Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Higher finance costs hit AECI’s business (JSE: AFE)

HEPS has decreased year-on-year

AECI has released a trading statement for the year ended December 2023. HEPS is expected to decrease by between 7% and 16%. This means an expected range of between R10.77 and R11.99 for HEPS, with the share price currently trading at around R95.

If you’ve been following the company, you’ll know that the business in Germany has been a source of headaches. Finance costs are also biting, with the balance sheet needing to support revenue growth through higher working capital levels.

Altron’s HEPS moved higher in continuing operations (JSE: AEL)

As for total operations, the story looks different

Altron had to recognise some non-cash adjustments in the first half of the year that ruined the full-year result. This included issues in Altron Nexus and Altron Document Solutions of R334 million and R95 million respectively, as well as an impairment of R33 million related to Altron Nexus. Both of these businesses are recognised as discontinued operations for the full year numbers, which is why the HEPS result looks so different for continuing vs. total operations.

Starting with continuing operations, HEPS will be between 16% and 24% higher. For total operations, this swings horribly from HEPS of 29 cents in the comparable period to a headline loss per share of between -21 cents and -16 cents for this period.

Altron Document Solutions and Altron Nexus are the subject of active disposal processes. In other words, just ignoring them as discontinued operations is dangerous. If they do badly, they may not be easy to sell and hence Altron shareholders could continue to suffer losses. The other discontinued operation is Altron Rest of Africa.

Looking deeper, the group notes Netstar as a highlight of the second half of the year, reaching over 1.7 million subscribers and over 2 million connected devices. They can’t help but mention Big Data (including the capital letters), of course.

CA Sales Holdings just keeps delivering (JSE: CAA)

This company just keep impressing

The CA Sales Holdings business is all about helping FMCG product providers reach their market. The model is based on driving volumes, which can grow even in a slow growth market through winning market share.

The results speak for themselves, with the company achieving HEPS growth of 23% to 28% in the year ended December 2023. This has been achieved through growth in existing and new clients.

Clientele releases the 1Life acquisition circular (JSE: CLI)

This is a category 1 transaction, so it’s a big one for Clientele

Clientele announced this deal back in November 2023, with the plan being to acquire 100% of 1Life from Telesure Investment Holdings. The idea is that this will create a larger mass and middle income insurance business with a combined embedded value of around R7.8 billion and 1.5 million contracts. The scale benefits are obviously part of the plan here.

The price is based on the embedded value of 1Life being calculated in a similar way to that of Clientele, plus a premium of 6.23% for control. This is a modest control premium, with the trick here being that Telesure will receive shares in Clientele as consideration for the deal. Don’t feel too bad as a Clientele shareholder, because Telesure is receiving the shares at a price of R16.25 per share. That’s much higher than the current market price of Clientele shares, reflecting the embedded value per share rather than the market’s view on value.

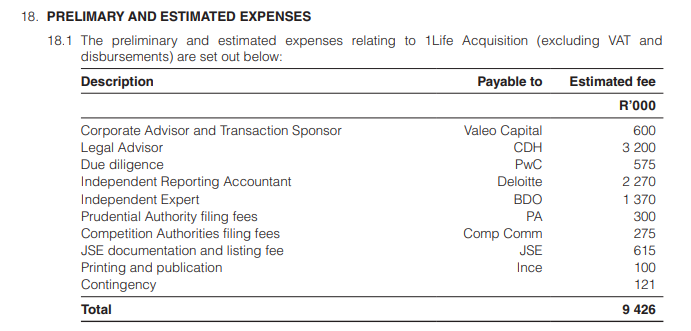

Long story short, this is a deal based on embedded value for embedded value, with a small control premium for 1Life. That seems like a sensible approach to me. I must also give credit to Clientele for managing the deal in such a way that expenses are reasonable, coming in at under R9.5 million for the entire thing:

For a deal worth R1.9 billion, that’s a modest cost indeed. This tells me a lot about the Clientele management team. For all the details, get the circular here.

Jubilee is growing, but margins are taking strain (JSE: JBL)

Jubilee bucks the mining trend

Jubilee Metals has released results for the six months to December 2023. Group revenue is up 18.4%, driven by higher levels of production. EBITDA is only up by 13.6% though, which looks somewhat spectacular vs. other mining groups but reflects margins under pressure at Jubilee when you view it alongside revenue growth.

By the time we get to earnings per share, the increase is only 6.7%. It’s worth noting that a placing of shares took place in January, so earnings per share will have that headwind to contend with in the 2024 year as well.

Looking further into the numbers, the highlight is copper production increasing by 46.5% in Zambia. The growth in South Africa is far more modest, yet it remains a stable cash generating base for the group.

Normalised HEPS drops at Libstar (JSE: LBR)

And in this case, this is the right metric to look at

Libstar has released a trading statement dealing with the year ended December 2023. It’s a long one, giving far more details than a trading statement usually does.

