Featured: Naspers and Prosus finalises the capitalisation issue

In a complicated transaction, Naspers (JSE: NPN) and Prosus (JSE: PRX) have released a finalisation announcement for the capitalisation issue that effectively removes the cross-holding structure that the market was very unhappy with during its relatively short-lived existence. You can get all the details in this announcement>>>

Featured: RCL Foods needs a brighter Rainbow

Our poultry industry in South Africa is in a lot of trouble

Revenue at RCL Foods increased by 17.3% for the year ended June 2023. That sounds strong, but things go very badly as we move down the income statement. EBITDA fell 24.5%, or 11% excluding material once-offs. HEPS fell by 42.4% overall and by 45.7% from continuing operations. In the same way that they calculated the 11% drop in EBITDA, HEPS was down 20.2%.

The numbers aren’t pretty, which is why there’s no dividend this year.

The special levy raised by the South African Sugar Association got a lot of attention this year. Despite that levy, the sugar business actually delivered a solid result. The baking segment was flat year-on-year. The grocery segment didn’t get any tails wagging, with pet food production down by almost 50% from November 2022 to April 2023 because Eskom is the furthest thing from a good boy.

But to find the real pain, you need to go looking for rainbows. The chicken business is taking severe strain, with Rainbow’s underlying EBITDA down by 74.9% because the market simply cannot absorb the pricing increases that would be required to offset input cost pressures.

Notably, the Vector Logistics segment has been classified as a discontinued operation at year end. The disposal of that business was completed at the end of August.

You can get full details on the announcement at this link>>>

African Rainbow Minerals on the wrong end of Transnet (JSE: ARI)

Local infrastructure continues to hurt our mining houses

African Rainbow Minerals reported a drop in headline earnings of 21% for the year ended June 2023.

The group generates 61.6% of its headline earnings from the ARM Ferrous division, which fell 17% with pressure on iron ore (down 11%) and manganese (down 34%).

ARM Platinum took the most pain, tanking 52% in line with what we’ve seen with the rest of the industry. That segment now contributes 16.3% of group headline earnings.

For some good news, you can look at ARM Coal with headline earnings up by 65%. It only represents 17% of the group total, so this wasn’t enough to save the result.

In general, lower commodity prices have been the driver of the decrease, with logistical challenges at Transnet and Eskom doing nothing to help the situation.

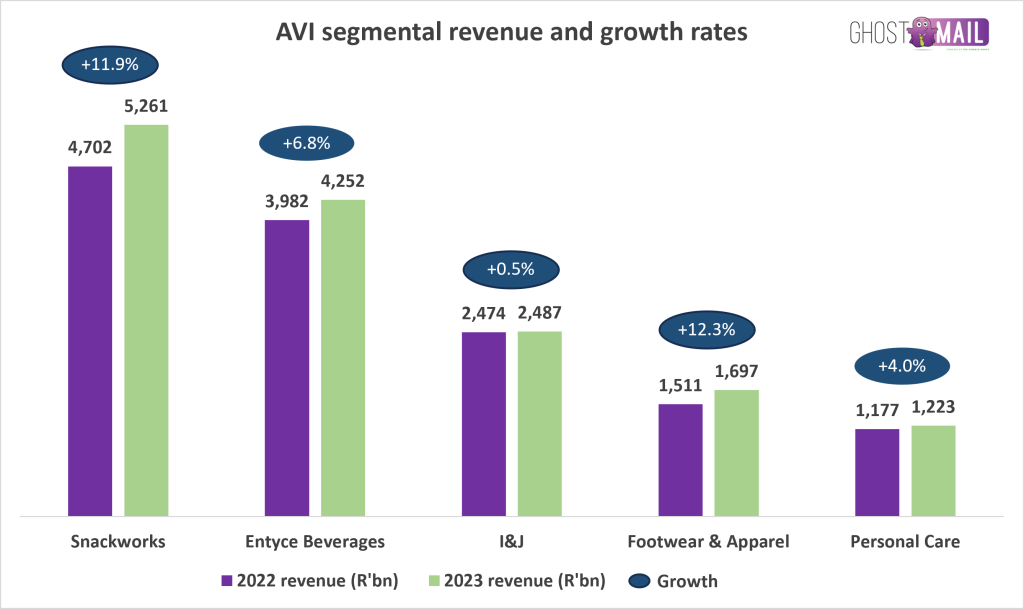

AVI looks pretty good excluding I&J (JSE: AVI)

Unfortunately for shareholders, they can’t just exclude I&J

For the year ended June, AVI’s revenue increased by 7.8%. This was no thanks to I&J (16.7% of the business) which was flat year-on-year on the revenue line. If I exclude I&J from the numbers, revenue grew by 9.3% which is a bit more interesting.

