Adcock’s dividend is up 20% (JSE: AIP)

This was achieved off revenue growth of just 8%

Adcock Ingram has delivered a masterclass here, with great earnings and dividend growth off relatively modest top-line growth.

It’s funny how just one product can cause major swings, with Panado demand normalising and volumes down by 5.4% in the Consumer business as a result. Thanks to average selling price increases of 9.8% though, turnover was higher and trading profit grew by 7.1% as costs were well managed.

In the OTC business, turnover was up 15.3% with volume growth in brands like Allergex. Although gross margin was under pressure from production costs and the weaker currency, trading profit still increased by 8.5%.

The largest segment is Prescription, which increased turnover by 9.4%. Combined with a higher gross margin, the net impact was a substantial 37.4% jump in trading profit.

The disappointing segment was Hospital, which saw turnover decline by 2.2%. Still, with gross margin going in the right direction, trading profit improved by 10%.

As you can see, the trading profit performance was impressive across the board and Adcock Ingram really did a great job here in tricky conditions. With the Single Exit Price increase of just 3.28% this year, cost control will be critical in this industry. The company has warned that gross margin compression is almost unavoidable.

The interim dividend is 20% higher at 125 cents per share and the share price was trading at just under R53.00 in afternoon trade.

Assemble, Avengers! (JSE: AEG)

A 13.4% rally was the reward for punters

I’m old enough to remember when Aveng was trading at one cent per share. Literally. In the heat of the pandemic when the Fed was making it really easy for everyone by letting money fall out of the sky into the economy, the Aveng fans called themselves the Avengers.

It’s worth remembering where Aveng came from:

Buy and hold, they said. It will be fun, they said.

You can’t see it on the chart, but the share price is down 28% over the past year. This is despite Tuesday’s rally. In case you’re wondering what happened to the “one cent” share price, there was a huge share consolidation during the pandemic.

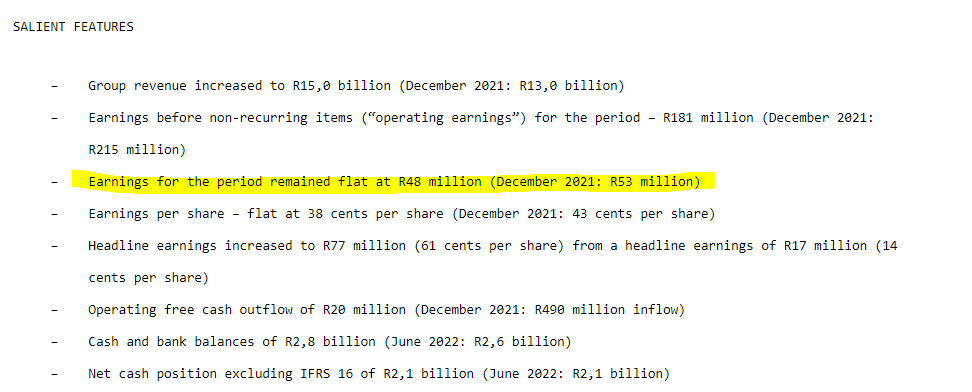

Moving on to results for the six months to December, someone really needs to help Aveng with what “flat” means. When earnings drop from R53 million to R48 million (-9.5%) that’s not “flat”:

Corporate nonsense aside, the business is clearly more profitable and has cash in the bank. The metric they don’t include in the summary is “normalised earnings” which dropped from R82 million to R44 million. So…is it more profitable?

I think the market focused on the debt. R125 million was repaid in the period. There’s another R353 million of “legacy debt” that will be dealt with by the proceeds of the Trident Steel disposal. The trade finance facility will also be settled.

The focus going forward is on McConnell Dowell in Australia and Moolmans in South Africa.

BHP on the wrong end of iron ore and copper prices (JSE: BHG)

Attributable operating profit is down 32%

Managing a mining giant isn’t easy. There isn’t much you can do about commodity prices, so you have to focus on controlling production, expenses and capital allocation.

