Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

At Alphamin, Mpama South is working as planned (JSE: APH)

Production to sales specification has been underway for two weeks now

Alphamin announced that Mpama South has been producing tin concentrate to sales specification since 14 May, so that means two weeks with no hiccups. Even more importantly, the tin grade of the feed ore was increased from 17 May, with the focus on consistent throughput and producing in line with the targeted recoveries for the processing plant.

The good news for shareholders is that the facility is doing what it is supposed to do: operating at targeted levels of processing recoveries and is producing high grade concentrate to sales specification.

Barloworld signs off on a tough period and renews the cautionary announcement (JSE: BAW)

A group with cyclical exposures can’t always go up

Barloworld has released results for the six months to March 2024. Although revenue fell by 7.7%, the highlight is that EBITDA margin was steady at 12.9%. It’s unusual to see margins stay consistent when revenue has fallen.

The consistency goes all the way down to HEPS which also fell by 8% for the period. This is despite finance costs moving 13.4% higher for the period. One of the key offsetting benefits was a much lower effective tax rate after restructuring the domicile of the equipment businesses. The share of profit from associates and joint ventures came in 22.4% higher and this also boosted HEPS.

You might assume that the same is true for the dividend, but the surprising outcome is that the interim dividend is 5% higher at 210 cents per share. This tells you that the balance sheet is in good shape, with net debt to EBITDA at 0.6x (giving plenty of headroom vs. covenants of 3x).

Return on invested capital (ROIC) was in line with the prior period at 14.3%.

As you might guess, the consistency in group level results isn’t because the underlying divisions were all in line with the prior year. In a diversified group like this, there will be good years and bad years at divisional level, with the hope being that the group result is smoother over time than the underlying divisional numbers. In this period, Barloworld Mongolia was the standout performance with a 43% revenue increase, whereas VT in Russia reported a drop of 24%. Between those extremes, we find Equipment Southern Africa with a drop of 10% and Ingrain with a decrease of 3%.

EBITDA movements at divisional level were more volatile than what we saw at revenue level, which is to be expected when a business has fixed costs. Equipment Mongolia led the way with an EBITDA jump of 78.8% and EBITDA margin of 24.7%. Disappointingly, Ingrain put in the worst EBITDA performance despite the modest dip in revenue, with EBITDA down 19.6% as margin contracted from 14.1% to 11.7%. Equipment Southern Africa saw EBITDA decrease by 8.5% and VT was down 16.1%.

For further context, Equipment Southern Africa is the largest EBITDA contributor at R1.4 billion. Barloworld Mongolia is next up at R479 million, followed by VT at R417 million and Ingrain at R372 million.

In a separate announcement, Barloworld renewed the cautionary announcement that was first issued on 15 April. They haven’t indicated what the potential opportunity on the table is. We don’t even know if they are looking to acquire or dispose of something in these discussions.

Collins Property isn’t shy of debt (JSE: CPP)

You won’t often see a target loan-to-value this high – but what’s the catch?

Collins Property Group is officially a REIT and they aren’t wasting any time in getting those dividends out the door, with a dividend for the year of 90 cents based on distributable income per share of 94 cents.

Of course, REITs are supposed to have very high payout ratios. That’s kind of the whole point of being a REIT. It’s easier said than done though, with many of them tripping up when debt is high.

There are no such issues at Collins it seems, despite a very high loan-to-value ratio of 54.3%. The target range is 45% to 55%. Total debt on the balance sheet comes in at R6.3 billion, with various banks lending to the group.

With bank covenants for a 55% loan-to-value as the maximum, Collins is sailing close to the wind and feeling just fine about it. Generally speaking, companies in the Wiese stable aren’t shy of taking a financial risk or two.

Note: an earlier version of this article noted a large outstanding balance of preference shares held by Christo Wiese’s Titan entity. I misread R1.3 million as R1.3 billion. My apologies for this. The loan-to-value ratio information was correct in the original article.

Datatec reports a massive jump in earnings (JSE: DTC)

This is what happens when a low margin EBITDA business goes the right way

In Datatec’s results for the year ended February 2024, you’ll find a 6.1% increase in revenue. That may not sound like much, until you see the 15.8% increase in gross profit and excellent 80.7% jump in EBITDA. The EBITDA increased from 1.9% to 3.3% and there’s an important lesson here about earnings volatility in low margin businesses. It takes just a small change further up the income statement (like a shift in gross margin) to drive big moves in EBITDA.

If you can believe it, the gross margin was 15.8% and the increase in gross profit was also 15.8%. At first I thought it was a typo in the SENS announcement!

The company announces various measures of earnings per share, not least of all because of Analysys Mason as a discontinued operation in the comparable year. The best measure is probably continuing underlying earnings per share, as this has the minimal level of distortion. Even then, it increased by 231.1% to 20.2 US cents!

