A little less conversation, a little more Acsion (JSE: ACS)

This is the property development company you’ve probably never heard of

Acsion isn’t in the news very often, yet it has a market cap of roughly R2.3 billion. This group is focused on growing its net asset value (NAV) per share rather than just its dividend, so this sets it apart from the REIT structures on the JSE.

Liquidity in the stock is very limited, with a 21% move on Thursday as a perfect example of what happens when liquidity is tight.

Results have been released for the year ended February 2023, with revenue up by 22% and HEPS up by 14%. The NAV per share has increased by 12% to R23.90. At a closing price of R5.80, that’s one of the biggest discounts to NAV that you’ll find on the market.

Although there were repurchases during the year, there is also a cash dividend of 18 cents per share. At this enormous discount to NAV and with no pressure on the company as it isn’t a REIT, there should theoretically be no cash dividend at all. Every cent should be invested in share buybacks.

As was pointed out to me on Twitter after the first version of this article was posted (thanks @RossMalt), the CEO holds most of the shares in issue. This makes it difficult to execute share buybacks to a great extent, though the difference between a cash dividend of R71 million and buybacks of R121k is still vast. It really begs the question of why this group is listed in the first place, as minorities could be taken out at a large discount to NAV.

Blue Label announces new management at Cell C (JSE: BLU)

An ex-Vodacom executive has taken the top job at Cell C

I quite enjoyed the comment in this Blue Label Telecoms announcement about how new CEO Jorge Mendes is “poised to steer Cell C towards new heights of success” – this implies there are previous heights of success, which there most definitely aren’t. Cell C has been a financial disaster throughout its life, with Blue Label now giving it another roll of the dice with a new, more capital-light strategy.

In fairness, this is probably Cell C’s best chance of success. The announcement is just doing an excellent job of putting perfume on a pig.

Mendes is the former Chief Consumer Business Officer at Vodacom South Africa and has experience in various African markets. Let’s see what he can do!

The blandest of bland cautionaries at Clientele Limited (JSE: CLI)

Bland or not, the stock closed 20% higher

Although large bid-offer spreads always need to be considered when looking at one-day moves in JSE stocks, I still found it interesting that Clientele managed to close 20% higher after releasing the blandest cautionary possible.

The JSE doesn’t love these bland cautionaries that are drier than a small McDonald’s burger without tomato sauce. We don’t even know whether Clientele is looking to buy or sell a business. All we know is that shareholders should exercise caution when trading in the shares. That didn’t stop the late afternoon punters!

Highlights from the Motus investor day (JSE: MTH)

The company has made the presentation and recording available

An investor day is a wonderful thing if you hold the stock in question. Although there is often a lot of repetition of the most recent results, there are also updates on the state of the market and the recent performance.

The very first meaningful slide in this investor presentation from the Motus event deals with the “fragile consumer” and why that is the case. As one might expect, the list of problems in South Africa is longer than in the UK and significantly longer than in Australia.

This is a smart way to kick off the story around the investment thesis, as Motus is pursuing a diversification strategy. The target is a 50-50 EBITDA split between vehicle sales and non-vehicle sales. There is also a goal to get to a 70 – 30 split in terms of SA vs. international contributions to operating profit. These aren’t pie in the sky targets, as the group is pretty close on both metrics.

