Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Alexander Forbes grew earnings sharply (JSE: AFH)

Despite this, the share price ended flat for the day

Alexander Forbes has released a trading statement for the six months ended September. It makes for attracting reading, with operating profit up by between 5% and 15%. The continuing operations benefitted from various factors, not least of all higher investment income driven by interest rates.

There are several other reasons for this year-on-year move, including once-offs in the base. Either way, HEPS from continuing operations is up by between 55% and 7%%, while group HEPS is up by between 85% and 105%.

For the interim period, group HEPS is expected to be between 26.1 and 28.9 cents. The share price is R6.00 and the market must’ve seen this coming, as it ended the day flat.

Altron achieved a meaningful increase in HEPS (JSE: AEL)

Is the “ugly duckling” of the Bytes spin-off turning the corner?

The Altron share price closed 6% higher on Monday in response to results for the six months to August. They came out early in the morning, as the company wanted the market to spend the day digesting and discussing them.

This is because the numbers are solid, with revenue up 11% and EBITDA up 26% if we exclude the ATM Business. Before you get worried about this adjustment, it makes sense as that business was sold with effect from 1 July 2023.

Operating profit improved by 25% and HEPS increased by 19% to 50 cents a share. The interim dividend jumped 56% to 25 cents per share, as the payout ratio increased from 40% to 50% of HEPS from continuing operations.

The blemish on the result is that EPS was flat, impacted by an impairment on Altron Nexus that is equivalent to 9 cents a share. That business is classified as a discontinued operation. The impairment refers to the restructuring that was necessitated by the loss of a major contract in Gauteng and the exposure to the City of Tshwane.

There are a number of highlights within the group, one of which must be 26% subscriber growth at Netstar. Enterprise customers grew by 13% and the consumer side was up 8%. They have a really fun stat in the announcement:

“At the end of the financial year 2023, Netstar was fitting one car every four minutes, Netstar now fits four cars every one minute.”

There are various other businesses in the group, which is half the problem. This is a classic case of a value unlock strategy that included the spin-off of Bytes, which has turned out to be exceptional for those who held onto it. Perhaps Altron is finally ready to reward shareholders as well!

Ethos Capital Partners won’t make more investements (JSE: EPE)

Shareholders are clearly tired of the discount to NAV

Ethos Capital Partners is expected to update the market on its NAV after Brait releases results on 15 November. Even if you knew nothing else about this company, this already tells you that you’re dealing with a multi-layer listed structure. This only ever means one thing: large discounts to NAV.

The board of Ethos has been engaging with large shareholders and the message was clear: focus on the existing 22 portfolio companies and realising value from them. No new fund commitments or investments are to be made.

Is this the start of the classic value unlock strategy, where management is lauded for trying to claw back some of the value that was lost? A 7.2% rally in the share price suggests that it just might be.

Harmony in tune with the market (JSE: HAR)

An 8% rally was the happy outcome of this update

Harmony released an operational update for the three months to September and the market clearly liked it. Gold production was up 17% and gold revenue jumped by 33%. Together with a drop in all-in sustaining costs of 7%, this created a ridiculous 278% increase in group operating free cash flow.

Net debt to EBITDA is now zero. Zero. Thanks to a seriously impressive performance, not least of all from the Hidden Valley mine in Papua New Guinea, the company managed to get rid of its debt.

It’s also worth highlighting that silver production was 35% higher and uranium production was up 50%. Major initiatives are in progress to bring copper into the mix as well.

The share price is up a rather glorious 48% this year!

Premier improved margins in this period (JSE: SHP)

It’s unusual to see a company this relaxed about load shedding

Brait spent a very long time dressing Premier up for listing. Liquidity is fairly light at the moment despite the R7.7 billion market cap, with the share price roughly flat since it debuted on the market (having given shareholders a scare to the downside along the way).

The business itself is doing very nicely, with revenue up 7.1% in the six months to September. EBITDA is up 23.9% and normalised HEPS has increased by 25.4%.

HEPS as reported is only up 0.8% because the prior period included foreign exchange moves and a once-off tax adjustment.

Interestingly, the company believes that load shedding was “only” a R17 million impact on EBITDA of R1 billion. Group EBITDA margin expanded by 150 basis points despite that challenge, thanks to Millbake (EBITDA up 27.3%) rather than Groceries and International (EBITDA down 4% because of issues in Mozambique).