The dividend was lower this year though, coming in at 130 cents vs. 195 cents in the prior period (a 33.3% drop).

Looking deeper, Westcon International is the largest contributor with EBITDA of $121 million, up by 150% thanks to significant improvement in gross margin. Logicalis International saw its EBITDA increase by 31.7% to $66.5 million, once again thanks to improved gross margin. Logicalis Latin America wasn’t so fortunate, with gross margin increasing but not enough to offset foreign exchange losses in Argentina that led to a drop in EBITDA from $21.2 million to $11.5 million.

In terms of prospects, the company highlights the opportunity of AI driving a new cycle of computing hardware investment. I’m hearing this more and more in the market and it certainly makes sense to me.

At Exemplar, the bankers are smiling more than shareholders (JSE: EXP)

Despite strong growth in net operating income, the distribution per share has dipped

Exemplar’s portfolio is rather unusual in the modern South African context, in that it has absolutely no exposure to the Western Cape. The fund has 26 retail assets across five provinces with a particular focus on malls that service township areas. 86% of tenants are national and international tenants, or those with rental guarantees, featuring many large retailers who want to service lower income consumers who represent a high growth opportunity. If you’re building out a property portfolio, this is a good example of how you can diversify vs. many funds that are focused on properties in premium urban areas.

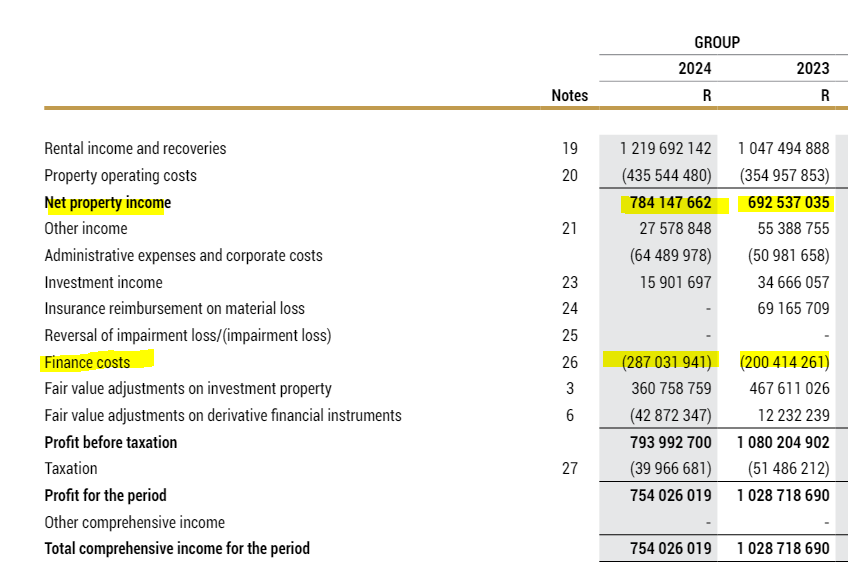

Despite a 16.4% increase in rental and recovery income, as well as a 13.2% increase in net property income, the total distribution per share for the year ended February 2024 fell by 1.5%.

The culprit? You guessed it: finance costs. They increased from R200 million to R287 million, completely offsetting the increase in net property income. This is what it looks like when you’re working hard so your bankers can have a better life:

Mantengu Mining is profitable (JSE: MTU)

The share price closed 32% higher on strong volumes (for a small cap)

Mantengu Mining released results for the year ended February 2024. This is the first year-end in production for the group, so the year-on-year movements look a bit silly (e.g. revenue up from R4.5 million to R109.9 million).

It’s probably better to just look at the results in isolation as opposed to comparing them to the prior year. Gross profit came in at R52.6 million and operating profit was R24.9 million. HEPS came in at R0.01 per share – positive by the smallest of margins. Even then, these results don’t tell much of the story, as there were only two months of steady state production at Langpan.

Aside from the a full production period at Langpan for FY25, the future looks interesting with the recent acquisition of 100% of Birca Copper and Metals that approximately doubles the existing chrome ore supply at Mantengu.

Be careful of the wide bid-offer spread in this stock, with the best bid currently at R1.07 and the best offer at R1.57. The share price closed 32% higher at R1.03 on strong volumes of roughly 8x the average trading volume.

The Ackermans get out the way at Pick n Pay (JSE: PIK)

The financials are in disarray and the turnaround will be extremely tough

Pick n Pay has released results for the 52 weeks to 25 February. They reflect revenue growth of 5.4%, which is pretty poor, along with a particularly revolting decline in gross profit margin from 19.6% to 18.1%.

