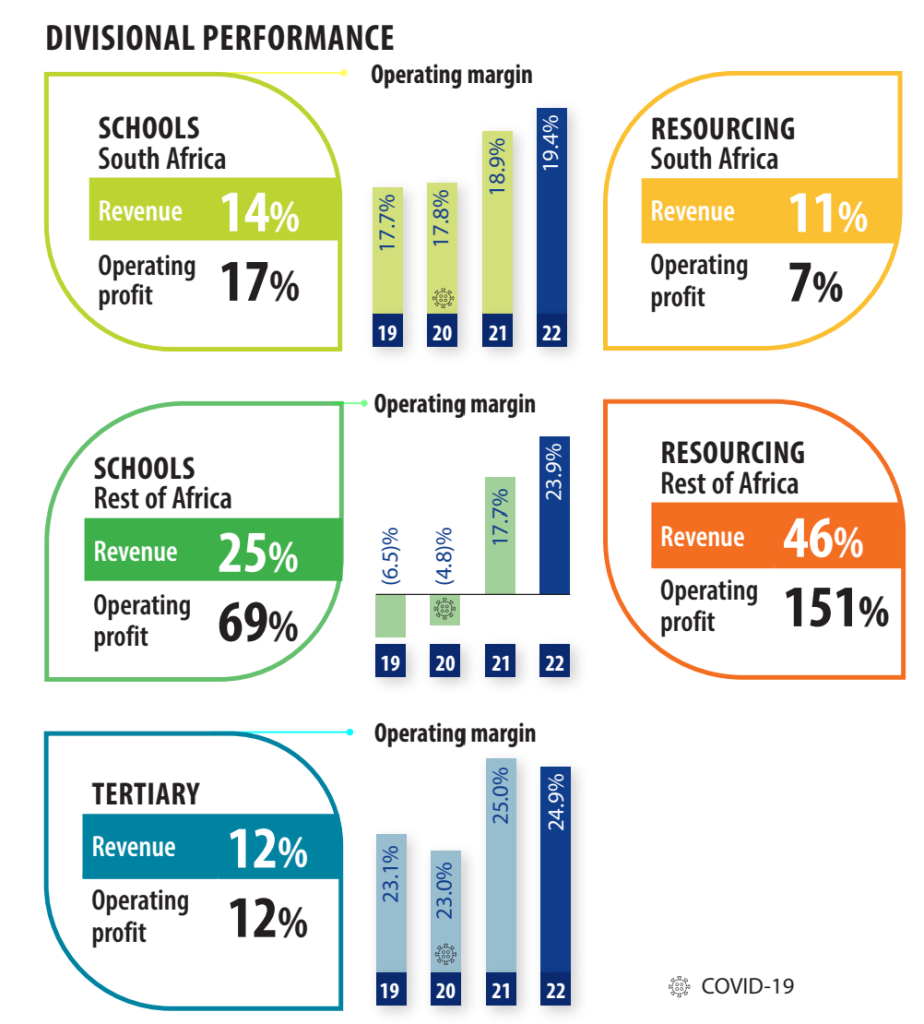

ADvTECH has mastered confusing infographics (JSE: ADH)

I just hope that the kids at the schools get better explanations than this

Credit where credit is due: even with hours to think about how to do it, I doubt I could come up with something more confusing than what ADvTECH has put forward here:

An infographic is supposed to give you a quick understanding of the numbers, not leave you with more questions than answers. After staring at this fruit salad of numbers for a while, you can eventually see what they are trying to do. But yikes, it doesn’t need to be that hard.

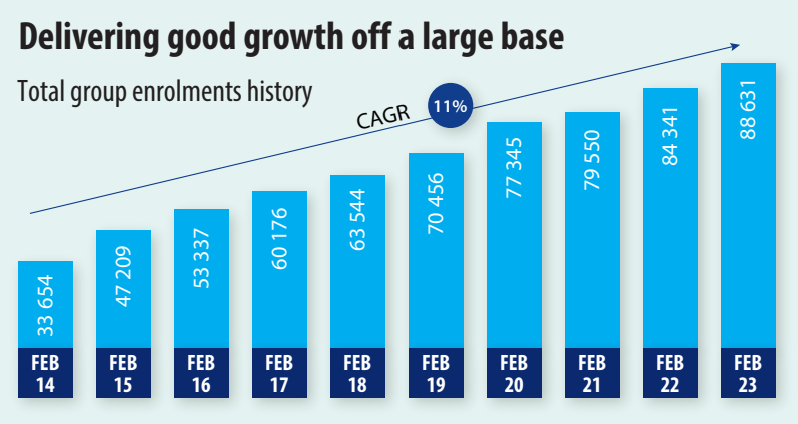

To be fair to the company, I’ll include a chart that certaintly speaks my language as a shareholder:

