Advanced Health needs to make SA profitable (JSE: AVL)

Losses have worsened in the South African business

Advanced Health’s business in Australia is profitable. It is also in the process of being sold for around R522 million.

This leaves the group with its South African business, a day hospital operation (see what I did there?) that could do with a few procedures itself. In the six months ended December, it lost R23.1 million vs. a loss of R21.9 million in the comparable period. Although the company attributes the negative trend to higher finance costs, the reality is that the business model is clearly not working.

There are various strategic initiatives highlighted in the earnings release to try and improve matters in the local business. Reducing group debt will help as well!

The Daily Maverick forces AYO’s hand (JSE: AYO)

Full marks to the publication for its role in the disclosure of these terms

When AYO Technology first released an announcement about the settlement with the Public Investment Corporation (PIC) and Government Employees Pension Fund (GEPF), they gave almost no details.

At the time, I wrote:

“There is now an “amicable” conclusion of a settlement agreement, but the terms are confidential. This is surprising, because AYO shareholders now have no idea what the settlement looks like and what the financial impact will be.”

Thanks to the existence of media houses like Daily Maverick who are investigative journalists rather than market commentators and analysts, AYO didn’t get away with this. Tim Cohen and Neesa Moodley published an article that was clearly painful enough for AYO that disclosure became necessary, with some pressure presumably applied by the regulators as well.

The Daily Maverick reports that a R4.3 billion investment was originally made at R43 per share for AYO shares. The company traded at R4.78 at close of play on Monday, so this hasn’t exactly been a lovely investment.

AYO will repurchase 17.2 million shares for a total amount of R619 million. That’s not too bad actually, implying a price per share of R36 that is vastly higher than where AYO is currently trading. After five years, the GEPF can sell another 5% of its stake at the higher of R20 per share or 90-day VWAP. Call me a skeptic if you must, but I would wager which of those two numbers will be higher.

The GEPF will retain a stake of 25.01% in the company. Lucky them.

The arbitrage was obvious at Cashbuild (JSE: CSB)

The odd-lot offer ended up being more than twice the expected size

Fun fact about the market: it’s full of smart people who like making money. When there is the ability to buy an odd-lot of shares (fewer than 100) and have them bought from you a couple of weeks later at a tidy profit, many punters happily play the arbitrage and put some money in the bank. The profit per trader is obviously limited, as it can only be made on fewer than 100 shares per account, but it can add up to a lot for Cashbuild.

When the odd-lot offer circular was released, there were 40,493 shares that were held by investors who each had fewer than 100 shares. By the time the deal was concluded, Cashbuild repurchased 89,164 shares.

Goodness knows it won’t break the bank at Cashbuild, but the total value ended up being R17.6 million when it should’ve been less than half that amount. I hope their calculation on the cost savings took into account the arbitrage and the number of shareholders who would jump onto the register purely to be taken out at a premium.

There’s more good news at EOH (JSE: EOH)

The debt package with Standard Bank has been refinanced

There’s a definite shift in momentum at EOH, with the company emerging from a rights offer with a far better story than before. That doesn’t help those who held before the rights offer, but it might help those who bought afterwards.

In very encouraging news, the company has refinanced its debt package with Standard Bank and words like “normalised debt structure” are now being used. They have also “significantly lowered the cost of debt” for the group, which is more good news.

If you’re wondering what a sustainable debt structure looks like, here are the details:

- R200 million 4-year amortising term loan (therefore capital and interest repaid over four years)

- R250 million 3-year bullet term loan (interest paid for three years and the capital right at the end)

- R250 million 4-year revolving credit facility (a bit like having an access bond)

- R500 million general banking facility including working capital and ancillary banking facilities (essentially a huge overdraft)

Glencore tries to swoop in on Teck (JSE: GLN)

For now at least, the Canadian company has told Glencore where to go

Teck is one of Canada’s leading mining companies, with a focus on copper, zinc and steelmaking coal. The company is currently busy with a restructure of its operations and different classes of shares, which Glencore clearly saw as an opportunity.

Later this month, Teck shareholders will vote on a proposed spin-off of the steelmaking business and a sunset clause on the voting rights held by the super-voting Class A shares. This doesn’t leave Glencore with much time to win over the Teck board, with the initial Glencore proposal strongly rejected by Teck in this press release.

Glencore’s proposal is a merger of the companies, followed by a demerger to create two distinct groups. One would be the “dirty” business with coal and ferroalloys and the other would be the clean(er) business with transition metals like copper.

At the proposed ratio, Glencore shareholders would own 76% of the entities and Teck shareholders would own 24%.

Glencore reckons that synergies worth $4.25 billion and $5.25 billion would be achieved through this deal. This is estimated on a net present value basis.

