Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

ADvTECH is building a new university in Sandton (JSE: ADH)

Private tertiary education is growing at pace in South Africa

ADvTECH has announced some exciting news for its tertiary education division. The company has purchased a training and conference centre from FNB and will use the site to build a new university campus. The IIE’s Varsity College Sandton and Vega Bordeaux will relocate to the new campus ahead of the 2026 academic year, so they have a busy year ahead to get it ready.

There’s plenty of money earmarked for this, with a plan to invest R419 million over two years. The business case is that it will double student capacity from the current Varsity College and Vega campuses, with an offering spanning undergraduate to postgraduate qualifications.

Remember all those #FeesMustFall protests and how they severely disrupted the academic year for so many students? Like it or not, that’s one of the reasons why the private sector has a gap here. Parents aren’t so keen to pay for easily disrupted years and neither are students taking out student loans for their studies.

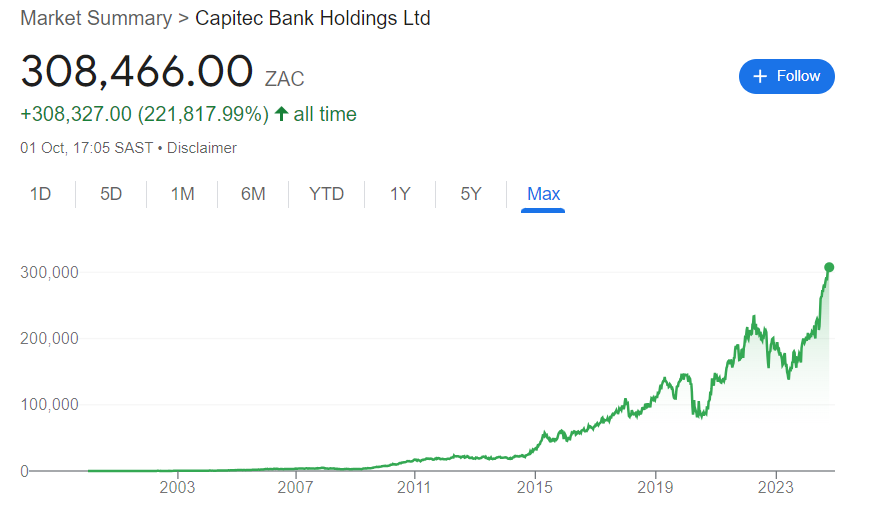

Extraordinary growth at Capitec (JSE: CPI)

How does a growth rate of 36% sound to you?

For a group the size of Capitec to be achieving growth in HEPS and the interim dividend of 36% is incredible. Return on equity has jumped from 24% to 29%, which means they are running at roughly double the level of some competitors.

The one metric that has worried me a bit is the cost-to-income ratio, which has moved from 38% to 41%. The trajectory needs to be managed carefully for Capitec to avoid becoming a lumbering giant like competitors, but 41% is still a great level. As a reminder, lower is better on that ratio. Operating expenses excluding the impact of the AvaFin acquisition grew by 24%, not least of all because of staff incentives to reward success. There are other major areas of investment, like a 36% increase in IT costs.

The major driver of this performance wasn’t just the net interest income growth of 20%, but also the 15% decrease in credit impairments. The net effect was a 72% jump in net interest income after credit impairments. Add on 22% growth in non-interest income (an excellent result in and of itself) and you end up with operating profit up by 41%.

On the business banking side, customer numbers increased by 31% over 12 months. They seem to be doing an excellent job of taking the lessons from the retail bank and rolling them out there, even if headline earnings in that segment fell by 12% as Capitec takes an aggressive approach to fees and winning market share. Here’s another data point for you: after launching a life cover product in June 2024, it contributed R8 million to the insurance result by the end of August.

Here’s a little reminder of what the best business success story of democratic South Africa looks like on a chart:

As a final point, the share price only closed 1.3% higher for the day despite this incredible set of numbers. Although Capitec had previously indicated that the numbers would be strong, it still tells you a lot about just how much is being priced in here.

Unsurprisingly, Kibo Energy is partially settling Riverfort with the shares in MED (JSE: KBO)

The mezzanine funding structure was always going to end like this

At some point, I remember writing that Kibo shareholders should be aware that the value in the group (what little there is) was heading directly to Riverfort as the mezzanine finance provider into the structure. The process has been accelerated by the planned reverse listing of assets into Kibo, with part of the outstanding balance of £463k to Riverfort being settled by the sale of Kibo’s remaining 19.25% interest in Mast Energy Developments (MED).

This takes the loan down to £343k, with the balance attracting interest at 10% per annum. It will be payable on the earlier of the listing suspension being lifted, completion of the reverse takeover or 31 March 2025. Kibo has the choice to settle the remainder in cash or shares.

All the value going forward is going to be in the new assets coming into the structure.

Trencor is looking at winding up during 2025 – if all goes well (JSE: TRE)

The cash shell has received dispensation to remain listed until 31 December 2025

Trencor is nothing more than a legal entity with a bunch of cash on the balance sheet and various legal relationships that need to run their course before the cash becomes available for distribution to shareholders.

The company expects to commence the winding up process as soon as practically possible after 31 December 2024. To buy time for this, they had to get a dispensation from the JSE to remain listed until 31 December 2025. This is not necessarily a guarantee that the winding up will be completed by then, so be cautious with that.

Nibbles:

- Director dealings:

- An associate of Christo Wiese loaded up on Brait (JSE: BAT) convertible bonds with a purchase price of £2.6 million (around R60 million).

- A director of a major subsidiary of Oceana Holdings (JSE: OCE) has sold shares worth R688k.

- Buried deep down in a Santam (JSE: SNT) announcement about share awards, we find a note that a director acquired shares worth R645k in an on-market trade (i.e. unrelated to the awards).

- Pick n Pay (JSE: PIK) achieved all the shareholder approvals required to separately list Boxer on the JSE later this year. It remains a great pity that they intend to exclude retail investors from that opportunity, with only institutional investors able to participate in the placement at what will likely be an appealing price.

- Vukile (JSE: VKE) has already announced the transaction that will see Castellana Properties acquire three shopping centre assets in Portugal. To make the deal happen, Vukile is lending €108 million to its subsidiary in two tranches. The tranche intended to be converted to equity is priced at 5.5% and the rest is at 7.75%. Both loans should be sorted out by the time that RMB Investments and Advisory becomes a 20% shareholder in the entity making the acquisition.

- African Dawn Capital (JSE: ADW), which is currently suspended, announced that subsidiary Elite Group has attracted investment of R5 million from EXG Partners, as well as R15 million in the form of a long-term commercial loan. They aim to “revolutionise the credit industry” – I’m not sure how much of the revolution there will be with that balance sheet.

- Pan African Resources (JSE: PAN) announced that Marileen Kok has been appointed as the Financial Director of the company. She has been with the company since January 2020, so this is an internal appointment which is always great to see.

- Europa Metals (JSE: EMI) has scheduled the general meeting of shareholders for 25 October. This will be for the vote for the sale of the subsidiary EMI to Denarius Metals Corp.

- OUTsurance Group (JSE: OUT) has received approval from the SARB for the special dividend of 40 cents per share.

- Wesizwe Platinum (JSE: WEZ) advised that its financials are late but will be published before 14 October, so luckily they are only a couple of weeks off.