Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Adcorp’s South African professional service division is struggling (JSE: ADR)

HEPS from continuing operations has taken a significant knock

Adcorp has released a trading statement dealing with the year ended February 2024. Revenue is up by between 5.2% and 10.2% and that’s largely where the highlights stop.

Gross profit is down between 1.0% and 3.0%, so there’s margin pressure right at the top of the income statement.

HEPS from total operations is up by between 27.0% and 47.0%, but this has to be viewed against HEPS from continuing operations which has fallen by between 38.4% and 48.4%. Seeing the core businesses going the wrong way is far from ideal.

The pressure is being felt to the greatest extent in the professional services division in South Africa, which focuses on placing professional staff in roles. This tells you a great deal about how South African businesses have sat on their hands in the past year, with a combination of load shedding (perhaps behind us now) and the run-up to elections. Interestingly, the equivalent business in Australia has had some challenges, but obviously not for quite the same reasons as South Africa.

On the plus side, the contingent staffing businesses in South Africa and Australia are doing well, so the benefit of diversification is showing here. Other good news is that the group has no debt and sits on a cash balance of R204.2 million. That’s not insignificant on a market cap of R420 million!

HEPS from continuing operations will be between 76.3 cents and 91.1 cents. The share price is only R4.00. Once you adjust for the extent of cash on the balance sheet, this business is trading at an exceptionally low Price/Earnings multiple. For the most part, it’s been a value trap for investors though, with limited liquidity and a negative share price trend over the past couple of years (even if you take into account the large special distribution in 2023).

Altron’s continuing operations are growing strongly (JSE: AEL)

But the group numbers reflect a loss

Altron has at times taken adjustments to the financials a bit far. When we start talking about adjusting for credit losses in the public sector, then I get worried. After all, that’s a pretty well understood business risk in South Africa.

But when the adjustments are because a business was sold during the year, that’s clearly a reason to accept the adjusted numbers. Altron’s ATM business was only included for four months of the year ended February 2024, so that really skews the annual revenue growth vs. the comparable period that included it for a full year.

If we focus only on continuing operations and exclude the ATM business, then revenue grew 8% and EBITDA was up 27%. Operating profit increased by 33%. This is the most rose-tinted way to look at Altron’s numbers.

Before you pop the champagne, we need to consider the impact of discontinued operations on the group. There’s more to this story than just the ATM business. If you include both the ATM business and the discontinued operations, Altron swung from HEPS of 29 cents to a headline loss of 25 cents per share.

It helps in this case to dig into the more detailed segmental numbers. The Own Platforms segment grew revenue 9% and EBITDA 23%. Netstar is the largest part of this segment and grew revenue by 12%, while expanding its EBITDA margin and finding some rather interesting ways to scale into new markets and products through partnerships with the likes of Toyota. The FinTech platform is the second largest in this segment, growing revenue by 5% and EBITDA by 22%. HealthTech is the smallest platform and grew revenue by 7% and EBITDA by 3%.

For context, Own Platforms contributes EBITDA of R1.2 billion.

The Digital Transformation segment is good for EBITDA of R243 million, up 60% thanks primarily to profit improvement strategies at Altron Systems Integration. There are various other operations within that segment.

Within discontinued operations, we find Altron Document Solutions with revenue growth of 13%. That sounds good until you consider the operating loss of R65 million in the first half of the year, which was turned around quite spectacularly into an operating profit of R53 million in the second half. Long may that continue.

If you’re wondering where the group result really broke, then look no further than Altron Nexus and a 35% drop in revenue, with an operating loss of a whopping R433 million. The business was not awarded phase 3 of the Gauteng Broadband Network project, leading to a full business review and a winding down of parts of it. They are trying to sell this business.

And yet, despite the overall group loss, the final dividend was 74% higher at 33 cents vs. 19 cents in the comparable period. Talk about a confusing set of numbers. If you keep digging, you’ll find that there was a significant working capital release in this period (including from discontinued operations), along with a reduction of debt.

This certainly isn’t an easy set of numbers to work through, but those who have believed in the turnaround in the past year have been rewarded with a 50% share price rally over 12 months.

Astral Foods and a casual 441% increase in HEPS (JSE: ARL)

Welcome to the poultry rollercoaster

Businesses with structurally low margins can experience absolutely wild swings in profitability. Astral Foods is the latest example, with a 4% revenue increase and a 461% jump in operating profit from just R98 million to R550 million. Things are certainly looking a lot better in the poultry industry and if the load shedding and avian flu can just stay away, they will get even better.

