Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Adcorp’s profits are under pressure (JSE: ADR)

This is a perfect example of a group that is swimming upstream

Adcorp has released results for the year ended February 2024 and they reflect difficulties in the business, particularly on the professional services side in both South Africa and Australia.

It feels like blue collar labour solutions still have a place in the market, but professional skills can be attracted in many ways beyond the traditional route of working with recruitment firms like Adcorp. Just think of LinkedIn and how powerful that platform has become in connecting talent with opportunities.

To give you an idea of how tough things have been for Adcorp for several years now, this year is the second consecutive year of revenue growth and this is the first time they’ve achieved this rather basic goal since 2016!

Although revenue from continuing operations was up 7.7%, margins came under pressure and gross profit was down 2%. This led to a decline in operating profit from continuing operations of 21.5%. HEPS from continuing operations fell sharply from 147.8 cents to 83.8 cents, a decline of over 43%.

The strength of the balance sheet means that although HEPS declined, the final dividend is up from 16.1 cents per share to 24.2 cents per share.

Radio assets drive African Media Entertainment forward (JSE: AME)

Algoa FM and OFM both grew EBITDA by 16%

For the year ended March 2024, African Media Entertainment can feel proud of a result that saw revenue move 8% higher and HEPS jump by 63%. That’s the kind of operating leverage that shareholders want to see.

Cash conversion was excellent, with operating profit of R56.9 million and cash from operating activities of R64.9 million. This gave the group the confidence to repurchase R6.9 million worth of shares during the period. In addition to the interim dividend of R1.00 per share, there’s a final dividend of R3.50 per share. This takes the total dividend for the year to R4.50, so the share price of R44.00 is a trailing dividend yield of just over 10%.

Algoa FM and OFM were the highlights of this result, each growing EBITDA by 16% year-on-year. Some of the other assets assets are struggling in a changing media environment, needing to find new ways to generate revenue.

AYO Technology has reduced its losses (JSE: AYO)

But the remaining losses are still substantial

AYO Technology released results for the six months to February 2024. They reflect a modest uptick in revenue (growth of just 0.19%) and a drop in gross margins. Despite this, the impact of cost saving initiatives (including retrenchments) means that the headline loss per share has improved from 79.13 cents to 33.12 cents.

A rather interesting nugget in the numbers is a 22% increase in revenue in the unified communications division, which distributes AV products and gaming equipment for brands like Logitech. They reckon that the hybrid work culture has led to significant investment by companies in virtual meeting hardware.

There are no fewer than three pages of disclosures related to litigation, ranging from various banks through to the South African Clothing and Textile Worker’s Union and Daily Maverick!

Brikor had a much better financial year (JSE: BIK)

The core bricks segment led the way

Brikor has released results for the year ended February 2024. Revenue increased by 12.4% to R350.4 million, with the bricks segment up by 6.8% to R226 million and the coal segment up 24.4% to R124.5 million.

The bricks segment makes the bulk of the profit though, with operating profit up from R15.7 million to R24.5 million. Coal improved from an operating loss of R5.8 million to an operating loss of R0.6 million.

At group level, this small cap saw HEPS come in at 1.3 cents per share, an improvement from a loss of 0.1 cents in the comparable period. The net asset value per share is 13.9 cents.

The share price at R0.16 is therefore higher than where you would expect to see it trading based on these numbers. The mandatory offer by Nikkel Trading that was completed at the start of the year was at a price of R0.17 per share, so the share price appears to still be anchored by that offer.

Crookes Brothers flags much sweeter numbers (JSE: CKS)

Sugar cane and bananas for the win

Primary agriculture group Crookes Brothers gives us a great example of how volatile agriculture actually is. This is firmly a feast-or-famine situation, being the industry from which the term comes from in the first place.

The year ended March 2024 was a feast, with HEPS of 334.50 cents vs. a headline loss of 708.80 cents in the comparable year. Over two years, this means that the group still made a loss. That aside, the improvement came from the sugar cane and banana operations, along with a reduction in fertilizer and other agricultural input costs.

