Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

African Rainbow Minerals suffers a sharp drop in earnings (JSE: ARI)

PGM and thermal coal prices dragged earnings lower

African Rainbow Minerals has released a trading statement for the year ended June 2024. HEPS took a proper knock, down by between 40% and 50%. A drop of this extent isn’t unusual in the mining sector at the moment, as some commodities have come off severely in price.

PGMs and thermal coal were the culprits for African Rainbow Minerals, with higher average realised iron ore export prices helping to mitigate some of the pain. Detailed results are due on 6 September, so we will get all the insights soon.

Despite the decline in earnings, the share price is surprisingly flat over 1 year – admittedly with plenty of volatility along the way.

Alphamin has released its detailed interim financials (JSE: APH)

We already knew from previous announcements that Q2 was a record for tin production

With Alphamin on such a growth path, it’s not surprising to see that the management team includes quarter-on-quarter comparisons as well as year-on-year. Typically only high growth companies will compare quarters sequentially, rather than just year-on-year.

The growth rate over the past year is immense, with revenue up 37% year-on-year for the second quarter and operating profit up 63%. Net profit over that period increased by 27%.

If we compare the second quarter to the first quarter, then revenue dipped 5% but operating profit was up 5%. After various other moves, including some major tax line items, net profit was down 10% quarter-on-quarter. It may be high growth, but very few companies can grow every single quarter.

With Q2 as a record for production, it might puzzle you that revenue dipped from Q1 to Q2. The clue is in the word “production” which isn’t the same as tin sold. They actually experienced a 21% drop in sales vs. a 28% increase in production, so they will need to play catch-up there. If they are lucky, tin prices will stay elevated, as the average tin price was up 20% quarter-on-quarter and 26% year-on-year.

The company expects tin sales in Q3 to exceed tin production by around 500 tonnes, which would recover more than half of the differential between production and sales in Q2.

Alphamin’s share price is up 15% over the past 12 months and 23% year-to-date.

A rough day for Gold Fields shareholders (JSE: GFI)

An upward move in the dividend payout ratio couldn’t stop the bleeding in the share price

The gold miners have been such a mixed bag recently, despite the more appealing gold price. This is a good lesson on the volatility when you buy the miners rather than the commodity itself, as plenty can go wrong on the production side. We’ve seen that play out at Gold Fields, where production for the six months to June 2024 is down by 20% year-on-year. Ouch.

When volumes drop like this, even for reasons outside of the company’s control (like the weather), there’s inevitably a major knock-on impact for unit costs. Mining has substantial fixed costs, so lower production volumes mean higher overhead absorption on a per-unit basis. All-in costs were up 47% to $2,060/oz, so the 14.7% increase in the dollar gold price was ruined by the jump in costs of production.

The net impact is that HEPS from continuing operations fell by a rather ugly 26.5%, which certainly isn’t what you expect to see when the gold price has moved higher. The interim dividend per share is only 7.7% lower as the payout ratio has been moved from 30% of normalised earnings to 40% of normalised earnings. This is a classic example of a company trying to use the headroom in the payout ratio to soften the blow of poor earnings. The market is usually smarter than that.

The balance sheet also has an unfortunate story to tell, with a free cash outflow for the period of $58 million vs. an inflow of $140 million in the comparable period. Net debt has increased by $129 million, admittedly including lease liabilities. If we exclude them, then net debt increased by $91 million, or 14.5%.

The first half of the year was so disappointing that full year guidance is being reduced, which is probably what gave the market a reason to take the share price 7.8% lower on the day. Although guidance has been moderated, they do still expect the second half to be much better than the first half. There are some uncertainties around this though, like the ramp-up at Salares Norte and the potential for further delays.

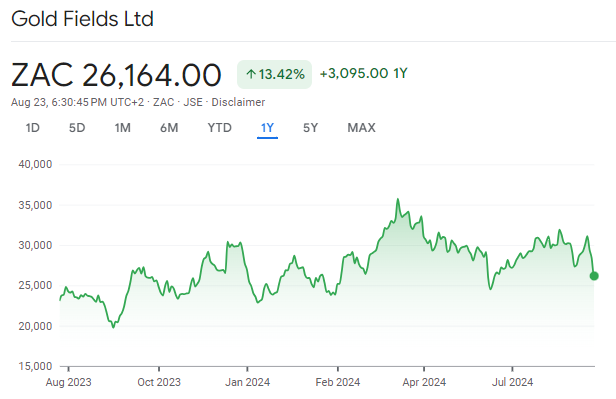

Despite these numbers, the share price is still up 13.4% over the past 12 months. Traders may find some interesting volatility in this chart to consider:

