both related to the base year (2021) rather than the 2022 earnings. Hulamin talks about the Metal Price Lag (and even gives it capital letters), which is the timing difference between the purchase and sale of metal. I think most companies call this Normal Business.

If you are willing to work with Metal Price Lag, then you’ll be pleased to note that normalised HEPS has increased by between 20% and 38%.

The share price was trading around 3.5% lower in afternoon trade. This is called Share Price Lag.

Liberty Two Degrees is robust but perhaps expensive (JSE: L2D)

Operating costs are under serious pressure and the trailing yield isn’t juicy enough for me

Liberty Two Degrees makes for fascinating reading, as the property fund owns some of the most iconic properties in South Africa, including Sandton City and Melrose Arch. This is a mix of really desirable retail and office space, although the portfolio also includes a few other malls that aren’t nearly as prestigious.

Importantly, consumers have returned to malls and key retail metrics are running ahead of pre-pandemic levels. Turnover is up 21.9% vs. 2019 and footcount is up 9.9% vs. that year in the retail portfolio. Despite this, rental reversions were -9.7% for retail space, so tenants are still negotiating hard with landlords.

The situation in the office portfolio is still horrible, with negative reversions of -25.5% vs. -24.8% last year. Office occupancy has dropped year-on-year from 86.2% to 80% because the fund sold the fully let Standard Bank building. This “reveals” the occupancy in the rest of the portfolio. Leaving aside that building, like-for-like office occupancy has improved at least, though one would certainly hope so based on the negative reversions!

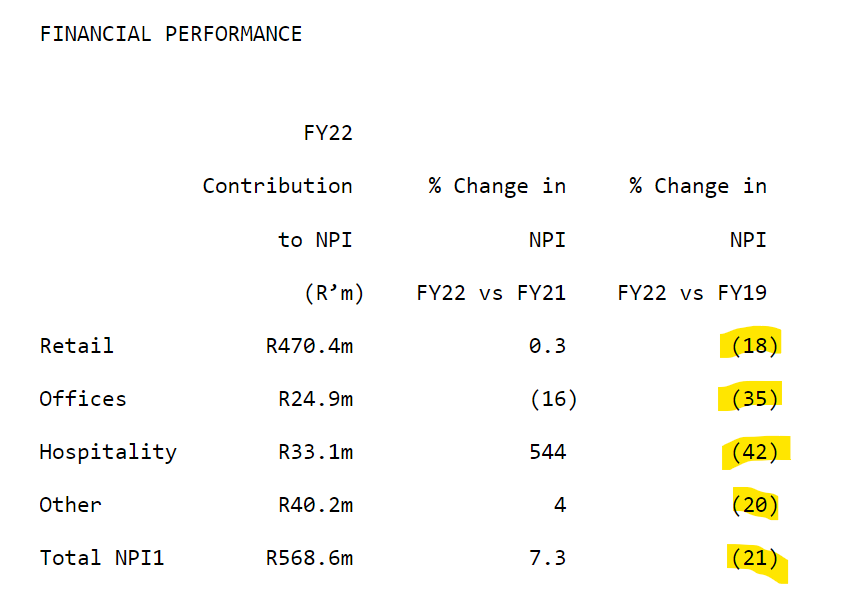

The trouble lies in operating costs, which have come under substantial inflationary pressure. We can see this in Net Property Income, which is still much lower than in 2019 despite the improvement in rental turnover and footfall. Here’s the real story vs. pre-pandemic numbers:

You also need to keep a close eye on interest costs, with a higher interest rate environment adding to the pressures. Net interest expense is 12.13% higher year-on-year, an unpleasant outcome when Net Property Income was only up 7.3%.

The good news is that the Loan to Value ratio is modest at 24.4%, so the fund isn’t carrying too much debt. This has helped support a 100% distribution pay-out for the year of 36.47 cents per share, which is 6.95% higher than in 2021. Under the circumstances, that’s a decent outcome.

The share price is trading at R4.30 which implies a trailing yield of 8.5%. Is that enough in this environment, particularly with load shedding pressures on operating costs? I don’t think so.

As this share price tells us, we are still a long way off pre-pandemic levels:

Murray & Roberts is losing money (JSE: MUR)

Is a rights offer coming at some point?

Murray & Roberts released an updated trading statement that treats the Australian business as a discontinued operation in this period and the prior period. This allows the market to isolate the rest of the business and see how that is performing.

The answer is: not well.

From both continuing and discontinued operations, the company is expected to report a headline loss in the six months to December of between -323 cents and -321 cents. From continuing operations only (i.e. ignoring the Blunder Down Under), the headline loss is -33 cents to -28 cents.

When a company says that it will “evaluate options to de-lever the balance sheet to achieve a long term capital structure”, it’s time to accept that the risk of a rights offer is very high. Have a look at the EOH share price to get a sense of what that looks like for shareholders.

Little Bites:

- Director dealings:

- A director of Argent Industrial (JSE: ART) has sold shares worth R374k.

- If you’re a Kibo Energy (JSE: KBO) shareholder or perhaps an energy junkie, you’ll be interested to know that Kibo subsidiary, Mast Energy Developments, exceeded expectations in 2022 at the Pyebridge synchronous gas-powered flexible generation facility. I’m not going to pretend to understand this stuff, so read the full details here if this interests you.

- Acsion Limited (JSE: ACS) has renewed the cautionary announcement related to a potential cash offer and delisting of the company.

- Chrometco (JSE: CMO) has renewed the cautionary announcement relating to a material subsidiary of the company. The company is suspended from trading on the JSE.

“Share Price Lag” put a smile on my face 😂

I thoroughly enjoy reading your pieces and find your insight very useful. Thank you for what you do.