A modest HEPS performance at Dis-Chem (JSE: DCP)

They are going to need to get tighter on costs while expanding the business and making acquisitions

Dis-Chem has a strong business, but they cannot afford to become complacent on costs. For the 12 months to February 2024, a decent revenue result of 11.1% growth couldn’t be translated into a strong HEPS performance.

HEPS as reported was down 1.6%, but that includes the distortion of a major once-off property gain in the base period. If we adjust for that, then HEPS would’ve been up by 3.8%. That’s a positive result but still a concern in terms of margin contraction.

The Dis-Chem announcement goes into great detail on the two halves of the year, showing that the first half in the base period was incredibly strong vs. averages. This is why the full-year numbers look better than the interim numbers did.

Retail revenue was up 9.7%, which is a solid result when you consider that COVID vaccine revenue was still in the base. If you split that out, revenue was up 10.3%. Comparable pharmacy store revenue growth was 6.9%, so they are doing well even without the impact of new stores. Retail total income was up 9.3%, with the margin contraction attributable to increased promotional activity to ensure market share retention. This is something to keep an eye on.

Wholesale revenue increased by 13.3%, including external revenue to independent pharmacies and The Local Choice franchises up by 21.4%. That’s a great top-line result. Total income was up 10.9%, with margins ever so slightly higher if you exclude the property gain from the base.

The concern is in expenses, which grew 10.9% vs. the comparable period. Although they make reference to pressures like load shedding, the biggest area of focus is staff costs that account for 62% of retail expenses excluding depreciation. Staff costs were up 8% for the year, split across 9.7% in the first half and 6.4% in the second half. They will hopefully maintain the better control that was seen in the second half.

Retail expenses were up 11% and wholesale expenses were up 8%.

Brace yourself for the jump in net financing costs, up by 25.6%. If you exclude IFRS 16 leases and interest on new term loans related to warehouse acquisitions, net finance costs were up 94.1% due to pressure on working capital (inventory increased by 12.7%) and higher interest rates. This is an expensive operating environment for retailers.

None of these pressures are slowing Dis-Chem down, with R869 million invested in expansionary capital expenditure vs. only R158 million in replacement expenditure. Of the expansionary capital, R502 million was for a new distribution centre in Gauteng.

Heading into the new financial year, revenue has increased by 11.4% year-on-year for the first three months of trading. Aside from cost control, the focus will be on ongoing expansion in the business and an improvement in working capital ratios. They also have significant ambitions in the digital space in health and in building out an integrated health ecosystem, including with the acquisition of a life insurance business.

The business in question is OneSpark Holdings, which is incorporated in Delaware. Related party deals never seem to be far away at Dis-Chem, with the Saltzman family and a couple of other directors having a financial interest in OneSpark. It’s likely that they acted as venture capital investors in that regard and have grown the business to the point where it makes sense for Dis-Chem to invest. Encouragingly, the investment takes the form of a share subscription of R156 million for a 50% stake, rather than a purchase of shares from those investors. In other words, the capital is flowing into OneSpark. This is much better than giving one of the other investors an exit.

This is proper start-up territory, as OneSpark made a loss for the four months to April of R25.3 million. These types of businesses in the digital space burn capital at an incredible rate. On that note, Dis-Chem has committed to subscribe for preference shares in OneSpark from time to time for R200 million.

PwC was appointed as independent expert and they have opined that the terms of the transaction are fair to Dis-Chem shareholders.

Finally, in a third announcement for the day, the Saltzman family confirmed that a deal has been done with key management of Dis-Chem that will see up to 3.75% of shares in the company change hands. The Saltzman family will vendor finance this at no cost to Dis-Chem. The executives are subject to a 4-year lock-up with incremental vesting over a subsequent 5 years. This is a win for minority shareholders in the group, as management is basically being locked in thanks to the Saltzmans rather than the company needing to put in place an expensive additional share scheme.

Finbond: not quite break-even at HEPS level yet (JSE: FGL)

They are much closer, though

The Finbond share price has had a rollercoaster year. Currently, it’s up 40% over 12 months, but the start date matters a great deal. The share price has bounced between roughly 30 cents and 49 cents a share, currently at 42 cents. Limited liquidity and a wide bid-offer spread is part of why it stays stuck in a range.

