Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Afine’s dividend has moved lower (JSE: ANI)

There’s also an awkward restatement of financials

Afine owns a portfolio of forecourts across four South African provinces. Revenue for the year ended February 2024 moved 2.7% higher, which is a pretty pedestrian outcome. Distributable earnings fell 4.3% and the dividend per share is down 6.2%. This specialised REIT isn’t giving investors any growth at the moment.

The net asset value is 12.2% higher at R4.06 and the current share price is R4.00, a rare example of a REIT trading at roughly its NAV. Speaking of the NAV, the fund had to correct a embarrassing issue related to the 28 February 2023 numbers, in which the valuation of one of the properties included an extra year of cash inflow in the discounted cash flow valuation. This led to the fair value adjustment being overstated by R7.2 million. They have now fixed this.

The total dividend per year was 41.10 cents, so the current price offers a yield in excess of 10%.

Anglo says no to BHP – yet again (JSE: AGL | JSE: BHG)

Anglo is stubborn about the proposed structure

In and amongst the election news headlines on the airwaves, Anglo American and BHP Group were playing ping-pong on SENS. Due to the local public holiday yesterday and the resultant catch-up of announcements on SENS before the market opened, it looked weirder than would otherwise have been the case.

It started with Anglo American responding to the news from BHP that it doesn’t intend to make a firm offer for Anglo American. There wasn’t much in that announcement beyond the usual corporate gumph reminding investors that Anglo American has a plan to unlock value.

Things then got more interesting, with BHP talking about a range of socioeconomic measures that have been proposed to address Anglo American’s concerned. They must’ve gotten an advisor on board who suggested some ESG stuff to tug at the heartstrings of Anglo shareholders, particularly after BHP gave South Africa the cold shoulder in the deal structure through not wanting any of the local assets.

These measures include things like local procurement, the establishment of a mining centre of excellence and even maintaining funding for charitable commitments. Investors were probably more interested in BHP being willing to discuss a break fee, payable in the event of the proposed structure failing to meet necessary regulatory approvals.

When you consider that Anglo’s value unlock proposal has a few similar steps to the BHP proposal and comes without the benefit of a buyout offer and break fee if implemented, I’m surprised that BHP didn’t give the break fee more airtime in its announcement.

Still, BHP wasn’t willing to put down a firm intention to make an offer and asked for a further extension of the deadline to do so.

Anglo was having none of it, commenting that the socioeconomic measures don’t address the structural difficulty in BHP’s proposal. It’s still beyond me why the BHP proposal is considered bad because all the execution risk is borne by Anglo, yet the Anglo value unlock proposal is somehow better than this even though the risk is quite obviously born by Anglo shareholders as the only parties in an internal restructuring. On this basis, Anglo believes that there is no need for an extension to the deadline.

This brings us to the final position, for now at least: BHP will not make a firm offer for Anglo American. They are allowed to come back to the table if a third party announces an offer for Anglo, or in other limited circumstances.

Watch this share price carefully, as the takeout premium can quickly wash away if nobody else puts their hand up for Anglo American:

Capital Appreciation had a better second half (JSE: CTA)

The expected credit loss for GovChat has skewed the HEPS move

Capital Appreciation released a trading statement dealing with the year ended March 2024. It reflects an increase in HEPS of between 81% and 84.8%, but be very careful in interpreting that, as the expected credit loss for GovChat was included in HEPS in the base period and was significantly reduced in this period.

Also note that Dariel Group, an acquisition completed in July 2023, was included in this period and not in the base period.

Instead of focusing on the percentage move, we can look at the solid second half of the year that took HEPS from the interim period of 6.5 cents to a full-year result of between 13.47 cents and 13.75 cents. This was driven by increased activity in the Payments division, better expense management and strong cash flows. The Software division is still struggling with delays or deferrals of contracts.

Detailed results are due on 5 June.

