Advanced Health wants to leave Australia

There’s progress in the deal to sell PresMed Australia

Back in December, Advanced Health told the market that it had agreed with a consortium of management and medical shareholders, alongside a major private equity backer, to sell its 56.44% stake in PresMed Australia for R522 million. The proceeds will be used to settle debt and support the working capital requirements of Advanced Health’s South African operations.

BDO Corporate Finance has been appointed as independent expert, with that report due to be included in the circular that will be distributed to shareholders. Another important step is that the TRP has been provided with the proof of funds for the consortium, a requirement under takeover law.

The various conditions need to be met by no later than 30 April, so things are heating up in this transaction. Irrevocable undertakings have been received from holders of 68.23% of the share capital of Advanced Health, so the deal looks to be in with a good chance of success.

Record tin production at Alphamin

Margins are juicy even with tin prices under pressure

Alphamin mines around 4% of the world’s tin, a little factoid that the company reminds us of in every announcement.

For the year ended December, the group achieved record tin production of 12,493 tonnes, up 14% from the prior year. In the fourth quarter, production of 3,113 tonnes was ahead of guidance of 3,000 tonnes.

The estimated EBITDA for the full year of $222 million is also a record.

The tin price moved severely over the year, with the average price for the full year at $30,636/tonne and the Q4 price at $21,436/tonne. The current price is around $30,000/tonne, so there’s been a significant recovery in the price this year, which is encouraging for the ongoing development of the Mpama South project.

Importantly, the EBITDA margin in Q4 (when prices were low) was a meaty 41%. When mining goes well, it really goes well!

The full year dividend was CAD$0.06 per share (roughly R0.78 per share). At a share price of R13.00, this isn’t an example of a mining business on a high dividend yield.

The group had net cash of over $109 million on the balance sheet as at the end of December.

Capital & Counties updates the market on 2022

London’s West-End is experiencing strong demand

In a story that we are seeing from the European property funds overall, Capital & Counties has confirmed that rental demand at properties is strong but valuations are going sideways because of higher yields being demanded by investors.

If you’ve ever run a valuation in your life, you’ll know that a 19 basis points move to a yield of 4.07% is significant. This can offset some really juicy underlying tenant demand.

Net debt at Capco has increased from £599 million to £622 million, with net debt to gross assets increasing from 24% to 28%.

The proposed merger with Shaftesbury is expected to close during the first quarter of 2023.

Italtile: it still hurts

The share price seems to know this already

Unless you’re a hedge fund manager looking to add to your short book, Italtile really hasn’t offered much since the middle of the pandemic. As people returned to work and interest rates went crazy, the thought of spending money on holidays (or even petrol) started to take preference over any plans to renovate the bathroom.

In a trading statement, Italtile has guided that headline earnings per share (HEPS) for the six months to December 2022 will drop by between -8.1% and -5.5%, coming in at between 77.1 and 79.3 cents.

The share price was flat on the day, with a recent downward trend clearly visible in this chart:

Nampak is doing its best, but it isn’t enough

The rights offer has dropped from R2 billion to R1.5 billion

Despite revenue growth of 20% in the three months to December 2022, Nampak’s operating profit is down because of foreign exchange losses.

I’ve beaten this drum many times: running a relatively low margin business with a complicated African treasury is exceptionally hard. Of the cash transfers in the period of R452 million, 68% was from Nigeria at a “significant cost to operating income” – i.e. transferred at a rate that is far more onerous than the quoted rate in the market, due to shortage of foreign currency.

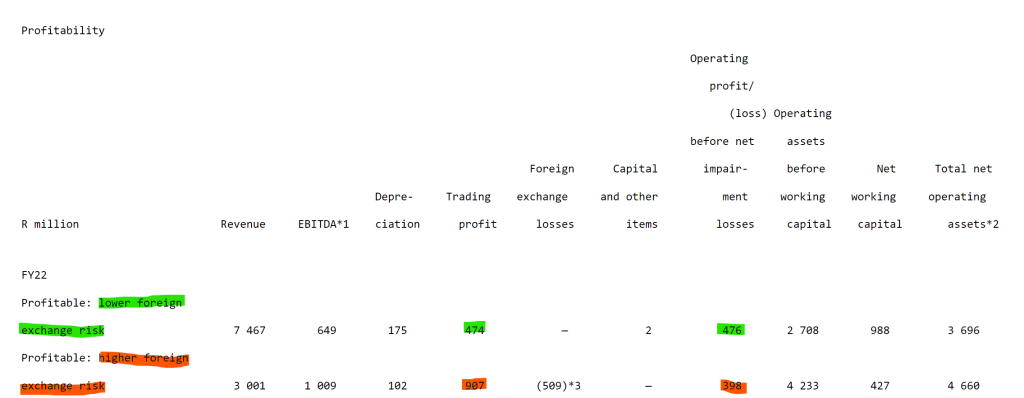

Here’s another view on why operating in risky jurisdictions should only be attempted with very juicy margins:

For those with dodgy eyes, it says that Nampak makes only R474 million in trading profit from jurisdictions with lower foreign exchange risk and R907 million from jurisdictions with higher risk. By the time the forex losses are factored in, the latter number has plummeted to R398 million.

The sad thing is that trading profit increased by a higher percentage than revenue, so all the pain is being felt due to either forex losses or issues further down the income statement (higher net finance costs as well as a higher effective tax rate that have both negatively impacted net profit).

The management team has been focused on the balance sheet and rightly so, unlocking a net working capital and liquidity improvement of R500 million. For this reason, the proposed rights offer has decreased from R2 billion to R1.5 billion.

Interestingly, Nampak notes that the operations can handle load shedding up to stage 4, with anything beyond that level causing trouble. I think we can all relate to that.

