Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

e>

The cash is raining down at Alexander Forbes (JSE: AFH)

Management is rewarding shareholders with fat dividends

Alexander Forbes has released results for the year ended March 2024. The last couple of years have been intense for the group, with major corporate activity to reshape the group into a more desirable financial services operation.

The acquisitions have a significant impact on the growth rates in income and expenses, as the group has effectively bought earnings. They’ve acquired six businesses in the past three years, with OUTvest and TSA Administration highlighted by the group as performing well. It’s hard to get every acquisition right, with an impairment recognised for EBS International.

Operating income increased by 12% overall (including acquisitions, while operating expenses jumped by 16%. The cost-to-income ratio has moved from 77.4% to 79.5%, which isn’t entirely unexpected in a period with corporate activity and related integration expenses. Alexander Forbes will look to reduce this over time.

The growth in expenses obviously blunted the benefit of top-line growth, with profit from operations up just 2%. Cash generated from operations was flat during the prior year.

HEPS tells a different story though, driven by an uptick in investment income. This led to HEPS from continuing operations increasing by 16% and normalised HEPS up by 31%. This would’ve driven the decision to not just increase the total annual dividend by 19% to 50 cents per share, but to add on a special dividend of 60 cents per share as well. On the current share price of R6.88 at time of writing, that’s a meaty return of cash to shareholders.

More than just Lucky Stars at Oceana (JSE: OCE)

HEPS is up dramatically in the latest period

Oceana has reported numbers for the six months to March and they look excellent. Revenue increased by 12.1% and this set the tone for the rest of the income statement, with operating profit up 57.1% and HEPS up 84.6%. The interim dividend is up by a juicy 50%.

It wasn’t just Lucky Star that did well here, although their second quarter benefitted from improved canned food sales volumes. Daybrook in the US was the star of the show, with record earnings. They had strong inventory levels coming into this period and this allowed them to take advantage of record prices for fish oil.

And of course, the weaker rand made the translation of those US-based earnings even more appealing.

Thanks to the stronger pricing in the market, gross margin from continuing operations was up 700 basis points to 34.1%. Although there were some offsetting factors like lower wild caught volumes and the impact on margins, this was clearly a great period.

The substantial jump in profits relative to revenue was achieved through overheads only increasing by 3.5% in continuing operations. This is the joy of operating leverage when it works with you, rather than against you.

The loss from joint ventures and associates of R25 million was mainly due to the Westbank Fishing operation, which was in its off-season for most of this period. That didn’t dampen the overall group earnings party.

The bigger negative in the result was the wild caught seafood business, which saw operating profit fall substantially from R108 million to R17 million. The business suffered various operational issues that plagued the results.

The finance costs line bucked the broader trend in the market and decreased by R3 million to R93 million. This also did wonders for the HEPS jump relative to the revenue increase. Net debt ended the period 16.7% lower and the net debt to EBITDA ratio improved from 1.6 times to 1.2 times.

The group is investing in future growth. Cash from operations was up 12.6%, giving the group confidence to ramp up capital expenditure by 44.9% to R297 million. R132 million of this was to upgrade the West Coast plants and the rest of the capex was replacement in nature.

And here’s an interesting one: Lucky Star is acquiring a 75% stake in a canned chicken liver business in Graaff-Reinet that supplies school feeding schemes in the Eastern Cape and Gauteng. This is interesting diversification.

Oceana will be presenting on Unlock the Stock on 13th June at midday. You can register to attend this online event for free at this link.

Omnia feels confident to pay a much higher dividend (JSE: OMN)

This is despite a decline in earnings

At first blush, it hasn’t been a good year for Omnia. Revenue fell 16% for the year ended March 2024 and operating profit was down 10%. Adjusted HEPS was roughly flat at 737 cents.

This isn’t the typical precursor to a dividend increase of 87%, yet here we are.

As you might have guessed based on that percentage increase, there’s a special dividend for this period. It comes in at 325 cents vs. the ordinary dividend of 375 cents. Management is feeling a lot more confident about the outlook, notwithstanding the recent results. I’m sure a 15% decrease in net working capital helped with the cash flow outlook.

It’s important to look at the segmental performance in a diversified group like Omnia. Starting with agriculture (excluding Zimbabwe), revenue fell by 22% and operating profit decreased by 21%. This means the operating margin increased every so slightly. South Africa had decent sales volumes, so the worst pressure was felt in Africa. They are reviewing their business models in the region in response to these challenges.