The good news is that revenue growth improved from 4.0% in the first half to 7.3% in the second half, taking full-year growth to 5.8%. The pricing vs. volume analysis is quite something, with volumes down 4.8% and prices (and mix) contributing growth of 10.6%.

Gross profit margin was 21.2% in the second half, which is an improvement of 120 basis points vs. the first half. Full-year margin is 20.7%, which is slightly lower than the 2022 result.

Despite all the diesel costs of load shedding, operating expenses only increased by 1.9%. That’s an impressive display of cost control. Sadly, the banks got the bulk of the benefit, as finance costs were up a whopping 53.3% thanks to higher financing costs. This is despite net debt to normalised EBITDA decreasing from 2.1x at 30 June 2023 to 1.6x at 31 December 2023.

If you look at HEPS without normalisation adjustments, it includes insurance proceeds of R120 million related to the Denny Mushrooms fire incident. That’s not a sensible way to consider performance, so the group quite correctly reports normalised HEPS without this number.

Unfortunately, normalised EBITDA fell between 2.2% and 4.3% for the full year, as the second half performance couldn’t make up for the 18.3% decline in the first half. Combined with the impact of finance costs, this is why normalised HEPS from continuing operations fell by between 9.7% and 12.7%.

Lower revenue hits profits at Sasol (JSE: SOL)

There is also a notable decrease in the dividend payout ratio

Sasol has released results for the six months to December 2023, showing why the share price has come under great pressure. Weaker prices for the commodities are not a helpful environment alongside inflationary pressures on costs. Of course, there are also the challenges of poor local infrastructure to contend with.

Revenue has fallen by just over 9%, with lower chemical prices as the major driver. Operating leverage has worked against the company here, with EBIT down by 34%. Aside from the drop in revenue, there were other issues for EBIT like valuations of financial instruments and derivative contracts. On a segmental basis, the biggest loser was Chemicals Africa with a massive negative swing in EBIT from R8.99 billion to R3.44 billion. The rest of the Chemicals business (America and Eurasia) moved from the green into the red, reporting losses. A strong improvement in the Energy Fuels business from R5.1 billion to R9.6 billion couldn’t offset this.

Shareholders only enjoyed a slightly less severe impairment in this period than the prior period. After writing down its assets by R6.4 billion in the comparable period, this period saw write-downs of R5.8 billion.

Headline earnings excludes the impact of impairments, so the 34% drop in HEPS happens to be in line with the drop in EBIT in this period. The interim dividend is 71% lower though, so the payout ratio has decreased considerably.

To get the full details of the Sasol results, you can read this article from the company

Little Bites:

- Director dealings:

- The CEO of Marshall Monteagle (JSE: MMP) has acquired shares in an off-market transaction to the value of R13.7 million.

- Sean Riskowitz, acting through Protea Asset Management, has bought another R726k worth of shares in Finbond (JSE: FGL).

- The CEO and Dr. Christo Wiese are at it again, each buying shares in Invicta (JSE: IVT) worth R202k.

- The company secretary of Trematon (JSE: TMT) has sold shares worth R135k.

- An associate of a non-executive director of Mondi (JSE: MNP) has bought shares in the company worth R120k. Here’s the thing: the trade happened in April 2023 and wasn’t disclosed due to an “administrative oversight” – the punishment for undisclosed trades really does need to get more severe for it to be taken seriously.

- The CEO of Primary Health Properties (JSE: PHP) has purchased shares worth £3.2k under the company dividend reinvestment plan.

- Hammerson (JSE: HMN) has sold Union Square, a shopping centre in Aberdeen, for £111 millon in cash. Importantly, the net initial yield is 11% and the sale is at a discount of 8% to the 31 December 2023 book value, so that’s a disappointing price. This reduces net debt for the fund and concludes the £500 million non-core asset disposal programme communicated to the market at the start of 2022.

- Sea Harvest (JSE: SHG) achieved 100% approval from shareholders who attended the meeting for the proposed acquisition of the businesses from Terrasan Beleggings. Related to the same deal, Brimstone (JSE: BRT) as the controlling shareholder of Sea Harvest received 99.95% approval from its own shareholders for the transaction.

- Sibanye-Stillwater (JSE: SSW) released a mineral resources and mineral reserves declaration. This is really aimed at more technical modelling of mining company prospects so I don’t usually write on these in any detail in Ghost Bites. I thought it was worth a mention that mineral reserves for SA PGMs are down 10.4% and for SA gold are down 15.7%, impacted by a combination of depletion and cessation of activities in the case of gold. The shift towards green metals is clear in the group strategy.

- Ellies (JSE: ELI) is in business rescue and it’s not hard to see why, with a headline loss per share of between 12.80 cents and 13.66 cents for the six months ended October 2023. Keep in mind that the share price is only R0.01!

Keep up the good work.. and keep my email on your ghostmail for advances in improved companies growth on the jse.