Delta Property Fund has seen some improvement (JSE: DLT)

The swing into an operating profit is thanks to reduced expenses, amongst other things

Delta Property Fund is fighting for its survival, having renewed debt facilities with Nedbank out to April 2025. Investec facilities have been renewed until June 2025. The banks are hoping that the fund will find a way out of this mess and to their credit, Delta’s management team is giving it a full go. Operating profit came in at R399.2 million for the year ended February, which is vastly better than a R226.1 million loss in the comparable period.

Asset disposals aren’t easy in this environment, with debt reduced by R74.1 million in the past year from disposals and R109.7 million from dividends. The loan-to-value ratio is down from 59.9% to 59.4%. It’s like trying to dig a hole with a spoon. Since the end of this financial period, further disposals of R144.9 million have been achieved.

Portfolio vacancies have increased from 32.9% to 33.4%, so they are fighting that battle as well.

There are still no guarantees whatsoever that Delta will emerge from this in one piece.

Emira releases numbers, but reporting periods changed (JSE: EMI)

This makes the year-on-year comparisons unhelpful

When a company changes its year-end, the annoyance is that year-on-year comparisons become silly. You can’t compare a 12-month period to a 9-month period, or a 15-month period. In the case of Emira, the year ended March 2024 must be compared to the 9 months ended March 2023, so we find ourselves with this problem.

The percentage movements are therefore not worth focusing on. Instead, we can consider numbers like the total dividend per share of 117.02 cents, which puts the fund on a trailing yield of 12.2%. Tell me again about that residential buy-to-let investment on a net yield of maybe 7% if you’re lucky?

Emira’s loan-to-value ratio is 42.4%, which is better than 44.0% as at March 2023. Balance sheet numbers can be compared regardless of changes in the length of a reporting period, as they represent a snapshot rather than a period of time.

You may recall that Emira is selling a large portfolio to Spear REIT (JSE: SEA) for a total price of R1.146 billion. There are various conditions still to be met for this. Emira will use the proceeds to reduce debt and fund new acquisitions.

Nampak releases the circular for the largest disposals (JSE: NPK)

These deals are part of the plan to fix the balance sheet

Nampak is in the process of a difficult turnaround that has been made particularly tricky by the ongoing challenges with African currencies. To try and address the problems in the group and create a sustainable balance sheet that will be supported by lenders and shareholders alike, there are various disposals underway. They’ve been captured in a circular available here.

The Liquid Cartons disposal entails selling Nampak Liquid Cartons to a consortium of Corvest, Dlondlobala Capital and management. This includes the South African Nampak Liquid Cartons business, as well as Nampak Zambia and Nampak Malawi. The base price is R350 million.

The Bevcan Nigeria disposal is to a new company incorporated in Singapore and owned by the Evergreen Trust. Nampak shareholders will be thrilled to see the back of this business, based on all the life that the Nigerian currency has sucked out of various South African corporates recently. The price is $68.5 million and the deal includes Bevcan Nigeria repaying $10 million to Nampak for historic trade payables.

Ultimately, these deals are part of an asset disposal plan to raise R2.6 billion and create a focused group that has a much better chance of success going forward. It’s still not going to be easy, with this paragraph from the circular laying it out pretty clearly:

While actively pursuing these strategies, it is anticipated that there will nevertheless be sustained low growth in most of the geographies the Group operates in, with significant hard currency liquidity constraints. A serious risk is volume loss, some of which has crystalised already, but the Group is responding with appropriate mitigation actions. The Nampak corporate strategy and transformational plan intends to hurdle all these restraining forces.

I can’t see a world in which shareholders don’t approve of these disposals.

Old Mutual is struggling with cash outflows (JSE: OMU)

Hanging onto assets is tough out there

Old Mutual has released a voluntary update for the quarter ended March. Of course, the headline they focus on is double digit sales growth, which is true for Life APE sales (admittedly only just, with 10% growth). This is definitely the pick of the numbers, so I’m not surprised they focused on it.

