Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Acsion is an oddball that is still at a huge discount to NAV (JSE: ACS)

I’m not sure the market knows what to do with this one

Acsion is a property development firm rather than a REIT. That’s fine in principle, as there are other such firms on the market. The problem, I think, is that the strategy is all over the show, as the company has various rental properties and even generates 10% of its revenue from the hospitality industry, actually operating hotels itself.

The market likes things that are easy to understand, especially among the more obscure names with little or no liquidity anyway.

Acsion’s revenue is up 20% and net asset value (NAV) per share is up 17% to R26.16. The interim dividend is 16.40 cents, down from 18 cents last year. The market couldn’t care less about the NAV, with the share price languishing at R5.56.

The problem is that the dividend yield and the NAV don’t really make sense next to each other, so the market is focusing on the cash flow from the assets rather than the paper value. If the NAV is a genuine reflection of what the assets are worth, this should be a slam-dunk take-private opportunity.

The percentage moves at Crookes are a bit daft (JSE: CKS)

Agriculture is many things, but steady and smooth isn’t one of them

Crookes Brothers has released results for the six months to September. Thanks to a previously released trading statement, we knew they would reflect a huge improvement. Revenue from continuing operations is up by 17% and operating profit after biological asset fair value movements has jumped by a ridiculous amount, from R8.8 million to R108 million!

Once finance costs and other things are taken into account, the swing is from a headline loss of R29 million to headline earnings of R49 million. Importantly, cash generated from operations came in at R112 million, a huge increase from R28.9 million previously.

Despite this, there’s no dividend for the interim period.

In case you’re wondering how the group makes money, sugar cane generated operating profit of R166.9 million, bananas came in at R7.6 million and macadamias registered a loss of R33.9 million. These numbers are all net of fair value movements in biological assets. In particular, world macadamia nut prices are severely depressed.

Adjusted earnings are a lot higher at Deneb (JSE: DNB)

And in this case, the adjustments are appropriate

I’m normally skeptical of adjusted HEPS. The concept of HEPS is already somewhat adjusted in nature, as there are rules about what can be excluded as once-offs or non-recurring items. Still, those rules don’t capture every possible reality. In this case, Deneb received a large insurance claim in the prior year that was included in HEPS, which is why HEPS as reported is down by 36%.

In reality, it’s up 69% if that amount is excluded from the base, driven by revenue up 9.4% and adjusted profit up by 30.4%. The net asset value per share is up by 3%. Notably, the operating profit growth was driven by very strong cost control and a decline in gross margin of only 10 basis points.

Like last year, there’s no interim dividend.

eMedia was resilient in this period (JSE: EMH)

There were many reasons why the numbers should be a lot worse

Load shedding. Inflation. Fuel prices. General pain in FMCG, which is where a lot of advertising revenue comes from. It’s been a perfect storm for many businesses, yet eMedia has managed to constrain the revenue decrease to just 0.8%. Clearly, all those years of showing Anaconda on e.tv built some resilience into the place.

Operating profit fell by 4.4% and HEPS is down by 8.4%. Again, it could’ve been so much worse. The dividend per share is down by 14.3%.

eMedia is the biggest broadcaster in South Africa, so it has considerable potential upside if things improve. I would argue that an environment where rates start to taper off would be supportive of growth here. Most media companies have been treading water in 2023 at best.

There have been numerous legal battles with the other broadcasters in South Africa as they all fight over sports rights in particular. This resulted in significant legal fees in this period.

The numbers in the Media Film Service business are quite frightening, where profit fell by R20.9 million as a direct result of the actor and writer strike in Hollywood. The company relies on international film productions. It seems like there’s a tentative agreement to end the strike.

Exxaro is navigating a tough climate (JSE: EXX)

Local infrastructure problems remain a challenge

Exxaro released a financial director’s pre-close message. Basically, that’s just a pre-close update for the year ending December 2023.

It won’t go down as the happiest of years, with the API4 coal export price having dropped quite spectacularly from $271 per tonne in FY22 to $122 in FY23. Those elevated coal prices are but a distant memory. Total coal production is flat, with sales volumes down 2%.