Despite commodity prices moving against BHP in the six months ended December and revenue dropping by 16%, the company still achieved an EBITDA margin of 54%. Margins were under pressure though, as EBITDA was down 28% year-on-year.

After $3 billion found its way into capital expenditure, there was $3.5 billion in free cash flow for shareholders to enjoy.

Net debt is at $6.9 billion, which is towards the bottom of the target range of $5 billion to $15 billion. An interim dividend of $0.90 per share has been declared, equivalent to a 69% payout ratio.

BHP tells a cautionary tale for the second half of the year, noting a volatile operating environment and a global slowdown in the wake of anti-inflationary policies (i.e. higher interest rates). Much of the commodity demand depends on China.

KAP Industrial Holdings reports a drop in HEPS (JSE: KAP)

Safripol and Restonic had a particularly tough time

KAP Industrial Holdings is a well-diversified business. The downside is that one of the businesses is usually having a tough time, so the company trades in a frustrating price range that now sees it near the 52-week low of R3.68. The price closed at R3.75 after releasing results, down 3.85% on the day.

Revenue increased by 12% in the six months to December. This doesn’t help when operating profit falls by 8%, driven by a 26% decline in Safripol based on lower volumes and pressure in Restonic as well. If you read further down the report, you’ll realise that profitability took a knock across almost the entire business, with revenue up and operating profit either flat or slightly down in several divisions.

With finance costs up sharply, the impact was amplified at HEPS level, down 17% year-on-year.

The cash story is the worst one of all, with cash flow from operations down by 96% due to a R2.2 billion temporary absorption of working capital. Investors will be hoping that “temporary” is the operative word there.

The company describes the near-term outlook as “challenging and uncertain” – but they are confident in the group. Still, there’s no obvious reason why the group’s operating environment should materially improve in the second half of the year, as the macroeconomic pressures aren’t disappearing.

Kumba reports a 46% drop in HEPS (JSE: KIO)

This is despite average realised FOB export prices 13% above the benchmark

Demand for Kumba’s high-grade iron ore helped the company achieve an average price of $113 per wet metric tonne, which is 13% above benchmark prices. With production lower across the group and export sales down by 9%, that wasn’t enough to save this result.

Unit costs increased sharply, driven by inflation and lower production. EBITDA margin fell from 63% to 50%, a situation that would’ve been worse without Kumba’s cost saving efforts.

Free cash flow was 66% lower at R10.4 billion. Total dividends for the year fell by 61% to R40.

With a closing price of R540, this puts Kumba on a trailing dividend yield of roughly 7.4%.

Motus earnings are up, but watch the balance sheet (JSE: MTH)

There’s a lot more debt in the system now

In the six months ended December, Motus achieved revenue growth of 14% and EBITDA growth of 25%. Although operating profit was 22% higher, attributable profit only increased by 9%.

The difference lies in the interest costs (which more than doubled), with Motus having taken on far more debt as part of making strategic acquisitions. Net debt to equity has increased from 30% to 75% and net debt to EBITDA is up from 0.9x to 1.6x. More debt was also required for higher levels of working capital. Of the bank funding (rather than floorplan funding), only 9% is at fixed rates and the rest is floating.

Whilst growth in HEPS of 13% is nothing to get upset about, metrics like free cash flow (down from R2.9 billion to just R425 million) spooked investors. The dividend was up only 9% and investors don’t want to see a dividend growing at a slower percentage than revenue, as it means that the top-line story isn’t being enjoyed by shareholders.

In terms of market share, Motus holds 20.5% share of the retail new car market in South Africa, which contributes 65% to revenue and 78% to operating profit. The company doesn’t disclose the share in the UK and Australia but notes that it maintained market share in those countries.

Growing organically is the “cheap” but difficult way to do it. Motus uses acquisitions to grow faster, with two deals in this period. One was for Motor Parts Direct in the UK, a substantial deal for Motus. The other was a bolt-on acquisition of three Mercedes Benz passenger dealerships and one commercial vehicle dealership.

