Advanced Health proposes a clean-out dividend (JSE: AVL)

There’s a 20 cents dividend on the table before the 80 cents per share buyout offer

Advanced Health is on its way out from the JSE. The controlling shareholders are taking it private at a price of 80 cents per share. Before that happens, there’s a clean-out dividend being proposed to shareholders. This is basically a final kiss goodbye from the company.

It was clearly bigger than the market expected, as the share price jumped nearly 29% to 98 cents. I’m genuinely not sure why anyone paid 98 cents for a 100 cents return with deal risk. The real winners are those who bought a year ago when the stock was trading below 30 cents!

A significant media mistake re: Kibo Energy (JSE: KBO)

Mistakes happen, but this one is particularly awkward

The approach I take in Ghost Mail is to only ever report on what I read on SENS. I avoid any kind of speculation, hearsay or information that isn’t released through the official JSE system. Goodness knows I’ve made mistakes on this website (and I’m always so grateful for the kind corrections), but Moneyweb made a big one here.

After an article screamed good news about Kibo Energy from the rooftops, the share price saw some pretty big action in the morning. The company was quick to correct the article, as Moneyweb was reporting on a gas discovery near Secunda by a company called Kinetiko Energy that has nothing whatsoever to do with Kibo Energy, despite the headline to the contrary.

This share price has been stuck between 2 and 3 cents forever, so an apology from Moneyweb is cold comfort for those who punted at the stock and paid up to 5 cents in morning trade. Just think about that in percentage terms – a drop from 5 cents to 2 cents means 60% of your money has evaporated!

This is a most unfortunate situation for all involved. It’s also a good reminder to always do your own research, instead of relying on others.

NEPI Rockcastle achieved solid growth (JSE: NRP)

This is a very encouraging trading statement

NEPI Rockcastle isn’t bothering with an earnings range. Instead, the company has given the exact distributable earnings per share for the six months to June 2023 of 28.50 euro cents, which is 24.8% higher than the comparable period. This is thanks to a strong operating performance in Central and Eastern Europe and acquisitions in the second half of 2022.

The dividend will be no less than 25.65 euro cents per share, which is a dividend payout ratio of at least 90%.

Happy news for shareholders all round!

Sun International released an interesting trading statement (JSE: SUI)

Yup – that means it’s time for the chart of the day

Of all the sectors that got hurt by the pandemic, the hospitality industry surely came off worst. With hotels shut across the world, you could drive past them and just about hear them racking up losses.

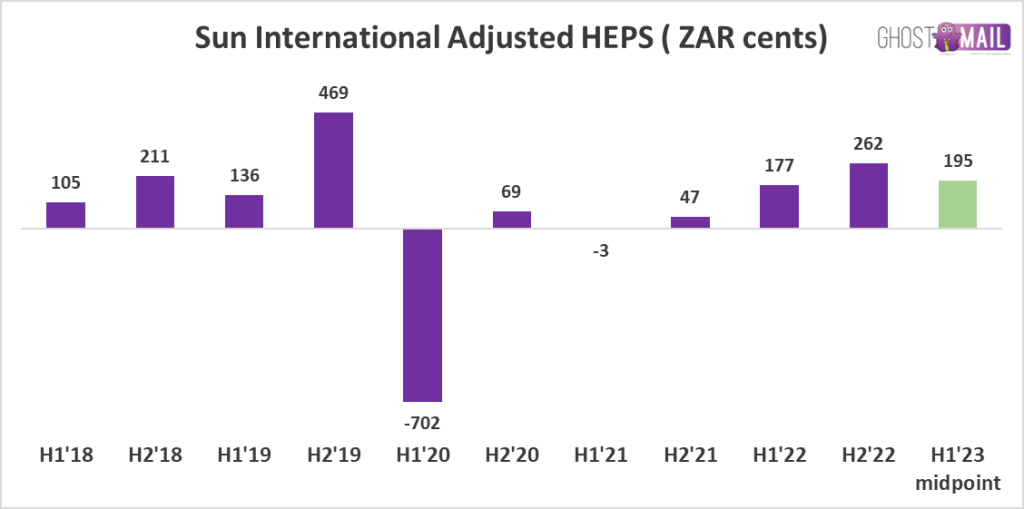

Sun International reports adjusted HEPS in addition to normal HEPS and whilst I’m generally very skeptical of this approach, this is what they base the dividend payout ratio on. It’s been that way for years. So, I worked back through the numbers and used adjusted HEPS for the chart of the day.

As you can see, the pandemic was awful. In fact, if we start at H1’20 when the pandemic hit, the company has generated just 44 cents in cumulative HEPS!

The chart has already given away the growth in adjusted HEPS as indicated in the trading statement, which is between 7% and 12% year-on-year. If you know your JSE rules, you’ll now be wondering why there is a trading statement when the movement is less than 20%. The secret lies in HEPS as per the usual rules (i.e. not adjusted HEPS), which is up by between 73% and 98%.

The difference between adjusted HEPS and HEPS is mainly attributed to the SunWest put option liability and the devaluation of the Naira.

Looking deeper, SunBet achieved record income and the hotels and resorts segment had a very strong first half. Urban casinos grew income and Sun Slots came under pressure due to load shedding. You can’t play on electronic slot machines if there’s no electricity!

Net debt is consistent with the levels seen at the end of December 2022, with net debt to adjusted EBITDA still at 1.8x despite a decent dividend being paid and interest rates increasing.

Little Bites:

- Director dealings:

- With the Lighthouse (JSE: LTE) results out in the market, Des de Beer is buying shares again. This time, the value was R969k.

- The lead independent director of Nedbank (JSE: NED) has bought shares worth R250k – that’s a trade you won’t see every day.

- Two prescribed officers of Mpact (JSE: MPT) collectively sold R3.5m worth of shares.

- The shareholders of Tsogo Sun (JSE: TSG) approved the odd-lot offer, which will be executed at a 5% premium to the 10-day VWAP. Before you get excited, the share price is only R12.47, so an arbitrage profit on 100 shares isn’t worth anything.