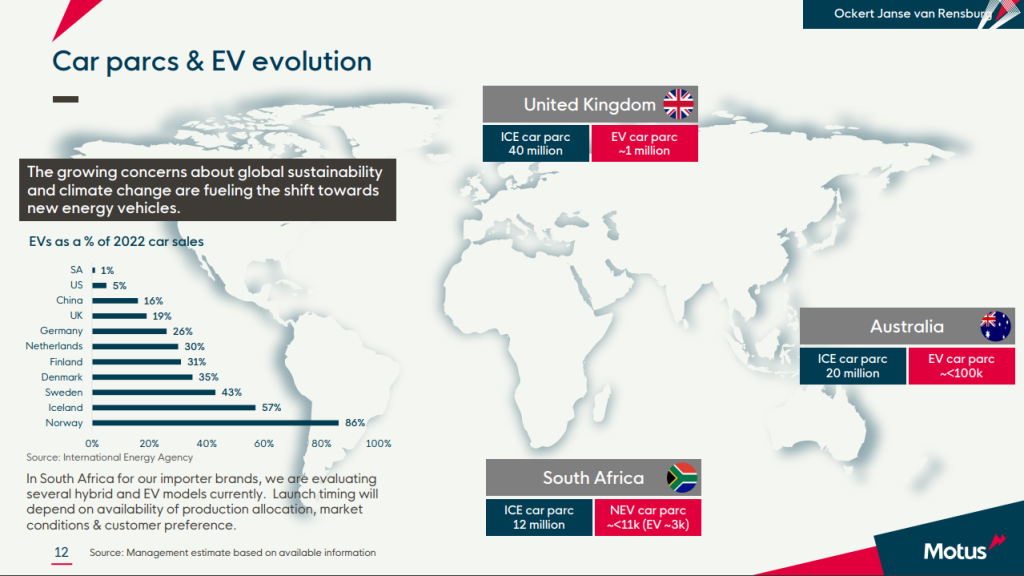

And for all the noise around electric vehicles in the market, there’s a great slide in the presentation showing the level of adoption in SA vs. other countries:

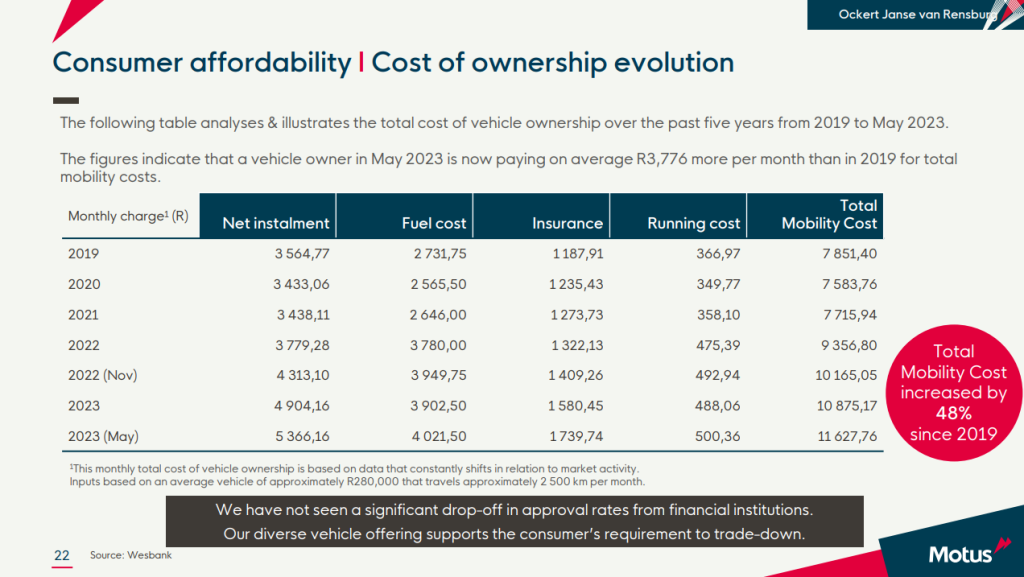

There’s another slide that I want to highlight. It quite brilliantly shows how the cost of mobility has gone through the roof in recent years, driven by everything from currency weakness through to inflation and fuel costs. Consumers are trading down in response to this, with banks still happy to lend money against the cost of vehicles. In a country with such limited public transport alternatives, here’s part of why our savings rate is so poor:

You’ll find the full presentation here and the recording here.

PPC is still loss-making (JSE: PPC)

But the headline loss at group level is smaller than before

As a strong reminder of what happens when a balance sheet goes wrong in a complicated African group, PPC reports based on the “SA obligor group” and that obligation relates to debt. In other words, this is the part of the group that has to keep the banks at bay.

One of the biggest threats to the company is cement imports, with a weaker rand actually helping PPC in that context. But despite the coastal regions enjoying better competitiveness against imports, volumes in the SA obligor group still fell by 5.8% because of pressure on the inland region. Thankfully, pricing increases at least took the revenue growth to 1.7% for South Africa and Botswana collectively. Costs were up 4%, so that means margins went the wrong way.

EBITDA in the SA obligor group fell by 26% to R570 million in the year ended March 2023. Importantly, net debt reduced considerably from R1.06 billion to R800 million. This is a decent debt to EBITDA ratio and it excludes any dividends from Rwanda and Zimbabwe.

