AECI: the German business is the wurst (JSE: AFE)

HEPS is higher, but there were substantial impairments

For the year ended December 2022, AECI grew HEPS by between 12% and 18%. That’s a solid result under these economic conditions, especially with higher funding costs brought on by working capital pressures.

Importantly though, HEPS excludes the impact of impairments, which were large enough in Germany to cause EPS to drop by between 18% and 24%. There’s a new management team in place in Germany and that will hopefully improve matters.

BHP shows us what the yield curve looks like (JSE: BHG)

The company has raised $2.75 billion in debt through the US market

Large companies with debt programmes actively manage their exposure in terms of maturity dates and costs. You’ll often see bond repurchases or issuances from the largest companies in the world.

This usually isn’t notable for equity investors, unless the company is materially increasing or reducing the overall level of leverage.

From the latest BHP update, I thought it was worth including the details of the debt issuance to show you how funky the US yield curve looks at the moment. The company raised as follows:

- $1bn in three-year bonds at 4.875%

- $1bn in five-year bonds at 4.750%

- $750m in ten-year bonds at 4.900%

I’m certainly no debt or yield curve expert, but note how three-year money is more expensive than five-year money. This is the impact of an inverted yield curve.

Buka: no deal and a suspended listing (JSE: BKI)

The owners and directors of this cash shell will have to tread carefully

Back in July 2022, Buka Investments announced the acquisition of the Socrati Group from B&B Media and Moltera Group. B&B Media is in the final stages of discussions to acquire a shoe manufacturing business that would be merged with Socrati Group.

In order to complete that transaction first, B&B Media has requested Buka Investments to put the Socrati deal on ice. This means that Buka Investments has not met the JSE requirement for a cash shell to execute a transaction within six months of that classification, so the listing has been suspended.

City Lodge’s detailed results couldn’t stop the bleeding (JSE: CLH)

The share price has lost over 12% in the past week as earnings disappointed

The market was looking for a major recovery in City Lodge’s earnings as tourists returned to our shores and business travelers ditched Zoom and got back to doing things face-to-face.

For the six months ended December 2022, average group occupancies were up from 30% to 57%. The trend is important here, with second quarter occupancies ahead of the equivalent quarter in 2019. The challenge lies in pricing, as average room rates are up 10% year-on-year but only 1% vs. 2019. This suggests that City Lodge has achieved the volume recovery through potentially unsustainable pricing.

A good news story is food and beverage revenue, with the group putting in a proper effort to become more than just a bed for tired business people. Food and beverage revenue increased by 132% and now comprises 16% of total revenue.

The COVID business interruption claim was received in this period. To give it context, the claim was R27 million and EBITDAR was R304 million. That “R” isn’t a typo by the way – EBITDAR is a standard metric in the hotel industry and removes rent costs from operating profit.

Here’s another important number: the cost of generators in this period was a whopping R7 million vs. just R0.9 million in the prior period. This doesn’t help the profit performance.

Salaries and wages were up 43%, but there was a substantial salary sacrifice in the comparable period with 30% salary reductions. This explains the year-on-year move. The utilities bill is up 25%, a function of inflation and higher occupancies.

The company reported profit of R97.9 million in this period vs. a loss of R33.8 million in the prior period. This means that the COVID claim contributed 27.5% of profits in the current period. I would focus on HEPS excluding that claim which is 14 cents.

Thanks to an improved balance sheet after selling off assets and reducing debt, there’s a perhaps surprising dividend of 5 cents per share for shareholders.

The share price of R4.35 is very hard to justify against interim earnings of 14 cents per share. Investors also look at net replacement value per share based on insured values of the hotels, which is R10.60 per share. Personally, I look at earnings. The cost of building something again is irrelevant if that “something” can’t deliver attractive returns.

Keep an eye on this chart:

Libstar needs more pricing power (JSE: LBR)

Revenue is higher but gross profit margins have deteriorated

In inflationary times, we quickly find out which companies have pricing power and which don’t. With Libstar helping retailers execute private label strategies as a meaningful part of its business, the company is sadly a price taker from those retailers.

We can see this clearly in the year ended December, where revenue growth was 10.7% but gross profit was only up by 3.9%. This is despite 7.7% of the growth being attributed to pricing increases (and 3% to volume growth), which tells you how severe the cost pressure on manufacturing was in this period.

