Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

More liquidity at Afine’s petrol pumps than in the stock (JSE: ANI)

This makes it difficult for the market to respond to earnings

Afine owns fuel filling stations with long term leases escalating at fixed rates. The company looks to add between one and two suitable properties per year.

Revenue for the six months ended August was 9.8% higher, while profit from operating activities increased by 2.7%. Despite this, distributable earnings fell 6.8%. The interim dividend is 20.60 cents per share, with the share price currently at R4.00 for reference.

There is very little liquidity in this stock, which probably explains why the share price is higher than the net asset value per share of R3.62.

The ongoing listing of AH-Vest remains a mystery (JSE: AHL)

The business is sub-scale and heading in the wrong direction

Being listed is expensive. Considering that AH-Vest has generated total profit of R3.5 million in the past two years, which is less than a modest restaurant should achieve, I really can’t understand why it remains listed.

The All-Joy brand (and a few others I’ve never heard of) would be a good fit in a food business that is currently light on sauces. They do have some resonance with customers, otherwise R211 million in revenue wouldn’t be possible. With gross profit margin down 310 basis points to 34.9% in the year ended June 2023, the company would probably benefit from some production scale as well.

Load shedding has obviously been a big problem here. The lesson is that you can’t respond to problems if you are up against some really big hitters in the same market. If you’re doing the corporate equivalent of taking a knife to a gun fight, there’s only one outcome.

With a market cap of just R16 million, it’s time for an industry player to come squeeze the last bit of sauce out of this one.

Alphamin releases detailed nine-month results (JSE: APH)

There is some interesting stuff to learn in here

Alphamin released detailed third quarter and nine-month results, reflecting tin production in line with Q2 and EBITDA up 8.6% quarter-on-quarter. The average tin price received was 4% higher but all-in sustaining costs came in 5% higher, both of those being Q3 vs. Q2 numbers.

The company is very focused on the Mpama South project, where development is running in line with the updated two-year underground plan. They are looking to achieve the expanded production from FY24.

Of course, there’s never a dull moment when mining in emerging markets. A bridge on the primary export / import route in the DRC was damaged in September, driving longer transit times and delays in revenue receipts. Ongoing heavy rains in October and November caused the roads to deteriorate further. This is putting the balance sheet under strain, as revenue is being delayed further. The company raised an additional $10 million in senior debt finance and this facility was drawn down in November.

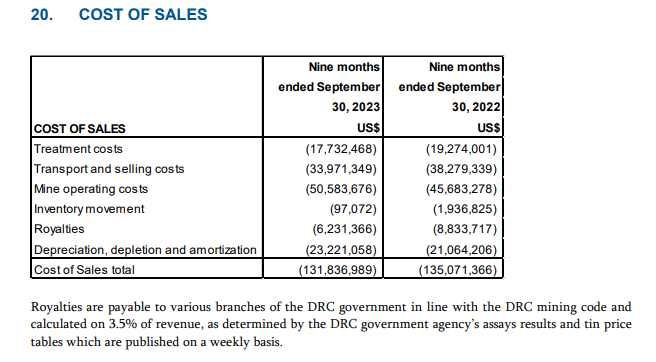

If you’ve ever wondered what the costs of running a mine tend to look like, wonder no more. Here’s the cost of sales breakdown at Alphamin:

Note the footnote regarding royalties. This is why mining is so important to governments in resource-rich countries.

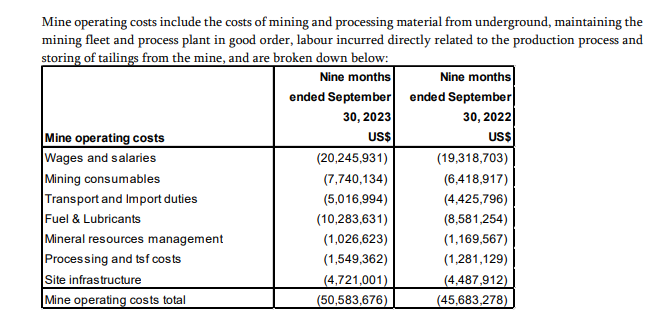

As noted, that breakdown was of cost of sales. There are many other operating costs of course. Here’s what they look like:

Interesting, isn’t it? Now when mines talk about inflationary pressures on costs, you have a better idea of where the toughest areas might be.

Frontier Transport Holdings shows a big jump in HEPS (JSE: FTH)

This company owns Golden Arrow Bus Services and a few other transport businesses

The six months to September 2023 have been a much happier time for Frontier Transport Holdings. I would imagine that high levels of inflation are encouraging more consumers to use busses rather than taxis, although of course this isn’t always possible.

When full results come out next week, I’m sure we will get all the details. In the meantime, we know that HEPS is up by between 60% and 71%, coming in at a range of 57 cents to 61 cents for the interim period. The share price closed 4.3% higher at R5.89.

