Alexander Forbes shows the benefit of its strategy (JSE: AFH)

Growth in HEPS from continuing operations is encouraging

Alexander Forbes has been a group on a mission to execute major strategic changes. Aside from the sale of the life insurance business, the group also sold the client administration business to Sanlam Life.

The correct measure to assess performance is thus HEPS from continuing operations, as it splits out the gain on sale of the businesses and the improved performance in discontinued operations for the portion of the year for which they were held. Continuing operations, as the name suggests, are what the shareholders will be exposed to going forward.

On that measure, HEPS increased by between 20% and 25% for the year ended March 2023. Things have definitely improved at this company, with the share price up roughly 20% in the past year.

Bytes reports impressive numbers (JSE: BYI)

Demand for the group’s services remains strong

Cybersecurity. Cloud. Hybrid datacentres. These are high-growth service offerings and Bytes has all of them, which is why revenue increased by 26.5% in the year ended February 2023. I feel compelled to point out that this is growth in British pounds, a real currency.

Although gross margin came down from 73.7% to 70.3%, we can all agree that this is still a pretty juicy margin. Operating profit increased by 20.6%, a similar percentage increase to gross profit. Operating profit margin was 27.6%.

HEPS increased by 23% and the dividend nearly followed suit.

Strategically, bolt-on acquisitions are clearly still in play here, with a 25.1% investment in AWS partner Cloud Bridge Technologies. This is a business that has worked with Bytes for a long time, which is always encouraging when you see deals like these.

I remain a happy Bytes shareholder.

Coronation has troubles beyond the tax (JSE: CML)

Outflows of 5% of average AUM are not helpful to shareholders

With R623 billion under management, Coronation is absolutely enormous. It hasn’t been a good period for the company, with the jokes writing themselves about the “Trust is Earned” slogan in light of major fights with SARS and a huge tax bill.

That fight is ongoing, with Coronation having applied for the right to appeal the ruling of the Supreme Court of Appeal in the Constitutional Court. It’s a worthwhile exercise, as the tax bill is a cool R716 million. This was the major driver of HEPS being obliterated by 97% to just 6.2 cents in the interim period.

There’s a potential sting in the tail though, with SARS lodging a cross-appeal to the Constitutional Court to appeal the Supreme Court of Appeal decision to dismiss the penalties. The tax problem could get worse rather than better!

Even without SARS, there are reasons to be concerned about these results. Although closing assets under management (AUM) increased by 9%, outflows were 5% of average AUM and that reflects the lack of ability for many South Africans to meaningfully save and invest.

Worryingly, the 11% increase in fixed expenses was impacted by the weakening of the rand, with Coronation clearly having many technology expenses that are denominated in dollars or at least linked to the currency.

Between the outflows and the increase in costs, Coronation seems to be getting squeezed by macroeconomic issues that go a lot further than just the value of the equity markets. Profit before tax fell by 8% year-on-year and that obviously excludes the huge SARS problem.

As a closing comment, I must note that the entire SARS expense (excluding a potential further issue related to penalties) has been recognised in the interim period. In other words, although interim earnings have been crushed, the second half of the year should see a normalised profit performance and so the impact on the full year numbers will be a lot less severe than the impact on the interim numbers.

Datatec has discovered “adjusted EBITDA” (JSE: DTC)

The scourge of this reporting style continues

Another soldier has fallen. Datatec has been reading earnings reports from international peers and has decided that adjusted EBITDA is the way forward.

And guess what? The adjusted numbers look better than the reported numbers. Isn’t that a massive surprise?

Continuing adjusted EBITDA margin was 3.5% for the year ended February 2023, identical to the prior year. Continuing EBITDA margin as reported properly actually fell from 3.2% to 1.9%. We shouldn’t let this minor inconvenience ruin everyone’s snacks after the results presentation.

I don’t actually mind when the adjustments relate to genuine once-off costs, like restructuring costs. I mind a lot when they involve share-based payments. Tech companies love falling into the trap of paying staff big chunks of their bonuses in shares rather than cash, proudly showing a strong adjusted EBITDA number when in reality, shareholders are constantly being diluted.

Adjusted EBITDA is generally like Pringles – once management teams start, they just can’t stop.

If we lift our heads to the overall performance, continuing revenue grew by 13.1% and continuing gross profit grew by only 2%, so the margin pressures are clear and dollar strength in the first half was the major culprit. Continuing EBITDA fell by 31.5%.

With Analysys Mason having been sold, the remaining businesses are Westcon International, Logicalis International and Logicalis Latin America. EBITDA decreased across the board.

The share price closed 5.9% higher, so clearly reporting all these adjusted numbers has worked.