With the share price down 3%, the market must have a concern or two about this balance sheet. I know that I do.

NEPI Rockcastle: record operating income (JSE: NRP)

Management is bullish about the momentum continuing

Despite the challenging economic background and the obvious problems in Eastern Europe related to Ukraine, NEPI Rockcastle enjoyed resilient consumers in Central and Eastern Europe (CEE) who spent more per visit to the malls. With record net operating income in the year ended December 2022, the management team expects growth to continue.

The company highlights that regional malls play a huge role in CEE, which is different to the high street culture in Western Europe. That sounds rather similar to South Africa!

With a loan-to-value ratio of 35.7%, the NEPI Rockcastle balance sheet is in very good shape.

Distributable earnings per share for the year was 52.15 euro cents, which was 51.5% higher than in 2021. An adjustment is needed for a once-off item, which would see a recurring view on earnings reflecting 20% growth. That’s still impressive.

Sasol was a mixed bag in this interim period (JSE: SOL)

Local supply chain challenges dampened the earnings party

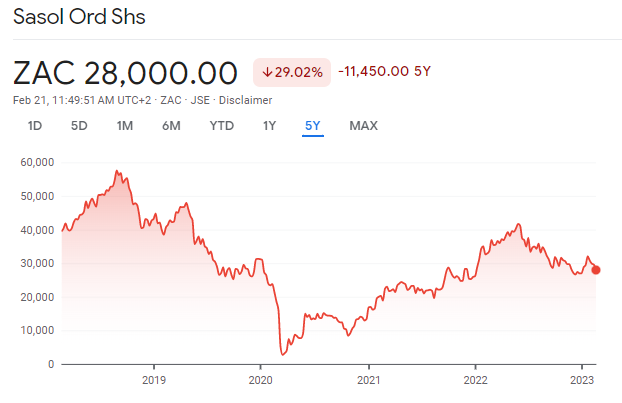

Here’s a little reminder of how crazy things got in the pandemic for Sasol vs. where they are now:

This chart hides the recent momentum, which has been poor to say the least. Sasol has lost 15.7% in the past six months as local operational issues have plagued the company.

We now have results for the six months ended December, a period during which oil prices helped but chemical prices didn’t. Pressure on input costs hit the chemicals side of the business and lower coal quality in the mining business contributed to lower volumes.

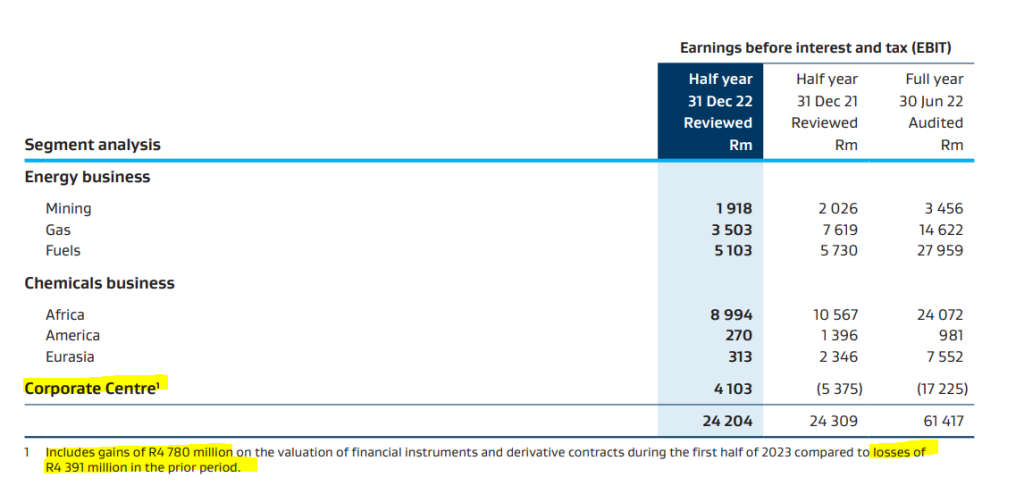

This resulted in a flat EBIT performance of R24.2 billion. There were valuation gains on financial instruments of R5.1 billion, more than offset by impairments with Secunda liquid fuels refinery as the main culprit (R8.1 billion).

