Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

At Acsion, the market continues to ignore the NAV (JSE: ACS)

You won’t see a discount to NAV of this size very often

In the property sector, a discount to net asset value (NAV) is nothing new. Most funds trade below the NAV per share for various reasons. At Acsion, the discount is just particularly huge. The share price closed at R5.61 on Friday and the NAV per share is R26.62.

The portfolio is a difficult thing to understand, as it includes complications like an hospitality model where Acsion is owner and operator of the hotel rather than just the landlord. This makes it difficult for the market to predict the cash flows. Another complication is that Acsion isn’t a REIT, so investors can’t value it based on the net operating income and the knowledge that most of it will pop out as dividends.

Case in point: the dividend per share for FY24 is 33 cents, but HEPS was 98 cents. That’s a low payout ratio. Speaking of HEPS, it fell by 18% for the year.

Another interesting angle to Acsion is that the loan-to-value ratio is only 10%, but current liabilities exceed current assets as at the reporting date because of when loans are maturing. Acsion is confident that this won’t be an issue, as banks have approved new facilities at more favourable terms. Still, the market doesn’t like uncertainty.

There really is no reason for this company to pay dividends. Acsion should only be executing buybacks at this discount to NAV. They executed repurchases worth R357 million in FY24 and declared dividends worth R132 million. I suspect that the share price would respond positively to dividends being dropped completely in favour of buybacks.

Altron shows one of the better ways to do a B-BBEE deal (JSE: AEL)

Avoiding bank debt makes sense and a genuinely broad-based approach is a noble one

Altron has announced a new B-BBEE transaction. There have been many ways to do these over the years, with the initial years of B-BBEE deals leading to highly leveraged transactions funded by banks and supported by corporate guarantees. Time showed us that those deals often end in tears, with only the banks actually making any money. These days, there are better ways to do things.

Altron’s new deal uses a sustainable funding structure in the form of a preference share that effectively takes the ordinary equity of the empowered entity down to zero. Instead of going to the banks and asking for a big loan to buy ordinary shares, this approach captures the current value of the entity in a preference share and allows the B-BBEE partner to buy ordinary shares at a nominal value, thereby participating in future value creation.

The B-BBEE partner is structured as a broad-based trust, with objectives around addressing scarce ICT skills within South Africa. Instead of empowering one person or even a handful of people, Altron is aiming to make a broader difference to the skills crisis in South Africa and the lack of employment opportunities. Altron will contribute R5 million to the trust in FY25 to get these initiatives off the ground.

The trust will acquire a 20% interest in Altron South Africa Holdings, which in turn will hold 100% in Altron TMT SA Group.

In this case, the preference share is priced at a spread to the official prime lending rate – in other words, a rate higher than prime. Current Altron shareholders therefore continue to earn that return from the empowered entity, as well as 80% of the equity value going forward.

Although it wasn’t strictly necessary for the deal, Altron obtained a fairness opinion for the transaction from BDO Corporate Finance. They opined that the terms are fair to Altron shareholders.

Generally speaking, the B-BBEE partner is no worse-off in this structure than in a deal funded with external bank debt. The current shareholders in Altron are materially better off than in a traditional structure that gives a guarantee to an external bank. With the trust structured with a long-term approach in mind, another benefit is that this isn’t a deal that will need to be restructured after 7 – 10 years, the typical holding period in private equity structures.

AVI’s most important businesses are doing well (JSE: AVI)

But I&J remains a worry

AVI has released a trading update for the year ended June 2024. Group revenue is up by 6.3%, but that is an over-simplification of what’s going on at AVI. Before we dive into the segments, the important point to note is that HEPS will be up by between 21% and 25% vs. the prior year, so AVI has managed to turn a modest revenue performance into a great performance at HEPS level.

The biggest part of the business is the Food & Beverage segment, which grew revenue by 9.0%. This consists of Entyce Beverages – the star of the show with 18.2% growth – as well as Snackworks (up 6.4%) and I&J (down 1.1%). I&J is thankfully the smallest part of the segment and contributes 15.5% of group revenue, so it’s important but not critical to the group result. Still, it would be a lot better to see the fishery heading in the right direction.

