African Rainbow Minerals reports higher earnings

Manganese and coal have been the winners

In a trading statement released on Wednesday, African Rainbow Minerals highlighted that headline earnings should be between 34% and 44% higher, with the manganese and coal operations as the major drivers here.

There were several asset impairments that led to a much lower increase in earnings per share (between 8% and 16%). This is a good example of one of the major differences between HEPS and EPS, as impairments are excluded from the former.

Not much fire at Brimstone

HEPS is down between 72% and 82%

Brimstone is an investment holding company, so I would’ve thought that net asset value per share would be a useful measure of performance. Nevertheless, the Brimstone trading statement focuses on earnings per share and reflects a drop in HEPS of between 72% and 82%. That’s not pretty.

There are several reasons for this, ranging from lower profitability at Sea Harvest through to higher finance costs. Detailed results are due on 7 March.

The Equites – Shoprite relationship continues

Good business is about partnerships, like this one

When it comes to being a strong tenant, it’s hard to fault Shoprite. The group is growing beautifully and has immense financial muscle. Equites Property Fund specialises in logistics properties and has a funding profile that suits this strategy, where Shoprite investors are looking for a different risk-return opportunity vs. a property fund.

The Equites-Shoprite relationship is interesting, as the parties seem to be able to do a variety of different types of deals. In the latest example, Equites is going to acquire an existing logistics campus from Shoprite for R560 million. There’s another R78.2 million changing hands for undeveloped land and costs already incurred by Shoprite as part of the development plan.

Over and above the R78.2 million, Equites expects to invest R344 million in extending the facilities.

These are long-term plays, with a 20-year lease with Shoprite and three additional 10-year lease renewal periods. The initial rental yield is 7.75% and the rental will escalate at 5% per annum. The initial yield is where I feel a little uneasy, as that seems to be on the low side in this environment.

Equites’ loan-to-value ratio will increase by 230 basis points due to this deal, which will be funded through a combination of undrawn debt facilities and capital recycled from property disposals.

Grindrod Shipping: which way will it go?

Supply – demand dynamics have swung sharply

In Textainer’s recent quarterly update, we saw a drop in fleet utilisation rates. 2022 was a record year for the container company and so the year-on-year story needs to be interpreted in that context. Still, demand for containers has cooled off.

With a quarterly update from Grindrod Shipping now available to us as well, we can see the same trend coming through. Revenue in the 4th quarter was only $81.4 million vs. $460.5 million for the full year, so that’s a big slowdown in the final quarter.

Gross profit is even worse, coming in at $23 million for the quarter. Over the preceding three quarters, total gross profit of $143.8 million had been generated. You don’t need to get the calculator out to figure that negative momentum out for yourself.

The company actually reported a loss in the fourth quarter of $4.6 million. Adjusted net income was $10.6 million though, with various non-recurring charges taken out. I would still be careful of putting too much importance on the adjusted number.

Instead, I would focus on this paragraph from the announcement:

When a cyclical business starts talking about reducing debt, having more flexible liquidity and optimising operations, you know that the good times are coming to an end.

So, would you go long or short this share price chart?

South32 looks forward to better margins

The first half of the year wasn’t a happy time

South32 has a very interesting commodity mix, which includes aluminium, copper, nickel, zinc-lead-silver, manganese ore and metallurgical coal. There are over 25 exploration prospects, so the group has plenty of options out there. The projects are also found in several continents, so South32 is a diversified resources play.

