Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

AECI’s dividend is a thing of the past (JSE: AFE)

And yet the share price is only slightly down this year

For the six months to June, AECI suffered a drop in revenue of 4% and a substantial decrease in EBITDA of 24%. It only gets worse as you work down the income statement, with HEPS down 57% and no interim dividend declared.

They describe recent organisational restructuring as going to the “third level below the Executive Committee” so they really have made a large number of changes. The market is being remarkably patient with the management initiatives based on the share price this year, which is only slightly lower despite the struggles.

Some of the pain is strategic, like statutory shutdowns in AECI Mining that contributed to lower volumes of ammonia sales in South Africa at a time when ammonia prices were also lower. If the cost of shutdowns, including alternate sourcing of ammonium nitrate solution, is excluded (which you can’t really do), the AECI Mining segment was flat year-on-year at profit level. In reality, profit was down 12%. They expect volumes to increase based on a recovery in mining activity in South Africa. The export business is also doing well.

AECI Chemicals saw revenue fall 4%, yet profits from operations increased by 9%. That’s great cost management, with operating margin up from 8% to 9%.

AECI Property Services and Corporate recorded a loss of R484 million vs. a loss of R42 million a year ago. This included major corporate costs for various restructuring activities.

Net debt is up to R5.1 billion from R4.4 billion at the end of December 2023 due to investment in working capital and the level of spend on restructuring activities. This is marginally higher than the guided range for gearing levels, so they need to bring that in line.

Against this backdrop, it’s not surprising that the dividend is gone for now. They are hoping for a much stronger second half of the year, which should improve the balance sheet and hopefully bring the dividend back sooner rather than later.

Altron’s positive momentum from the last financial year continued (JSE: AEL)

HEPS is strongly in the green

Altron closed 5% higher after releasing a strong trading statement for the six months to August. The great news is that continuing HEPS is at least 20% higher than the comparative period, which is the bare minimum disclosure for a trading statement. In other words, there’s a good chance that the move is much higher.

The Own Platforms segment has delivered solid growth in EBITDA. This includes Altron FinTech, Altron HealthTech and Netstar. The IT Services segment saw revenue growth come through in Altron Digital Business, but EBITDA went the wrong way. Altron Security at least saw positive growth in EBITDA. Over at Altron Arrow, revenue is down and margins are steady, which means profits are down as well.

On the discontinued operations side, offers received for Altron Document Solutions were below the board’s assessment of value in the business, so they’ve chosen to keep that business. It will be included in continuing operations and profits are higher.

Altron Nexus is still part of discontinued operations.

The Altron share price is up a massive 64% this year, showing what happens when a turnaround starts to work.

MTN Nigeria has released half-year numbers (JSE: MTN)

EBITDA has gone firmly the wrong way

MTN’s troubles in Nigeria seem to be continuing, with MTN Nigeria’s EBITDA down by 10.9% despite service revenue increasing by 32.6%. When margins are disintegrating like that, there’s real trouble. EBITDA margin fell by a whopping 17.4 percentage points to 35.6%. When you consider that the inflation rate averaged 32.8% over the period, that service revenue increase doesn’t look impressive anymore either.

Although these are local currency numbers, the weakness of the Nigerian currency still has an impact as some operating costs are linked to foreign currency. Adjusting for the effects of forex, EBITDA margin would’ve been 50.9%. This shows just how rough the macroeconomic situation is for the business, with an effort underway to reduce exposure to USD-denominated letters of credit.

And despite all this pain, they have to keep investing in the business, with capex up 19.9%. At least free cash flow was still positive at N362.5 billion, admittedly 7.1% down on the comparable period.

There doesn’t seem to be any relief on the horizon for MTN here.

Rentals are up and so are valuations at Shaftesbury (JSE: SHC)

There wasn’t much growth in value per share in the past six months, but there was some at least

Shaftesbury is focused on the West End in London, which is a great place to be. Leasing activity in the six months to June achieved rentals that were on average 7% ahead of the December 2023 levels, so that’s impressive. Valuations also seem to finally be heading in the right direction, with a net tangible asset value per share of 193.4 pence per share, up 1.6% vs. December 2023. The rental growth is finally driving a modest uptick in valuations. For the past couple of years, we’ve generally seen property valuations go backwards in developed markets as yields moved higher.

It gives further support to the balance sheet valuations that £216 million in disposals at a premium to book value were completed since Shaftesbury’s merger with Capital & Counties, with £86 million reinvested in acquisitions. The loan-to-value ratio is 30%, slightly better than 31% at the end of December. Either way, the balance sheet is strong.

The interim dividend of 1.7 pence per share was 3% higher than the comparable period.