If you want a wonderful example of corporate finance at the very top end of the market, here’s the letter sent by Teck to Glencore that politely tells them to get lost.

Hammerson sells at a discount to book value (JSE: HMN)

This won’t do much to improve sentiment

Hammerson has had some bad press recently, mainly because Resilient is upset that the company isn’t paying a dividend. In my view, that’s why listed companies shouldn’t own minority stakes in other listed companies. If you don’t have control or at least significant influence over the asset, you shouldn’t be earning a fee as a listed management team to own it.

Moving on, the latest news from Hammerson might not help matters. Although the company is making progress towards its asset disposal target to reduce debt, the latest sale is at a discount to book value – a 4% discount, to be exact. That’s a lot better than the discount that most property funds trade at, but it still calls into question the accuracy of the portfolio book value.

The latest sales are worth €164 million, taking the group closer to the target of €500 million worth of disposals by the end of 2023. Around €360 million worth of disposals have now been achieved. Headline LTV (a measure of gearing) improves to 36% as a result of this disposal.

A bonanza for shareholders in Industrials REIT (JSE: MLI)

The mother of all offers has landed from Blackstone

You won’t see a 37.5% rally in a share price very often, even when there’s a potential offer on the table. A premium in an offer is normal, but this is a particularly juicy one at Industrials REIT.

I’ve covered Sirius Real Estate (another industrials fund) in an update below, so it’s fun to plot the two on a chart:

Even with this mammoth offer for Industrials REIT, the share has lost value over the past year!

Blackstone may make an offer of 168 pence per share (yes, denominated in GBP), a premium of 40.6% to the one month volume-weighted average price (VWAP). If Blackstone pulls the trigger on the offer, the board of Industrials REIT will unsurprisingly recommend it to shareholders. A due diligence is underway as we speak, which will need to be finalised before an offer is made.

Investec amends the ManCo internalisation (JSE: IPF)

I guess that the institutional shareholders agreed with my sentiments here

I went back and read what I wrote about this Investec Property Fund ManCo deal when the news first broke. I talked about investors being fleeced of their capital and I stand by that view.

Institutions seemed to agree, putting pressure on the fund to temper its enthusiasm in paying a fortune to the ManCo. The deal isn’t much better for shareholders, but at least some of the purchase price has become an earn-out.

The fund starts off the announcement by noting strong support from investors for the strategic rationale of the deal, which isn’t the same as support for the price. Of the proposed price of R975 million, R125 million is now subject to an earn-out arrangement rather than being a guaranteed part of the price.

The measure for the earn-out is growth in assets under management, which feels like completely the wrong measure to me. All that is being encouraged here is capital raising activities, not great returns for shareholders.

There is also a note that Investec (the recipient of this wonderful amount of money) will contribute R45 million to the fund for management retention, IT systems and rebranding.

Shareholders controlling 36.2% of the voting rights in the company have agreed to vote in favour of the deal. The fund needs to achieve 50% approval for this deal to go through. Investec and its associates obviously have a conflict of interest here, so they can’t vote.

The circular should be released on 17 April or thereabouts.

Pick n Pay will need the power of Star Wars Day (JSE: PIK)

May the 4th be with shareholders when these results come out

After the close on Monday, Pick n Pay released an earnings update for the 52 weeks ended 26 February 2023.

I don’t have much good news for you here, with diluted HEPS (excluding business interruption insurance and hyperinflation in Zimbabwe) down by between 12% and 18%. Ouch.

The cost of diesel generators has had a “significant influence” on these results, which I can certainly believe based on other retailers. As a mitigating factor, the retailer managed to hold gross margins constant in a really tough environment and they seem to be happy with trading expenses.

We will only know the full story when results are released on May 4th. We will at least know what the market thinks on Tuesday morning when trade opens after the market digested these numbers.

Although not directly comparable, Shoprite managed to grow its HEPS by 10.2% (excluding the discontinued operation in the DRC) for the 26 weeks to 1 January 2023. I would argue that the Shoprite result is made more impressive by the time period, as it included an even more concentrated period of load shedding.

