Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Is African Rainbow Capital finally making it rain? (JSE: AIL)

Intrinsic net asset value per share has shown decent growth

African Rainbow Capital Investments (commonly referred to as ARC) has been a disappointment for investors, with a history of large management fees at the expense of shareholders. A recent change to the management fee structure has started to address that issue, although there’s no way to claw back the original payments. The management fee for the year ended June 2023 was R98 million vs. R225 million in the prior year.

I still don’t think a 10% performance hurdle is appropriate though. These days, you can get that by just locking the money up in a fixed deposit for a few years! Performance fees are still too high.

A positive step is that the portfolio is more focused than before, with three major disposals and a particular focus on reducing exposure to listed shares. The best way to start closing a discount to intrinsic net asset value (INAV) per share is to own assets that investors can’t get elsewhere. If the assets are simply shares in other listed companies, then what is the point of the intermediary group even existing in the first place?

The top 13 investments now comprise 88% of the portfolio and the unlisted portion of the portfolio is 89%. The largest asset is Rain, contributing 27.6% of the fund’s value. The valuation increased in response to improved EBITDA and the acquisition of spectrum. TymeBank is 12.3% of the fund’s value has now has 7.4 million customers. Tyme Global is reported separately and is 4.8% of fund value.

There have been some substantial investments in portfolio companies, with debt in the ARC Fund increasing by 51% as a result. R664 million was invested in TymeBank and Tyme Global to fund the acquisition of Retail Capital and R883 million was advanced to Kropz Plc (which contributes 11.7% of fund value).

After a performance hurdle was met in the previous year and more shares were issued, NAV per share on an IFRS basis only increased by 13.5% despite the effective share of invested assets increasing by 19.8%.

The INAV per share is R11.41 and the share price is R6.00. That’s a discount of 47.4%.

AfroCentric flags a significant drop in earnings (JSE: ACT)

Once-offs are only partially to blame here

In a trading statement dealing with the year ended June 2023, AfroCentric guided a drop in HEPS of between 30% and 40%. This is based on Private Health Administrators being reflected as a discontinued operation in this period and the restated comparable period.

The company notes various once-off impacts in these earnings, like corporate and restructuring activities. The procurement of hospital surgery consumables has also been closed down, leading to write-downs of inventory and debtors. A normalisation of trading in the pharmaceutical cluster has also impacted profitability.

The good news is that the medical scheme administration cluster has been stable, with growth in private and public schemes during the year.

FirstRand’s cautious approach drives 12% growth in HEPS (JSE: FSR)

Normalised ROE increased to 21.2%

FirstRand is very proud of its credit loss ratio, which is below the through-the-cycle range. Being below the range isn’t necessarily a good thing though, as it suggests that the bank may not be taking enough risk! Being too cautious is almost as bad as being too risky, as a conservative approach can lose out on growth.

Growth in HEPS of 12% is nothing to sneeze at and normalised ROE of 21.2% wipes the floor with other banks. FirstRand has enjoyed structurally higher ROE for as long as I can remember.

Despite the cautious approach, the jump in impairments of 55% is much higher than growth in net interest income of 16%. Non-interest revenue grew 11%. Operating expenses were 12% higher, with a 14% increase in staff costs and a 5% increase in headcount. The cost-to-income ratio improved from 52.5% to 51.8%.

The top performing division (ignoring all the complicated stuff accounted for at the centre) was Wesbank, up 16%.

In terms of outlook, FirstRand expects the credit loss ratio to be marginally above the mid-point of the through-the-cycle range. ROE is expected to remain at the upper end of the 18% – 22% target range.

Where did the sparkly earnings at Gemfields go? (JSE: GML)

If it comes out the ground, it’s volatile

For the six months ended June, Gemfields has reported an ugly drop in adjusted headline earnings per share from 62.6 ZAR cents to 35.1 cents. The “adjusted” point is a reference to fair value losses in Sedibelo Resources, with a substantial write-down of $13.3 million because valuations have dropped for platinum group metals companies. HEPS as reported includes this fair value drop, whereas traditional impairments are usually excluded. That’s why I’m OK with using the adjusted number here.

If we look at the key operating assets, then Kagem’s revenue (emeralds) fell from $85.2 million to $64.6 million and MRM’s revenue (rubies) fell from $95.6 million to $80.4 million. Fabergé, a perennial disappointment, saw revenue drop from $9.5 million to $8.4 million, citing a softer luxury market.

Although not the reason for such a large drop in adjusted HEPS, having 3% more shares in issue on a weighted average basis doesn’t help matters.

This announcement was a trading statement rather than a release of detailed results, which are expected on 22 September.

Metair? Met debt, that’s for sure (JSE: MTA)

EBITDA and HEPS are telling completely different stories

Metair really has had to deal with a number of horrible things, ranging from hyperinflation and earthquakes in Turkey through to floods in KZN. The company just can’t catch a break, yet it is still standing and is profitable.