HCI flags a substantial jump in earnings (JSE: HCI)

Another 5% jump in the share price takes the year-to-date increase to nearly 33%

It’s been a tough year for South Africa and many investors, yet your money would be smiling back at you if it had been invested in Hosken Consolidated Investments (HCI) shares at the beginning of the year.

To back up the juicy share price gains, a trading statement for the year ended March reflects expected growth in HEPS of between 50.2% and 60.2%. With so many different businesses in the stable, investors will look forward to digging into the group company updates to see what the key drivers were.

Indluplace shows decent growth in income (JSE: ILU)

There is no dividend at this stage while the scheme of arrangement is in progress

You may recall that Indluplace is the target of an acquisition by SA Corporate Real Estate (JSE: SAC), with one of the terms being that no dividend is payable on the interim profits at this stage. Instead, Indluplace would pay a clean-out dividend prior to the scheme being implemented. I’ve seen this called a “clean price” in the property sector before, designed to ensure that current shareholders get their dividend in a process that has uncertain timing.

Excluding interest on loans earned from participants of the Indluplace share purchase and option scheme, distributable income has grown by 7.3% year-on-year for the six months to March.

Will MultiChoice shareholders be alright this year? (JSE: MCG)

With the business under pressure, MultiChoice held a capital markets day

Eskom isn’t doing MultiChoice any favours whatsoever, with load shedding making it increasingly difficult for families to justify a monthly spend on entertainment on TV. This also has a negative impact on advertising, something that eMedia Holdings (JSE: EMH) has consistently flagged in periods of bad load shedding. And of top of all of this, MultiChoice’s customer base has discovered the joy of streaming instead.

Without a doubt, Eskom cannot be blamed for all of MultiChoice’s challenges. Every time I see an advert on Facebook for DSTV, the comments section is filled with people begging for a SuperSport-only bouquet. I currently pay MultiChoice absolutely nothing. I would love to pay them a couple of hundred bucks a month for sport.

MultiChoice’s strategy is to look beyond South Africa’s borders. The focus is on Africa, with the company also seeking out major global partners. In my view, the biggest strength is the regional content, which is a genuine competitive advantage against the likes of Netflix. I would also caution that Netflix is equally focused on creating regional content, so MultiChoice doesn’t operate in a competitive vacuum even in that space.

Another competitive advantage held by MultiChoice is the ability to receive payments across Africa. That sounds so silly if you’ve never run a business that receives payments, but there are around 200 payment partner integrations and receiving money in Africa isn’t as easy as you might think. Of course, the problem lies in getting the money back from the African subsidiaries to group level.

MultiChoice is responding to growth in access to broadband on the continent by putting in place key streaming partnerships, like the recently announced deal to partner with Comcast on Showmax. It will be Showmax powered by Peacock, the streaming technology that underpins Comcast’s streaming offering. MultiChoice will own 70% in that business and perhaps the most important element is the access to Comcast’s content like English Premier League football and HBO.

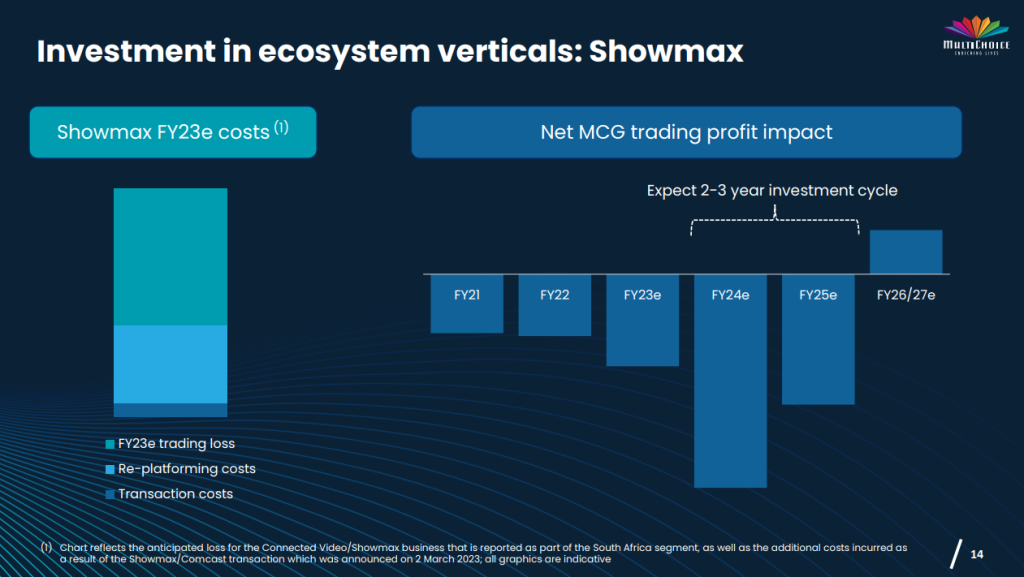

In case you think streaming will be good news for MultiChoice’s profits in the next two years, think again:

Another strategic driver that possibly makes sense is sports betting, an obvious opportunity alongside SuperSport. Will that be the catalyst for a sports-only bouquet? I wouldn’t bet on it just yet.