In the year ended December, ADvTECH grew revenue by 18% and operating profit by 20%. HEPS increased by 20% and so did the full year dividend, coming in at 60 cents per share.

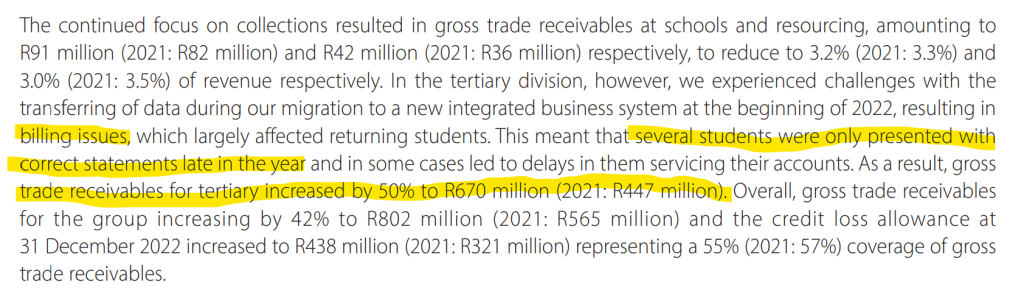

But before we move off this company, I have to point out this exceptionally dicey paragraph buried in the earnings announcement:

It’s great to recognise revenue, but it’s more important to collect it. The group says that the billing system issues have been resolved. I certainly hope so.

Datatec’s trading update looks promising (JSE: DTC)

But supply chain backlogs are still hurting the business in Latin America

Ahead of results in May, Datatec has released a trading update for the year ended February. This is different to a trading statement that is triggered when earnings will differ by more than 20% vs. the comparable period. This is a voluntary update, something that companies do to keep the market appraised of performance and foster good relationships with investors.

Excluding Analysys Mason which was sold in September 2022, group revenue is expected to increase by 13% for the period. The largest business, Westcon International, grew revenue by 18%. Logicalis International was 10% higher and Logicalis Latin America (significantly smaller than the other divisions) was down 6% as supply chain issues continued for the region.

The good news is that the Latin American business had a better second half to the year, so the momentum into the new financial year is promising.

Fairvest wants to focus on retail (JSE: FTA)

The sale of Indluplace is a major portfolio tilt and will significantly reduce debt

Fairvest released a pre-close presentation that says “coming of age” on the cover page. In this case, this is corporate-speak for “we only want retail assets” – a major shift from the current portfolio exposure.

This is a process rather than something that can be achieved immediately, although the sale of Indluplace is certainly going to help. The expected proceeds of just over R650 million will be used to reduce debt, driving a 500 basis points reduction in the loan-to-value ratio.

There is also R422.8 million coming from properties that have been sold but not yet transferred. Most of them are office properties, as one would expect based on the stated strategy. A couple of them were sold well below book value, with the entire “sold” portfolio coming in at 0.8% below book value.

With 37 assets in the office portfolio, there’s a long way to go. Tenant retention has worsened and so has the vacancy rate. Things just aren’t getting better for this sector.

The emerald market is normalising (JSE: GML)

Still, the pricing achieved at Gemfields’ latest auction has been attractive

Total auction revenues of $21.2 million were achieved at emerald auctions during March, with Gemfields selling 86% of the lots offered for sale. The average price of $7.12 per carat is the third highest price per carat achieved over 21 auctions, so pricing is still looking strong.

Having said that, the management team has warned in the release of results that 2023 will be a year of normalisation and they have reinforced that view in this announcement, highlighting that the market has “normalised appreciably following the exuberance” in 2022.

To give an indication of how volatile pricing is, the prices over the past five auctions varied from $4.01 to $9.37 per carat.