As a further note on Millbake, that division’s revenue growth of 8.1% was thanks entirely to price and mix, with overall volumes flat. This period included some price relief to consumers due to softer commodity prices. There are still many other inflationary factors, like fuel prices and the rand.

Voluntary debt repayments of R357 million were made during the period.

Strategically, it’s interesting to note the acquisition of a 35% stake in UK-based niche skin care treatment range Science of Skin.

In terms of outlook, revenue growth is expected to moderate because of slowing inflation in soft commodities, driving an expected increase of low single digits in revenue for the second half of the year. The company believes that it can maintain the first-half margins. With less debt on the balance sheet, there’s also a boost to net profit from a reduction in finance costs.

Life after Beitbridge still looks good at Raubex (JSE: SHP)

Despite the completion of that project in the prior period, earnings have powered forward

For the six months to August, Raubex grew revenue by 14.5% and HEPS by 19.4%. That’s particularly impressive when you remember that the company cautioned shareholders that the flagship Beitbridge Border Post Project was completed in the year ended February. There were other reasons why they felt that the full-year was a bumper period.

But despite this, earnings for the first half of the new financial year are clearly very strong. The cash looks good too, with cash generated from operations up by 23.6%. The interim dividend has increased by 18.7% to 63 cents per share.

If you dig deeper, the Materials Handling and Mining Division was the star performer, with a 56.3% growth rate in revenue and an improvement in operating margin from 8.5% to 10.9%. Substantial improvement in the operations of recently acquired Bauba Resources seems to be the main driver here. Performance in the other two divisions of the group wasn’t fantastic, so be careful in extrapolating this result.

Shoprite is still hammering the competition (JSE: SHP)

But this has already been priced in, which is why I don’t hold the stock

At its AGM, Shoprite gave shareholders an update on trading conditions for the first quarter. The group marches on, with a whopping 13.3% growth rate in Supermarkets RSA during a period of inflation of 8.3%. This means substantial growth in volumes, with market share for the 52 weeks to September up by 124 basis points according to the company.

Shoprite has now achieved uninterrupted market share gains for 55 months.

Load shedding has been better recently, but the quarter to September still saw an incremental increase of R90 million in diesel costs vs. the comparative period.

Store growth in this part of the group continues, with a net 42 stores opened during the quarter. This includes eight Petshop Science, two UNIQ and two Checkers Outdoor stores. If you wondered why Wooloworths acquired Absolute Pets, perhaps the Shoprite strategy gives you a clue.

The numbers look good in the other segments as well, for the most part at least. Supermarkets non-RSA grew 9.7% as reported or double digits in constant currency. Store growth is minimal in that part of the business. In Furniture, sales were up by just 0.5% as consumers buckled under current pressures. Other operating segments grew 22.2%, with OK Franchise doing particularly well.

Overall, group sales for the quarter grew 13.2%. It’s another mega result, yet the share price closed 1.3% lower. This tells you just how much is priced in.

Vodacom shows why I still don’t like telecoms (JSE: VOD)

Organic growth is pedestrian

Vodacom fell 4% on Monday after releasing results for the six months to September. Vodafone Egypt is in these numbers, which means you need to be careful of things like a 35.5% increase in revenue, as this company now contributes 24.1% of Vodacom group revenue. The “pro-forma” numbers exclude the impact of that acquisition, showing revenue growth of 7.9% and EBITDA growth of 5.5%.

HEPS is where the rubber still hits the road, particularly when an acquisition is paid for with shares. Although the Vodafone Egypt earnings are now in Vodacom, there are many more shares in issue as a result. HEPS fell by 4.2% in this period.

