AECI achieved a juicy jump in operating profitability (JSE: AFE)

A pre-close update looks good for shareholders

In a pre-close update covering the five months to May, AECI flagged a 22% increase in revenue and a 25% increase in EBIT. The improvement in profitability and margins is particularly impressive when you consider that AECI Schirm Germany posted a R154 million loss, significantly worse than the loss of R57 million in the prior year.

Working capital levels are higher, which is a function of higher sales volumes and related pressure on debtors and inventory requirements. Net gearing increased from 45% at 31 December 2022 to 50%, with net debt to EBITDA of 1.7x (well within the loan covenant threshold of 2.5x).

The group is focusing on reducing debt and refinancing long-term debt, which makes sense in this environment.

Looking at segmental performance, AECI Mining grew revenue by 35% and EBIT by 45%. AECI Water grew revenue by 15% and EBIT by over 100%. In AECI Agri Health, the results excluding Germany showed revenue up by 10% and EBIT by 24%. With Germany included, the segment made a loss despite revenue being 15% higher.

Importantly, the R154 million loss in Germany included R89 million in retrenchment costs.

AECI Chemicals is the largest segment and didn’t have a good year, with flat revenue and EBIT down by 39%. The EBIT margin of 5% is not what investors want to see.

The company also noted that the B-BBEE employee share scheme was a failure, wound up with no value at the maturity date. Participants received dividends during the period and an ex gratia payment from the company to help keep the peace. A new scheme is being considered.

Interim results will be released on or about 26 July.

Argent signs off on an excellent year (JSE: ART)

Excellent offshore, at least – the local businesses didn’t do quite so well

If you remember nothing else from 2023, at least remember that industrial groups did a much better job of withstanding inflationary conditions than retailers. Higher prices drive better returns on assets, with many industrial groups sitting with fully depreciated assets that can still churn out products.

At Argent Industrial, the year ended March 2023 saw revenue increased by just 1.1%. That sounds very sad, until you see EBITDA up by 12.8% and profit up by 23%. Diluted HEPS increased by 22.5%.

The total FY23 dividend of 95 cents is significantly higher than 42 cents in the prior year. This was greatly assisted by a jump in cash from operating activities from R113 million to R163.5 million.

The overall story here is that the overseas operations had a very strong year, including offshore businesses and South African subsidiaries expanding into global markets. Predictably I suppose, one of the wins has been the export of security doors and related products!

However, Argent Industrial easily wins the award for the single most outrageous comment I’ve ever seen in listed company results:

I promise you, that is a screenshot from the actual report. One might argue that “Fun” is an autocorrect for something else that starts with an F.

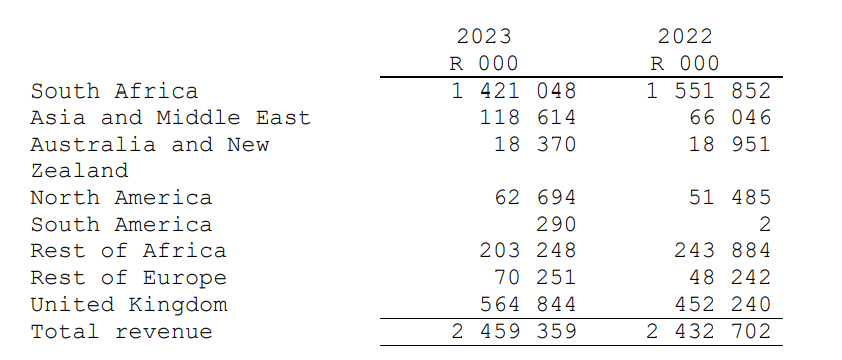

They go on to talk about how international expansion is an ongoing priority. As this table shows, they are still heavily dependent on the “perfect Fun Show” of South Africa:

Crookes Brothers releases awful results (JSE: CKS)

The ridiculous bid-offer spread means that the share price isn’t reflecting them – yet

Crookes Brothers as a bid-offer spread that you could park an entire farming operating in. The bid is R7.50 and the offer R32.00. Sadly, based on the current results, I can understand why there aren’t any bidders at a decent price.

In the year ended March 2023, revenue increased by 7%. That’s literally the only good news. Operating loss after biological assets was a huge deterioration from R42.7 million profit last year to a R149 million loss this year.

Headline earnings swung from a R35 million profit to a R108 million loss.

And in case you think these are all impairment and depreciation losses, cash generated from operating activities fell from positive R14.5 million to an outflow of R46 million.

The net asset value (NAV) is just over R66, which means that even the R32 price (at which there are absolutely no bidders) is a big discount to NAV.

Kibo Energy releases full year results (JSE: KBO)

Firmly in build phase, the company’s losses are at least lower

For the year ended December 2022, Kibo Energy posted just over £1 million in revenues and made an operating loss of £10.6 million. Around £7 million of that loss is attributable to impairments on coal to power projects.

Still, group net debt has increased from £404k to over £5 million.

There’s been a lot of activity around renewable energy contracts for the company, but these don’t mean much until they convert into profits.