Moving on to mining, revenue fell by 3% but operating profit increased by 26%. This means that operating margin expanded significantly. They managed to grow volumes in a difficult market in South Africa, but it seems like the international operations delivered the big uptick in this segment. Markets like Canada, Indonesia and West Africa are key here.

In the chemicals segment, revenue was down 23% and operating profit collapsed by 92% to just R11 million, so this was a disastrous outcome with operating margin of just 0.5%. It sounds like just about everything went wrong in the local market, with macroeconomic conditions giving them plenty of headaches.

The fight with SARS regarding the 2014 to 2016 years of assessment is ongoing, with the Alternative Dispute Resolution (ADR) proceedings underway. Other avenues may be possible if needed, like court adjudication.

So, it was a rather odd year in which the mining division did the heavy lifting. The special dividend will be seen as a positive outlook for the group, with the share price up 11% by late afternoon trade in response.

RCL Foods publishes Rainbow’s pre-listing statement (JSE: RCL)

And to help shareholders further, there’s an independent research report

The Rainbow Chicken business isn’t new to investors, as it has been part of RCL Foods throughout. This means that the market is already fairly familiar with Rainbow. Of course, with the pre-listing statement now published as part of the plan to unbundle the business to shareholders, there’s more public information than ever before on Rainbow.

With 165 farms, there are a lot of chickens at Rainbow. The group is dividend into three segments though: chicken (self-explanatory), animal feed and Matzonox (a waste-to-value operation based at the Chicken division’s Worcester and Rustenburg chicken processing sites which processes wastewater from chicken processing plants and poultry manure from chicken farms to generate electricity, heat and recycled water). Talk about vertical integration.

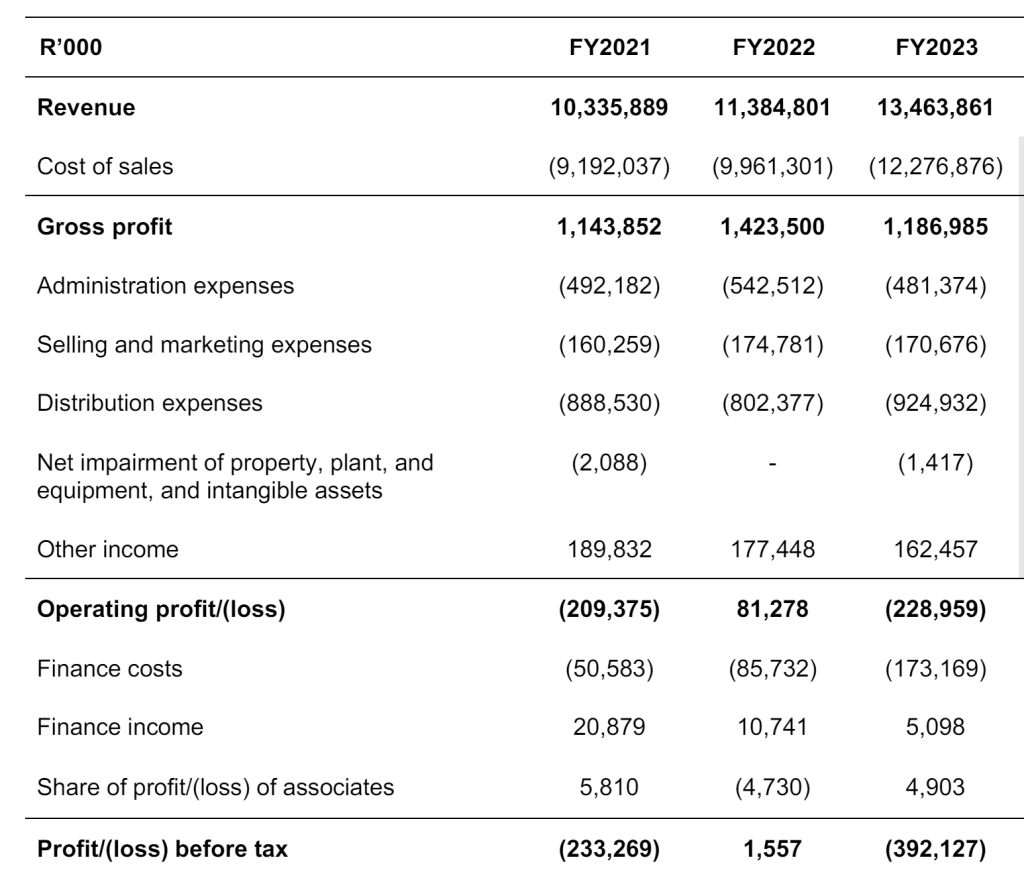

This excerpt from the pre-listing statement gives you a good idea of how volatile this industry can be, especially with all the craziness over the past few years of avian flu, load shedding and wild macroeconomic swings:

If you want steady profitability, the chicken business isn’t for you. If you enjoy opportunities that require a more active approach to managing the position, then this sector might appeal.

The independent research report will only be published on 11th June, the day after the pre-listing statement. In the meantime, you can read the pre-listing statement here.

Little Bites:

- Director dealings:

- MTN (JSE: MTN) made a pretty bad mistake in its SENS announcement last week. I must say, I was surprised to see the announcement of a director of a major subsidiary buying over R4 million worth of shares. That surprise was warranted in the end, as he actually sold the shares rather than purchased them.

- Finbond (JSE: FGL) announced that Protea Asset Management, managed by director Sean Riskowitz, bought shares worth R1.7 million.

- Two directors of OUTsurance (JSE: OUT) have acquired shares worth a total of R1.09 million.

- The CEO of Capital Appreciation (JSE: CTA) has purchased R900k worth of shares on the market. This is a positive signal after the recent release of excellent numbers.

- A director of Hyprop (JSE: HYP) bought shares worth R374k.

- Exemplar REITail (JSE: EXP) announced the acquisition of Eerste Rivier Mall in Stellenbosch, marking its first steps into the Western Cape. The purchase price is R282 million.

- Primeserv (JSE: PMV) released a trading statement for the year ended March 2024. There’s a juicy jump in HEPS of between 31% and 41%, coming in at between 30.70 cents and 33.10 cents. On a share price of R1.39 at time of writing, this low single digit Price/Earnings multiple is typical of what we see on small caps.

- There has been decent uptake of the Equites Property Fund (JSE: EQU) dividend reinvestment alternative, with holders of 65.91% of shares in issue electing to reinvest their dividends in the shares at R12 per share. This helps with retaining equity on the balance sheet and many property funds take this approach.

- Labat Africa (JSE: LAB) is currently suspended from trading and in the process of appointing new auditors. The business continues regardless. It takes on new meaning when they say that the “group is continuing to grow” as Labat is focused on medical cannabis. Retail division CannAfrica has opened more than 20 franchises in the past year.

- Visual International (JSE: VIS) announced that the proposed related party acquisition of a 20% stake in Tuin Huis has been cancelled due to weak performance in the residential property sector in the past year. The acquisition of the Stellandale Gardens land has also been pushed out until after February 2025 to allow the company to focus on Stellandale Junction.

- Powerfleet (JSE: PWR) is certainly playing the listed game, announcing that the company will be joining the small-cap Russell 2000 Index with effect from 1 July when the index is reconstituted. Being included in an index is helpful not just for visibility, but for ETFs and unit trusts who have a specific mandate related to that index. This does good things for liquidity in the stock. The much more exotic part of the announcement is Powerfleet calling itself an “artificial intelligence of things (AIoT) software-as-a-service (SaaS) provider” – a wonderful example of buzzword bingo. To drive that message home, the stock ticker for the Nasdaq listing will change to AIOT. It doesn’t look like the JSE listing ticker will change.

- Oasis Crescent Property Fund (JSE: OAO) is unusual for a few reasons, not least of all the lack of debt in the fund to meet Shari’ah requirements. One of the other nuances is that the default for the recent distribution was for shareholders to reinvest the distribution in the fund. Investors have to specifically elect to receive cash. Unitholders of 95.5% of units in the fund elected to receive cash, so maybe they should give the default a rethink.

- Efora Energy (JSE: EEL), which is suspended from trading, is in the process of catching up on its financial reporting. We know this because the company released a trading statement for the six months to August 2023. I have no idea why suspended companies need to release trading statements, as you can’t trade in the stock anyway and an early warning of major movements isn’t necessary. They should just release results once finalised.

- If you hold preference shares in Ibex Investment Holdings (JSE: IBX), then check out the finalisation announcement related to the scheme to repurchase the shares. Their listing will be terminated on 25 June.