The recent interest in the company has come from improved financial performance. Although there’s still no dividend for 2024, the headline loss per share came in at a much lower 0.4 cents vs. 19.1 cents in the comparable period. This was driven by a revenue increase of 22.8%. Profit before tax was actually positive, so the group has made a song and dance about a return to profitability despite there still being a headline loss.

The performance is being driven mainly by the South African business, with the American business taking time to come right. There are good reasons to believe in the momentum in the American operations, particularly as it takes a while for growth in the book to reflect as growth in profits because of the way the accounting works.

Gemfields enjoys resilient pricing for emeralds (JSE: GML)

But these numbers were skewed by unsold lots at this auction being of lower quality

Gemfields has announced results from the May emerald auction, which achieved auction revenue of $35 million. 93% of lots on offer were sold, with a couple of lower quality lots going unsold. Although pricing per carat was even higher than the previous record auction, the company points out that this was skewed by the unsold lots. Pricing was strong in this auction but not as strong as in the previous auction if you take the unsold lots into account.

The next auction is for mixed-quality rubies in June, followed by commercial-quality emeralds in September.

Huge Group sees a modest uptick in NAV (JSE: HUG)

Not sure it matters though, as the market largely ignores the NAV

Investment holding companies tend to trade at significant discounts to NAV. This is for various reasons, including the costs at the centre. In some cases, it’s because the market simply doesn’t believe the NAV.

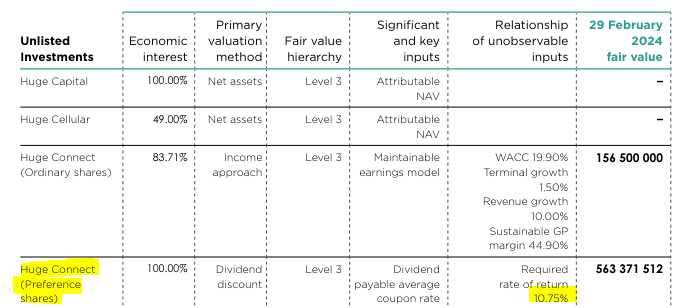

At Huge Group, the name is a good way to remember the extent of the discount. The NAV as at February 2024 was 964.54 cents and the share price is R2.20, a huge gap indeed.

Just one reason why this might be the case can be found in the note dealing with the fair value of investments held. For example, the preferences shares in subsidiary Huge Connect are valued using a required rate of return of 10.75%. This is lower than the SA 10 year government bond yield!

Nobody is going to take a company seriously when an asset representing more than a third of total holdings on the balance sheet is valued as though it carries lower risk than government debt.

For what it’s worth, the NAV per share of 964.54 cents is 2.2% higher year-on-year.

No dividends have been declared and perhaps more importantly, no shares were repurchased. At this discount to NAV, all that Huge should be doing is trying to recycle capital at the values put forward by management and repurchase shares with the proceeds at a deep discount to that NAV.

Insimbi’s numbers have deteriorated sharply (JSE: ISB)

Higher finance costs and lower EBITDA aren’t a great combo

Insimbi Industrial Holdings reported numbers for the year ended February 2024 and they aren’t great at all. Revenue is down 2%, which is a recipe for serious trouble in a business with tiny operating profit margins. Sure enough, operating profit dropped by 38%, with R15 million of the R77 million decrease being attributable to a non-recurring gain in the prior period.

However you cut it, a 34% decrease in EBITDA at a time of higher interest rates and and an increase in working capital isn’t what shareholders wanted to see. HEPS fell by 54% and the dividend was down 69% for the year, with no final dividend declared.

The company will hope that the global focus on cleaner metals leads to higher copper and aluminium prices, as this is a net positive for the business. They will also need to do what they can to bring debt down, as a business with so much operating leverage really shouldn’t be running financial leverage as well.

At Lewis, credit sales continue to fuel growth (JSE: LEW)

There’s an impressive increase in the dividend

Lewis Group released results for the year ended March 2024. They managed to accelerate in the fourth quarter, taking the full-year merchandise sales growth to 4.7%. Traditional retail grew by 6.9%, but UFO fell by a nasty 12.6%, leading to an impairment of the remaining goodwill in UFO.