The other issue is that export sales were lower, leading to an under-recovery of overhead costs. This double-whammy impact in manufacturing businesses can really bite, as the combination of volume pressure and a deteriorating gross margin can cause havoc with profitability.

Load shedding also didn’t do gross margins any favours, with R39 million in operating costs related to generators and a whopping R31 million of that amount coming through in the second half of the year. This is worrying for the current gross margin under Stage 6 load shedding.

The 3.9% increase in gross profit wasn’t enough to offset a 6.5% increase in operating costs. Although cost control was solid at Libstar, the company still saw a drop in normalised EBITDA of between 2.6% and 5.6%.

Impairments of R277 million were recognised, of which R98 million was attributed to the Denny mushroom business that suffered a fire.

Those impairments don’t impact the HEPS line, which is expected to decrease by between 8.6% and 13.6%. The share price fell 3.4% in response.

Old Mutual: read carefully (JSE: OMU)

The unbundling of 12.2% in Nedbank in 2021 makes a big difference

You know my views on “adjusted” or “normalised” earnings in general and how this term gets abused by listed companies. For some reason, Old Mutual went too far in the other direction here and made very little effort to highlight a critical adjustment that is justifiable.

In a trading statement for the year ended December, profit from operations could as much as double based on an improved mortality experience from COVID. Although conditions have clearly improved, Old Mutual highlights persistency (customers continuing to pay premiums) as a worry, as consumers are under so much pressure.

Adjusted HEPS will be up between 7% and 27% and in this case, the adjustment has to do with the number of shares in the calculation and the exclusion of earnings in Zimbabwe. As reported, HEPS is up between 0% and 20%.

But the adjustment I care about is the unbundling of the 12.2% stake in Nedbank in 2021. That stake contributed R646 million of the R5.4 billion of adjusted headline earnings in the prior period, so it was a huge contributor.

If the impact of Nedbank is excluded, adjusted headline earnings would be between 23% and 43% higher. You just have to read the announcement very carefully to know this.

HEPS drops sharply at Royal Bafokeng Platinum (JSE: RBP)

The joy of cyclical mining groups is on display once again

For the year ended December, HEPS at Royal Bafokeng Platinum fell by a rather ugly 48.2%. Ouch.

The company attributes this to a number of factors and most of them sound internal, like operational issues at Styldrift and a higher income tax expense. Inflation at the mines is also running ahead of CPI, which doesn’t help much.

