Afrimat updates the market on Glenover (JSE: AFT)

Mining deals take a long time to implement

Afrimat’s acquisition of Glenover was first announced in December 2021. The deal structure was the purchase of certain assets and a right to mine select deposits at the Glenover mine, with the option to acquire 100% of the shares in Glenover Phosphate.

Of the total deal value of R550 million, R250 million was for the sale assets and R300 million for the option to buy the company.

The sale of assets was implemented in August 2022. Just a couple of months later in October 2022, Afrimat exercised the option to acquire the Glenover shares.

Although there are still a couple of conditions precedent for the share acquisition, including approval under the Mineral and Petroleum Resources Development Act (MPRDA), Afrimat has announced the negotiated payment profile for the R300 million.

The really interesting thing is that R150 million will be settled through the issuance of Afrimat shares based on the 30-day volume weighted average price. This issuance will take place in the next couple of weeks. Then, R147 million is payable in cash on 30 April 2024. This settles the claims against Glenover held by the current owner. In other words, this deals with the shareholder loans being bought by Afrimat.

The price of R3 million for the equity will be paid when the conditions are met.

Once the shares are issued in part settlement of the sale claims, Afrimat will enter into a contract mining agreement with Glenover that will entitle the company to commence mining of other minerals in addition to vermiculite. The benefit here is that Afrimat can start extracting economic value before the shares change hands, as the regulatory process can really drag on.

AngloGold reports a big year-on-year drop in profit (JSE: ANG)

A flat $ price doesn’t help when costs are going up

The conundrum with gold (and why I gave up on this sector) is that the gold price doesn’t automatically go up because of inflation, yet the costs to mine do. The gold price is far more intricate than that, impacted by all kinds of macroeconomic and geopolitical issues.

The latest quarterly update from AngloGold shows exactly how this plays out in practice. In the three months ended March 2023, the average gold price received per ounce was $1,895. This is almost identical to $1,881 in the three months to March 2022. Unfortunately, total cash costs per ounce increased by 14% in the subsidiaries and 28% in the joint ventures. Whichever way you cut it, that means a lot of pressure on margins.

Production issues seem to be part of the problem, primarily due to lower grades being mined. That doesn’t sound good. There are some good news stories at individual mines, but the overall story is clear to see.

For this reason (along with a higher cost of debt as well), profit before tax has dropped from $218 million to $92 million. I have to mention the cost of debt, as the company has borrowings of over $2.1 billion. Finance costs on borrowings increased by 12% year-on-year.

With cash from operations down by 82% and capital expenditure up 5%, it’s not like the cash situation is any prettier.

The recent gold price run has been driving the share price, but it is now moving lower again. The volatility you’ll see in this chart is exactly why I think gold stocks are for trading, not investing:

And against this tricky backdrop, the COO of AngloGold is retiring after 12 years with the company. An interim COO has been appointed and they are looking for a permanent replacement.

One step closer to the Rathbones deal (JSE: INL)

Investec’s deal has received approval from shareholders of Rathbones

If you’ve been staying up to date with news from Investec, you’ll know that the UK Wealth & Investment business is merging with Rathbones Group Plc to create a scale player that has a much better chance of successfully competing in that market.

Shareholders of Rathbones have approved the deal, so the remaining conditions relate to regulatory approvals. Completion of the deal is expected in Q3 / Q4 2023.

Is this Steinhoff’s final report as a listed company? (JSE: SNH)

Interim results have been released

With the WHOA Restructuring Plan approved by the Dutch courts, Steinhoff will now implement the transaction that will see it delist from the JSE once the various steps have been put in place. That might take longer than six months, so there may still be another financial report to come from the business.

It hardly matters, with the share price down at 6 cents. I’m tired of saying I told you so.

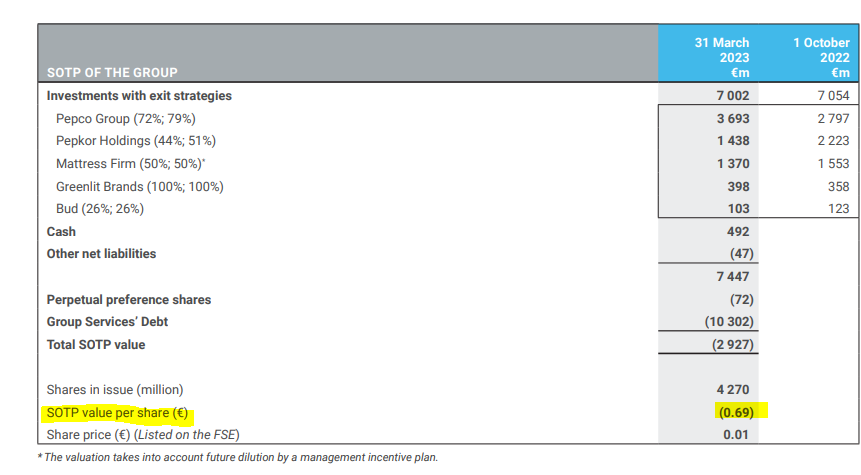

With net debt of €9.8 billion and a roll-up of interest that is higher than the rate at which the group could repay the debt, it’s not hard to see why Steinhoff has no value left for shareholders.

The restructuring process has been a gold mine for advisors, with advisory fees of €29 million in this period vs. €6 million in the comparable period.

The most interesting thing is that Steinhoff is now accounting for its investments under investment entity rules. Here is the sum of the parts calculation, showing just how severe the shortfall is vs. the debt balance:

For what it’s worth, the perpetual preference shares in this table are also listed under the ticker JSE: SHFF. They are up 8.6% this year. It makes all the difference knowing where you are playing in the capital stack.

Little Bites:

- Director dealings:

- The CEO of Bytes (JSE: BYI) sold £4.75 million worth of shares for estate planning purposes. That’s quite an estate, because this excludes the very valuable 1.18% stake that he still has in this R29 billion group.

- An associate of the risk director at Investec (JSE: INL) has sold shares worth £3.9 million.

- I’m not sure that it is causing too much of an overhang in the Vukile (JSE: VKE) share price, but strategic B-BBEE partner Encha Properties is about halfway through its plan to sell 5.5 million to 6.0 million shares as part of settling upcoming commitments to Investec Bank.

- AEEI (JSE: AEE) has released updated pro-forma financials dealing with the effect of unbundling AYO Technology (JSE: AYO). If for some reason you hold shares here, refer to the full announcement for the impact as it is way too detailed to repeat here. In summary, the headline loss would drop from 34.49 cents to 1.13 cents per share.