The group net cash balance is R13.5 billion and the company wants to retain R12 billion to R15 billion to fund the growth strategy. On that basis, I wouldn’t expect much of a dividend here.

In some regions, product originally destined for the export market was rerouted for domestic sales. This is why we see a growth rate of 19% in Mpumalanga domestic thermal coal sales. Transnet Freight Rail (TFR) remains an issue, although the company has put a number of initiatives in place to try mitigate this issue. Concerningly, Exxaro notes that attempts by the coal export industry to support TFR have not yielded an improvement in tonnage railed.

None of this is stopping Exxaro from investing further in its business, with capital expenditure up 57% year-on-year.

The company seems fairly upbeat on near-term prices, while acknowledging that coal demand is being dampened in the long term by Europe’s drive for decarbonisation. On exports, higher prices would support the economics of sending coal by trucks rather than train.

The Fairvest B dividend is lower this year (JSE: FTA | JSE: FTB)

But the 100% payout ratio has been maintained

Fairvest has an unusual dual-share class structure that was popular several years ago on the JSE. The A shares increase their dividend by the lesser of 5% of CPI inflation, with the B shares then picking up the variability in the rest of the earnings. In other words, the A shares give more certainty and the B shares are the crazy cousin at the Christmas party.

In the year ended September 2023, inflation was high and so the A shares increased the dividend by 5%. Given the broader operating challenges in the country, the B shares saw the dividend drop by 4.6%.

The group is selling non-core assets and is working towards being a retail-focused fund. Progress was made in this strategy in this financial year, with guidance for the B shares being modest growth in distributable income per share.

The A shares are trading on a yield of 9.2% and the B shares on a yield of 12.4%.

Grindrod Shipping’s final quarterly report is a large loss (JSE: GSH)

The company is changing to a semi-annual reporting cycle, like most local groups

When people talk about highly cyclical industries, shipping is often used as an example. If you read the latest report from Grindrod Shipping, it’s not hard to see why.

In the three months ended September, the company generated revenue of $112.5 million and a gross profit of $4.2 million. Adjusted EBITDA was $11.2 million, which tells you that ship sales also play a role on the income statement. Despite this, the attributable loss for the quarter was $8.5 million. This takes the year-to-date situation into a loss as well, with an attributable loss of $7.2 million for the nine months.

After a large capital distribution this year, no further cash distributions are envisaged for 2023. The company has also reduced debt by $36.1 million, in some cases achieved through sales of ships.

The good news heading into the fourth quarter is that the shipping rates agreed thus far are ahead of the year-to-date numbers and well ahead of the third quarter. Festive demand obviously plays a role in this. Still, a 10% drop in the share price after this announcement tells you that some are still being caught out by how cyclical this industry is.

Mothership HCI is, as usual, a mixed bag (JSE: HCI)

The most severe drop in earnings was in the coal business

Hosken Consolidated Investments (or HCI) sits at the top of a structure that includes various unlisted and listed businesses, including Deneb and eMedia that I’ve covered elsewhere today. Frontier Transport Holdings is also in there, having recently released results.

For the six months to September 2023, EBITDA increased by 18%. That sounds good, yet HEPS is down by 13% and there’s no dividend as the company needs to preserve cash for the oil and gas investments in Namibia.

If we dig deeper, we find that higher finance costs and equity-accounted losses were a major driver of the EBITDA increase not translating into a happy HEPS result. There were also substantial gains on investments that are excluded from headline earnings.

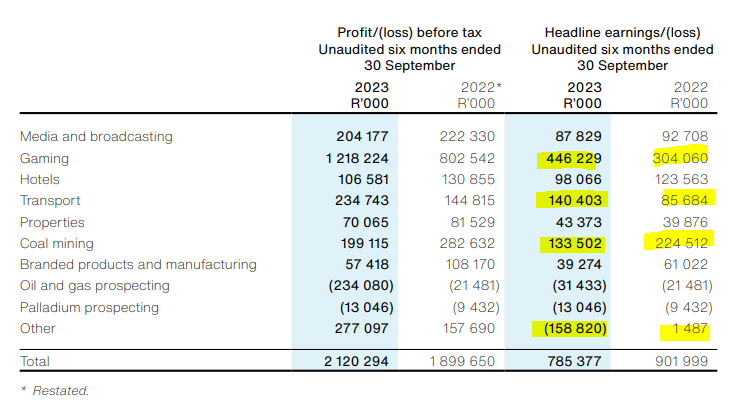

Here’s the segmental view, with the more important moves highlighted:

Note the huge difference between profit and headline earnings on the “other” line, which is where the group recognises gains on investments (which are reversed out for headline earnings) and funding costs (not reversed out).