Gross flows increased by just 4%, driven in part by an acquisition in Malawi. Still, it’s positive at least. Net client cash flow was ever-so-slightly positive at R166 million, down sharply from R899 million in the prior period despite the increase in gross flows. The culprit is large outflows in the investments and personal finance side of the business, despite growth in wealth management.

Loans and advances increased by 3% (mainly in Africa) and gross written premiums grew 7%

Trustco is profitable, but NAV has moved lower (JSE: TTO)

I can only smile at the reference to the CAGR since 1992

After releasing a trading statement, Trustco closed 48.65% higher and on strong traded volumes, so there are people happy to throw their money at this story. I’m not one of them.

The company references its compound annual growth rate (CAGR) of 68.97% since 1992. That would be a lot more impressive if it wasn’t for what this chart looks like:

Nevertheless, for the six months to February 2024, HEPS came in at between 8.63 cents and 13.71 cents. That’s a nice swing from the headline loss per share of -25.38 cents in the comparable period. Despite this, the net asset value per share is down by between 10.27% and 30.27%, coming in at between 112 and 144 cents per share.

The share price even after the rally is 55 cents, so that’s quite a discount to net asset value.

Detailed results are due on 31 May. This is another example of a trading statement being released the day before results.

Separately, the company renewed the cautionary announcement related to Sterling Global Trading becoming a 70% shareholder in Meya Mining.

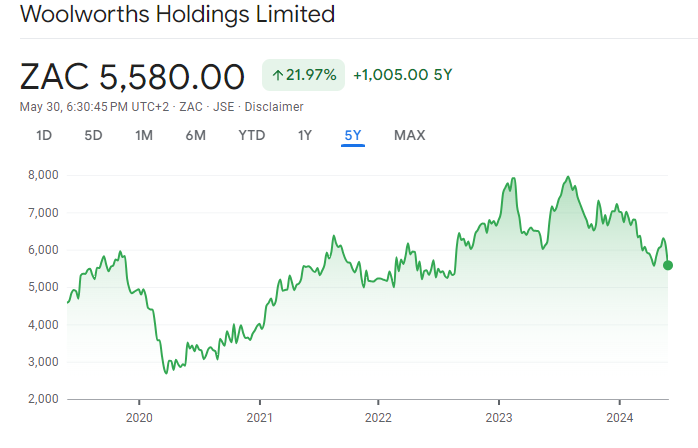

Woolworths’ apparel business is letting them down (JSE: WHL)

This turnaround story is faltering

After the release of a trading statement dealing with the 53 weeks ending June 2024, Woolworths suffered a share price drop that took the return over the past year into the red. It was a bad day overall for the sector, but there has only been one grocery winner in the past 12 months:

Of course, Woolworths is more than just a grocery business. For a while, this was a good thing, as a recovery in Fashion Beauty and Home was driving much of the support from the market, particularly with Woolworths Food under assault from Checkers.

With a 53-week period and all the David Jones noise in the base, we need to wait until the release of detailed results in September to know for sure what the performance looks like. For now, we know that earnings will be down at least 20%, even at adjusted HEPS level.

The major concern is that the second half of the year is proving to be a further disappointment for the apparel business, with discretionary spending power down in both South Africa and Australia. This is putting margins under pressure, which is exactly what the market doesn’t want to see.

The Food business is described as experiencing market share gains, presumably at the expense of hapless Pick n Pay, although the announcement doesn’t say for sure.

Either way, the momentum in this turnaround is gone. As this five-year chart shows, Woolworths needs to hold the current level or potentially face an ugly journey back towards COVID lows:

Zeda announces its maiden interim dividend (JSE: ZZD)

But my hope for a share price pop after earnings hasn’t transpired

Zeda is one of those locally listed companies that looks cheap regardless of how you cut it. This is why I own the shares. I was hoping for the share price to jump after the release of earnings, but this didn’t happen. I’m happily still holding, though.