Murray & Roberts gets rid of A$7 million in debt (JSE: MUR)

It’s incredible how listed groups can own such scrappy assets

Thanks to materiality, an accounting concept that determines the level of disclosure required, you have to really dig into financial statements to find all the assets that a listed company owns. It’s only when a corporate needs to clean up its act and its balance sheet that the insects come crawling out of the woodwork.

One such insect even sounds like one, with Insig Technologies being sold by Murray & Roberts for the king’s ransom of A$1. Yes, less than a loaf of bread. Aside from the worthless equity, the important point is that the purchaser is assuming A$7 million worth of liabilities. In other words, Murray & Roberts is making the debt and this business someone else’s problem.

Insig is a Perth-based technology company that made a loss of A$1.7 million for the year to February 2023. It has a net asset value of A$2.9 million. The company needs further investment and Murrays barely has enough money to afford coffee at the staff canteen, so this transaction makes sense.

The buyer is AVID, a name that astonishingly also sounds like a certain little green insect if you pronounce that “A” with all your might.

You can now play in the Premier league (JSE: BAT and JSE: PMR)

Premier Group is now listed on the JSE and Brait has received the proceeds

Brait has announced that in light of food group Premier trading on the JSE since 24th March, it has received gross proceeds of R3.6 billion, which could reduce to R3.5 billion depending on the outcome of the overallotment option of R100 million.

The funds will be used to settle Brait’s R2.1 billion revolving credit facility, with the rest going to working capital and investment needs going forward. That seems like a lot of money left over…

Importantly, Titan (Christo Wiese’s company) holds 31% of Premier, South African institutional investors hold 21%, Brait will remain the largest holder at 47% and Premier’s management team will have 1%. Brait is subject to a 360 day lock-up arrangement but is entitled to unbundle its shareholding in Premier within that period.

There’s no much volume in Premier and I don’t expect that to change until the Brait unbundling, which could still be several months away.

A busy day for Remgro-related corporate actions (JSE: REM)

There are timing updates on the Distell (JSE: DGH) and Mediclinic (JSE: MEI) transactions

With Remgro’s discount to NAV at a higher level than normal, there’s been much talk in the market about how (and if) that would close. There were two updates on the market on Monday that are relevant to Remgro, even though neither of them specifically reference the company.

I’ll deal with Distell first, with the transaction with Heineken set to be implemented in April – May of this year. Some punters in the market are excited about Remgro’s positioning here, which will see it take on AB InBev through the enlarged Heineken – Distell vehicle. Importantly for the discount in the Remgro share price, Distell won’t be listed anymore in a few weeks from now.

Mediclinic is comfortably the largest exposure inside Remgro and there is further progress on the take-private deal here. As you may recall, Remgro and MSC Mediterranean Shipping Company are jointly bidding to take the group private. The Competition Tribunal has now approved the acquisition, with only outstanding regulatory approval being the SARB. Once that is in place, a UK Court will need to sanction the scheme, a milestone that is expected to be reached in mid-May.

Will a greater mix of unlisted vs. listed exposure in the Remgro portfolio help close the discount, or at least get it back to historical levels?

Tharisa raises commodity-backed finance (JSE: THA)

This is a useful reminder of how specialised mining debt can be

Tharisa is a co-producer of platinum group metals (PGMs) and chrome and is listed on the JSE and in London. It has also raised a bond on the Victoria Falls Stock Exchange, which you’ve likely never heard of before.

To add to that capital mix, the company has also put together a $130 million debt facility with Absa and Société Générale. This is a 42-month facility with a term loan of $80 million and a revolving facility of $50 million, secured by commodity offtake agreements.

The last part is also the most interesting part, as it is a reminder that mining debt raises are specialised in nature. The banks look to the commodities themselves as security.

This is a significant capital raise, as the net cash position at the end of December was $101.1 million.

Thungela continues its slide (JSE: TGA)

The share price has lost a quarter of its value this year

Thungela has declared a final dividend of R40 per share. Let’s put that in perspective. At the start of the year, it was trading above R257 per share. It’s now below R192.

This is an excellent lesson in why chasing hot commodity stocks is a fool’s errand. The dividend doesn’t help you if the share price falls sharply.