This talks to the trend that has underpinned Lewis for years now: credit sales are driving the growth. Credit sales were up 15.8% this period vs. cash sales down 11.8%. Credit sales have achieved a CAGR of 16.9% over the past three years, now accounting for 66.2% of total merchandise sales. This has knock-on benefits for other revenue sources like insurance revenue, which is why group revenue growth of 9.8% is well above the increase in merchandise sales.

It’s natural to worry about the credit quality here, with Lewis pointing out that the quality of the book has improved with satisfactory paying customers at an all-time high of 81.3%. Despite this, the impairment provision as a percentage of debtors has increased due to the macroeconomic outlook.

Although operating profit came in 13.1% higher, a substantial jump in net finance costs blunted the benefit by the time we reach the bottom of the income statement. Headline earnings actually fell by 1.9%, with the share buybacks that Lewis is well-known for helping to turn that into a positive result, with HEPS up by 7.1%.

Along with ongoing share buybacks, Lewis also increased the dividend for the year by 21.1% to 500 cents per share.

The trading outlook isn’t appealing, with Lewis expecting conditions to not improve in the short- to medium-term. Despite this, they continue to invest in the store footprint. When the economy is ugly, the biggest groups can afford to keep investing to win market share at the expense of smaller competitors, positioning them strongly for when the cycle turns positive.

Nedbank’s HEPS is being helped greatly by buybacks (JSE: NED)

The first four months of the year reflect modest growth in the underlying business

Nedbank has released a trading update for the four months ended April 2024. With an expectation of interest rate cuts later this year, the bank is going to need to do more to get expense growth in line with revenue growth.

Headline earnings has only grown by mid-single digits for the four months, with Nedbank Wealth and Nedbank African Regions as the laggards. Thanks to share buybacks, HEPS increased by early double digits.

Although they talk about good expense management in the announcement, the reality is that jaws (the difference between income growth and expense growth) is negative and margins have gone the wrong way, even if that is mainly due to lower than expected growth in net interest income (NII) and non-interest revenue (NIR) rather than runaway expenses. They can’t control income to the same extent that they can control expenses.

For the four months, NII growth was just below mid-single digits. There was slight improvement in net interest margin year-on-year, but we are firmly at the top of the interest rate cycle and the likelihood from here onwards is that interest margin comes under pressure as rates start declining. Margin was already lower for these four months than for FY23. I was surprised to see that banking assets only increased by low-to-mid single digits despite the prevalence of inflation. This suggests a cautious approach in the run-up to elections, particularly by South African corporates. Deposit growth was ahead of advances growth, which also talks to caution and companies sitting on their cash.

Impairments decreased year-on-year and so did the credit loss ratio, but it remains above the through-the-cycle target of 60 basis points to 100 basis points due to pressure in the retail and business banking book.

Moving to NIR, growth was above mid-single digits if you adjust for distortions in the base related to Nedbank Zimbabwe and below mid-single digits if you don’t make that adjustment. The insurance business was the disappointment for the period, while areas like deal closures in CIB and cross-sell to main-banked clients were encouraging.

Associate income related to Nedbank’s 21% stake in Ecobank is expected to be 32% lower year-on-year for the first half of the year. This was due to a non-recurring gain in the base period.

Expense growth was above mid-single digits. Variable costs were slower than expected because of the revenue growth pressure. When viewed against income, jaws came out slightly negative and the cost-to-income ratio increased.

Trustco’s NAV per share is well down year-on-year (JSE: TTO)

But it has moved higher over the past six months

Trustco has released its financials for the six months ended February 2024. As this is an investment holding company, the income statement looks different to what you might be used to seeing. It includes fair value gains and losses on investments. It also included a significant gain on debt settlement in this period.

The net asset value per share as at February 2024 was 128 cents, which is down 20.5% year-on-year. It’s worth highlighting that this is an increase from 117.06 cents that was reported as at August 2023, the end of the last financial year.