With no dividend to shareholders because of the investment in oil and gas, all eyes will be on the performance of that investment.

At some point, PBT Group had to run out of puff (JSE: PBG)

The share price has corrected this year, with the five-year performance still ridiculously good

PBT Group is a good little business. It’s ultimately a technology and data consulting business, not hugely dissimilar to Accenture. Many of the clients are in the financial services sector. PBT Group sells time, but a quick look at Accenture will show you that selling time can be very lucrative.

After an almost perfect run of performance, eventually something had to go wrong. This is especially true in a country that is struggling for economic growth.

The group has released a trading statement for the six months to September. It includes a lot of financial information, so this is more like a mini-results release than a traditional trading statement.

Before we dig into them, it’s important to understand that PBT Group Australia was disposed of on 30 September 2023, so it comes through as a discontinued operation in these numbers. Focusing on continuing operations is a good idea.

On that basis, revenue is up by between 5.4% and 9.8%. EBITDA is only up by between 0.5% and 4.6%, so there’s clear margin pressure there. Although profit after tax looks better at growth of 7.7% to 12.1%, normalised HEPS is down by between -6.2% and -2.4%. HEPS as reported is down by between -20.2% and -17.0%, but there’s a significant distortion from the accounting treatment of B-BBEE shares.

The share price closed 10% lower at R7.11. The interim normalised HEPS range is 30.8 cents to 32.0 cents. By small cap standards, the multiple had moved too high here.

Despite an extra trading week, Pepkor’s dividend fell sharply (JSE: PPH)

Here is yet another example of why I’m bearish on South African retail shares

For the year ended September 2023, which has a 53rd week of trading in it, Pepkor’s revenue grew by 7.7%. That’s not enough, sadly. Operating profit fell by 8.1% and HEPS was down 8.2%. The dividend payout ratio moved lower as well, so the dividend per share is down 12.9%.

The drop is payout ratio is despite a 15.9% improvement in cash generated from operations. I guess when you’re staring deep into the abyss of South African consumer spending, conservatism around the balance sheet is advisable.

The highlight, unsurprisingly, is that performance in Avenida in Brazil is ahead of the original plan. Latin America is a vastly more appealing consumer opportunity than South Africa. I genuinely don’t know why more South African retailers aren’t looking for opportunities there.

Based on HEPS of 149.2 cents, Pepkor is trading on a P/E multiple of 12.4x. The dividend yield is only 2.6%.

Prosus – Naspers expect the eCommerce businesses to break-even in the second half of this year (JSE: PRX | JSE: NPN)

Of course, there’s no mention of return on capital yet

Prosus has released interim results for the six months to September. There’s more focus on talking about profitability than before, which can only be a good thing. Consolidated trading losses in the eCommerce business (all the frothy stuff they bought with Tencent dividends) came in at $36 million, which is a lot better than $220 million in the comparable period. The company has given a bold prediction that breakeven can be achieved in the second half of this financial year!

I must point out that on an economic interest basis, trading losses improved from $820 million to $249 million. There’s still a long way to go here for shareholders.

The reduced losses in that side of the business contributed to an increase of 85% in core headline earnings to $2 billion. On a per share basis, it helps that Prosus has repurchased 16% of its shares. Core HEPS is up 99% and HEPS as reported is up 27%, both in dollars.

At Naspers, core HEPS is up 546% and HEPS as reported is up 143%.

One of the headaches in the business at the moment is the Edtech business, where Stack Overflow certainly isn’t overflowing with profits. The other business there is called GoodHabitz. The jokes write themselves. The group has intervened in both businesses to improve profitability.