The full year dividend was R100, but that doesn’t help you much if you bought at the start of this year.

HEPS for the year increased by 97%, coming in at R130.82 per share. The dividend payout ratio was thus 76.4%.

With net cash of R14.7 billion on the balance sheet, there’s no shortage of money here, with R5.6 billion earmarked for the final dividend. But instead of returning the remaining excess to shareholders, the group is on the acquisition trail in an effort to diversify away from South Africa (and specifically Transnet). This is going to lead to debt being raised, which is precisely why investors have gotten cold feet rather than coal feet.

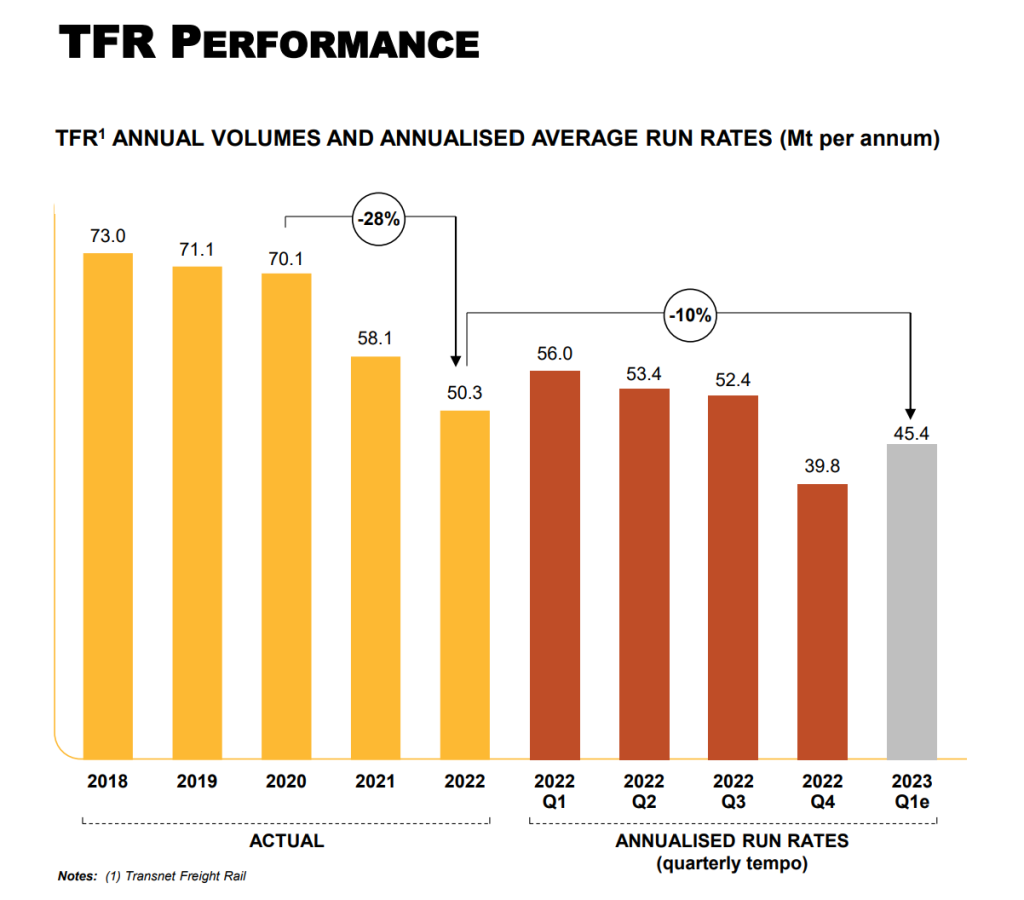

The group has given guidance for 2023 that has been negatively impacted by Transnet Freight Rail. Our infrastructure is so bad that Thungela won’t give guidance for 2024.

Here’s the chart from the results presentation that tells the story of Transnet Freight Rail, which in 2022 recorded its lowest railed volume since 1996:

Vukile bucks the property trend (JSE: VKE)

It’s rare to see property companies raising equity at a discount to NAV

After the heady days of 2015 – 2016, property companies have found life a lot more difficult. With share prices trading at discounts to net asset value, the market screams for buybacks rather than capital raises. Most funds resort to recycling capital by selling assets for attractive prices (or not, in some cases) and reinvesting the capital in other opportunities. With a requirement to pay almost all profits out as a distribution, this can leave REITs in a very tight position where it is tough to grow.