Woolworths still needs to steady the ship (JSE: WHL)

Earnings have dropped in the year ended June

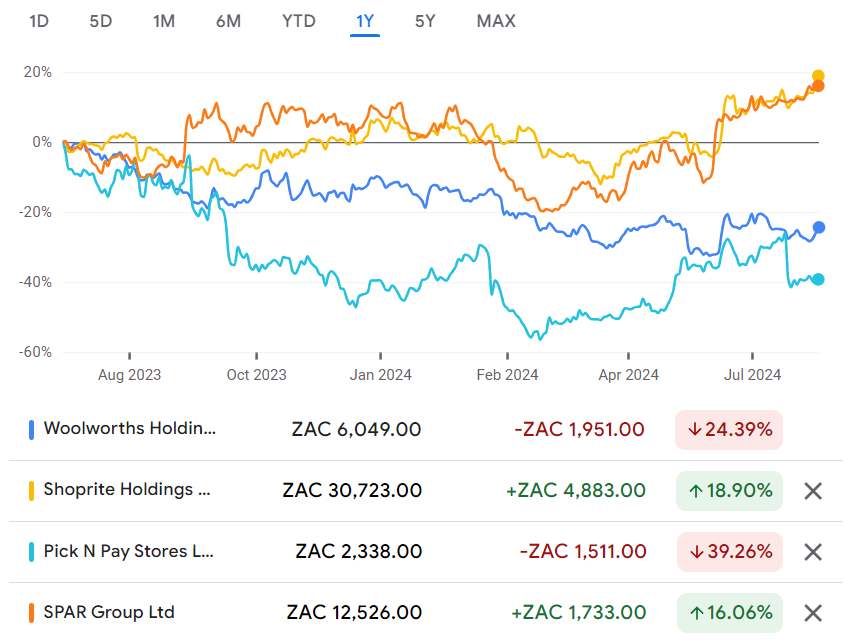

The Woolworths share price is down 24% in the past year, putting it in an unpleasant situation where it has strongly underperformed Shoprite and Spar for that matter. In fact, it’s only a bit better than Pick n Pay:

In the results for the 53 weeks to June 2024, we can see why this has been the case. You have to be careful with comparability, as a 53 period isn’t comparable to 52 weeks. Also, they sold David Jones in the prior year. It’s therefore important to look at adjusted numbers on a 52-vs-52 week basis.

Group turnover excluding David Jones and on a 52-week basis only increased by 4.3%. Things got slower in the second half, with growth of only 3.2%. Online sales were up 13.3% for the year and contributed 9.2% of group sales, so at least there’s some growth there.

In South Africa, the Food business grew turnover by 9.0% on a 52-week basis. Price inflation for the period was 7.9% and comparable stores grew 6.9%, so this suggests that there was still a negative move in volumes. Also take note that the inclusion of Absolute Pets in the fourth quarter boosted the numbers, with sales growth of 9.6% in the second half. The summary is therefore that volumes are under pressure but Woolworths has continued expanding, including with trading space growth of 3.2%. Investing into a period of Pick n Pay weakness is probably the right approach. Online sales were up by a substantial 52.8%, contributing 5.5% of South African sales. Woolies Dash increased 71.2%.

The Fashion, Beauty and Home business in South Africa could only manage a 0.4% decline in sales on a 52-week basis. Comparable store sales were up 1.3% if I’ve interpreted the announcement correctly, with a trading space decrease of 0.2% that helped drive the overall decrease. Comparable sales were impacted by a decline in sales volumes that mostly offset the price movement of 8.9%. That price movement is driven by a combination of inflation and full price sales, with the latter being very encouraging. Online sales grew 30.4% and contributed 5.6% of South African sales.

Financial Services saw the book decrease by 2.9% year-on-year, or 1.8% excluding the disposal of part of the book Impairments improved from 7.3% to 7.0% for the period.

Across the pond, Country Road Group saw a further deterioration in conditions in the second half, with consumer sentiment under real pressure. Sales fell 6.8% for the year and 8% on a comparable 52-week basis, with comparable stores down 13.1%. Even though there was a strong base, it’s still really messy. Trading space was up 4.0% due to expansion of concession channels, with the business using a tough period to help build out the right footprint for an upswing. Online sales increased to 27.6% of total sales.

Adjusted HEPS on a 52-week basis fell by between 10% and 15%. It’s much worse if you include David Jones because of the impact of the timing of the disposal. As reported, Group HEPS is down by between 27% and 32% for the 53-week period to between 350 cents and 375.7 cents. Note that this includes the extra week of trading.