The fair value moves were a mixed bag for the portfolio. The micro-finance, commercial banking and education portfolios all lost value, attributed to higher interest rates. The insurance portfolio was also down, with market volatility as a further challenge. On the positive side, the real estate and mining portfolios moved in the right direction.

The discount rates used to value the investments range from 18.03% to 28.68%. Unsurprisingly, the highest rate is used in the mining portfolio where the risk is the highest.

There are a few transactions currently underway at Trustco, including accessing up to $100 million in hybrid capital from Riskowitz Value Fund. Trustco has announced the acquisition of a further 11.35% in Legal Shield. Finally, they are aiming to convert NAD 4.4 billion of debt and “equity liabilities” into equity. The regulatory process is being followed in terms of drafting the circulars etc.

Little Bites:

- Director dealings:

- Associates of two different directors of a major subsidiary of RFG Holdings (JSE: RFG) sold shares worth nearly R2.9 million.

- Here’s a strong signal for you: the company secretary of Altron (JSE: AEL) as well a a director of a major subsidiary have bought shares in the company with a total value of R962k.

- An associate of a director of Workforce Holdings (JSE: WKF) sold R825k worth of shares to a B-BBEE investment group to improve the B-BBEE shareholding of Workforce. The price was R1.65 per share which is above the current market price of R1.40, so it wasn’t exactly a subsidised trade.

- Although the total value is small, a few executive directors of Hammerson (JSE: HMN) have elected to reinvest their dividends in the company.

- African Rainbow Minerals (JSE: ARI) has closed the deal to subscribe for a 15% stake in Surge Copper Corp, which is listed on the TSX Venture Exchange. The total value is C$3.93 million (around R55 million) and the subscription price was an 18% premium to the 20-day VWAP, which isn’t uncommon in a deal like this. To buy up a stake that size in a small listed company is usually impossible due to liquidity constraints. The share price would run by far more than 18% if a stake this size changed hands on-market. The other nuance of course is that the cash is flowing into the company, not to other shareholders.

- There are wholesale leadership changes at EOH (JSE: EOH), with Andrew Mthembu stepping down as chairman and interim CEO after he helped fill that role to effect a leadership transition. Marius de la Rey comes in as interim CEO, which is an internal appointment as he is currently the CEO of iOCO South Africa. I don’t know why this is yet another interim appointment, as it sends a message to the market that they don’t back him in the role. There are also three appointments of independent non-executive directors.

- Rebosis (JSE: REA | JSE: REB) gave an update on the property disposals currently underway as part of the public sales process under the business rescue plan. It looks like pretty much all the disposals have either already gone through or are expected to go through by the end of June.

- Vunani (JSE: VUN) released a cautionary announcement regarding negotiations to dispose of a minority shareholding in a subsidiary. They don’t give any further details at this stage.

- Between September 2023 and May 2024, Momentum Metropolitan (JSE: MTM) repurchased 3.06% of shares in issue at an average price of R20.87 per share. That’s slightly below the current traded price. They can repurchase a further 1.94% of issued shares under the current share repurchase authority. As the share price is trading at a discount to embedded value, they point out that R1.53 billion in embedded value was repurchased for R913 million. This is a similar concept to an investment holding company or a property fund trading at a discount to NAV.

- Southern Palladium (JSE: SDL) announced that 46.7 million shares (over half of total shares in issue) will be released from escrow in June after a 24-month escrow period. This might encourage some liquidity in the share price but could also put downward pressure on it. 45.5 million of those shares were issued to the vendors of a 70% interest in the Bengwenyama PGM project. Of those being released from escrow, 22.75 million shares will be subject to voluntary escrow for up to 24 months or until certain project milestones have been achieved, whichever is earlier. The shares may be clawed back by the company and cancelled for a nominal sum if project milestones aren’t achieved within four years from the date of the ASX listing.

- The acquisition by Novus (JSE: NVS) of Bytefuse, a small related party deal, has been amended to extend the fulfilment date for suspensive conditions from 31 May 2024 to 30 June 2024.

- Oando (JSE: OAO) is still playing catch-up with financial results, with a flurry of announcements on Friday that included all the quarterly numbers for 2023.