Port volumes are up, but Grindrod’s results are flat (JSE: GND)

The Port and Terminals segment is just one part of the group

The Grindrod investment case gets a lot of positive attention based on the Port and Terminals segment, with a 22% compound annual growth rate (CAGR) in port volumes over three years and a 12% CAGR in terminal volumes. In the latest period being the six months to June, Richards Bay bounced back with 20% growth in volumes, adding to another 18% growth from the Port of Maputo. This has driven substantial growth in profit attributable to ordinary shareholders from the Port and Terminals segment of 61.5%.

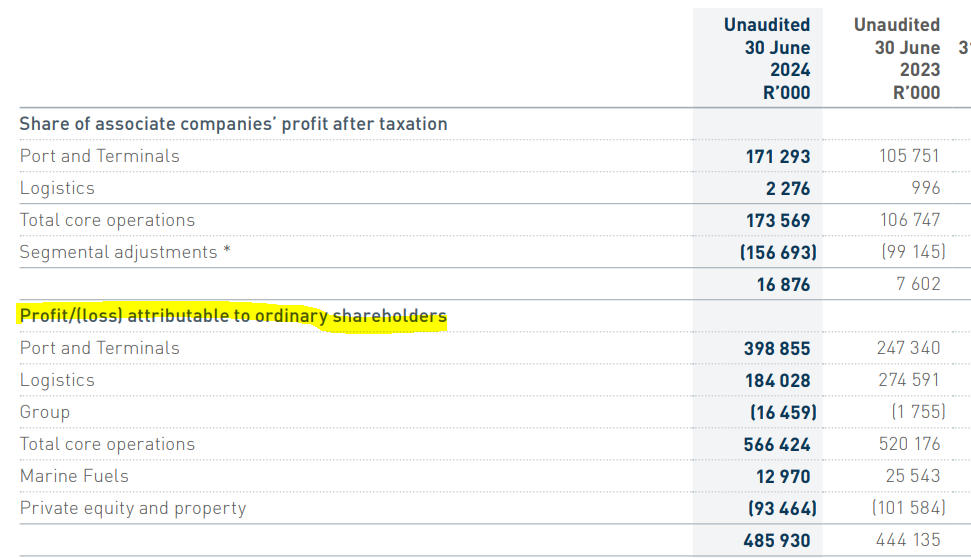

As you can see from this table, the Port and Terminals business is unfortunately just one part of the group story and was certainly the highlight in this period:

The Logistics segment struggled in this period, although there was a bright spot in the form of the ships agency and clearing and forwarding businesses. As for container handing, that was impacted by broader logistical constraints in the market. The rail business has also been through quite a bit, with that structural reorganisation now complete. The less said about the private equity and property segment, the better.

When it comes to HEPS, Grindrod went backwards slightly from 73 cents to 72.1 cents. The interim dividend took far more of a knock, down from 34.4 cents to 23.0 cents as the payout ratio was decreased.

The share price fell 4% on the day of this news. That’s just a minor blip in the recent growth trajectory though, with the share price up a substantial 45% in the past 12 months.

Little Bites:

- Director dealings:

- There’s yet more selling by a member of the founding family of Famous Brands (JSE: FBR), this time to the value of R11.4 million.

- Aside from some selling related to share awards by executives at Investec (JSE: INL | JSE: INP), there’s a sale by Stephen Koseff of £530k that is worth taking note of.

- A Dis-Chem (JSE: DCP) prescribed officer has been selling shares for a while now and the selling has continued, with R4.9 million as the latest tranche.

- A director of Sasol (JSE: SOL) bought shares worth R286k.

- Property group Putprop (JSE: PPR) released a trading statement reflecting a drop in HEPS of between 40.5% and 60.5%. They didn’t give any further details, with results expected to be released on 30 August.

- There’s an unusual shuffling of chairs at Texton (JSE: TEX), with current CEO Pienaar Welleman moving into the CFO role and current COO Jonathan Rens taking the CEO role.

- Trustco (JSE: TTO) has decided to walk away from its commercial banking business, with a decision to return its banking licence to Bank of Namibia for cancellation. This is less than 1% of Trustco’s total investments, so the operations are probably more of a pain than they are worth.