MAS benefits from Eastern European retail conditions (JSE: MSP)

Although interest rates are rising, real GDP growth is driving consumer spending

If you own retail malls, you ideally want them to be in a fast-growing economy where consumers have money in their pockets that they are willing to spend. This is the case in Central and Eastern Europe (CEE) at the moment, which is why MAS has reported strong growth in footfall and trading density.

In the five months to May, footfall was 11% above the same period in 2019. Tenant turnover per square metre was 29% ahead of pre-pandemic levels, with inflation obviously playing a big role here.

Occupancy cost ratios were stable at 10.7%, as the property owners have been able to push through inflationary pressures due to indexation clauses in leases.

The group is currently disposing of properties in Germany and the UK.

It’s not all good news, with the company reworking its forecasts out to 2026 and being more conservative about the likelihood of achieving an investment grade credit rating and enjoying the associated benefits. For this reason, the dividend payout ratio may need to be reduced. More information will be given when full-year results are announced.

As frustrating as that may be, I applaud the management team for the transparency and clear planning ahead.

Diluted adjusted distributable earnings per share guidance for the year to June 2023 is between 8.85 and 9.34 euro cents per share. 4.36 cents of this was already earned in the six months to December 2022.

Remgro voluntarily announced the Mediclinic results (JSE: REM)

The delisting date was very close to when full year numbers would’ve been released anyway

Kudos to Remgro for keeping the market well informed on the Mediclinic performance here, as the easy thing to do would’ve been to never release these full year results.

As reported, revenue increased by 12% and operating profit fell by a whopping 72%. But on an adjusted basis, revenue was the same as on the reported basis and operating profit increased by 8%. To make it more confusing, HEPS was up by 75%.

The biggest difference between HEPS and EPS is usually impairments, which is the case here as well. This is also the reason why adjusted operating profit is so different to operating profit as reported. The group recognised £228 million worth of impairments in Switzerland, based on weaker performance and higher discount rates. There were some other impairments as well.

Average revenue per case fell in this period and tariff increases were below inflation, demonstrating once more that hospitals aren’t the most lucrative businesses around. Even on an adjusted basis, the drop in EBITDA margin from 16.1% to 15.8% reflects higher employee costs due to general nurse shortages in Switzerland and other factors.

Cash conversion was strong, which is why the leverage ratio decreased from 3.9x to 3.6x despite an increase in capital expenditure from £178 million to £203 million.

Hospitals aren’t high on my list of businesses to own, as they tend to produce a return on capital that is far from inspiring. In an environment where investors demand higher returns because of the cost of capital, it’s not surprising to see the impairments here.

Safari Investments improves on almost every metric (JSE: SAR)

Mostly good news for shareholders in the latest results

For the year ended March 2023, Safari Investments grew property revenue by 7%. Although the cost to income ratio increased from 35% to 39%, the group still managed to grow HEPS by 7.8%.

A positive reversion rate of +3.6% is helpful, although occupancy did drop from 98.1% to 96.75%.

Net asset value per share increased by 7% to 915 cents. The loan-to-value ratio improved from 37% to 35%.

In property funds, investors tend to pay the most attention to the distribution per share. This was 14% higher at 65 cents per share.

As the bulk of this portfolio is in the retail sector, this is another example of solid performance from shopping centres.

Little Bites:

- Director dealings:

- An associate of ex-Investec CEO Stephen Koseff has disposed of shares in the company worth £334k (JSE: INL).

- An executive director of Cognition Holdings (JSE: CGN) has retired and sold R1.4 million worth of shares in an off-market trade.

- The chairman of Sibanye-Stillwater (JSE: SSW) has bought shares worth R744k.

- Associates of two directors of Ascendis Health (JSE: ASC) collectively acquired R236k worth of shares.

- Life Healthcare (JSE: LHC) has renewed the cautionary announcement related to the potential disposal of the Alliance Medical Group.

- In an ironic turn of events considering its name, Accelerate Property Fund (JSE: APF) announced a delay in the reporting of financial results for the year ended March 2023. They will not be announced by the deadline of 30 June and no date has been given yet. The company merely references a delay in finalisation of the audit and annual financial statements.

- Speaking of delays, Sebata Holdings (JSE: SEB) is also running late due to valuations for current B-BBEE deals. The results will be released on or about 14 July 2023.

- The big day has finally come for Impala Platinum (JSE: IMP) and Royal Bafokeng Platinum (JSE: RBP), with the Takeover Regulation Panel issuing the all-important compliance certificate for the transaction. The only remaining condition is JSE approval for listing the shares that Implats wants to offer to Royal Bafokeng shareholders, but that is literally a formality. With ongoing efforts to acquire shares, Implats now holds 56.41% in Royal Bafokeng.

- Sappi (JSE: SAP) has announced that Global Credit Ratings has upgraded its long-term debt from AA+(ZA) to AAA(ZA), with a stable outlook. The short-term rating of A1+(ZA) has been affirmed.