HEPS for the six months to March came in at R8.84, which is a magnificent improvement from R1.63 in the comparable period. The second half of the previous financial year (i.e. April to September 2023) was an absolute disaster, with a headline loss for the full year of -R13.24 as Astral literally had to subsidise the cost of producing chicken. Investors in this sector will be hoping that the horrors aren’t repeated, allowing Astral to conclude a solid recovery year.

Perhaps even the weather will play ball, with the outlook section noting that El Niño is weakening, which could mean La Niña and thus improved conditions for the local planting season. This matters because of maize prices, a key cost input in farming of chickens.

The balance sheet certainly looks much better, with gearing down to 10.1% – much lower than 25.6% at September 2023.

My bearishness on Balwin continues to be proven correct (JSE: BWN)

This business is firmly on the wrong side of South African trends

Balwin has released results for the year ended February 2024 and they aren’t pretty. Revenue is down 29% and HEPS has plummeted by 48%. When you see extensive promotions for developments (like I witnessed at Montecasino on trip to Joburg towards the end of 2023), you know that the apartments aren’t exactly flying off the shelves. There was a 32% reduction in the number of apartments sold year-on-year.

They’ve worked hard at building the annuity business portfolio and it’s now up to 5.6% of group revenue, with an operating profit margin of 41%. That’s a cute contribution, but nowhere near enough to protect shareholders from a year like this.

To make it worse, the sales incentives to try and boost revenue from apartments led to a dilution in gross margin from 27% to 24%. That’s certainly not what you want to see when volumes are under pressure. At least they managed to bring operating expenditure down by 11% year-on-year to try and limit some of the pain.

Against this backdrop, it’s perhaps not surprising that there’s no dividend to shareholders. They paid 24 cents per share last year and the share price is trading at around R2, so this is a harsh lesson in buying something on a high trailing dividend yield without considering how resilient that dividend is.

The loan-to-value ratio reduced slightly from 40.7% to 40.5%. I’m just not sure that this is the best metric for the group, as the net asset value (NAV) also happened to increase by 4% to 858.49 cents per share despite the drop in profits. In a development company, I feel like profitability metrics are more important than balance sheet metrics like NAV.

The share price at a 73% discount to NAV suggests that the market agrees with my view.

At Deneb, looking at adjusted earnings is justified (JSE: DNB)

HEPS isn’t always the right measure of performance

Deneb has released a trading statement dealing with the year ended March 2024. Looking at HEPS is misleading for once, as it shows a drop of between 10% and 30% which sounds like a poor outcome.

If you read further, you’ll see that the base period included insurance proceeds for business interruption and flood damage. This is obviously a non-recurring source of income, hence why earnings have dropped so much if that is included in the base for comparison.

A better way to view these numbers is by excluding the insurance claims, in which case HEPS on an adjusted basis would be up by between 15% and 35%. That’s more like it!

Operating margin pressure at Famous Brands (JSE: FBR)

On an adjusted basis, earnings have inched higher in the past year

Famous Brands has released results for the year ended February 2024. They aren’t very exciting unfortunately, despite revenue growth of 8%. The business is far more diversified than a group like Spur, boasting 16 restaurant brands and a presence in 18 countries. Here’s the thing though: diversification isn’t always beneficial.

The year-on-year movements need to take into account the once-off Gourmet Burger Kitchen liquidation dividend of R75 million that was received in August 2022 (part of the base period). Excluding this, operating profit increased 3.3%, which reflects a decline in operating margin from 10.6% to 10.1%. Adjusted basic earnings per share would be 2% higher after this adjustment.

HEPS fell by 5% and I must highlight that the headline earnings calculation takes out the liquidation dividend in the base, so that’s the best way to view this result in my view. It hasn’t been a great period for Famous Brands, with pressure on consumer spending on one end and production costs on the other.

If we look at the segments, Leading Brands (the more affordable restaurants) grew revenue by 5.6%, while Signature Brands (the fancier eat-in formats) grew revenue 2.3%. Even within Leading Brands though, we need to distinguish between classic quick-service restaurants – the takeaway joints – and casual dining restaurants, which are generally found in shopping centres. The casual restaurants did better, with load shedding as a factor there due to landlords providing backup power. Remember, we are looking at full-year numbers here where load shedding was prevalent throughout.