A new equity funding package is being negotiated with the lenders who require Nampak to execute a rights offer with net proceeds of at least R1.35 billion. A number of shareholders have pushed against the order of events, saying that the terms of the funding should be finalised before the rights offer is launched.

Nampak has committed to give details of the funding package before the rescheduled extraordinary general meeting on 8th March.

Pan African Resources drops more than 6% after an update

Production came under pressure in the first half of the year

For the six months ended December, Pan African Resources managed to make significant progress on its renewable energy strategy. Aside from solar projects, there was also the issuance of a $47.3 million sustainability-linked bond that will help fund the Mintails project.

The problem lies in the production numbers, not the strategic initiatives. Load shedding and difficult weather conditions put the business under pressure, particularly at Barberton Mines. Production for the period fell by 14.6%, a significant drop from what was admittedly record production in the prior year.

Despite this, production guidance for the full year has been maintained. There’s a big catch though: this guidance is “subject to consistency in Eskom’s electricity supply” – and this probably explains the share price drop.

Investors will also take note of a significant jump in net debt, which is attributed mainly to capital expenditure and the payment of a dividend.

Pepkor is flattered by Avenida, with SA businesses under pressure

The company joins the Mr Price WhatsApp group of like-for-like pain

With Pepkor adding its voice to the retail sales updates over the festive period, we now have a proper overview of what happened in the sector. Revenue increased by 6.5% at group level, but we have to dig deeper to really unpack it.

The number to look for is like-for-like sales, particularly with the major acquisition of Avenida in these numbers. Sure enough, like-for-like fell by 1.4%. This is despite 70% of stores being able to trade with backup power, so there’s more to the festive retail story than just load shedding.

The poor result in clothing was driven by Ackermans, where like-for-like sales nosedived by 8%. That’s a really ugly outcome in an inflationary environment of around 5%, implying that volumes fell by approximately 13%.

Across Mr Price and Pepkor, along with cash vs. credit sales at Lewis, we now have pretty clear evidence that lower income earners are being hammered by current economic conditions. Still, that’s not the only reason for the pain. At Mr Price, I think that the brand isn’t resonating with customers anymore. In Ackermans, Pepkor admits that the merchandise mix wasn’t aligned to the brand promise of “unbeatable value” – and in fashion, that’s a major issue. Markdowns have been implemented, which means gross margins are going to take strain.

There’s some hope in January at least, with the back-to-school rush driving strong sales at Pepkor’s core value brands. This is a necessity though, with parents likely making sacrifices elsewhere to afford school clothes.

The rest of the group posted positive like-for-like growth, with Avenida up 6.8%.

The DIY / building material format within the group performed decently in the broader economic context. The Building Company managed to grow 1.8%. The performance has deteriorated in January, with general iffyness around load shedding not helping matters.

I can’t help but wonder how Pick n Pay Clothing is performing in this environment. One of the best success stories to come out of Pick n Pay in recent years, the value-driven offering has resonated with customers and taken market share. We don’t get to see detailed numbers unfortunately, as the division gets bundled into the broader (and much larger) Pick n Pay business.

A management band-aid at Spar

The group is casting the net wide for a new CEO

With the…sudden retirement of the CEO of Spar, the company has found itself without anyone at the helm. As a temporary measure, non-executive chairman Mike Bosman will now become Executive Chairman (and Spar even uses capital letters here to make this significant upgrade even clearer). He has resigned from the board of AVI after 13 years to make sure he can deliver this role.

With the…sudden retirement of the CEO of Spar, the company has found itself without anyone at the helm. As a temporary measure, non-executive chairman Mike Bosman will now become Executive Chairman (and Spar even uses capital letters here to make this significant upgrade even clearer). He has resigned from the board of AVI after 13 years to make sure he can deliver this role.

Bosman will have his hand held sweetly by the Board Chairman’s Committee, to “strengthen governance” in the aftermath of a really embarrassing period for the company. Lead independent director Andrew Waller will be the chair of that committee.

While Spar fights to regain any level of respect in the market, the search for a new CEO is underway and the company hopes to make an announcement within three months.

The CEO of Tongaat heads for the exit

But the business rescue practitioners are running the show now anyway

Things seem to keep getting worse at Tongaat, with CEO Gavin Hudson retiring from the top job. He joined in the aftermath of the accounting irregularities and tried to steady the ship, but a cocktail of a pandemic, civil unrest and floods made it an almost impossible task.

Tongaat is in business rescue and the plan is expected to be published before 28 February, with the company’s “core team of executives” working with the business rescue practitioners.

The reality is that Hudson’s departure probably doesn’t make a huge difference at this stage, as the business rescue practitioners are in charge of the company’s affairs.

Little Bites:

- Director dealings:

- A trust linked to directors of Ninety One has acquired shares worth around £86k.

- A director of Mustek has sold shares worth around R875k

- It’s such a tiny amount that it probably doesn’t matter, but an associate of a director of Ascendis Health bought shares worth nearly R4k

- Safari Investments is currently under offer from Heriot REIT at a price of R5.60 per share. Before the latest block trade, Heriot and its concert parties collectively held 40.7% of the total Safari shares in issue. After a deal with SA Corporate Real Estate Limited (also at R5.60 per share), Heriot and its concert parties now own 47.1% in Safari.

- Trustco doesn’t seem to be getting anywhere in court. After the High Court dismissed Trustco’s review application regarding the JSE’s decision around Trustco’s financial statements, the company applied for leave to appeal to the Supreme Court of Appeal. This application was dismissed with costs. I’m no lawyer, but I assume they will give up now.

Hi Mr Ghost Bites,

Engineering News has kept me sane in this turbulent corrupt ANC creation. I was pleasantly surprised to scroll through your Ghost mail and am definitely a fan and will frequent your Mail from now on, well done!!