The difference is far larger at operating profit level. I&J’s flat revenue isn’t what you want to see in a time of inflationary pressure, with operating profit down by 36%. Operating profit excluding this business was up by 12.7%. The blended group result is a 6.9% increase in operating profit.

By now, you must be wondering what went wrong at I&J. Fishing is a tough business, with catch rates and fuel costs as major variables. In the first half of the year, lockdowns affected the abalone sales mix as well.

The good news story in these numbers is that AVI has decent pricing power, with gross margins stable in this environment. You can see strength in the numbers beyond I&J. This helped drive HEPS growth of 4.3%, a result that is admittedly below inflation but still on the right side of zero. A decent result in terms of cash conversion means that the final dividend of 310 cents per share is also 4.3% higher.

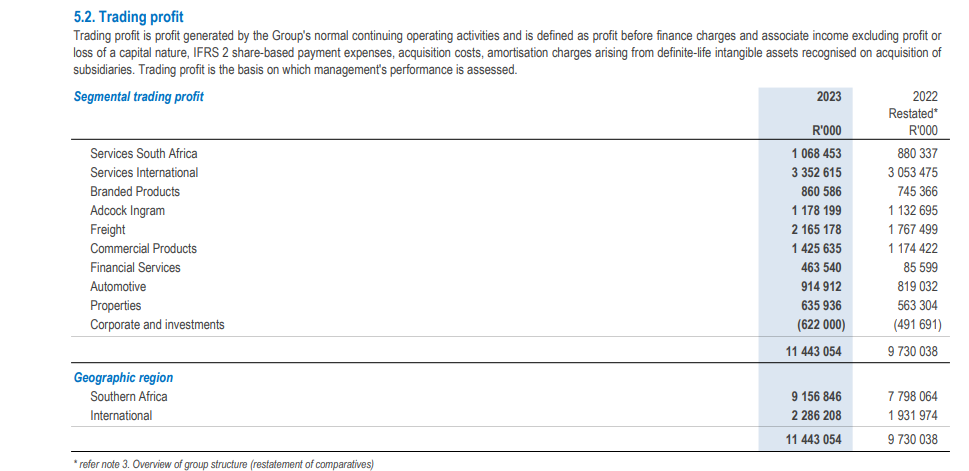

Bidvest’s focus on capital discipline pays off (JSE: BVT)

The second half of the year was all about generating cash

For the year ended June, revenue at Bidvest increased by 15% and trading profit jumped 17.6%. That’s a good story for operating margins. It also helps that cash generated from operations was R12.2 billion vs. trading profit of R11.4 billion, with R10.4 billion of that cash generated in the second half of the year!

This cash flow performance supported dividend growth of 20.6% vs. HEPS growth of 17.7%.

Bidvest is a highly diversified business and the result has been driven by various factors across the group. It’s certainly notable that the Freight division reported trading profit that is double the level reported three years ago. There were seven divisions that reported double-digit trading profit growth in this period.

Return on Funds Employed (ROFE) improved from 37.6% to 38.3%. Return on Invested Capital (ROIC) might be a measure that you are more familiar with, up from 17.1% to 17.3%. This is well above the cost of capital, which means that Bidvest is generating genuine economic profits.

The note on trading profit gives you a great idea of how diversified the business is:

Brimstone reports a drop in intrinsic NAV (JSE: BRT)

You need to go to the website to find the intrinsic value calculation

Brimstone’s financial results aren’t really as important as the calculation of intrinsic NAV. This is because Brimstone is an investment holding company and thus the value of the underlying portfolio is more important than a set of numbers that is partially consolidated and partially based on other accounting methods.

Oceana and Sea Harvest collectively contribute 73% of the portfolio and are both listed, so the market value per share is used in the intrinsic NAV calculation. There are positions in Equites, Phuthuma Nathi, STADIO and MTN Zakhele Futhi that get the same treatment, with listed positions contributing 85.4% of the portfolio.

There are a variety of unlisted investments, with FPG property fund as the largest with a 6.2% portfolio weighting.

Intrinsic NAV fell by 6.7% between December 2022 and June 2023. An 11.3% increase at Oceana was the only meaningful highlight, with substantial drops at the likes of Sea Harvest and Equites as major contributors to the overall decline.

The intrinsic NAV per share has fallen from R14.193 at the end of December 2019 to R12.362 at the end of June 2023. The share price’s discount to intrinsic NAV has also increased from 46.1% to 55.9% over that time period, so it really hasn’t been a happy time for shareholders.

Cognition Holdings: all about the cash (JSE: CGN)

The current value has very little to do with the earnings

After selling its controlling stake in Private Property, Cognition Holdings unlocked a massive amount of cash and recognised a R66.7 million profit on the sale. Of total assets of R266 million on the balance sheet, almost R215 million is attributable to cash.