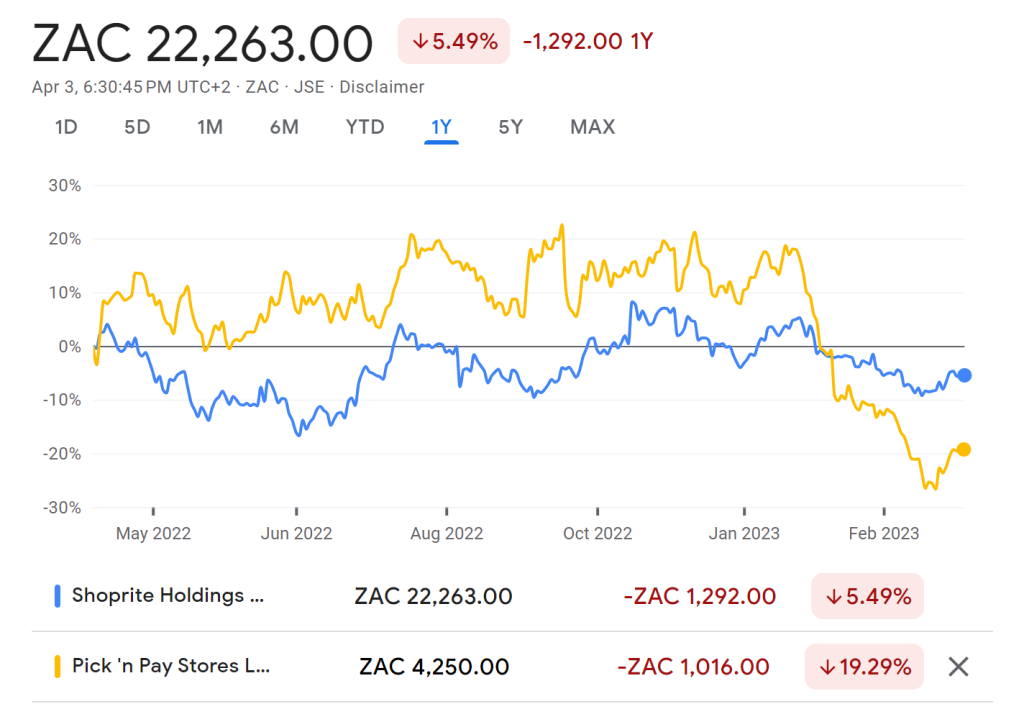

I wouldn’t want to own either retailer in this environment, but I don’t expect the relative underperformance of Pick n Pay over the past year to reverse:

Sirius recycles more capital above book value (JSE: SRE)

The latest sale is a mixed-use property in Germany

Listed property funds usually trade at discounts to net asset value (NAV) per share. There are exceptions and I’m always worried when I see them, as investors get burnt more often than not by buying above NAV.

You wouldn’t buy a house in your area for 20% more than it’s worth, so why do it with a listed fund?

I wrote about Sirius Real Estate often during the pandemic, warning about buying at such an inflated valuation. The share price chart looks like a rather exciting mountain biking race, which isn’t what you want to see as an investor:

The company is focused on justifying its NAV to the market, as evidenced by the latest announcement regarding the sale of two properties. It’s one thing for the directors to tell us what a property is worth. It’s quite another for them to demonstrate it through sale.

The latest example is a mixed-use property in Germany that was acquired by Sirius in 2007. It has been sold for €8.8 million, a price that is 5.3% above book value.

Sirius has disposed of 6 properties in the past year at an aggregate premium of 25% to the net book value. In case you’re wondering about whether there was an outlier driving this outcome, each sale was at or above book value.

The proceeds were invested in three new sites in Germany, which are generating higher revenues than the properties disposed of.

It’s a good story, which is why the share price closed 4% higher. Can these sales be extrapolated to the rest of the portfolio? Perhaps that’s the biggest question of all.

Little Bites:

- Director dealings:

- Value Capital Partners has bought shares in ADvTECH (JSE: ADH) worth roughly R42.5 million. They have representation on the board, hence it comes through as director dealings.

- I don’t usually report on employee share option trades, unless I spot something unusual. It’s common for executives to sell shares to cover the tax obligations on these share awards. In the case of Woolworths (JSE: WHL) CEO Roy Bagattini, he only sold enough shares to cover half the tax obligation, which means he paid half the tax from his own pocket (seems to be R6 million) and kept more shares than usual. That’s a director purchase in my books.

- Des de Beer has bought more shares in Lighthouse Properties (JSE: LTE) worth R314k.

- An associate of a director of Ascendis (JSE: ASC) has bought shares worth R176k.

- Here’s a fun one for you: Grindrod (JSE: GND) no longer needs a property in London as the operations in the UK have been spun-off. The Grindrods (yes, you read that correctly) are buying the residential property from Grindrod for the tidy sum of R35.6 million. What does this get you in London? Two bedrooms. Yes, two of them. I’ll continue taking my chances in Cape Town, thanks. Jokes aside, the property was only on the balance sheet for R6.6 million, so there’s a juicy profit on disposal here!

- ArcelorMittal (JSE: ACL) has appointed Siphamandla Mthethwa as the company’s new CFO. He is currently the CFO of Airports Company South Africa.

- The chaos continues at Pembury Lifestyle Group (JSE: PEM) where a legal letter from the firm acting as company secretary set out various allegations against the company. This led to the resignation of three independent directors in March. The company has announced their replacements, also highlighting that the allegations by the company secretary have been announced on SENS as part of the company trying to clean up its act.