Listen to the latest episode of Ghost Wrap here:

ADvTECH schools the market on how to grow (JSE: ADH)

All divisions have been strong contributors to this result

We will need to wait until 28 August to get all the details, but we do know that ADvTECH put in a very strong earnings performance over the six months to June.

The education group has indicated growth in HEPS of between 21% and 26%, which suggests a range of 82.3 cents to 85.7 cents. The share price closed more than 4% higher at R19.42.

CA Sales Holdings drives earnings forwards (JSE: CAA)

This really is an interesting business

CA Sales Holdings isn’t on the radar of most investors, yet the company has a fascinating business model and it is clearly working. In a trading statement for the six months ended June, the company has highlighted growth in HEPS of between 19% and 24%. This implies a range of 35.69 cents to 37.19 cents, with a current share price of around R7.15 for context. Remember, those are half-year earnings.

The company was featured on Unlock the Stock as recently as April 2023. You can watch that recording here>>>

A capital raise at Capital & Regional (JSE: CRP)

This news was accompanied by the release of interim results

Capital & Regional isn’t a company that you’ll regularly see in the news. This property fund is focused on community shopping centres in the UK and has announced the acquisition of The Gyle Shopping Centre in Edinburgh for £40 million.

To finance the deal, the company is raising £16 million in new debt and around £25 million in equity, so that’s a very rare thing these days: an equity raise on the JSE! There’s zero chance of the capital raise failing, as Growthpoint is underwriting the offer in full at a price of 54 pence per share. In London, the share price closed at 56.40 pence, so that’s a slight discount.

The debt is being provided by Morgan Stanley at a fixed cost of 6.5% for 5 years. The days of cheap debt in the UK (and everywhere, really) are over. The asset is being acquired at a net initial yield of 13.51%, so the days of property owners selling on a low yield also seem to be over! At that purchase price and with strong anchor tenants in place, I can see why Growthpoint is happily to put up all the capital if other shareholders don’t support the capital raise.

You have to start asking some tough questions about valuations in the local market if a mall in Scotland (a land of electricity and service delivery) is priced on a yield of 13.51%.

Alongside the news of this transaction, Capital & Regional also announced its results for the six months to June 2023. Occupancy improved, rent collections were good and like-for-like rental income increased by 13%, driving a 17% increase in adjusted earnings per share.

Net asset value increased by 2.3% as valuations finally started to stabilise.

The interim dividend has been increased by 10% to 2.75 pence per share. That’s a lower payout ratio than the prior year based on adjusted earnings per share, perhaps in response to the loan-to-value increasing from 41% to 42% and a general increase in average cost of debt in the market.

Cashbuild got hammered, but perhaps by less than expected? (JSE: CSB)

HEPS has dropped sharply, yet the share price had a good day

Cashbuild isn’t exactly an illiquid counter, so a 3.7% increase for the day isn’t just because of the spread. Yes, the broader market was also in the green today, so Cashbuild’s outperformance after the market had the entire day to consider the trading statement says something about how bad the expectations were.

For the year ended June 2023, HEPS is down by between 35% and 40%.

Although I don’t usually focus on earnings per share (EPS), I will note that the P&L Hardware business has had its goodwill impaired in response to ongoing pressure on that business.

The HEPS range for the year is R11.576 to R12.541. The share price is R168, so that still feels like a big Price/Earnings multiple for something that is struggling so much.

Life Healthcare is still exploring a deal for AMG (JSE: LHC)

Unsolicited proposals received this year are being taken seriously

Life Healthcare has been trading under cautionary since February 2023 based on unsolicited proposals received from third parties for the group’s stake in Alliance Medical Group in Europe.

Although there is still no guarantee of a sale of the stake, these are clearly serious proposals because the group has “narrowed the scope off its evaluation” and is working to see if a transaction is possible.