This is why the share price of 95 cents makes sense compared to net asset value per share (103.37 cents) rather than HEPS (3.15 cents).

The underlying operations aren’t doing very well I’m afraid, with revenue down 13.6% and gross profit down 8.2%. Because of significant cost cutting, EBITDA managed to increase by around 10x to R4.8 million. This shows you how tiny the remaining operations actually are.

The company is working with its parent company Caxton & CTP (JSE: CAT) to figure out the best way to return value to shareholders.

There’s no interim dividend at property group MAS (JSE: MSP)

This debt environment is starting to really hurt some of the property funds

A property fund relies on having a decent mix of debt and equity on the balance sheet to drive returns. This makes the sector vulnerable to not just rising rates, but a tighter lending environment in which banks are more cautious.

Some companies are proactive and take a more conservative approach to cash management before there’s an issue. Others run head-first into the fire and then look all surprised when they end up in serious trouble.

Although the market gave MAS an 8.5% knock on the news that the interim dividend won’t be declared this year, the company does deserve credit to taking a safer approach to its self-imposed debt limitations.

Alongside this news, the company also released results for the year ended June 2023. The operational performance looks strong, with adjusted distributable earnings per share up by 30.7%. The exposure to Central and Eastern Europe continues to work well for funds in that region. But despite this, Moody’s downgraded the fund based on the difficult funding environment for real estate companies and this becomes a self-fulfilling prophecy, as demand for sub-investment grade bonds has declined and the cost of new funding has increased.

Although the downgrade from Ba1 to Ba2 didn’t take it below the investment grade threshold (even Ba1 has “speculative elements” on the Moody’s scale), every move further down the ratings scale has an impact.

The company thus has to be mindful of bond maturities in 2026 and what the funding environment might look like at that point. The board has dropped the loan-to-value limit from 40% to 35%, although they are already below that level so that’s a bit of a non-event from what I can see. As a further step, the company is raising debt against unencumbered properties (assets that aren’t already pledged as security for debt), with those proceeds aimed at reducing risks associated with the bond maturity.

As a final step in de-risking the business, residential property projects in Romania have been put on hold in the group’s construction joint venture. Unsold units will be retained for rental.

This feels like an incredibly conservative approach, which tells us a lot about both this management team and the outlook on interest rates and debt.

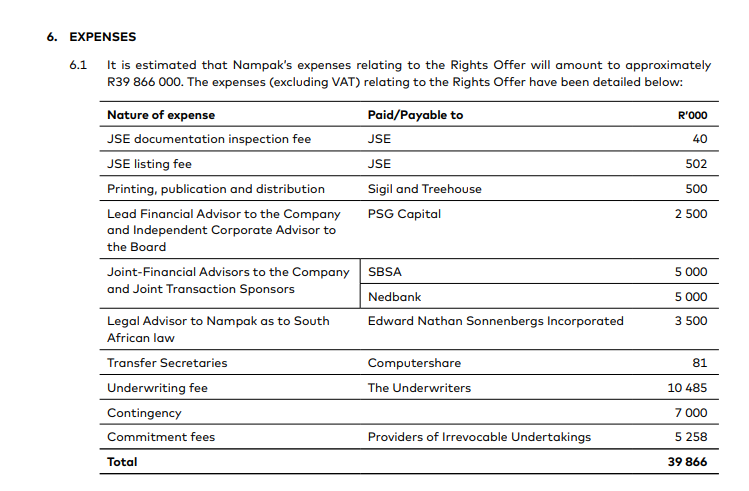

Nampak lays out the details of the rights offer (JSE: NPK)

The circular has been released to the market

In case you’ve been living under a rock, Nampak is in serious trouble. The company needs to raise R1 billion in equity to fix the balance sheet.

If you read the circular, you’ll find a section called “rationale” that lays the blame for the capital raise squarely at the door of the decision to expand into Africa in 2011. Between 2011 and 2014, Nampak invested heavily in Africa and funded that expansion in US dollars. You can refer to this article to see the comments by none other than Andre de Ruyter when he was CEO in 2014, talking about the vote of confidence in Africa.

Hindsight is perfect, of course. Many companies have learnt the hard way that even when the operations in Africa look good, funding those operations with US dollar debt is almost financial suicide. It’s extremely difficult to expatriate dollars from African countries to service that debt.

There were other issues, like the South African businesses coming under pressure as well. This was the tipping point for the group. Despite various management interventions, the company still operates in 10 countries on the continent and is thus highly exposed to volatile currencies that are often dependent on a single commodity.

With strong management having been appointed to restructuring positions, Nampak needs capital to sort out this spider web of pain and agony.