It gets patchy after that, with other initiatives like FinTech and Home Services. Yes friends, DSTV Internet is coming. If you can’t beat ’em, join ’em?

The Rest of Africa business is on track for trading profit breakeven in FY23. That’s a nice way of saying it would be profitable without forex headwinds. Sadly, those headwinds tend to be a feature of doing business in Africa.

Finally, for Phuthuma Nathi shareholders, the good news is that MultiChoice will need a lot of capital at group level and the biggest source of that cash flow by far is MultiChoice South Africa. Phuthuma Nathi holds shares alongside MultiChoice in MultiChoice South Africa, so the movement of cash to group level for investment purposes means that Phuthuma Nathi gets its slice of the pie.

Of course, this makes it even more important for MultiChoice to look after the South African business properly. I’ll say it again for employees reading this: give us a SuperSport bouquet! My money is waiting.

Zeda is growing HEPS, albeit only slightly (JSE: ZZD)

The traded multiple is looking very modest at this stage

Mobility business Zeda was unbundled by Barloworld (JSE: BAW) in December. It’s been one-way traffic since then unfortunately, with the share price down nearly 40% since initial trade.

When you consider earnings drivers like growth in leasing and an increase in inbound and corporate travel, it’s not obvious why the company is trading at such a light multiple. The results are seasonal in line with what you might expect, with HEPS for the year ended September 2022 of 325 cents vs. HEPS for the six months to March 2022 of 182.3 cents. You therefore can’t just double the interim guidance to work out a forward Price/Earnings (P/E) multiple on this stock.

But with Zeda closing at R10.14, the P/E is just 3.1x on the full-year numbers. The guidance for HEPS for the six months to March 2023 is between 187.8 and 191.4 cents, representing growth of 3% to 5%. Although that is modest growth, it still makes Zeda sound cheap at this price point.

Is the market missing a trick here?

Little Bites:

- Director dealings:

- A director of Gemfields (JSE: GML) locked in the gain on share options, selling shares worth R8.1 million that were acquired at a discount of up to 35% on the current market price.

- The CFO of Discovery Life (a subsidiary of Discovery – JSE: DSY) has sold shares worth R201k.

- GMB Liquidity continues to live up to its name, with the new CEO of Grand Parade Investments (JSE: GPL) mopping up another R172k worth of shares via his investment vehicle.

- The CEO of Spear REIT (JSE: SEA) has bought more shares for his kids and family worth nearly R72k.

- A director of Sea Harvest Group (JSE: SHG) has acquired shares worth over R46k.

- Value Capital Partners has reduced its stake in Novus Holdings (JSE: NVS) to 6.42%. The stake was over 10% previously.

- Orion Minerals (JSE: ORN) has issued a large number of shares in line with previous announcements. Other than to directors and managers, as well as Tembo Capital as repayment of a convertible loan, the latest issuance includes the first tranche of the capital raising activities that bring Clover Alloys (SA) onto the register as a strategic partner.

This is a typical example of retail investors taking the brunt of Corporate Action. An opportunistic offer by SAC to acquire the entire properties portfolio at a discounted price of 51% of NAV (659,83c). Fairvest inherited a +56% shareholding in Indluplace properties with the merger of Arrowhead. Fairvest is not worried about the lost that will be incurred by the retail investors who bought Indluplace as an income stream.

This company was over geared by bad management decisions and the impact of rent reversion due to COVID. Instead of getting rid of non-performing buildings to sure up their balance sheet they are opting to accept this ridiculous scheme of arrangement.

The retail investors have no chance of voting against this proposed offer as Fairvest, Management(trusts) and Old Mutual hold the bulk of the shares. This is a travesty of justice for the retail investors!

The property sector is a mess to be honest. Basically if SAC just gently winds the thing down and sells all the properties, it’s roughly a 100% return on investment! Easier said than done to execute that, obviously. Also depends on whether you believe the NAV.

In an interview on “RSA Geldsake”, Indluplace CEO admitted that Fairvest is not interested in holding these shares and just wants to dispose of these non-core assets. This decision is extremely detrimental to retail investors who will incur huge losses. These dissenting shareholders have little recourse in a court application (Section 115 [3a & 3b] of Companies Act) as this would be too costly.

The disposal of these shares could have been dealt with in a far better manner by uptake by existing shareholders.