Trading profit collapsed from just over R3 billion to only R385 million, with a paltry trading profit margin of 0.3%. It only gets worse from there of course, with a loss after tax of nearly R3.2 billion. A vast increase in finance costs to just over R700 million was a major contributor here, along with impairments of R2.8 billion. The impairments are a non-cash item. The same cannot be said for the finance costs.

Unsurprisingly, there’s no dividend. This is what happens when the headline loss per share is -254.72 cents.

Net debt ballooned to R6.1 billion at the end of February vs. R3.7 billion the year before. What’s that old story about gradually and then suddenly?

Silver linings? Well, Boxer grew revenue 17.3% and they will need to get the market to pay a decent price for those shares when Boxer is set free from this mess, so that’s good news. Pick n Pay Clothing standlone stores were up 17%, a strong result that might bring some hope to the broken grocery business.

The SENS announcement claims that experienced leadership has re-energised the supermarkets business. I can hand on heart say that my last visit to a Pick n Pay was many things, but energetic wasn’t one of them. I’ve heard that some stores look much better, but it’s the inconsistency in the footprint that makes Pick n Pay so hard to believe in. Although like-for-like sales growth for the first 12 weeks of the year is up vs. FY24, that’s hardly saying much. They are in a different postal code to Shoprite these days in terms of in-store execution. Just ask your friends where they shop.

Part of the turnaround is to either close 100 loss-making supermarkets or convert them to Pick n Pay franchise or Boxer stores. I somehow doubt that franchisees will be queuing around the block for these.

Pick n Pay has a huge mountain to climb here and they will probably only have one shot at raising the equity capital required to get it right. People have a limit to how willing they are to throw good money after bad.

The big news at the top is that Gareth Ackerman is stepping down as chairman, getting out of the way after being there for a period of time during which Pick n Pay’s core supermarkets business was left for dead by Shoprite. In even bigger news, the Ackerman Family has agreed to let go of majority shareholder voting control. The SENS announcement puts a positive spin on this, calling it a vote of confidence in the current management team. Somehow, I suspect the boardroom discussions weren’t quite that simple.

Ackerman Investment Holdings will follow its rights in the recapitalisation up to a maximum of R1.025 billion. The offer is R4 billion in equity, with three banks (Absa, RMB and Standard Bank) coming in as underwriters in equal proportions. I can’t help but wonder just how exposed those banks are to Pick n Pay. At this point at least, perhaps it hurts less to underwrite the equity raise than to face facts around the debt.

Speaking of the debt, the R4 billion in equity will primarily be used to repay group debt. If they don’t achieve a proper turnaround quickly, the debt hole will be back before you know it.

Remember when property funds invested in Edcon to try and save a sinking ship? The jury is still out on Pick n Pay, but you would be incredibly naïve to think that Shoprite won’t try and deliver the death blow here. Pick n Pay better pray night and day that load shedding doesn’t come back after elections, as I think an environment devoid of load shedding is the best chance they have to emerge in a sustainable (albeit smaller) form.

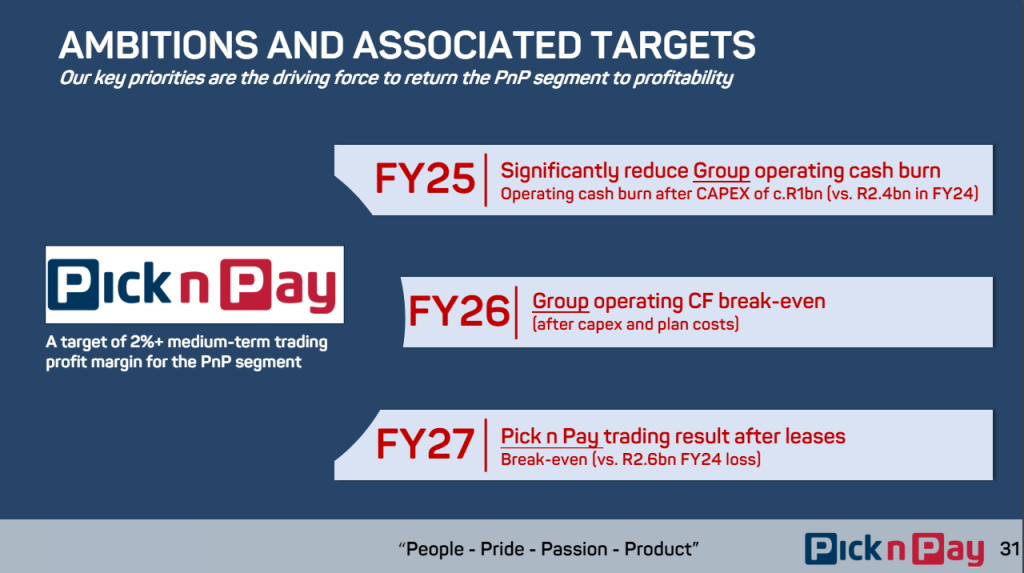

Just take a look at how difficult this will be, based on this slide from the strategic turnaround presentation:

RH Bophelo grew its NAV by 19% this year (JSE: RHB)

They have moved through the R1 billion NAV mark

RH Bophelo is an investment holding company in the healthcare sector. The group now boasts a net asset value (NAV) of over R1 billion after growing NAV by 19%. NAV per share is now R15.99 and the share price is only R2.25, so the market clearly has a very different view on what the NAV is.