MiX Telematics presents the Powerfleet deal to the market (JSE: MIX)

Shareholders need to be convinced that this transaction is a great idea

Landmark mergers are difficult things to execute and investors know this, which is why corporate management teams have to put in the work to convince shareholders that a proposed merger is going to buck the trend and be successful. Sadly, most mergers end up being a disappointment.

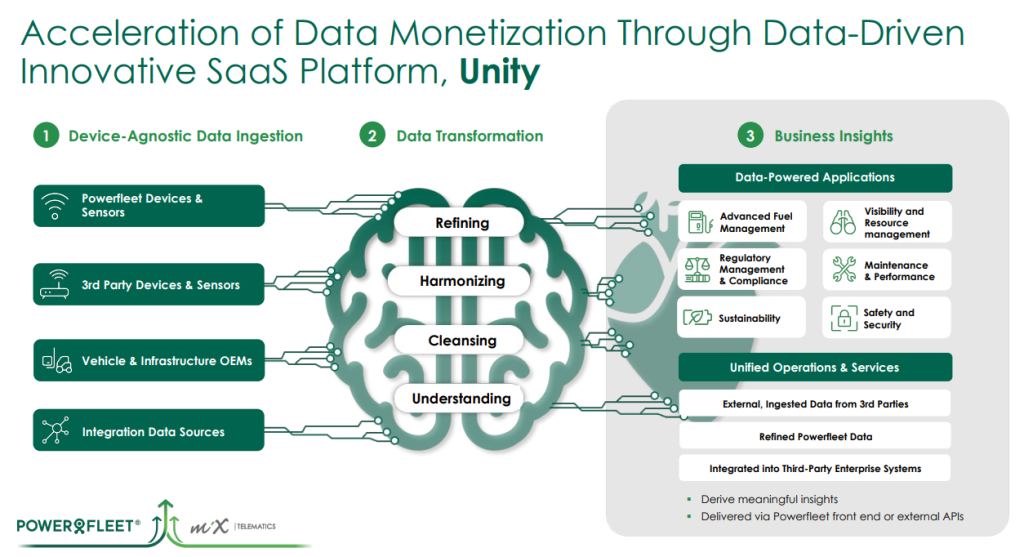

The MiX Telematics – Powerfleet deal has one of the better deal rationales that I’ve seen before, namely being the achievement of scale. Two sub-scale players can genuinely create value by combining efforts and becoming stronger as a result.

I do however get nervous when I see companies talking about a Rule of 40 performance, which is a silly rule of thumb from venture capital land that talks to growth and usually adjusted EBITDA margin. I don’t know too many local investors who care much about the Rule of 40. Around here, we care about free cash flow.

For those of you who like tech and fancy slides, check this one out:

If you are a MiX shareholder, or you are just curious about this space, then you’ll find the presentation here.

MTN reduced its non-rand debt (JSE: MTN)

In this case, a tender offer has nothing to do with something you say to your romantic partner

The near-term stress for MTN is the same as it’s been for a while: the balance sheet. Forex is a nightmare for African businesses and the difficulties in repatriating cash from countries like Nigeria have given MTN many headaches. It’s also given MTN a rather ugly share price chart, with a 52-week high of R149 and a current price of under R94.

To try and improve the balance sheet, MTN is focused on reducing non-rand debt. In other words, US$-denominated debt. To this end, MTN invited noteholders of the $750 million 4.755% notes due November 2024 to tender them for an early redemption. Tenders of $353.1 million were received, so that’s an early reduction of debt.

Although the total level of holding company leverage is relatively unchanged at 1.5x after this early settlement, non-rand debt as a percentage of total debt is now down from 37% to 24%.

PPC has decided to sell the Rwandan business (JSE: PPC)

The group is focusing on its southern African markets

PPC has agreed to sell its entire shareholding in CIMERWA PLC in Rwanda to National Cement Holding Limited. This is a cash deal worth $42.5 million. PPC has held a 51% interest in the company since 2013, with the other 49% listed on the Rwanda Stock Exchange.

The purchaser is a private company that is part of the Devki group, one of the largest manufacturers of clinker and cement in East Africa. The buyer also has operations in Kenya and Uganda.

It’s not difficult to see how CIMERWA fits into the buyer’s strategy. For PPC, this allows the company to unlock a lot of cash and focus on the southern African markets.

It also helps that at March 2023, PPC’s accounts reflected a book value for this investment of $38.5 million. This is therefore a disposal above book value. This is a Category 2 transaction and hence shareholders won’t be asked to vote on it, but a 6.5% increase in the share price gives us a clue as to what the market’s opinion of the deal is.

Sanlam shows improved life insurance margins (JSE: SLM)

There’s also solid growth in volumes

Sanlam released an operational update for the nine months to September 2023 and all looks good, although the share price closing nearly 1% down on the day suggests that the growth has already been priced in.

As we already know from the recent Santam update, the short-term game is difficult at the moment. Margins have been below target because of significant loss events and related underpricing of risk, with strong investment return on insurance funds as the saving grace in that business.

