Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Adcorp is facing margin pressure (JSE: ADR)

And there isn’t much in the way of margin to go around in the first place

The revenue performance at Adcorp is the best number you’ll read in this result, with revenue up 10.2% for the six months ended August 2023. Both South Africa and Australia were positive contributors in the contingent staffing divisions.

This brings us neatly to the end of the good news. Well, mostly.

The gross profit margin has fallen from 10.7% to 9.7%. Although operating expenses were up by just 2.8% (a solid example of cost control) the gross margin pressure meant that operating margin fell from 1.2% to 0.9%.

The margins here are enough to make chicken farmers feel better about themselves in an average year, which is why small movements in margin can cause significant movements in net profit. Sadly, net profit went the wrong way with a drop of 8.8%.

A glimmer of happiness is that because the overall level of debt in the group has dropped, net finance costs reduced from R23.8 million to R18.1 million. For context, operating profit was R59.5 million.

If you’re hoping to make yourself feel better by taking a peak at the statement of cash flows, you’ll be disappointed. After generating cash from operations of R89 million in the comparable period, this year you’re looking at negative R57.7 million after a massive increase in trade receivables of R152 million.

The special dividend in this period took the total dividend paid to R111.1 million. That’s starting to look like it was a brave decision.

enX Group reports Eqstra as a discontinued operation (JSE: ENX)

The board believes that a transaction is likely in the next 12 months

enX Group has released a trading statement for the year ended August 2023. It reflects growth in HEPS from continuing operations of between 11% and 21%. From total operations though, HEPS is expected to drop by between 34% and 43%.

The main difference is Eqstra, the group’s leasing and fleet management business. This has now been recognised as a discontinued operation, as the group’s view is that a disposal transaction for Eqstra is likely to be executed in the next 12 months.

There have been other disposals in the prior period that also skew the total group numbers.

Within continuing operations, the performance is being driven by revenue growth of 26% and profit before tax growth of between 29% and 33%.

Glencore affirms FY23 production guidance, except for nickel and ferrochrome (JSE: GLN)

Meeting guidance and increasing production aren’t the same thing

When a mining company talks about “meeting guidance”, this simply refers to the guidance that was previously given to the market. It tells you absolutely nothing about year-on-year growth (or lack thereof). Although it is good news that full year 2023 production guidance has been affirmed by Glencore for all but two of the commodities it produces, that doesn’t mean that production has increased.

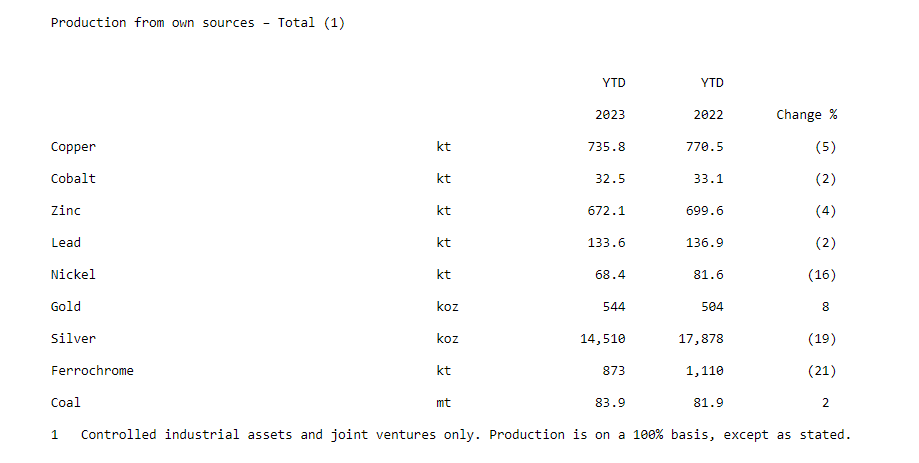

In fact, it hasn’t:

As you can see in the percentage change column, everything but gold and coal is down year-on-year. These are third quarter year-to-date numbers, so there are only three months left in this financial year.

Mining is a tough game. Guidance has been reduced for nickel due to a longer than expected recovery period following a strike and maintenance issues at a smelter, among other issues. Ferrochrome is down because of curtailment in response to ferrochrome market conditions. Remember, JSE-listed Merafe (JSE: MRF) is Glencore’s partner in ferrochrome production.