Long story short: Food is doing pretty well again, FBH in South Africa needs to turn the corner and Australia is once again a major headache, this time without David Jones!

Little Bites:

- Director dealings:

- An associate of a prescribed officer of Dis-Chem (JSE: DCP) sold shares worth R6.9 million in an off-market deal.

- A director of Hudaco (JSE: HDC) exercised share options and sold all the shares received with a total value of R4.3 million.

- An associate of a director of Hammerson (JSE: HMN) acquired shares in the company worth £80k.

- Two directors of Premier Group (JSE: PMR) each acquired exactly the same number of shares worth R992k.

- At the RECM & Calibre (JSE: RACP) AGM, the company noted that the name change to Goldrush Holdings will be effective from 14 August, with an associated accounting change that will see Goldrush consolidated rather than presented as an investment. This will give investors plenty of detail on this key investment. For the first four months of the year, the Bingo division is slightly down on revenue, Limited Payout Machines are flat on revenue despite having fewer sites, Sports Betting is in line with the prior year and Online has grown strongly. Total revenue for Goldrush is 5% higher year-on-year for the four month period. A further driver of profitability will be lower diesel costs as load shedding gently disappeared.

- The ex-CFO of Tongaat Hulett (JSE: TON), Murray Munro, received a public censure and fine of R6 million back in April 2023. He was also disqualified from holding the office of director for a listed company for 10 years. He appealed to the Financial Services Tribunal and the application was dismissed, so the censure and penalties all stand.

- MC Mining (JSE: MCZ) released an activities report for the quarter ended June. Run-of-mine coal production was 4% lower year-on-year. The trial with Paladar Resources for the sale of export quality coal seems to have gone well, with all high-grade inventory sold by the end of the quarter. Despite this, MC Mining elected not to extend the agreement. Sadly, thermal coal prices have remained depressed and well down on last year. Premium steelmaking hard coking coal prices are proving to be more resilient. Production costs per saleable tonne were 7% higher year-on-year, Of course, we now enter a period in which there are wholesale executive management changes after the recent corporate activity, with Godfrey Gomwe’s resignation as CEO effective from 30 June. Christine He is now the CEO.

- Kore Potash (JSE: KP2) noted in a quarterly update that all outstanding commercial points on the EPC proposal were resolved in a meeting in Dubai in July. The legal advisors now need to finalise the agreements between Kore Potash and PowerChina. The next major step once these agreements are signed will be to finalise the funding with the Summit Consortium. The share price is up 212% this year in anticipation of agreements being finalised.

- Southern Palladium (JSE: SDL) also released a quarterly activities report, noting that the pre-feasibility study campaign was successful. An updated mineral resource estimate will be released in the third quarter of calendar year 2024.

- Shareholders of Spear REIT (JSE: SEA) have spoken loudly and clearly: the acquisition of the Western Cape property portfolio from Emira (JSE: EMI) was approved by 100% of votes present at the meeting!

- Brimstone (JSE: BRT) released a trading statement for the six months to June. As this is an investment holding company, I would far rather focus on net asset value (NAV) per share rather than HEPS. The trading statement relates to HEPS though, which is up between 105% and 115%. I would largely ignore this and wait for results on 27 August.

- Rex Trueform (JSE: RTO) and parent company African and Overseas Enterprises (JSE: AOO) announced a small related party deal that will see Geomer Managerial Services provide advisory services to Rex Trueform and subsidiaries. The previous agreement entered into in 2022 expired in June 2024 and this is a new agreement. The deal continues until June 2026 or fees for services rendered equal R12 million, at which point the agreement terminates automatically. Marcel Golding is a director of Geomer and a shareholder in it, so that’s why this is a related party deal. The terms have been determined as fair by an independent expert, even though I think it’s ridiculous that there’s literally a target for fees to be earned, at which stage the agreement terminates. Exactly what kind of behaviour is being incentivised here? Glad I’m not a minority shareholder in either company.

- Dipula Income Fund (JSE: DIB) announced that Global Credit Rating Company (GCR) kept the ratings unchanged and affirmed the national scale ratings of Dipula of BBB+(ZA) for long-term and A2(ZA) for short-term credit.

- Sebata Holdings (JSE: SEB) announced that the disposal of 55% in the Water Group businesses, along with the associated donation of 5% in that group, have fallen through. Ditto for the similar transactions for the Software Group businesses. In both cases, Inzalo Capital couldn’t meet the profit warranties, so Sebata regained ownership of these interests with effect from 1 July 2024.

- Trustco (JSE: TTO) announced that the long stop date for fulfilment of conditions for the Legal Shield Holdings transaction has been extended from 31 July to 30 September. A circular will be distributed to shareholders soon.