Advanced Health shareholders say yes (JSE: AVL)

The proposed sale of the stake in PresMed Australia has been almost unanimously approved

Advanced Health plans to dispose of its entire stake in PresMed Australia (56.44% in the company) for A$45.2 million, which translates to roughly R520 million.

Shareholders like it, with 99.99% of votes cast in favour of the transaction.

The deal will now be implemented, with this major hurdle out of the way. In case you’re wondering, the anchor bidder here is a private equity fund, with management and medical shareholders also part of the bid.

Attacq is still negotiating with the GEPF (JSE: ATT)

The cautionary announcement has been renewed

If you’re a shareholder in Attacq, you are likely aware of the potential deal for the Government Employees Pension Fund (GEPF) to take a 30% stake in Attacq Waterfall Investment Company.

This is a great deal for Attacq shareholders as the price is much closer to NAV than the discount at which the listed shares are trading, so this creates value for listed shareholders (like me).

The cautionary has been renewed as Attacq is still negotiating the legal agreements. This deal isn’t finalised yet.

EOH commences the fight back (JSE: EOH)

The share price is green over the past month – can this be maintained?

In any turnaround story, there’s eventually a bottom. Sometimes, it happens after a horribly painful rights issue. In even more unfortunate cases, the bottom is sometimes zero, as I think we are about to see in Steinhoff.

In a trading statement for the six months ended January 2023, EOH has achieved a modest increase in revenue from continuing operations. Gross profit margins were fairly steady at 28% to 30%. Operating profit of between R100 million and R120 million compares favourably to R100 million in the corresponding prior period.

The problem hasn’t been the operations. No, it has been the balance sheet, which wasn’t fixed by the end of this period. For that reason, there’s still a headline loss for the interim period.

Debt had been reduced to R1.2 billion by the end of January and was then reduced further to R673 million thanks to the proceeds of the rights offer.

This should, in theory, mark the bottom in terms of financial performance. Having been through a torrid time, the onus is now on the management team to deliver operating profit growth.

Masters of drilling (JSE: MDI)

But you’ll need to be a master of timing to make money on this one

Cyclical companies are a wonderful thing. They lure investors in the pursuit of riches, either rewarding or ruining them along the way. Over three years, Master Drilling has doubled in value – admittedly because the Covid low is now the starting point of a three-year view. Over five years, the share price has managed around 17.5% in total, which certainly isn’t a good outcome.

As a supplier to the mining industry, Master Drilling is as cyclical as its customer base. The difference is that it lets you take a view on the commodity sector in general, without having to pick your poison in terms of a specific commodity.

It has worked in recent times, with revenue for the year ended December 2022 up by 31.7% in US dollars and HEPS up by 10.1%. If you prefer the South African view, HEPS measured in rand was up by 21.9%. Both the order book and pipeline look good, so that bodes well for 2023.

The company is investing heavily, with practically all cash generated from operations being sunk into capex. Of that capex spend, 63% is on expansion and 37% is on maintaining the existing business. The company was happy to increase its dividend per share from 32.5 cents to 47.5 cents (measured in rand), so with all the cash going into capex, the only outcome was an increase in debt. This was a deliberate decision to increase the mix of debt on the balance sheet, taking gearing from 5.8% to 7.8%.

Although Master Drilling services clients around the world, the group notes that Africa remains the key area and that further opportunities are being aggressively pursued.

Metair updates its earnings guidance (JSE: MTA)

At least shareholders now have more uncertainty around the recent pain

In its initial trading statement for the year ended December 2022, Metair flagged a decrease in HEPS of at least 104%. Clearly, this meant a loss for the period.

That guidance has now been tightened and it’s hardly any worse than the original guidance, coming in at a drop of between 104% and 106%. This indicates a headline loss of between 14 cents and 21 cents vs. HEPS of 354 cents in the comparable period.

The share price has only lost a quarter of its value over 12 months, which is pretty good under these circumstances.

Murray & Roberts may still hold on to RUC (JSE: MUR)

There’s a big step forward in the voluntary administration of the Aussie business

In the latest example of the public market casino, Murray & Roberts is up 45% in the past week. It remains 82% down over the past six months.

There has been positive newsflow around the latest rally, with another example coming through on Tuesday. Having now agreed a binding Deed of Company Arrangement with the administrators in Australia, Murray & Roberts has taken another step towards being free of the Clough nightmare.

As an additional bonus, ownership of the RUC Cementation Mining Contractors business should revert to Murrays under this agreement. This would retain the multinational status of the group’s mining platform.

These speculative plays can bring huge returns to punters in a short space of time. Those returns can disappear just as quickly as they appeared, so be careful.

PBT is set to sell Payapps and pay shareholders a special dividend (JSE: PBG)

A 13.3% rally was the reward for those who held PBT Group on Tuesday morning

PBT Group is finally selling the Australian business that doesn’t quite belong with the rest of the business. The stake in construction payment management software Payapps is being sold for A$14.35 million to the other shareholders in Payapps, being a group of Australian buyers.

After all transaction costs and taxes, proceeds of R158 million will be received by PBT. This works out to R1.51 per PBT share, which will be returned to shareholders as a cash distribution.

The selling price is well above the fair value of the investment that had been recognised in PBT’s financials of R124.27 million.

Stor-Age looks to be on the right track (JSE: SSS)

The share price pressure over the past year is a function of valuation, not performance

Stor-Age is a solid business. That doesn’t always make it a good investment of course, as it all comes down to market yields and what investors are prepared to pay for these cash flows.

The company can’t control the valuation or the macroeconomic environment. It can control its own performance, something that Stor-Age regularly delivers on.