The Fashion Brands segment fell by 4.8%. Within that, Footwear & Apparel put in an asthmatic performance of 3.6% growth. Personal Care was down 16.4% but there was a change to the underlying business in this period which contributed to the drop. The Coty distribution agreement ended in July 2023, leading to only a marginal decline in profit despite a negative impact on revenue.

As has been the case for a while, AVI’s food and beverage businesses are the best part of the group. When both volumes and price head in the right direction, revenue does well and margins tend to be protected (or even expanded) as well.

I&J has been the exception, with the fishing industry notoriously difficult to predict and understand. Catch rates and global selling prices lead to volatile earnings, with I&J struggling with reduced demand in key abalone markets in the latest period. Thankfully, I&J’s margins were in line with the previous year despite the revenue pressures, with the business putting a lot of effort into expense management.

Net finance costs were marginally lower than the previous year, with the benefit of lower debt being mostly offset by higher interest rates.

BHP and Vale will share any payments related to Samarco class action suits (JSE: BHG)

This confirmation was made necessary by proceedings filed outside of Brazil

The Samarco dam disaster has been going on for years, with extensive legal proceedings and rehabilitation work in Brazil. The issue has gone broader than that recently, with proceedings filed in English as well as Dutch courts.

As BHP and Vale each held 50% of Samarco, they previously entered into a framework agreement stipulating a 50-50 share of amounts payable to claimants in court proceedings. Oddly, BHP is the only defendant in the English court proceedings and Vale is the only defendant in the Dutch proceedings, so this agreement ensures that if liability will be established in either of those proceedings, BHP will only be on the hook for 50% of the payments.

Burstone could sell its Pan-European Logistics portfolio (JSE: BTN)

There’s no guarantee of a deal at this stage

Burstone has released a cautionary announcement regarding a potential transaction related to the Pan-European Logistics portfolio. Burstone is considering a disposal of the majority of its stake in that portfolio, with the purchaser being funds of Blackstone Europe.

They are calling this “exclusive negotiations regarding the potential formation of a strategic partnership” with those funds. A strategic partnership is different to a typical disposal, as it implies a working relationship going forward.

At this stage, there’s no guarantee of a transaction being concluded, hence why the cautionary has been released. There’s also no indication of price or deal structure at this stage.

Capitec flags a very strong period (JSE: CPI)

The six months to August were fantastic

Capitec released a trading statement for the interim period and the jump in headline earnings per share (HEPS) is something to behold. This all-important metric is up by between 25% and 35%, benefitting from a combination of strong operating conditions for the bank and a weak base period.

Let’s start with the base period, where HEPS only increased by single digits. This was driven by an increase in impairments and a generally tough economic climate. They’ve effectively now lapped a period of high rates and the economy is looking better, so the credit impairment charge and credit loss ratios are having a less negative benefit than a year ago. Essentially, the momentum from the second half of the previous financial year has continued, as the second half of FY24 saw an increase of 22% in HEPS.

They also got a boost from the acquisition of Avafin, an international online lending group. Capitec previously had a 40.66% stake in this company and accounted for it as an associate. Since 1 May 2024, Capitec has held a 97.075% stake and thus almost all the profits are attributable to shareholders of Capitec.