I always look for disclosure on Takealot as well. With Amazon about to enter the market, there’s yet another period of losses at Takealot. The loss is admittedly 85% lower as measured in dollars, which is great news, but it’s still a loss. Takealot group revenue grew 9% in ZAR, which isn’t exactly a high growth story. It shows you just how broken the broader general merchandise market really is.

FARFETCH is going as badly as I expected, with some relevance to Richemont (JSE: CFR)

We covered FARFETCH in Magic Markets Premium previously and concluded that the name was appropriate

I’m not even slightly surprised that things aren’t going well at FARFETCH. The business model of selling luxury goods online continues to make no sense to me at all. This is the group that Richemont hopes to shift YOOX NET-A-PORTER to, as Richemont has perhaps also realised that the online side is actually rather difficult.

After a disastrous US listing, there are rumours of FARFETCH being taken private. Richemont has confirmed to the market that it has no plans to lend or invest into FARFETCH. The company has no financial obligations towards FARFETCH either. The deal for YOOX NET-A-PORTER is also still subject to conditions and Richemont is reviewing them carefully.

I maintain my view that FARFETCH is a mess.

PGM operations in the US aren’t immune from job cuts either (JSE: SSW)

Sibanye-Stillwater is restructuring operations on that side of the pond as well

Due to the ongoing state of the PGM market, Sibanye-Stillwater is having to restructure operations to reduce costs. The US operations are also impacted by this, with the company announcing that 100 employees (mainly at the Stillwater Mine) will be affected. A further 187 contract workers will also be impacted.

This restructuring should not significantly impact production, but will of course reduce costs. Simply, PGM prices aren’t playing out the way Sibanye hoped they would.

Purple Group will report a full-year loss (JSE: PPE)

This isn’t surprising in this economic climate and the loss is smaller than I think many expected

Building in public is hard. Most startups are built in private, so that the extreme volatility is known only to a few. EasyEquities is very much a startup in the true sense of the world, only now expanding into its second market in the form of the Philippines. The product range is still being fully developed even in the South African market.

I’ll say it again: this is a startup. This means that expecting a smooth ride at Purple Group is like expecting to have fun at the dentist.

For the year ended August 2023, the headline loss per share is between -1.94 cents and -2.15 cents. The comparable period saw HEPS of 1.12 cents. In a market where interest rates and inflationary pressures have hammered South Africans and their ability to invest in the market, I’m not surprised by this downturn at all. In fact, I think this loss is quite modest vs. what might have been.

The two things to watch here are (1) performance as interest rates ease and (2) how successfully they achieve product-market fit in the Philippines.

If you can’t handle volatility, you shouldn’t be anywhere near this thing as an investor. And if you had listened to experienced voices during the pandemic instead of the army of overnight influencers on Twitter, you would’ve known that sooner. Perhaps lessons have been learnt by retail investors as they’ve journeyed from over R3.40 per share down to the current level of 62 cents.

Transaction Capital will keep SA Taxi in its entirety (JSE: TCP)

The net asset value range is R11.30 to R12.07, so the share price is still at a significant discount

I was one of the investors who was severely caught out by the capitulation in the Transaction Capital share price. Now at R6.98, it’s at least shown some signs of life recently. It still has a very long way to go and I don’t think it will ever return to the levels seen previously.

In a trading statement for the full year ended September 2023, the headline loss from continuing operations is between -R784 million and -R703 million. In the previous year, headline earnings came in at R1.6 billion. As swings go, that’s a violent one.

The group tries to make shareholders feel better by reporting a “core earnings” range of R220 million to R282 million, which is between 77% and 82% lower than last year.

The more important news is that there isn’t much difference between continuing operations and total operations, as Transaction Capital has decided to keep SA Taxi’s auto refurbishment and repair facilities. There’s a new strategy focusing on pre-owned taxis at lower volume, as affordability for new taxis is a serious problem in the current economy. This means that we are heading back to having older taxis on the road in general, yet another symptom of this country’s economic policies.

The ongoing support of debt funders is critical to the viability of SA Taxi. Importantly, Transaction Capital hasn’t put in any additional equity funding since March 2023.