You have to read really carefully when lookin at Sasol’s numbers, with the hedging at the corporate centre making a huge difference:

The mixed result means that earnings per share was down 3.1% year-on-year, but headline earnings per share (which excludes impairments) more than doubled to R30.90. The group reported core HEPS growth of 9%, coming in at R24.55.

The interim dividend is R7.00 per share, so you don’t get a particularly exciting payout ratio here. Sasol is a hungry animal in terms of capital expenditure and you can see this impact on the cash that eventually finds its way to shareholders. If you read the detailed results, you’ll see that Sasol might end up spending more than guidance on capex this year due to inflationary pressures.

The market was clearly expecting more here, with Sasol down nearly 4% by lunchtime.

Open market bids for Salungano (JSE: SLG)

RBFT Investments wants to increase its stake

RBFT Investments holds an 18.1% stake in Salungano Group and wants to make that bigger. The intent is to eventually acquire all the shares and delist the company. For now, the company wants to acquire up to 60 million shares at R1.40 per share and will be doing so on the open market.

This is an exempt partial offer, not a general offer. If you hold Salungano shares and want the price, you just need to offer the shares on the screen accordingly.

Sibanye wants New Century Resources (JSE: SSW)

Sibanye already holds 19.9% and has made an offer for the rest

Sibanye-Stillwater (which everyone just calls Sibanye) already owns 19.9% in New Century Resources, making it the largest shareholder in the company. New Century is an Australian base metal producer and a top-15 global zinc producer, operating a tailings operation in Queensland.

Sibanye wants to own all of it, which is in line with the company’s “circular economy” strategy that includes a goal to be a global leader in tailings retreatment and recycling.

If all New Century Resources shareholders accept the offer, then Sibanye will need to cough up US$83 million for the deal.

The offer price is A$1.10 per share, a whopping 42% higher than the prior day’s closing price.

Sibanye also released a trading statement and production update for the year ended December, reflecting a drop in HEPS of between 46% and 51%. This reflects the gold sector labour issues in South Africa and the severe weather event at Stillwater. The gold strike had a massive impact, with production down by 50% in that part of the business.

The share price fell 5.5% on the day to close at R39.24. For reference, the 52-week low is R39.24.

Super Group keeps doing well (JSE: SPG)

Another 2% gain takes the year-to-date performance to nearly 23%

For the six months ended December, Super Group’s revenue increased by 34.6% and EBITDA was up 24.2%. This means that margins came under pressure, but it also means that earnings grew considerably.

As we head further down the income statement, it gets exciting again with HEPS up by 30.1%.

The company certainly took advantage of favourable conditions, ranging from strong supply chain demand in South Africa in the transport business and higher revenues per load in Europe through to an increase in new car sales thanks to improved vehicle availability in South Africa and the UK. From an accounting perspective, LeasePlan in Australia was consolidated for the full six months.

Management sounds bullish after this result!

Texton: the market price doesn’t lie (JSE: TEX)

The fund trades at less than a third of NAV

After the initial news broke of the interim dividend becoming only a distant memory, Texton has now released detailed numbers.

The fund is following a rather unusual strategy, with a direct property portfolio valued at R2.2 billion and indirect investments valued at R538.5 million. Essentially, capital has been recycled from the direct portfolio into the indirect portfolio, which is how Texton has gained exposure to the US market.

Although distributable earnings grew by 5.24%, HEPS fell by 28.9% and there is no dividend per share for this period vs. 10 cents in the comparable period. The net asset value (NAV) per share increased by 2.7% to 609.51 cents. The share price trading at just R2 tells the story, less than a third of the NAV per share.

I guess this is what happens when you take shareholder capital and invest it in funds like the Blackstone Real Estate Income Trust instead. I still don’t see a single logical reason why Texton is pursuing this strategy instead of returning capital to shareholders.