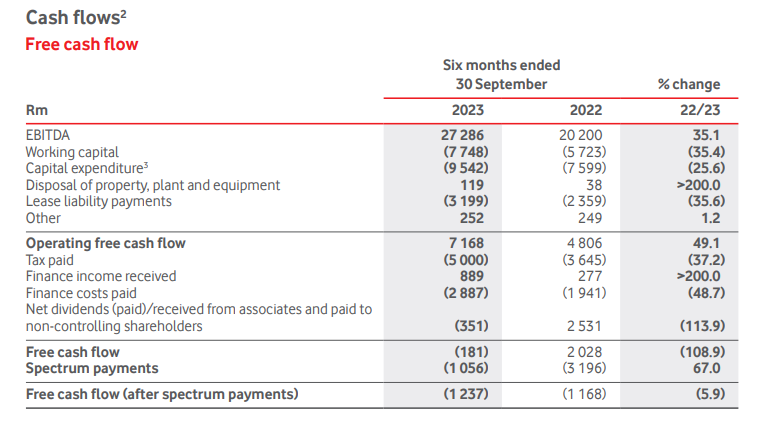

The interim dividend per share is even worse, down 10.3%. Perhaps this free cash flow table will explain why there’s less to go around for Vodacom shareholders:

I am not a fan of this sector at the moment at anything higher than a very cheap valuation. The growth story is primarily in Africa (particularly in ancillary areas such as financial services, which contributed 5.6% of Vodafone Egypt’s service revenue) and the macroeconomic situation with currencies is just too difficult, even in East Africa where Vodacom has really staked its claim.

The share price is down 17% this year.

Zeda defies debt skeptics and rallies 14.5% on earnings news (JSE: ZZD)

These are impressive numbers

There have been experienced voices in the market who have been skeptical about Zeda and the balance sheet. I was less worried, having written on the company in Financial Mail back in June (you can read it here if you’re a subscriber). Spot was R10.19, my target was R14.00 and the current price is R12.40. On the whole, I felt that the company would manage to do well despite the debt.

It’s nice to occasionally get one right, with Zeda releasing a trading statement for the year ended September that the market loved. Although we don’t have full details yet, we know that revenue growth is over 10% and EBITDA growth is over 15%. Operating profit margins were sustained.

Although net finance costs did indeed jump sharply by over 60%, a net positive tax benefit vs. last year helped mitigate that impact. I’m certainly not going to suggest that I saw the tax benefit coming, but either way HEPS was up by between 15% and 20% and the jump in EBITDA was the primary driver of that gain.

Net debt as at the end of September is R5.1 billion, with the unbundling legacy debt having been fully settled. This bodes very well for the coming year.

HEPS is between 373.4 cents and 389.6 cents, which suggests a Price/Earnings multiple of roughly 3.3x at the mid-point.

Little Bites:

- Director dealings:

- A director of Vunani (JSE: VUN) sold shares worth R2.5 million in an off-market deal.

- A number of Hyprop (JSE: HYP) directors chose the dividend reinvestment alternative, with a total value of nearly R800k split across several directors.

- Des de Beer is back! He bought shares in Lighthouse Properties (JSE: LTE) worth R662k.

- The CEO of British American Tobacco (JSE: BTI) reinvested dividend income in shares worth £5.9k.

- An associate of a director of Wesizwe Platinum (JSE: WEZ) has sold yet more shares, this time worth R35.6k.

- The Chairman of Sasol (JSE: SOL), Sipho Nkosi, has stepped down with a cautious approach to perceived conflicts of interest based on his business interests. This is of course the correct approach at that level. Current lead independent director Stephen Westwell will fill the role on a temporary basis.

- Hudaco (JSE: HDC) announced that 85% held subsidiary Hudaco Trading has entered into a lease with Dufomo Investments in respect of its Ambro Steel division. The CEO of Hudaco is an 82% shareholder in Dufomo. This is therefore a related party transaction, but Ambro has been renting the same building for over 29 years so this is nothing new. This is a small related party deal, which means it can go ahead provided an independent expert opines that the deal is fair. Merchantec Capital was appointed as expert and has given the green light.

- Kibo Energy (JSE: KBO) subsidiary Mast Energy Developments really is bending over backwards for its new joint venture partner, extending the payment date of the initial sum by the new partner yet again. The blame is on administrative and international banking transfer delays. I really do hope they get the money, or it will be terribly embarrassing.

- Bytes Technology Group (JSE: BYI) has confirmed the exchange rate applicable to the interim dividend. A gross dividend of R0.6173591 per share will be paid to local shareholders.

- In case you love staring at tables of numbers, AngloGold (JSE: ANG) has released gold production tables for the third quarter. This is a supplement to the previously announced numbers. Check out the SENS announcement if for some reason you want to read tables and tables of numbers with no commentary.