Vukile has clearly had enough, announcing an accelerated bookbuild targeting an equity raise of R500 million. In such a raise, you need to be in the little black book of the advisor (in this case Java) to get a phone call offering you the shares. The offer isn’t open to the general public.

The capital raise announcement was made alongside the release of a pre-close presentation giving details of the performance in South Africa and Spain.

The presentation included the all-important news that vacancies have dropped in South Africa to the lowest point since the company listed in 2004, and the reversionary cycle has turned positive, which means new leases are finally being concluded at higher rentals than the expired lease being replaced.

The news from the South African portfolio almost seems impossibly good, including this comment: “As figures are now comfortably ahead of pre-COVID levels we will no longer be referencing that period.” That’s quite something, referring to both sales and footfall.

Clearly, the lower-income economy is bustling despite what the unemployment rate is telling us. The informal economy is alive and well and those profits get spent at the local mall. Vukile is looking to invest further in this portfolio, acquiring the Pan Africa Shopping Centre in Alexandra for R421 million (phase 1) and R254 million (phase 2), as well as BT Ngebs City in Mthatha for R400 million. Both deals are at an initial yield of 9.25%.

The performance also looks pretty good in Spain, with almost all retail categories ahead of pandemic levels.

Looking to the balance sheet, 88% of group interest-bearing debt is hedged and all FY23 expiries have already been repaid, refinanced or renegotiated. 63% of FY24 debt has also been dealt with in one of those three ways.

Vukile has reaffirmed guidance for FY23 of growth in funds from operations and the dividend of between 5% and 7%.

Woolworths clears a lot of headspace (JSE: WHL)

The nightmarish journey with David Jones is finally over

Woolworths has announced that legal completion of the David Jones sale has been concluded. The proceeds from the deal will be finalised by the end of June, as this is a completion accounts structure that sees the final price vary based on the working capital on the balance sheet at completion date.

Perhaps as a reminder of the pain in case they are ever tempted to do another acquisition like this again, Woolworths will retain ownership of the Bourke Street, Melbourne property asset. It will be leased to David Jones on market-related terms.

R1.6 billion has been returned to Woolworths from David Jones over the past 12 months. Far more importantly, R22 billion in liabilities will no longer be a headache for Woolworths with David Jones off the balance sheet, which will allow management to focus elsewhere.

The value destruction is over and a new broom is certainly sweeping clean at Woolworths. To get to know the current CEO, Roy Bagattini, you could listen to this recent episode of Ghost Stories.

Little Bites:

- Director dealings:

- Value Capital Partners is related to directors of Sun International (JSE: SUI), so this comes through as director dealings even though it is more comparable to institutional shareholder dealing. Nevertheless, Value Capital Partners has bought over R56 million worth of shares.

- A director of a major subsidiary of Clientele (JSE: CLI) has sold shares worth R2.15 million to diversify exposure. That sound plausible, but keep an eye out for any further selling, as Clientele doesn’t often feature here.

- A director of Richemont (JSE: CFR) has sold shares worth R2 million.

- A director of Motus (JSE: MTH) has bought shares worth R950k.

- Associates of directors of Astoria (JSE: ARA) have bought shares worth nearly R820k.

- Pepkor (JSE: PPH) has had its credit rating and outlook (stable) reaffirmed by Moody’s. A focus on value products in this environment and its strong liquidity were highlighted as major contributors to this outcome.

- In case you ever doubted whether property funds are really just capital structuring machines, Sirius Real Estate (JSE: SRE) has appointed a new CFO who brings many years of experience primarily in investment banking and corporate advisory roles. At property funds, it’s all about the balance sheet.

- KAP Industrial Holdings (JSE: KAP) is changing its name to KAP Limited and will retain its existing ticker.

- The sole director of GMB Investments (Gregory Mark Bortz – the name now makes sense) has been appointed to the board of Grand Parade Investments (JSE: GPL) along with another new director.

- Sable Exploration and Mining (JSE: SXM) has announced that 9.8% of shareholders accepted the mandatory offer from PBNJ Trading and Consulting, leaving that company with a 59.9% stake in Sable.