The loan to value ratio is at least healthy, coming in at 26.9%.

Tiger Brands is roaring, for now at least (JSE: TBS)

For how much longer can consumers keep this up?

For the four months to January, Tiger Brands managed to increase revenue by a whopping 17%. Here’s the real kicker though: 18% is due to price increases and volumes fell by 1%.

The volume performance obviously varies significantly at category level. Snacks & Treats did well for example, whereas the Baby division reported lower volumes and a drop in market share.

Load shedding cost pressures are still coming for consumers, with costs of R27 million for generators in this period. Tiger Brands hasn’t “yet” recovered this in price, which suggests that food inflation isn’t going anywhere. Each day of stage 6 load shedding costs Tiger Brands R1.5 million in incremental costs.

To prepare for stages 6 – 8 (something most of us are living in denial of), Tiger Brands needs to invest a further R120 million in additional generating capacity. To make it worse, the bulk of this investment would be on diesel and water storage capacity to mitigate the impact of load shedding on the municipal water supply.

The inflation outlook is low double digits in the second half of the financial year. Of course, this depends on Eskom not getting even worse.

For the six months to March, Tiger Brands expects solid operating income growth. I’m once again surprised by the company’s ability to keep growing earnings in this inflationary environment.

At what point will consumers simply break? Or will the pain keep going elsewhere, like into discretionary retailers?

Transpaco reports a major jump in HEPS (JSE: TPC)

The dividend isn’t far behind, up more than 41%

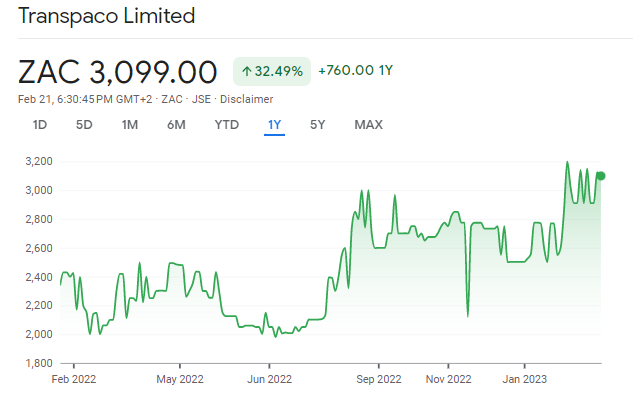

Transpaco isn’t the most liquid stock around, so the share price chart includes those typical horizontal periods where not much happens in the share price:

Still, the 32% gain over the past year has been backed up by earnings. For the six months to December, HEPS increased by 45% to 316.7 cents and the dividend increased by over 41% to 85 cents per share. This was achieved off revenue growth of 19.8%, so this is a perfect example of operating leverage (a percentage change in revenue leading to a higher percentage change in profits because of fixed costs in the structure).

Operating margin expanded from 9.0% to 10.0%. Those aren’t the biggest margins around, but at least they are heading in the right direction.

To add to the happy news, the gearing position (level of debt) improved.

Little Bites:

- Director dealings:

- Two directors of Spar (JSE: SPP) sold shares worth a total of R1.27m that vested under a conditional share plan, but the announcement doesn’t specify whether this was just the portion to cover taxes.

- An associate of a director of Newpark REIT (JSE: NRL) has acquired shares worth R21k.

- An associate of a director of Tradehold (JSE: TDH) has acquired shares worth R13k.

- Steinhoff (JSE: SNH) has agreed to settle litigation in Europe for EUR202 million. The share price dropped another 3% to 31 cents, which means it is now only 31 cents too expensive.

- Shareholders of Premier Fishing and Brands (JSE:PFB) have approved the acquisition of an additional equity stake in Talhado Fishing Enterprises.

- The publication of the Rebosis Property Fund (JSE: REB) business plan has been postponed for the fifth time. It is now expected by 3rd March.

Very funny view on Steinhoff, agree. 100%

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a

comment is added I get four e-mails with the same comment.

Is there any way you can remove me from that service? Cheers!

Will sort out for you