The operations outside of South Africa range from simpler (like SADC countries with operating profit of R55 million) through to complex, particularly in Northern Africa and Middle Eastern (AME) markets. An operating loss of R14 million was suffered in AME, which is at least a lot better than a loss of R26 million in the prior year.

Wimpy UK saw a slightly decline in operating profit from R19 million to R18 million. They don’t have the Joburg – Durban roadtrip on that side of the pond to help justify Wimpy trips.

At heart, Famous Brands is a manufacturing and logistics play, with those segments contributing operating profit of R297 million and R94 million respectively. In both segments, profits were down year-on-year due to pressure from operating costs and load shedding.

In the retail segment (the sauces on the shelves), revenue was R368 million but operating profit was only R6 million. Talk about a marginal way to make any money. Hopefully, a significant portion of further revenue growth will drop straight to the bottom line.

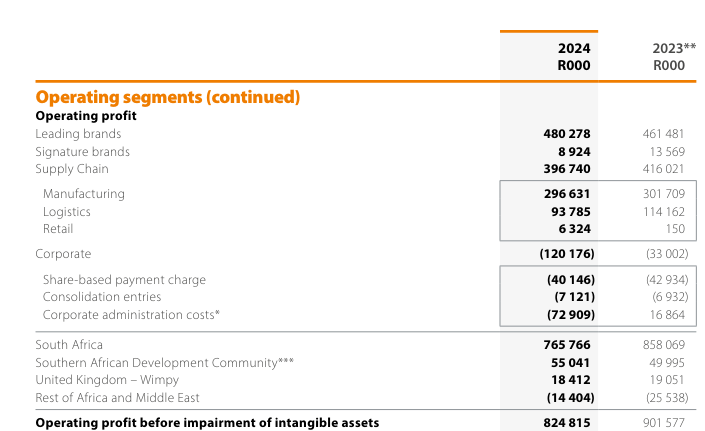

In case you struggled to follow all that, here’s an overview of the segments for context:

Looking ahead, the group has flagged improvements that need to be made to the logistics and manufacturing footprints. This suggests a period of increased capex, which will be staggered over several years. Money isn’t cheap at the moment and they will need to think about returns carefully, particularly as interest on borrowings jumped from R89 million in the prior year to R125 million in this year.

Frontier Transport still has great momentum (JSE: FTH)

Helping people get from A to B can be lucrative

Frontier Transport is a perfect example of the benefit of excellent execution in a sector that is anything but sexy. The group operates a number of commuter bus services, with Golden Arrow as its most well-known business. It’s not exactly AI and cloud computing, yet HEPS is up by between 35.3% and 39.5% for the year ended March 2024.

This implies a range of 130 cents to 134 cents, which means the share price at R6.58 is still on a modest multiple.

There was only a slight reduction in the number of shares outstanding, so this growth was driven by higher earnings, not extensive share buybacks. That speaks to the quality of the business.

Impala executes a B-BBEE deal (JSE: IMP)

With equity values under pressure, this is expensive timing for existing shareholders

Impala Platinum’s acquisition of Royal Bafokeng Platinum included a merger approval condition related to a need to increase B-BBEE ownership in the group. These types of deals are usually costly to existing shareholders and even more so when equity values are depressed.

This is a significant deal, resulting in 13% B-BBEE ownership in each of Impala and the newly renamed Impala Bafokeng Resources, with a combined transaction value of R9 billion. It includes a 4% community share ownership trust, a 4% employee share ownership trust and a 5% holding by a strategic consortium, led by Siyanda Resources. This will be called the Bokamoso consortium.

Siyanda is seen as a preferred partner in the PGM space based on its track record, leadership and reputation in the broader Rustenburg community.

The investment by the community share ownership trust will be facilitated by an interest-free vendor loan from Impala and Impala Bafokeng. 65% of its annual dividends will go to beneficiaries and 35% will service the debt. Much the same approach is being followed for the employee share ownership trust.

The Bokamoso consortium will subscribe for shares with a R100 million equity tranche and vendor funding for the rest in the form of preference shares that will be subscribed for by Impala and Impala Bafokeng. The commercial terms haven’t been announced yet. Aside from covering operational costs, 30% of dividends can be distributed to equity funders and the rest will go towards servicing the preference shares.