The situation is thankfully very different in life insurance, with value of new life insurance business up 28% and margin improving to 2.90% from 2.46% in 2022. South Africa came in at 2.53% and emerging markets at 5.01%.

There’s more to Sanlam than just life insurance. There are credit and structuring businesses, as well as investment management businesses. The net result from financial services increased by 19%, with the credit and structuring business as the star with 28% growth.

This helped drive a group result that showed net operational earnings up by 35%. A major underlying driver was growth in new business volumes of 13%. The other difference between operational earnings and the financial services result is the investment return on the shareholder capital portfolio, which was much improved in this period thanks to market performance.

As a reminder, the Absa LISP transaction closed on 1 November 2023, adding R66 billion of assets under administration to the Glacier platform in the retail affluent category. Another major move was the Capital Legacy transaction, which closed in August with a cash outflow of R904 million. The group also bought the funding instrument in the B-BBEE vehicle from Standard Bank at a price of R2.4 billion. A special dividend from Santam of R1.2 billion helped pay some of these major amounts, but there’s still a sharp decrease in discretionary capital from R3.2 billion to R1.1 billion.

The other major corporate action was the Sanlam Allianz joint venture, which started operations in September. It will be reported in Sanlam’s accounts from 1 October.

Looking ahead, the group expects performance in the final quarter to result in the second half of the year being similar to the first half. The results are sensitive to movements in global investment market levels, so don’t expect great numbers out of Sanlam if broader markets don’t do well.

Little Bites:

- Director dealings:

- The chairman of WBHO (JSE: WBO) is “restructuring his retirement portfolio” with a sale of R12.5 million worth of shares.

- An executive at Investec (JSE: INL | JSE: INP) sold shares worth £307k.

- There’s another purchase of Lighthouse Properties (JSE: LTE) shares by a trust linked to Mark Olivier. Perhaps Des de Beer is on holiday. Either way, the purchase is worth over R5.7 million.

- A prescribed officer of ADvTECH (JSE: ADH) sold shares worth R2.4 million.

- An associate of the company secretary of Stor-Age (JSE: SSS) has bought shares worth around R620k.

- The company secretary of Growthpoint (JSE: GRT) has sold shares worth R273k. Although these relate to scheme options vested, the announcement doesn’t make it explicit that this is only the taxable portion, so I’m assuming it’s a full sale.

- An associate of a director of Wesizwe Platinum (JSE: WEZ) is still selling shares, this time to the value of around R210k.

- An associate of Christo Wiese bought shares in Collins Property Group (JSE: CPP) worth R220k.

- Value Capital Partners is an institutional investor that has director representation on its portfolio companies, like Altron (JSE: AEL). Any further purchases of shares are therefore classified as purchases by an associate of directors. Although the messaging is similar, the quantum isn’t a fair comparison to other director dealings as this is an institutional shareholder. Hopefully you’ll agree with my view when I point out that the latest purchase of shares is to the value of R23.9 million.

- Brikor (JSE: BIK) is currently under offer. This doesn’t change the requirement for the company to announce earnings updates. In a trading update, HEPS for the six months ended August has been indicated at between 2.4 cents and 2.9 cents. The prior period was break-even, so the percentage increase isn’t meaningful.

- I think that shareholders at Ethos Capital Partners (JSE: EPE) are a little bit gatvol of the discount in the share price, voting down a resolution related to a general authority to issue shares for cash.

- In case you missed it on the news, climate protestors disrupted the Sasol (JSE: SOL) AGM to the point where it has to be reconvened. The Chairman invited the protestors to meetings with representatives of the board, which they declined. In other important news, CEO Fleetwood Grobler’s replacement has been announced as Simon Baloyi, who will move into the role on 1 April 2024. Grobler will stick around in an advisory role until 31 December 2024. This is an internal promotion, as Baloyi is currently Executive Vice President, Energy Operations and Technology. Incredibly, Grobler is celebrating 40 years with the company in various roles and Baloyi has been there since 2002!

- If you are interested in learning more about Jubilee Metals (JSE: JBL), then you’ll be pleased to learn that there’s a brand new corporate presentation available on the website. You’ll find it here.

- As a reminder of the ongoing dilution that comes with being an investor in a junior mining company, Orion Minerals (JSE: ORN) issued $2.27 million worth of shares to an option holder who acquired those options as part of the capital raise earlier this year.

- CAFCA Limited (JSE: CAC) is the company that you can be more than slightly forgiven for never having heard of. It is completely illiquid and couldn’t be more obscure. Nonetheless, I like to include everything on SENS, so the update here is that a dividend of 7.90 US cents has been declared as part of the release of financial results. The results are in Zimbabwean dollars, so there are some very large numbers as that currency is worth so little.

Hi. Will you kindly explain at some stage why Invested has two JSE tickers? I did try to Google.

Hi! It’s a legacy structure to do with a UK and SA mirror listing. You won’t see something like that again. Underlying company exposure is the same.

Thanks, appreciated.