AECI to sell Much Asphalt to an Old Mutual Private Equity consortium (JSE: AFE)

AECI is focusing on mining and chemicals

The name Much Asphalt is worth a chuckle, but the selling price of R1.1 billion means that this is a serious business with an entertaining name, with AECI selling 100% in the company to Old Mutual Private Equity and Sphere Investments.

Much Asphalt is South Africa’s leading independent manufacturer and supplier of bituminous products for use in infrastructure in roads, airport runways and other applications. This is probably a good time to sell, as a positive story can be told around a potential uptick in infrastructure investment in South Africa. AECI wants to focus only on mining and chemicals, so this is an non-core asset that they will be happy to see the back of.

The purchase price could be as high as R1.5 billion, depending on adjustments to the purchase price. That’s a significant difference to the likeliest deal price of R1.1 billion. The net asset value (NAV) as at December 2023 was R1.59 billion, so either way it’s a discount to NAV. Profit after tax for the year ended December 2023 was R74 million, so this is a classic case of a business with an inadequate return on equity that must therefore be sold at a discount to NAV. Based on those earnings, it actually seems like a decent price for AECI on what are admittedly outdated numbers.

This is a Category 2 transaction, so no shareholder vote is required and a detailed circular won’t be released.

Have we entered the Age of Altron? (JSE: AEL)

There’s a huge turnaround here

In the past year, Altron’s share price has more than doubled. The latest numbers show exactly why that is the case. Although there are a bunch of different ways to slice and dice it based on continuing vs. discontinued operations, the underlying story is one of a vast increase in profit and a 60% jump in the interim dividend.

The most sensible metric to look at is the one that adjusts for the sale of the ATM business and excludes Altron Document Solutions (ADS). I’m not sure why that is their view to be honest, as they are hanging onto ADS because the offers received for the business weren’t good enough to justify selling it. ADS is now a positive EBITDA contributor (R30 million in this period), which makes me even more confused about why management would prefer you to look elsewhere.

The Platforms segment, which includes Netstar, grew revenue by 10% and EBITDA by 37%. Netstar is just over half of that segment and had a strong story to tell, supported by a 54% jump in EBITDA at Altron FinTech (a powerful annuity revenue business) and a modest 4% increase in EBITDA at Altron HealthTech.

The IT Services segment is where the complications related to ADS and the sale of the ATM business can be found. If you’re happy to go with management’s view of ignoring both, then revenue increased 2% and EBITDA was down 21%. There are businesses in here that rely on project spending at major customers rather than a growing annuity book, which is why this is a far less lucrative part of the group than Platforms.

Another disappointment was Distribution, where Altron Arrow’s revenue fell 11% and EBITDA was down 7%. The broader market is struggling, with the business just trying to win market share in a falling market and protect gross margins.

Altron Nexus is the only discontinued operation in this set of accounts and improved its performance significantly, with the loss of R332 million shrinking to a loss of R14 million despite a substantial decrease in revenue. When you can achieve better results off a much smaller revenue base, there’s inevitably a working capital benefit that releases cash – in this case to the tune of R35 million.

This helps them invest elsewhere, with group working capital of R1.6 billion (up R144 million) and R359 million in capex in this period. Netstar is a particularly capital intensive business (as any fans of Karooooo will know), but offers a great annuity revenue stream.

Anglo sells a chunk of the Australian steelmaking coal assets (JSE: AGL)

They are in advanced stages to sell the rest

Anglo American is looking to exit the steelmaking coal assets in Australia. They’ve announced a major milestone on that journey, with the disposal of 33.3% in Jellinbah Group for $1.1 billion. The purchaser is Zashvin, a fellow 33.3% shareholder in Jellinbah.

Anglo doesn’t operate those underlying mines and doesn’t market any of the production volumes either, so this sounds like it was a passive stake that doesn’t fit with Anglo’s strategy to focus on copper, premium iron ore and crop nutrients.

In the first half of 2024, the 33% interest in Jellinbah contributed $154 million to Anglo’s underlying EBITDA, so they’ve received a multiple of around 7.15x here.

Collins grows its dividend by 25% (JSE: CPP)

And the market liked it

Collins converted to a REIT in the second half of the previous financial year. The group has a portfolio of 120 properties in South Africa, with only 6% exposure to office. Most of the portfolio sits in industrial and distribution centres (66%) and 28% is in convenience retail.

So, Collins was well positioned to benefit from improved conditions in South African property. Things are also looking better in the Namibian portfolio, with the sale of a large office property in Windhoek being finalised. They expect to sell the rest of the Namibian portfolio in the next year or so, depending on how negotiations go.