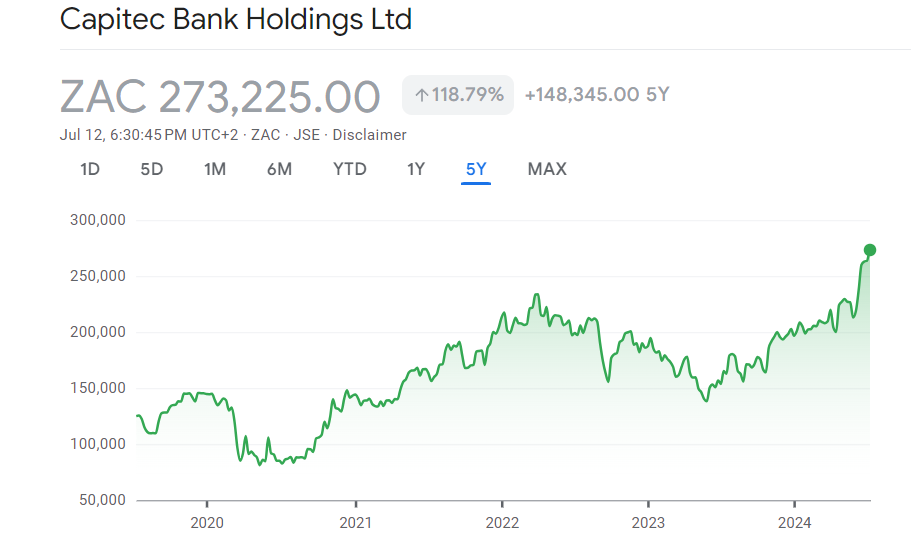

The Capitec share price has had a terrific time of things in 2024:

And over five years, it looks even more impressive. It took a while to regain the highs of 2022, but the share price has now pushed strongly through those levels:

Ninety One’s assets under management have ticked higher (JSE: NY1 | JSE: N91)

This is always good news for an asset manager

In the past couple of years, asset managers have had a tough time. For one thing, higher interest rates and inflation have put people under pressure and ensured that more of their capital is sucked into debt repayments and the cost of living. For another, most equity markets haven’t had a great run of things in recent times.

As asset managers earn their fees based on the quantum of assets under management (AUM), this has been a difficult time for many of the companies in this sector – particularly the ones that don’t have an army of wealth managers out there doing distribution.

The good news at Ninety One is that AUM has continued to tick higher. It was £124.8 million a year ago (June 2023). By March 2024, the end of the previous quarter, it had moved up to £126 million. As at June 2024, the end of the latest quarter, this had ticked up to £128.6 million.

Sirius announced the results of the UK retail investor raise (JSE: SRE)

Sadly, South African retail investors weren’t given a chance to participate here

As part of the latest capital raise activities at Sirius, the goal was to raise £150 million through a placement with qualifying institutional investors, as well as £2.5 million through a retail offering in the UK market. Whilst I absolutely love seeing retail investors being given a chance to invest, it’s a pity that South African retail investors weren’t included here.

Sirius had no problem raising the money from either group of investors, with the latest announcement being that the retail offer has closed and the full amount has been raised.

Spear REIT sells the legacy assets at the DoubleTree (JSE: SEA)

These are non-core sectional title units and parking spaces

Back in February 2022, Spear sold the Upper East Side Hotel, which is run as the DoubleTree by Hilton Hotel in Cape Town. I’ve been there and it’s a pretty cool place, not that this matters.

As part of the deal, Spear retained some sectional title units and parking bays. These units and bays have now been sold as well, with the hotel as the purchaser. The selling price is R11.8 million, which is higher than the net asset value of R9.5 million on the Spear balance sheet as at February 2024. It’s still tiny in the overall Spear portfolio, so this was a distraction more than anything else. Spear can take this capital and redeploy it into the opportunities that investors want to see, like retail and industrial properties in the greater Cape Town Metropole.

A couple of shareholders of the purchaser are associates of non-executive directors of Spear, so this is a small related party deal. This is why a fairness opinion needed to be obtained for the transaction, with PSG Capital opining that the terms are fair to Spear shareholders.

As part of the transaction, Spear has given rental income guarantees to the purchaser for a limited period.

Little Bites:

- Director dealings:

- Pay close attention to this one: Dr Christo Wiese’s personal investment vehicle, Titan Premier Investments, has increased its stake in Brait (JSE: BAT) from 28.66% to 34.26%. He’s therefore just below the threshold for a mandatory offer. This comes through as a director dealing because Wiese is a director of Brait.

- In addition to sales by various directors and prescribed officers to cover the tax on vested shares, two prescribed officers of Telkom (JSE: TKG) sold shares in the company worth R1.3 million.

- Sebata Holdings (JSE: SEB) announced a further delay to the results for the year ended March 2024. They will be published by no later than 31 July – hopefully.