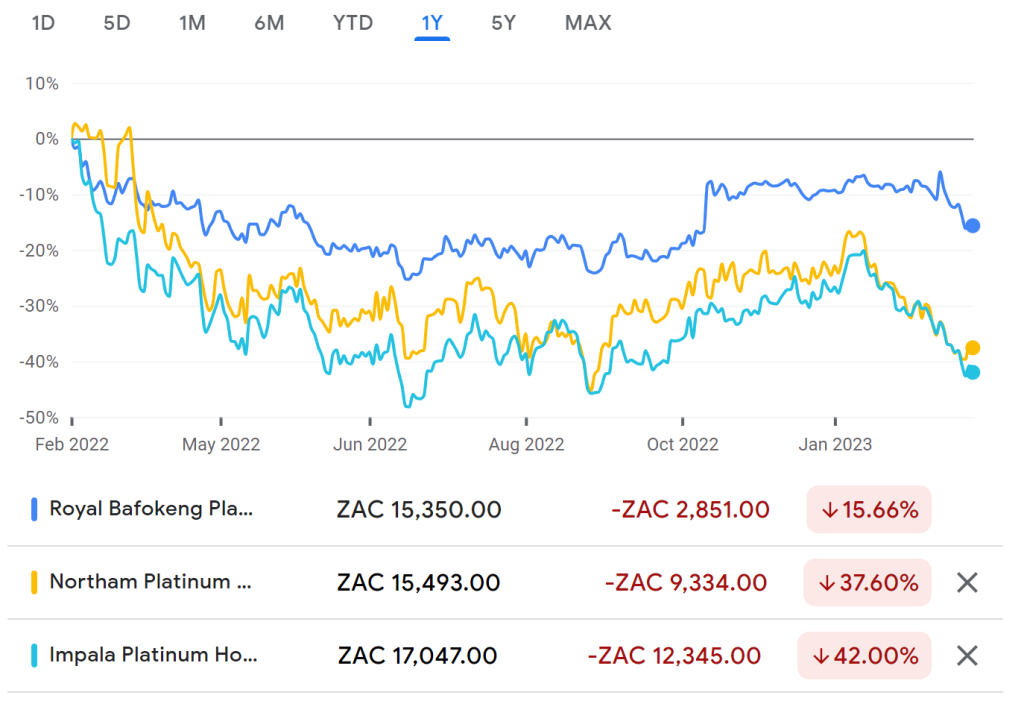

The share price has dropped 11.5% in the past year. The bidding war between Impala Platinum and Northam Platinum over the company has helped shield the share price from a much greater drop. In case you don’t believe me, here’s a chart of Royal Bafokeng vs. its potential suitors:

Spur feels “cautiously optimistic” (JSE: SUR)

These are meaty numbers, achieved despite consumers being under such pressure

Spur’s results for the six months ended December 2022 are obviously being measured against a base period that was absolutely ruined by COVID. It’s not surprising to see big year-on-year growth numbers.

To ground us in reality before getting into details, diluted HEPS in the six months to December 2019 was 124.9 cents. In the latest period, it was 136.65 cents. This puts Spur ahead of pre-pandemic levels, but HEPS is up only 9.4% in total over three years. It certainly hasn’t been a happy period even before we take into account the absolute disaster that was the pandemic itself.

As reported though, the year-on-year numbers like revenue up 35%, diluted HEPS up 198.5% and the interim dividend per share up 67.3% are all exciting. I would take note of how the dividend growth has trailed earnings growth and the message this sends about management’s confidence in these conditions.

Spur is “cautiously optimistic” going forward, with a warning given in the outlook regarding disposable income among consumers. Importantly, the balance sheet is ungeared. This means that there is no debt, which is a great position for a restaurant group to be in.

Steinhoff jumps 13.3% after a trading update (JSE: SNH)

And truly, I have no idea why

Steinhoff continues to confuse me. I think it’s worthless and the market now thinks it is worth 34 cents per share. I guess time will tell.

In a trading update for the first quarter of the year, the group disclosed a 14% increase in revenue. Pepco Group is the shining star, up 22% for the quarter. Mattress Firm was anything but firm, with a 14% drop in constant currency revenue. It’s little wonder that the IPO was pulled, even though Steinhoff blamed market conditions for that issue. I don’t care how good the conditions are, an IPO won’t be a happy experience when revenue has dropped like that.

I just hope that anyone buying shares at the moment has read the terms of the proposed capital restructuring very carefully.

Little Bites:

- Director dealings:

- RBFT Investments, an associate of a director of Salungano (JSE: SLG), has bought shares worth nearly R6m. There is still plenty of appetite to buy more, with the company looking for up to R84m worth of shares in the open market, as explained here.

- Worryingly, David McAlpin (who runs the Nutun business in Transaction Capital) has sold another big chunk of shares in Transaction Capital (JSE: TCP), this time worth R4.2m.

- An associate of a director of Huge Group (JSE: HUG) has bought shares worth R116k.

- DRA Global (JSE: DRA) has been notified of a claim by Andrew Naude for breach of employment causing a loss of present and future income. The amount has been quantified as over $9 million. Naude served as CEO of DRA Global until stepping down in 2022.

- If you’re a shareholder in Advanced Health (JSE: AVL), you’ll want to know that the circular dealing with the proposed disposal of PresMed in Australia has been released. This is a Category 1 transaction, so the circular goes into plenty of detail about the transaction. You’ll find it here.

- Impala Platinum (JSE: IMP) has once again had to extend the closing date of its offer to Royal Bafokeng Platinum (JSE: RBP) shareholders. The closing date is now 31 March.

- There’s a new independent executive director appointment at Transcend Residential Property Fund (JSE: TPF). I usually ignore non-exec appointments, but this one is interesting as the director is active in the corporate finance advisory industry. This points to potential corporate actions coming at the fund.

- After the unwind of the B-BBEE transaction, Remgro (JSE: REM) holds 80.22% of the shares in RCL Foods (JSE: RCL) and MandG Investment (that is the correct spelling) holds 5.24%. Like a fluffy toy being cuddled by a kid, this share register is tightly held.

- Luxe Holdings (JSE: LUX) continues to be a hot potato on the JSE, with Merchantec Capital resigning as the Sponsor. The announcement doesn’t give any indication of who the replacement Sponsor will be.