Collins likes Europe and wants to own more property there. They already have six properties in Austria and four in the The Netherlands, with the latter held through a consortium.

It’s an interesting portfolio that drove an increase in the interim dividend at Collins of 25% to 50 cents per share. The net asset value is up 18.9% to R15.01. The share price closed 14% higher at R11.50.

I must highlight the loan-to-value ratio, which is on the high side at 50%. It’s down slightly from 51% as at the end of February 2024. Although higher debt looks clever when rates are coming down, that’s well above the average leverage seen among listed REITs.

Discovery has released its presentation to debt investors – and it’s worth looking at (JSE: DSY)

Things are looking much more interesting for them these days

Discovery has a domestic medium term note programme, which means the group raises debt funding through listed instruments on the JSE. Investors often forget that this is a major part of our local market, connecting institutional capital with companies.

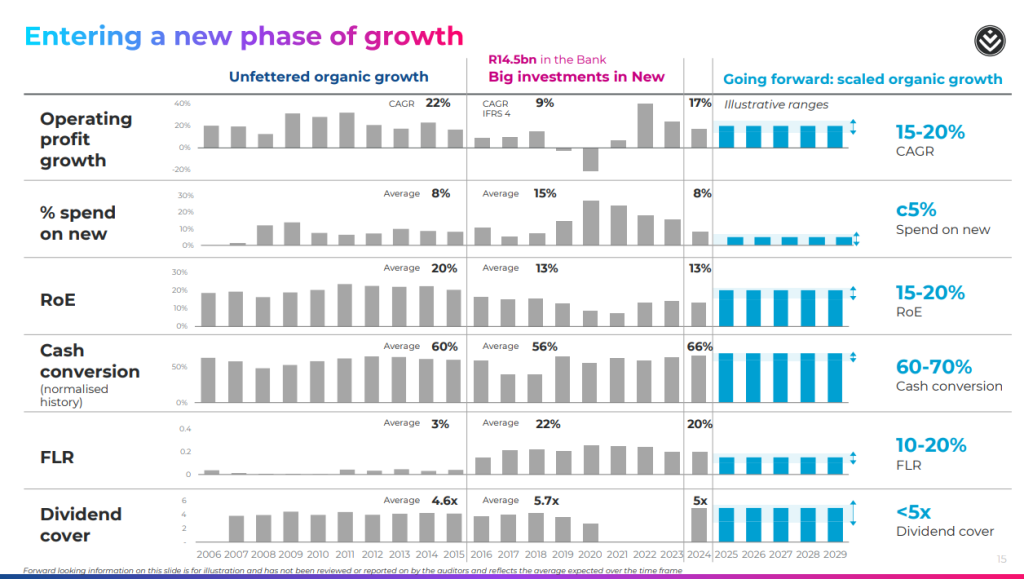

Discovery held a debt investor call and has made the presentation available at this link. There are some pretty solid slides in there, including this gem:

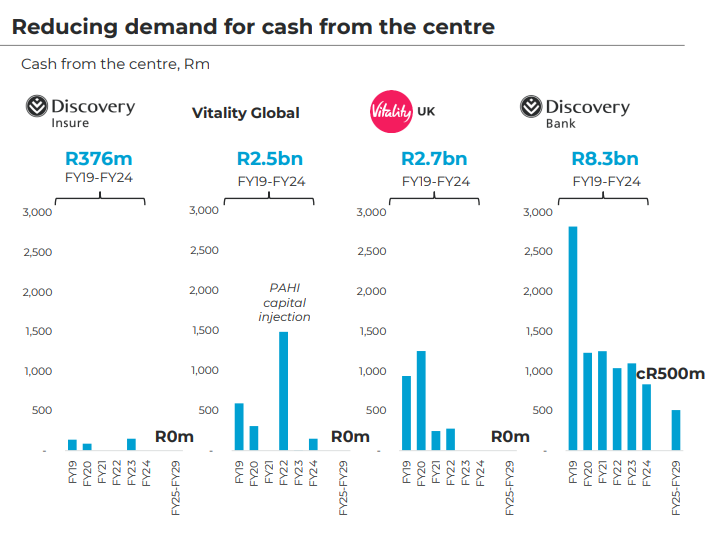

I also enjoyed the this portion of the next slide, which shows that Discovery Bank still has a long way to go in terms of requiring investment from the group:

enX impacted by lack of load shedding (JSE: ENX)

With Eskom functioning these days, there’s much less demand for power solutions

enX has released results for the year ended August 2024 and they have gone the wrong way, with revenue from continuing operations down 3% and HEPS from continuing operations down 11%. They also show a significant drop in net asset value per share, but there were large special distributions and so I don’t think it’s worth focusing on that number as it tells you very little about performance.

enX saw a cash outflow of R190 million from operating activities this year. Despite this, they were happy to pay out capital distributions of R1.1 billion. The key was the disposals during the year, particularly Eqstra. Group cash is up from R303 million a year ago to R772 million and total interest-bearing liabilities decreased slightly to R278 million.