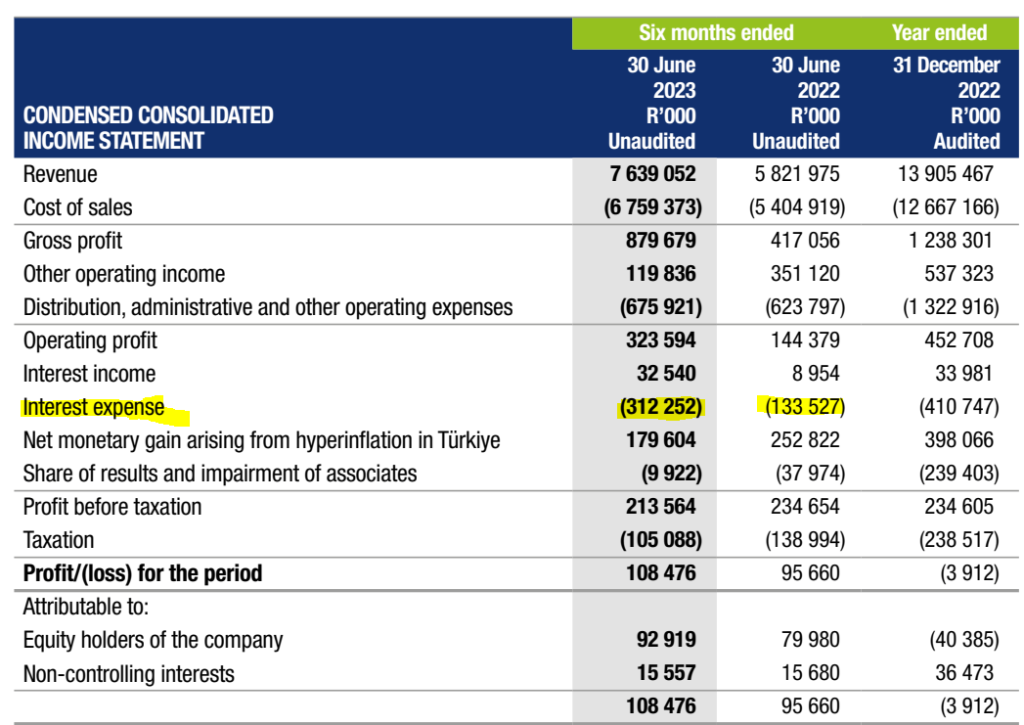

Unfortunately, they are working very hard so that their bankers can have a better life. EBITDA (earnings before interest and some other things) grew by 63% in the six months to June. HEPS (which is net of interest) fell by 9%. A quick look at the income statement shows you the culprit:

The problem isn’t just the quantum and cost of debt,, although it certainly doesn’t help when group net debt increased from R2.6 billion to R3.2 billion over the past six months. Because certain projects are still ramping up, return on invested capital (ROIC) was only 5.3% in this period vs. 11.7% in the comparable period.

Other than the known issues, it’s concerning that the Ford Ranger project seems to have been plagued with production challenges and higher than expected costs. They hope to recover at least some of these from Ford.

As a final example of the bad luck this company has been dealing with, Russia was an important export customer for the Mutlu battery business in Turkey. Due to sanctions and to preserve its reputation, the company ceased sales to Russia and export volumes fell 32% as a result, with a direct negative impact on hard currency earnings.

Overall, things really need to improve for Metair as the company is already on thin ice with its lenders, as covenants have been breached and needed to be waived. Lenders don’t have infinite patience with these things.

The share price chart for the past 12 months isn’t pretty:

SA Corporate Real Estate’s dividend falls 12.2% (JSE: SAC)

The company tries hard to get you to look at the cadence instead

Financial reporting is generally based on year-on-year movements. Most people actually don’t run their businesses like this, as it tends to make more sense to look at the recent monthly trend than the year-on-year numbers, except in seasonal businesses.

Property group SA Corporate Real Estate doesn’t have a great year-on-year story to tell, with the dividend down 12.2% for the six months to June 2023. Compared to the six months to December 2022, the dividend is up 1.8%. Similarly, net property income is down year-on-year but better than in the six months to December.

Including derivatives, the loan-to-value ratio is 36.3%. That’s an improvement from 37.8% at the end of December 2022.

The net asset value (NAV) per share is R4.17 and the share price is only R1.82, so it is trading at a 56% discount to NAV. The total distribution over the last twelve months is 22.57 cents, putting the group on a trailing yield of 12.4%. If the share price traded at NAV, the yield would be just 5.4%, which is precisely why the market isn’t interested in the NAV.

Sibanye-Stillwater enters a s189 process in the gold business (JSE: SSW)

This specifically relates to the Kloof 4 shaft

Sibanye has a problem in its local gold business. The Kloof 4 shaft has major operational constraints, including “seismicity” (how’s that for a word?) and cooling issues. There have been ongoing losses, even at the better recent gold prices. With a recent incident that caused damage to the shaft infrastructure, the situation has now reached breaking point.

A s189 process is a labour restructuring process i.e. retrenchments. This could affect 2,389 employees and 581 contractor employees. After significant labour issues in the gold business recently, this isn’t going to be easy to manage and isn’t fun for anyone involved.

Little Bites:

- Director dealings:

- The big dogs at Blue Label Telecoms (JSE: BLU) might have bought shares recently but other directors and directors of major subsidiaries have been net sellers, so read into that what you will. The latest trades are sales worth nearly R960k by three directors (including a group director).

- Astoria (JSE: ARA) has renewed the cautionary announcement that has been in place since July 2023, with negotiations for a potential acquisition still ongoing.

- If you are a shareholder in Tongaat Hulett (JSE: TON), you may want to attend the engagement session with the business rescue practitioners on 26 September. Refer to the SENS announcement for the Teams link.

- Astral Foods (JSE: ARL) is hosting a pre-close briefing session on 21 September. If you want to attend, refer to the SENS for registration details.

- British American Tobacco (JSE: BTI) has concluded the sale of the Russian and Belarusian businesses.