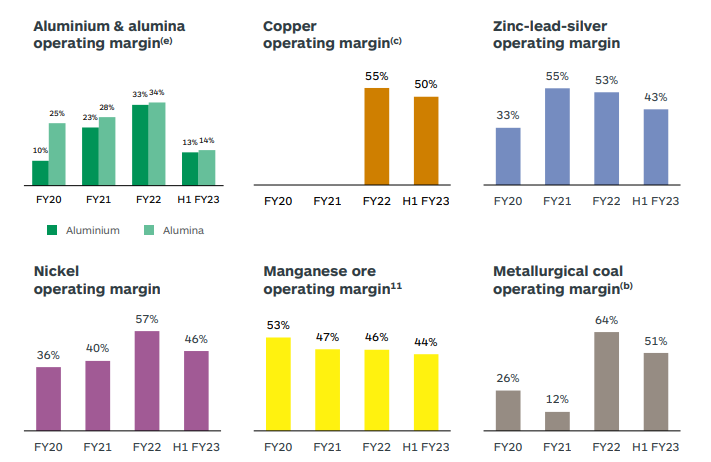

Metallurgical coal contributed 30% of EBITDA in the first half of the year. The next largest contributors were manganese ore (17%) and nickel and copper, both 13%. Margins have come under pressure across the various commodities, as shown by this excellent slide from the investor presentation:

The group highlights the reopening of China as underpinning a commodity price rebound to start the second half of the year. Operating margins are highly sensitive to the commodity prices of course, with South32 doing everything possible to manage what it can control (e.g. operating costs).

Full year guidance is unchanged and the company is still aiming to deliver production growth of 6% for the full year. This will help drive lower unit costs, which should improve margins.

For the first half of the year though, the margin pressure is biting. Revenue is down 8% and the ordinary dividend is down by a whopping 44% as HEPS has decreased by the same percentage.

Despite this, the share price is up 16% in the past year. Like Glencore, it’s been a solid performer through the pandemic.

Zeda is off to a cracking start as a listed company

Performance in the quarter ended December was strong

There are two really important things that you want to see as an investor: an increase in revenue and an expansion (or at least maintenance) of the EBITDA margin.

Zeda has achieved both these things in its inaugural quarter as a listed company, having been unbundled by Barloworld back in November. Revenue is up 24% and EBITDA is up 23%, so that’s really strong growth with EBITDA margin protected at around 38%, a juicy number in an of itself.

Zeda is primarily a car rental and fleet business and the holiday season is obviously critical for that model. Interestingly, this result was achieved despite an average utilisation rate for the quarter of only 70%. This was negatively impacted by the delivery of vehicles that Zeda had ordered ages ago, which is further evidence that supply chains have loosened up (refer to the Grindrod Shipping update).

An important element of the strategy is the mix between discretionary business (like travel) and contracted services (like insurance and monthly subscriptions), with the latter contributing 55% of revenue.

The optionality in this business lies in the opportunity to improve the utilisation rate, as revenue of the car rental business is ahead of pre-pandemic levels despite billed days only running at 68% of 2019 levels. They are targeting utilisation of 73% to 75% for the full year, which would deliver solid results.

The leasing business is a great revenue underpin for this group and is stable, with focus on the corporate business and value-added products.

On the used car side, both retail and wholesale sales recorded growth and margins were stable despite the supply of vehicles improving. Surprisingly, demand was strong in an environment of higher interest rates, inflation, fuel hikes and load shedding.

Little Bites:

- Director dealings:

- A director of Argent Industrial has acquired shares worth R750k.

- An associate of the company secretary of Stor-Age has acquired shares worth R550k.

- A director of Equites Property Fund has bought shares worth R106k.

- I haven’t included this under director dealings because I didn’t want to confuse you. Back in 2021, a director of Harmony Gold (at the time) casually sold R5.9 million worth of shares and didn’t get permission because of an “administrative oversight” – I have no idea what penalties or similar would be applicable in this case, but I hope something applies. If it doesn’t, then what is the point of even having these rules?

- AECI has appointed Holger Riemensperger as the group CEO. As you probably guessed from his name, Riemensperger is an international appointment who comes to the group with extensive experience across many regions.

I really enjoy your insights and thank you for them. Please note that the results of Textainer and GSH are not comparable as GSH does not operate in the container shipping market. GSH operates handy size dry bulk carriers. The index that measures the performance of bulk carriers is the BDI. You will note that this index shows long periods of stable but low earnings with occasional bursts of high earning activity. It answers your question would you go short or long on GSH!

Hi Mike! Thanks for the kind words. Interesting one to discuss – they aren’t the same for sure, but would you say there’s at least some read-through from what we’ve seen in both cases? Also interesting to note Zeda’s comments about supply chains easing up in vehicles and similar commentary out of Barloworld a day later re: lead times for supply chains.