Things will need to improve in the business, particularly as the Power segment suffered a 17.4% decrease in revenue and a nasty 48% drop in profit to R53 million. That more than offset the good work done at AG Lubricants to improve margins and unlock a profit increase from R77 million to R102 million despite flat revenue. Also within the Lubricants segment, the share of profit from associate Zestcor increased from R19 million to R32 million.

In the Chemicals segment, it was a flat story in revenue and profit before tax, although the underlying performance is more nuanced as the base period included a major once-off insurance receipt. In other words, they actually achieved better margins this year.

With load shedding hopefully gone for good, enX finds itself in an awkward position for growth from here.

Exemplar adds its name to the property companies doing well at the moment (JSE: EXP)

The fund is focused exclusively on rural and township retail

Exemplar holds 26 retail assets and is having a rather good time with them right now, with revenue for the six months to August up by 9.8%. This has driven an increase in net property income of 12.15%.

Of course, what investors in property funds care most about is the dividend. The interim dividend is up 9.3% to 70.25 cents per share. At the current share price of R11.50, that’s an annualised yield of 12.2%.

The current vacancy rate of 3.52% is above target, but at least renewed leases are showing escalations of 4.19%. The loan-to-value ratio of 37.9% is higher than 36.5% as at February 2024, mainly due to debt used to fund property improvements within the portfolio.

The net asset value per share is R15.26, so it is trading at a discount of roughly 25% to book value.

MTN Uganda banks another strong quarter (JSE: MTN)

If only this business was larger in the group context

Among MTN’s African subsidiaries, Uganda is consistently one of the better ones. The latest quarter is a continuation of the story thus far this year, with total revenue up 18.6% and EBITDA up 22.2%. This means a 150 basis points EBITDA margin expansion from 50.5% to 52.0%.

For the nine months year-to-date, revenue is up 19.6% and EBITDA 22.3%, at an EBITDA margin of 51.7%. It’s been a strong year and Q3 has set them up for a strong finish to the year.

As you know by now if you’re a regular reader, the key metric to focus on in the African telecoms businesses is capex intensity. Many of them generate cash but then spend every last bit on capex. Again, Uganda is an exception here, with capex intensity (capex as a percentage of revenue) down 210 basis points for the nine months, from 14.9% to 12.8%.

Of course, there’s never a dull moment in Africa, with MTN Uganda having to dispute a tax assessment received from the Uganda Revenue Authority. Let’s hope Uganda doesn’t go the way of Nigeria, with the government ruining the growth story and sentiment.

Oando is catching up on financial reporting (JSE: OAO)

There was a flurry of announcements to get things up to date

Although Oando has released its quarterly results for the March and June periods separately, it makes the most sense to just look at the interim period i.e. the quarters combined. They also released results for the year ended December 2023 which are now incredibly outdated and thus ignored for the purposes of giving a summary here.

The Nigerian energy group saw a decrease of 15% in upstream production across oil and natural gas, as well as a 35% drop in traded crude oil volumes and a 55% drop in traded refined petroleum products within the trading business.

Despite this, revenue was up 51%. It then gets weird again, with operating profit down 30% and profit after tax down 44%. As seems to be the norm for Nigerian companies, the dislocations are being driven by exchange rate translations, particularly on net finance costs.

The stock is still suspended from trading, but this should get them to the point where the suspension can be lifted.

Redefine’s performance dipped thanks to interest costs (JSE: RDF)

If rates keep dropping, it will help them greatly

Redefine has released results for the year ended August 2024. They reflect a 4.5% dip in SA REIT funds from operations (FFO) and a 2.7% decrease in group distributable income. If you’re thinking that perhaps it was a case of a great second half after a tough first half, think again – it’s actually the other way around. I went back and found their interim results, which shows growth in distributable income per share of 6.0% to 25.34 cents. Based on a calculation to isolate just the second half of the year, it looks like distributable income per share was down 10.6% in H2!