The business in Zimbabwe is debt-free and achieved EBITDA of R365 million, down 7%. This allowed PPC to receive R147 million in dividends (net of withholding taxes), significantly higher than R91 million in the prior year.

Rwanda is the jewel in the crown right now, with EBITDA up by 31% to R447 million. There is net debt of R105 million in that group. The SA obligor group received dividends of R79 million, net of withholding taxes. The annoyance is that PPC only holds 51% of this jewel, hence the significant difference between EBITDA and the dividend received.

So from a balance sheet perspective, the hard work to get net debt to a reasonable level has certainly paid off. If you include the dividends from Zimbabwe and Rwanda in the SA obligor group EBITDA, the net debt to EBITDA ratio looks manageable.

Despite all this effort, group HEPS is still a loss of between -8.0 cents and -10.5 cents. This is an improvement on -13 cents in the comparable period but is obviously still a loss.

As in every PPC announcement, the group reminds the market that it has excess capacity and is ready to respond to an uptick in infrastructure spending and economic growth.

Sephaku’s local business drops to breakeven levels (JSE: SEP)

This has had a significant impact on group results

For the year ended March 2023, Sephaku Holdings has noted a drop in HEPS of between 38% and 46%. Although we have to wait until detailed results on 28 June to get all the information, we do know where the problems were.

Sephaku Cement managed to maintain market share but sadly market share is no measure of profitability. Financial performance deteriorated to breakeven levels, which obviously hit the group numbers. Thankfully, the impact was blunted somewhat by a strong performance at Métier across revenue and profit.

Visual puts the concern in going concern (JSE: VIS)

This listed company had R3.7k in the bank at the end of February – not a typo

It’s not every day that a company will happily continue trading with current liabilities exceeding current assets by 78 times. Again, that’s not a typo. Current liabilities at Visual International Holdings are R25.3 million and current assets are R0.3 million.

This property developer is in a world of hurt, with SARS fights being part of the mix and even a claim by the old auditors that the company is now defending.

The company is a going concern in the opinion of the directors for various reasons, including disposals of land and the development at Stellendale Junction that is finally underway. I hope they are right, as the Companies Act provisions related to reckless trading aren’t pretty. I’ve seen companies go into business rescue with healthier balance sheets than this one.

Little Bites:

- Director dealings:

- In case you thought your last derivative trade was impressive, the latest from Dr Christo Wiese in Shoprite (JSE: SHP) should bring you back down to earth. He bought puts with exposure of R226.5 million at R226.45 per share and sold calls with exposure of R236 million at R236.18. These are December 2023 options. He also bought single stock futures contracts with exposure of R465 million.

- A director of Investec (JSE: INL) has sold shares worth £829k.

- An associate of a director of Ethos Capital (JSE: EPE) has bought shares worth roughly R5 million.

- Associates of two directors of Ascendis Health (JSE: ASC) have each bought shares worth R514k (total purchase R1.03 million)

- I skimmed the proposed amendments to the JSE Listings Requirements in terms of a new BEE Section on the exchange. One of my great irritations is how tiny the local investable universe is for BEE investors, especially when companies like Absa add to the problem by doing fresh deals that don’t have a listed element available to retail investors. The new rules relate to the listing of BEE special purpose vehicles. It would be great to see more listings in this part of the market as a way to encourage saving and investing.

- In an important step for the working relationship between the two companies, the CEO of Sanlam (JSE: SLM), Paul Hanratty, has been appointed to the AfroCentric (JSE: ACT) board as a non-executive director. Marinda Dippenaar has also joined the AfroCentric board from African Rainbow Capital.

- In a very fluffy ESG-filled announcement that says a lot but also doesn’t say very much at all, Anglo American (JSE: AGL) announced a collaboration with Jiangxi Copper in China on “responsible copper” – which means knowing how the stuff is mined, processed and brought to market. It reads like a government announcement about a foreign visit, with no indication of what this actually means for shareholders.

- Buried at the bottom of an announcement about its AGM, Finbond (JSE: FGL) announced that Protea Asset Management (linked to Sean Riskowitz) now holds 12.08% in the group after acquiring more shares.