With all said and done, Impala Holdings will have 87% in each of Impala and Impala Bafokeng. The interest-free vendor loans are obviously costly to the group but are necessary to ensure the commitment of the community and staff. The cost of the strategic consortium element of the deal will depend on the rate on the preference shares, which Impala shareholders will hope is on the higher side, particularly given the timing of this deal at a depressed point in the cycle.

HEPS up at Netcare, but a flat dividend (JSE: NTC)

A more conservative payout ratio probably makes sense here

Hospital groups are a grind, if we are honest. They achieve modest revenue growth and if they are lucky, EBITDA margin goes the right way. In the six months to March 2024, Netcare grew revenue 4.3% and EBITDA 7.0%, so that’s in line with the best possible shape that this kind of business can really hope for.

Profit was up 6.3%, with higher finance costs biting. Net debt is 16.4% higher and the cost of debt is of course still elevated, so the combination puts pressure on the income statement. Thanks to share buybacks though, HEPS is up 9.2%.

The interim dividend has stayed at 30 cents despite HEPS moving up to 48.9 cents. This is a more conservative payout ratio than in the comparable period, which is a reflection of (1) the levels of debt and (2) the share buyback programme that the company has been following, which gives it more flexibility and boosts HEPS – unlike a dividend.

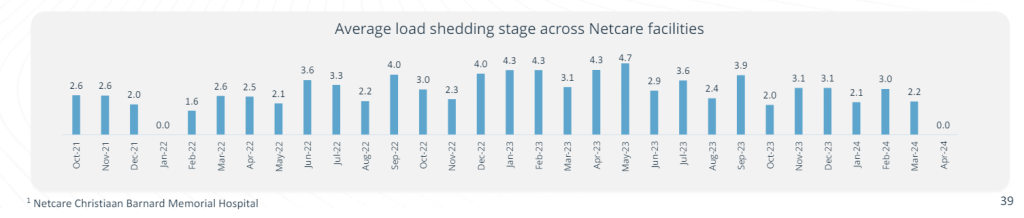

Here’s the chart that I don’t think many of us ever expected to see:

Little Bites:

- Director dealings:

- Zyda Rylands has sold more shares in Woolworths (JSE: WHL) as part of her process of retiring from the group. The latest sale is to the value of R18.75 million.

- Associates of a director of Sea Harvest (JSE: SHG) bought shares in the company worth around R115k.

- RMB Holdings (JSE: RMH) released a trading statement based on the movement in net asset value per share. The important thing to note is that there was a special dividend paid since the end of the comparable period, so adjusting for that means a much lower percentage move than the unadjusted number would suggest. The NAV per share as at March 2023 was 100.3 cents and a dividend of 23.5 cents was paid in January 2024. The expected NAV range for March 2024 is 71.4 cents to 87.2 cents. If we add back the dividend to that NAV, it implies a move over the year of -5.4% to 10.4%.

- Those following Merafe (JSE: MRF) will be interested (and probably irritated) to learn that the quarterly European Ferrochrome Benchmark price will be discontinued with effect from June 2024, which means the company will no longer publish this information. There’s no guidance given on whether there is some kind of disclosure that will replace this.

- MC Mining (JSE: MCZ) announced that with Goldway’s interest moving to 93.05% of shares in issue after the takeover offer by that party, MC Mining’s listing on the AIM will be cancelled. It’s not clear yet whether Goldway will invoke the “squeeze-out” provisions to force remaining holders to take the offer, so for now the company will continue to be listed on the ASX and JSE.

- As part of a B-BBEE deal going back to 2024, a subsidiary of Kagiso Tiso Holdings has elected to convert preference shares in Momentum Metropolitan (JSE: MTM) into ordinary shares to the value of R258 million.

- Salungano (JSE: SLG) released a renewed cautionary announcement regarding Wescoal Mining and Keaton Mining. The operations of Elandspruit and Khanyisa within Wescoal will be in a state of care and maintenance until the business rescue practitioners determine an alternative course of action. Over at Keaton Mining, operations at Vanggatfontein are continuing by agreement with the provisional liquidators, with a heading set for 3 July 2024 for a provisional liquidation order brought by a creditor. Discussions are underway with all major creditors to reach a compromise.