A big drop in the Lighthouse dividend (JSE: LTE)

Details will be released next week

You may recognise Lighthouse Properties as the company that Des de Beer always seems to be buying shares in. If you followed his strategy in the hope of happy news on the dividend, you’ll be disappointed.

The company has noted that the interim dividend is 1.35 EUR cents per share, a decrease of 16.92% year-on-year. Detailed results are due on 14 August.

An interim loss at Montauk, but a better quarter (JSE: MKR)

There has also been extensive capex in this period

Montauk Renewables is listed on the NASDAQ in addition to the JSE, so the company reports earnings every quarter. When you see a huge swing in interim headline earnings from $0.13 to -$0.01, you can dig into the quarterly results to figure out why.

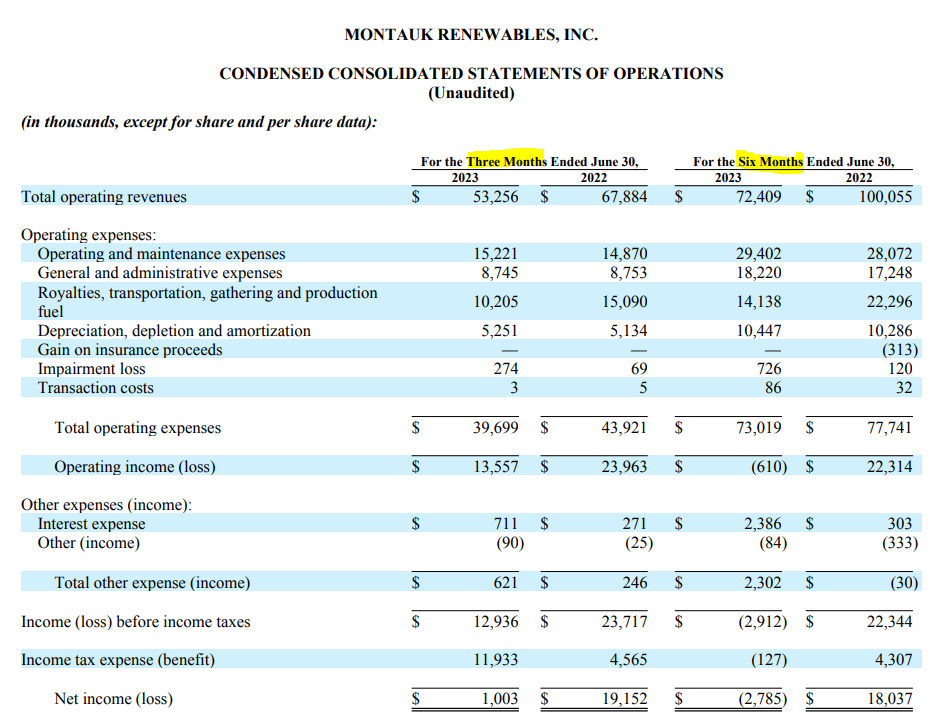

In there, you’ll find an income statement in this format:

As you can see, this lets you see the latest quarter as well as the six-month period. Although this quarter was profitable, it wasn’t enough for the performance over six months to be in the green.