R1 billion is the target for the capital raise and R950 million is already in the bag. Commitments worth R500 million were received from major shareholders A2, Allan Gray, Old Mutual and PSG Asset Management. These shareholders will receive a 1% fee for the pleasure of having given a commitment. That’s what underwriters used to get paid when the JSE was an easier place to raise capital a few years ago!

Speaking of underwriters, R450 million has been underwritten by Coronation (R300 million), A2 (R100 million) and Numus (R50 million). The fee to each of those parties is 2.33%.

The cost of this capital raise comes in at nearly R40 million, or approximately 4% of the amount being raised. This includes the commitment and underwriting fees. Here’s how that amount gets used:

PPC announces another international executive as CEO (JSE: PPC)

The company loves tapping into global experience

I must say, I was highly impressed with PPC CEO Roland van Wijnen when he appeared on Unlock the Stock to talk about PPC’s strategy. His contract actually ended on 31 August 2023 but was extended to 31 December 2023.

Having an international executive join the group at such a difficult time worked out very well with van Wijnen, so PPC has clearly felt confident about doing it again. Matias Cardarelli has been named as the incoming CEO, having moved to South Africa five years ago to run Natal Portland Cement. That means that dealing with cement imports should be second nature to him, which is useful to PPC.

Cardarelli has worked in countries like Egypt, Paraguay and Mozambique as well. This bodes well for the next phase of leadership at PPC.

Sea Harvest takes you to foreign waters (JSE: SHG)

The international revenue mix is up to 45%

For the year ended June 2023, Sea Harvest grew revenue by 18%. That most interesting part of that story is that international revenue now contributes 45% of the total, up from 39% last year. This is because MG Kailis in Australia has been included for the full year, so the Aussie business is up by 94% in revenue. That didn’t translate into operating profit because of higher fixed expenses and selling and distribution costs, with operating profit of just R2 million vs. R4 million a year ago.

The operating profit trajectory wasn’t very exciting in South African fishing either, with revenue up by 10%, but profits up by just 1% to R238 million as margin dropped from 17% to 15% thanks to a jump in fuel costs and other inflationary pressures.

The best profit story was in the aquaculture segment, with revenue up by 11% and EBIT swinging wildly from a loss of R19 million to profit of R79 million. Before you get too excited, this segment made an operating loss of R16 million. The rest of the swing is primarily driven by a gain on purchased loans related to the Viking Aquaculture deal.

At Cape Harvest Foods, revenue increased by 9% but operating profit fell by 48%, not least of all because of the double digit increase in the milk price in cost of sales and R15 million in load shedding costs. Profit decreased from R55 million to R29 million.

So, it doesn’t exactly sound like a great story in the core business, yet HEPS is up by 19%. Headline earnings increased by 17% from R182 million to R213 million. The gain on purchased loans is R93 million, so the result would look a lot worse without that transaction.

The share price fell 4% on the day.

Little Bites:

- Director dealings:

- Des de Beer really opened up his wallet this time around, buying R10.7 million worth of shares in Lighthouse Properties (JSE: LTE). He’s also been giving Resilient (JSE: RES) some love, buying R545k worth of shares.

- A prescribed officer of Standard Bank (JSE: SBK) bought shares worth R97k.

- BHP Group (JSE: BHG) announced that the court in Brazil ratified the judicial reorganisation plan of Samarco, the entity owned 50-50 by BHP and Vale that was at the centre of a terrible dam disaster in 2015. This will allow Samarco to restructure its debt. Samarco is responsible for $1 billion of Renova Foundation remediation and compensation program costs until 2030, with BHP and Vale on the hook for any excess cash needed above that cap on a 50-50 basis.

- Orion Minerals (JSE: ORN) announced the expansion of the Okiep Copper Project after securing prospecting rights over the Nigramoep Mine and other nearby areas. This is key to the investment case, as the plan has been to consolidate several mining opportunities in the area under a central operational hub.

- Lighthouse Properties (JSE: LTE) announced the results of the scrip distribution. It looks as though holders of 56% of shares in issue elected the scrip alternative. The issue price ended up being just below R5.40 vs. the current traded price of R5.25.

- Oando (JSE: OAO) is acquiring 100% of Nigerian Agip Oil Company from Eni. No value for the deal was mentioned in the announcement.

- Peter Todd has resigned as CEO of Conduit Capital (JSE: CND) and will continue as CEO of the subsidiary companies that are being sold. Peter joined to try and steady the ship when Conduit imploded. The current Chairman, Leo Chou, takes over as CEO and lead independent director Melvyn Lubega is now the Chairman.

Hi. Please can you explain to us why Des de Beer keeps on buying Lighthouse? Thank you

I’d also like to know

I can’t say for sure as I don’t know him personally, but I think just building up offshore property exposure in a company that he is 100% familiar with. He also takes advantage of the scrip dividends to build his stake.

Thanks for that.

Do you think it’s a good share to buy?