For the six months to March, Zeda reported revenue growth of 19% and EBITDA growth of 7.5%. HEPS fell by 12.5% to 165.5 cents. Return on equity was still very lucrative at 28.5%. Earnings may have dipped, but the group felt confident enough about the balance sheet to announce an interim dividend of 50 cents per share.

The share price at R11.90 doesn’t look expensive to me based on these numbers, especially as these are interim profit numbers rather than full-year numbers.

The leasing business grew revenue by 17%, with the operations in the rest of Africa contributing 22% to total revenue. EBITDA margin expanded from 57% to 59% in this business and operating margin was up from 23% to 26%.

The car rental business grew revenue by 19.6% but suffered a decline in profitability as the used car market declined. This drove discounts in the market for cars, which hampers the economics over the life-cycle of a rental vehicle that they need to sell once it gets too old. EBITDA was flat in this business and operating profit moved lower, with other issues including damage to the vehicles based on road infrastructure.

I was expecting a solid jump in revenue in car rentals. The impact on profitability isn’t great news, but I still believe in the story and especially the appeal of the current share price, especially with a dividend underpin.

Little Bites:

- Director dealings:

- If you read the Discovery (JSE: DSY) announcement carefully, you’ll see that Adrian Gore sold shares worth R29.4 million. Those NHI jitters must be quite something. He’s also hedged 1,873,770 shares in a put-call option structure, with the put at R94.15 and the call at R151.40. Fellow director Barry Swartzberg has entered into put-call options over a total of 1.7 million shares across two tranches. The put option price is R99.60 per share and the call options are at either R150.11 or R160.77 depending on the tranche.

- An associate of a director of Glencore (JSE: GLN) acquired shares worth £96.2k. In a separate transaction, two associates of a different director of Glencore acquired shares worth £49k.

- A director of a major subsidiary of Hulamin (JSE: HLM) received shares under the group’s share plan and then disposed of the whole lot for just over R1 million. Particularly in smaller groups, it’s always better to see executives retain a non-taxable portion. Selling the entire award is a bearish indicator for me.

- A non-executive director of Hammerson (JSE: HMN) has bought shares worth £9k through a dividend reinvestment plan.

- Although technically a director dealing, this trade is complicated enough to warrant its own section. An SPV related to the chairman of Metrofile (JSE: MFL) has bought 36 million shares from Sabvest (JSE: SBP) for R108.3 million. Sabvest has given limited funding guarantees to facilitate the transaction and will use the proceeds to reduce debt. The selling price is R3.01 per share. The buyer has also been granted a call option to buy another 21 million shares at the same price, exercisable until November 2025. Finally, the buyer has been granted a put option for 21 million shares at R3.01 that can be exercised either in November 2025 or May 2026. The current share price of Metrofile is R2.55. I can see why Sabvest offloaded at R3.01, even if there are strings attached that might come into play down the line.

- Italtile (JSE: ITE) announced the appointment of Brandon Wood (currently CFO) as COO and the appointment of Lamar Booysen as CFO as an internal promotion. This speaks to a solid succession plan within the group.

- Acsion (JSE: ACS) announced that the finalisation of results for the year ended February 2024 has been delayed. They expect to release them by 14 June.

- Salungano (JSE: SLG) announced that KPMG has resigned as external auditor of the company without giving any reason. That’s exactly the kind of look that you don’t want to have as a corporate.

- Capitec (JSE: CPI) announced that S&P has raised Capitec Bank’s standalone credit profile from bb to bb+. Although this may not have a direct implication for equity holders, the rationale for the upgrade was around the business banking operations and Capitec’s diversification, which gives support to the reasons why investors have been buying into the story.

I own it too and am in the same boat as you

I’m worried that management is fluffy and wordy, and doesn’t implement.

They should be killing it with tourism.