Looking at the other businesses, WeBuyCars actually did better than expected in the latest quarter, with previous guidance being that full year earnings would be down by around 20%. No updated guidance is given. Debt collection business Nutun is performing in line with previous guidance.

Results will be released on 5th December.

Vukile gives hope for the property sector (JSE: VKE)

Key metrics are looking much stronger

Vukile Property Fund is proof that not all property funds are created equal. Where some are struggling at the moment, others are doing really nicely.

In the six months to September, Vukile’s South African portfolio has grown like-for-like annualised net operating income by 5.1%. Vacancies are at 2.0% and reversions turned positive (+2.4% vs. -2.4%, a big swing). Even valuations are 3.9% higher on a like-for-like basis.

The Spanish portfolio showed normalised net operating income growth of 13% and vacancies of just 1%. Reversions are positive.

There is no debt maturing in FY24, so there’s no immediate refinancing risk. The loan-to-value of 42.9% is perhaps slightly high, but more than manageable. Thanks to the strong underlying performance, the interim dividend is 10% higher and guidance for the full year has been upgraded to reflect expected growth in the dividend per share of 8% to 10%.

The net asset value per share is R21.16 and the share price is R13.48. This is certainly one of the better local REITs.

Little Bites:

- Director dealings:

- There’s some strong buying in Sibanye-Stillwater (JSE: SSW) shares by very high ranking executives including Neal Froneman. The total purchases are worth around R18.5 million, so that’s material.

- An associate of a director of Afrimat (JSE: AFT) has sold shares worth R12 million.

- A director of STADIO (JSE: SDO) sold shares worth R1.1 million.

- A non-executive director of Richemont (JSE: CFR) has bought A share warrants with a value of R86k.

- Des de Beer has awoken from his slumber and is off to a modest start, buying just R12.7k worth of shares in Lighthouse Properties (JSE: LTE).

- Delta Property (JSE: DLT) is fighting inch by inch, with the latest news being the sale of the Smartxchange property in KZN for R46 million. A previous attempt to sell the property failed after the buyer couldn’t meet the required conditions. The proceeds will be used to reduce debt and the loan-to-value is expected to fall by 20 basis points to 59.8%. Vacancy levels will reduce by 60 basis points to 33.9%. The valuation of the property as at 28 February 2023 was R50 million, so the sale is below that value.

- Mantengu Mining (JSE: MTU) only commenced its Langpan operations midway through this interim period. Chrome production continues to ramp up monthly and the new processing plant is scheduled to be commissioned in the first quarter of calendar year 2024. Shareholders will be looking for the income statement to turn green, as the loss for the six months to August is R16 million.

- Copper 360 (JSE: CPR) announced the acquisition of all the shares and claims in Nama Copper for R200 million. This will take expected 2025 output to more than double the original estimates. The CEO of Copper 360 calls it a “game changer” for the company and it certainly seems that way. The deal includes an offtake agreement with the sellers of Nama Copper. The operations of Nama Copper are adjacent to Copper 360’s existing operations and are similar in many ways, although they are currently in care and maintenance state. Unlike most junior mining deals that require an issue of fresh equity, Copper 360 is looking to finance this from a combination of debt and royalty agreements.

- Life Healthcare (JSE: LHC) released updated pro-forma accounts related to the potential disposal of Alliance Medical Group. These should be read in conjunction with the transaction circular. Assuming the deal was effective on 30 September 2023, then the group HEPS per share would be 3.9% higher and the NAV per share would be 0.1% lower.

- If you would like to learn more about the AngloGold Ashanti (JSE: ANG) business and strategy, then you should refer to the latest investor update presentation by the company. It’s difficult to pick out highlights from it, as this really does cover all the strategic initiatives in detail. I suggest you read the full presentation at this link.

- The chairman of Trellidor (JSE: TRL) has decided to move on after 16 years in the role. The ex-CEO of Holdsport (you might remember that company as it was listed several years ago), Kevin Hodgson, looks set to join the board.

- Go Life International (JSE: GLI) released results for the six months to August 2023. Revenue is once again zero, with an operating loss of $62k. The company is changing its name to Numeral Limited, perhaps because some numerals will eventually be found on the revenue line?