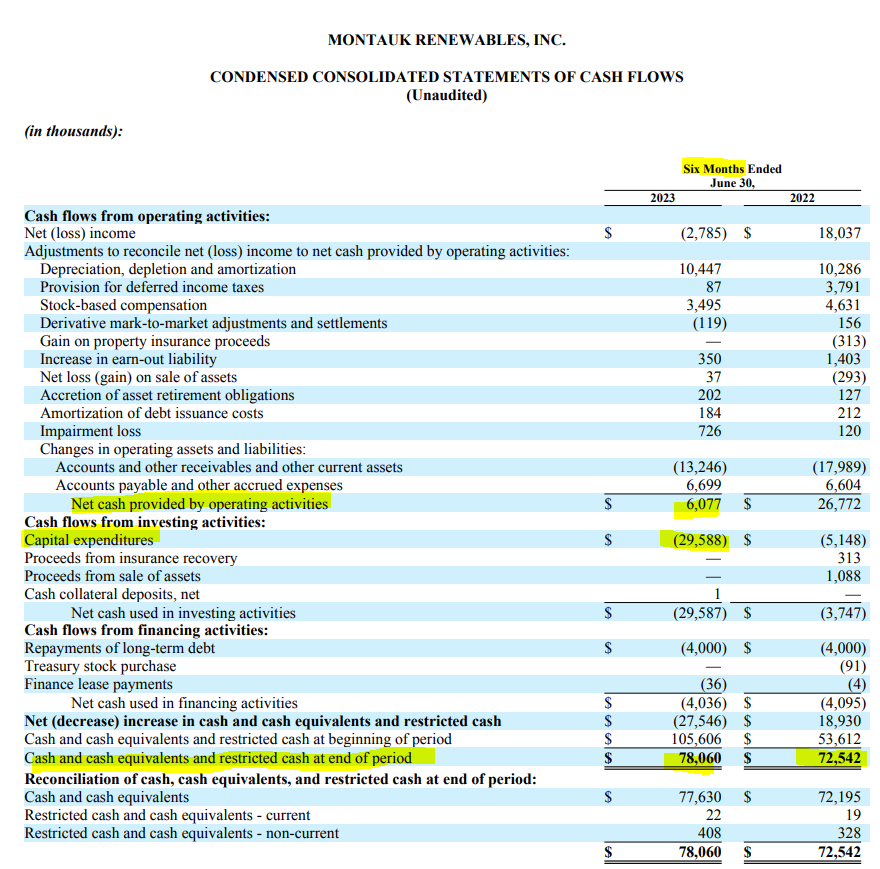

This business is very much in growth phase, which is why capital expenditure was $29.6 million in this interim period despite cash from operations being only $6 million. As the group came into this period with a lot of cash on the balance sheet, this brought the net cash balance down to where it was a year ago. Here’s how to spot the information that I just gave you:

Unsurprisingly, there’s no dividend.

In other news, Montauk continues to develop its project pipeline. The latest is an agreement with Duke Energy for a waste-to-renewable energy facility in North Carolina, with Duke agreeing to buy electricity for 15 years. The electricity is being converted from swine waste of all things! Renewable electricity and renewable natural gas is an interesting space.

Little Bites:

- Director dealings:

- The CEO of Argent Industrial (JSE: ART) sold shares worth nearly R18k.

- For completeness, it’s worth noting that Remgro (JSE: REM) told us what we already know thanks to Vodacom (JSE: VOD) on Tuesday – that the Competition Commission doesn’t like the transaction to combine Vodacom’s fibre assets with Vumatel and Dark Fibre in a new joint venture. Remgro sits on the other side of the deal to Vodacom, so a prohibition (if decreed by the Competition Tribunal) would hurt both companies.

- In rather interesting news, Orion Minerals (JSE: ORN) managed to settle R5.3 million worth of advisory fees to advisor Webb Street Capital through the issue of shares at 18 cents per share. That’s a pretty big discount to the current price of 27 cents but it does say something about their belief in the company as its advisor.

- Although I’m simply picking on Spar (JSE: SPP) here because it’s a fresh example, I really do wonder how a fee like R2.76 million to the Chairman of the Board can be justified. The cost of running a corporate board is just extraordinary and it’s very debatable whether there is a net benefit to the company or its stakeholders from such bloated boards full of committees and independent directors. Of course, the counterargument is that directors carry a lot of risk, so they need to be paid accordingly. The system just feels inefficient to me.

- African Equity Empowerment Investments (JSE: AEE) has been in dispute for a while with BT Limited. The dispute went to arbitration hearing in July and the parties are now working towards a settlement.

- After PKF Octagon was not reappointed by shareholders as the auditor of Acsion Limited (JSE: ACS), the company will need to propose a new auditor. We don’t yet know who that will be.