In South Africa, the full year net property income growth was 4.7% on a like-for-like basis. There are still negative reversions unfortunately, improving a bit from -6.7% last year to -5.9% this year. There are no prizes for guessing that the office portfolio is where the biggest problems are found, with average negative reversions of -13.9%. That’s actually worse than -12.1% in the previous year!

The EPP portfolio in Eastern Europe saw revenue up 4.3% on a constant currency basis or 9.6% as reported. Net property income was up 5.2% on a like-for-like basis.

So, where did it go wrong? Interest costs included in distributable income jumped by 23.2% for the year, clearly a much higher growth rate than anything the underlying properties could produce. This is due to a higher cost of debt and a major acquisition in December 2023 that put another R1.8 billion on the balance sheet. The full impact of that debt was felt in the second half of the year and only partially in the first half, explaining the H2 vs. H1 performance.

With a loan-to-value ratio of 42.3%, Redefine’s balance sheet is still in decent shape overall. They took on a major acquisition at a time when the office portfolio is still dragging down the overall story and interest rates have been high, so this feels like a case of short-term pain for potential long-term gain.

They expect things to improve modestly in FY25, with forecast distributable income per share of between 50 and 53 cents. They just reported 50.02 cents for FY24, so despite the branding of the report using the word “upside” approximately a zillion times, the reality is that there isn’t much upside here based on management’s base case.

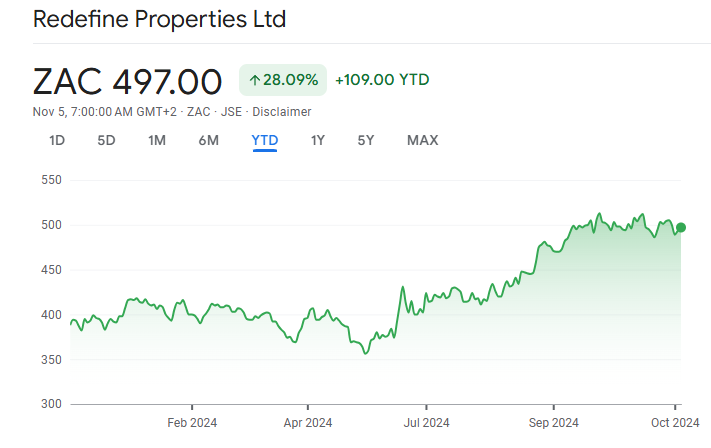

At R4.97 per share and after a dividend of 42.52 cents for the year, a yield of 8.6% just doesn’t feel appealing enough here. I think this one may have run out of puff, as evidenced by the shape of the share price chart:

Nibbles:

- Director dealings:

- In the big money club, Michiel Le Roux has refinanced another portion of the huge hedge over his Capitec (JSE: CPI) holding, this time through options referencing R785 million worth of shares with a put price of R2,862.74 and a cap of R5,407.39

- Des de Beer has bought R506k worth of shares in Lighthouse (JSE: LTE).

- Sirius Real Estate (JSE: SRE) announced that Fitch Ratings affirmed its BBB investment grade credit rating with a stable outlook.

- Mpact (JSE: MPT) announced that the disposal of the Versapak division has been completed. The final price received by Mpact was R254.7 million after adjusting for stock and liabilities, as is customary in such transactions.

- HCI (JSE: HCI) announced that the farmout agreement with TotalEnergies Namibia in respect of Blocks 2913B and 2912 has become unconditional. This of course relates to HCI’s oil and gas interests off the coast of Namibia.

- The JSE has been on quite a drive recently to make changes to its rules in favour of small- and mid-cap companies. This is no doubt in response to the flurry of delistings we’ve seen in the past few years. One such change is the proposed expansion of the FTSE/JSE All Property Index. If they go ahead, Spear REIT (JSE: SEA), Dipula Income Fund B (JSE: DIB), Octodec (JSE: OCT) and Schroder European Real Estate (JSE: SCD) would qualify for inclusion in the index. The important thing about this is that index-tracking funds that buy the All Property Index would then need to buy these property counters as well. Investors in such funds would then have exposure to these names as part of their portfolio under the new rules, albeit with very small weightings.

- Equites Property Fund (JSE: EQU) offered a dividend reinvestment alternative that was elected by holders of 66.98% of shares in the company. This means the fund has successfully retained R359 million in equity through this process, which is why I refer to such structures as miniature rights issues.

- If you’re invested in Caxton (JSE: CAT), keep an eye out for the release of a presentation being delivered to institutional investors. Although it frustrates me that retail investors don’t get these privileges unless companies do the right thing and engage directly through platforms like Unlock the Stock, at least Caxton is planning to make the presentation available.