In an update for the eleven months to February 2023, demand remained robust and churn was below pre-pandemic levels, although the company is seeing some return to seasonal trends.

On a same-store basis, occupancy increased in South Africa and the average rental rate increased by 7.3% in this inflationary environment. Occupancy in the same-store portfolio is 91.7%. The “same-store” concept is important, because Stor-Age is constantly building and acquiring new facilities.

In a sign of the times, the average rental rate in the UK portfolio increased by 8.3%, higher than the rate in South Africa! Occupancies are somewhat lower, coming in at 86.7% in the same-store portfolio.

The development pipeline is still going strong, with R900 million worth of development investment lined up in South Africa. The properties are all being developed in a joint venture with Nedbank, except for a Century City property that is a joint venture with Rabie Group. In the UK, the development pipeline is worth £64 million (note the currency).

Super Group reminds us that equity isn’t everything (JSE: SPG)

There are other ways to raise capital

People tend to forget that equity isn’t the only layer in the balance sheet cake. The local capital market is vibrant for debt raises, with no shortage of institutional investors looking for “corporate paper” – notes and similar debt instruments issued by leading companies.

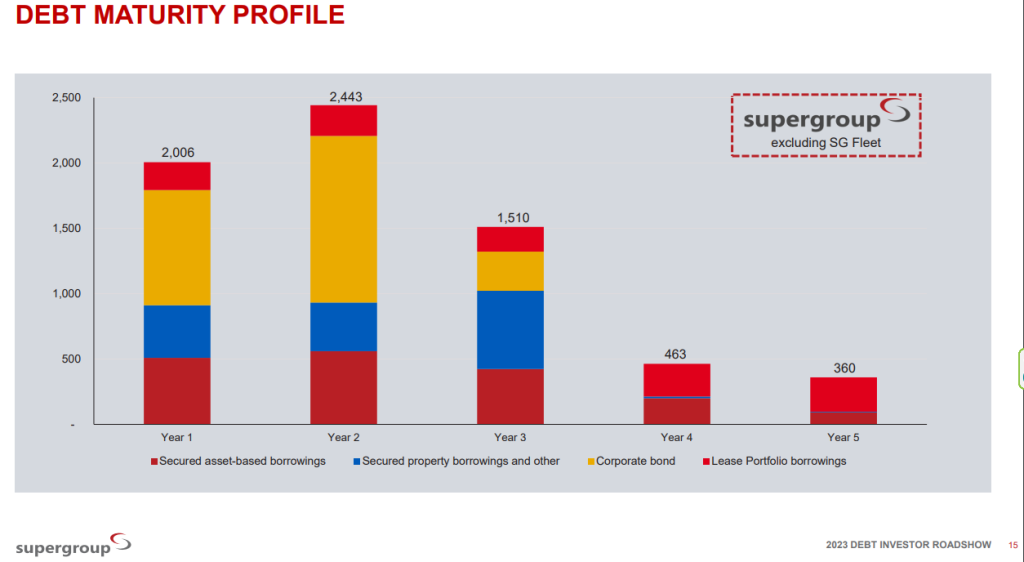

As Super Group announced a further successful debt capital raise on the local market, I went digging for the debt investor roadshow presentation to see if anything interesting popped out. To give you an idea of how interesting managing a balance sheet can be, here’s a useful graph of the type and maturity profile of the debt at Super Group:

The company raised R750 million and received bids for R2.46 billion, so the raise was heavily oversubscribed. Pricing was thus slightly below guidance, which is what the company wants to see.

If you’re curious about the full debt investor presentation, you’ll find it here>>>

Steinhoff: get ready to shout “Whoa!” (JSE: SNH)

This must be the most aptly named process I’ve ever seen

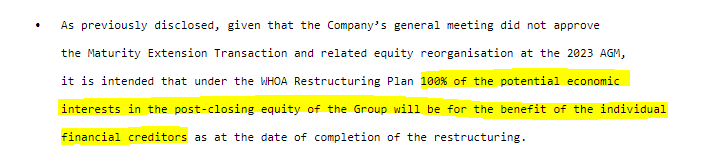

After shareholders chose to rather own worthless listed shares than worthless unlisted shares, Steinhoff’s board had to initiate a Dutch law restructuring plan called a “WHOA Restructuring Plan” – surely the easiest name in law to remember.

There are many complicated details in here about how the debt will be restructured. Here’s the paragraph you need to care about if you still stubbornly own equity in Steinhoff:

As I have been warning you for some time now, the equity is worthless. Despite this, there are still punters sitting on the bid at 26 cents per share. They clearly just hate having money and are looking for innovative ways to get rid of it.

Little Bites:

- Director dealings:

- The founders of Transaction Capital (JSE: TCP) climbed into more shares, buying R19.8 million worth of shares at an average price of R13.19 per share.

- Directors of Premier Group (JSE: PMR) bought shares worth roughly R4.6 million as part of the IPO.

- Des de Beer has bought another R3.3 million worth of shares in Lighthouse Properties (JSE: LTE)

- The Chief Sustainability Officer of Sibanye-Stillwater (JSE: SSW) has bought nearly R1.2 million worth of shares.

- Associates of directors of Nictus (JSE: NCS) have bought shares worth over R52k.

- If you are unfortunate enough to be a shareholder in Pembury Lifestyle Group (JSE: PEM), there’s an update on the ongoing soap opera. It includes everything from audits not being up to date through the discovery of historical fraudulent documents, along with a far-too-detailed update on the schools that are being prepared for opening. I’m surprised they didn’t mention a repainting of the school hall, such was the level of detail. It’s incredible how listed companies can become such a mess.