In Glencore’s Marketing segment, the likely outcome for full year adjusted EBIT is between $3.5 and $4.0 billion. This is well above the long-term guidance range of $2.2 billion to $3.2 billion per annum.

MTN is going from bad to worse (JSE: MTN)

The share price is heading into no man’s land

52-week lows are not ideal. They are even less ideal when it’s easy to see reasons for the stock to keep dropping from a combination of fundamental and technical weakness.

This chart isn’t pretty:

Nigeria is once again proving to be a serious headache for MTN, with results for the quarter and nine months ended September reflecting not just operational pressure, but also a major error in forex accounting.

I’ll start with the most important part: the underlying operations. Margins continue to compress, with revenue growth of 21.76% only translating into operating profit growth of 13.16% for the nine-month period. That number is before “finance costs”, which shot up in this period. At net profit level, there’s a drop of 45%.

The reason for the inverted commas is that foreign exchange losses have been lumped in with finance costs. The losses are vastly higher than in the June 2023 reporting, as an error was discovered in the accounting for trade lines related to capex investments and the associated cover given to banks.

The main thing to remember is simply that the ongoing depreciation of the naira in Nigeria is a serious problem and the accounting is complicated. With this error corrected, the results for the six months to June for MTN Group would’ve been a nasty 12.2% lower on the HEPS line than what was reported. This doesn’t give the market a good feeling and certainly doesn’t help the falling share price.

To add insult to injury, the Tax Appeal Tribunal in Nigeria upheld a $47.8 million VAT liability. The interest and penalty charges of $87.9 million were at least set aside. MTN Nigeria is appealing anyway in the hope of getting rid of the capital amount.

Shareholders are sadly also successfully getting rid of their capital amounts at the moment.

OUTsurance now holds 94.64% in Youi in Australia (JSE: OUT)

The deal to acquire half of Willem Roos’ stake has been completed

OUTsurance has completed the acquisition of half of the stake held by Willem Roos in Youi Holdings, the Australian insurance business. The deal is worth A$42.5 million, so the Roos family bank account is looking rather lovely, especially now that the conditions precedent for the transaction have been met.

This increases OUTsurance’s equity stake in Youi to 94.64%.

This is a rare example of a South African success story in Australia. The in-country management incentivisation to build this up and become wealthy in the process was a core part of the success. In well-structured corporate growth stories, there are always several people who make a great deal of money.

Little Bites:

- Director dealings:

- If I’m reading the announcement correctly, it looks like the CEO of AVI (JSE: AVI) held onto R2 million worth of shares awarded under a bonus plan. Usually, executives sell a portion to cover the tax. In contrast, a director of a subsidiary sold all the shares received (worth R117k).

- An entity associated with the CEO of Pan African Resources (JSE: PAN) bought shares worth R489k. The Financial Director also bought shares worth R494k. That’s a pretty strong signal.

- Des de Beer has bought another R86k worth of shares in Lighthouse Properties (JSE: LTE).

- If you’re keeping an eye on the MiX Telematics (JSE: MIX) deal with PowerFleet, then diarise November 16th at 2pm Eastern time. There will be a corporate event where the management teams will discuss the strategic rationale for the deal. The webcast will be available on the company’s website.

- Astoria Investments (JSE: ARA) has released quarterly results. As Astoria has its primary listing in Mauritius, results are released every quarter. The company policy is to only update the valuations of unlisted investments in June and December, so the September quarter only reflects price changes in listed investments and currencies. Over the first 9 months of the year, the NAV per share is down 9.95% in US dollars and up 0.15% in rands.

- RECM & Calibre (JSE: RACP) released results for the six months to September 2023. The core investment is a 58.8% stake in Goldrush, which contributes 97.3% of total assets. The NAV per share has decreased by 16.6% in the first six months of the financial year, with load shedding as a major concern given the electronic nature of the gaming machines and venues. Sports betting and online grew revenue by 32%, which is well ahead of the total Goldrush revenue performance of 6% year-on-year. EBITDA reduced by 9% due to cost pressures.