They do make some rather odd investments, like 29% in Ambit Health (a pathology company) for just over R1 million. How does this move the dial on a R1 billion NAV? Or even influence the dial?

If you can believe it, that was the biggest of three new investments in this period. Like I said, odd. The market doesn’t reward investment holding companies with vast portfolios of small investments. If they want to close the gap between the share price and NAV per share, this isn’t the way to do it.

The road ahead won’t be easy at Tiger Brands (JSE: TBS)

Income from associates saved the growth as core operations went sideways

Tiger Brands is under new management, with a new CEO and CFO in place as well as managing directors for the six business units in the group. The new brooms need to sweep clean, as Tiger Brands is currently trading at levels that we also saw in 2011. There have been some encouraging rallies in the past year, but the price just can’t seem to sustainably break higher:

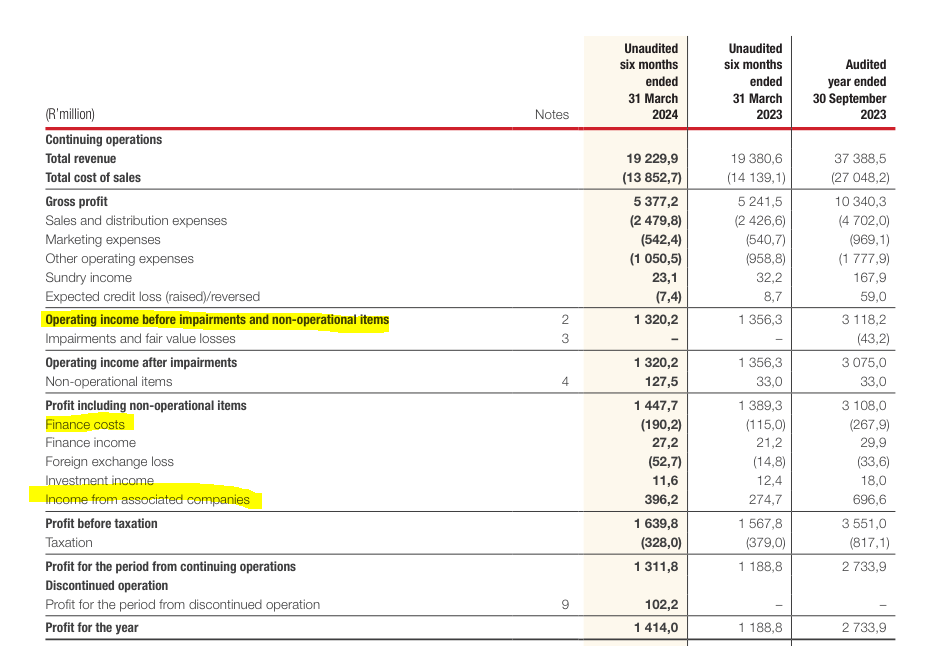

The results for the six months to March 2024 show why this might be the case, with revenue decreasing by 1%. Volumes fell by 9% and price inflation came in at 8%, with the loss in volumes being a deliberate strategy in some cases to improve pricing.

Group operating income fell by 3%, so the top half of the income statement clearly isn’t telling a positive story.

Finance costs also moved significantly higher, so the numbers at headline earnings level would’ve been pretty rough were it not for income from associated companies (Carozzi and National Foods in particular) that shot up from R274 million to R396 million.

I’ve included a screenshot of the income statement below to show you the shape of the financials and how it was the associates that came in right at the bottom to save the trajectory of profit before tax:

HEPS may have been up by 11% thanks to the associates, but not a cent in dividends was received from them in this interim period. In the context of such difficulties in the core businesses, as well as the levels of debt and associated finance costs, I therefore found it surprising that the interim dividend increased 9% to 350 cents per share.

Little Bites:

- Director dealings:

- A director of a major subsidiary of RFG (JSE: RFG) sold shares worth R248k and an associate of a director of the same major subsidiary sold shares worth just over R3 million.

- The CEO of Quantum Foods (JSE: QFH) was willing to increase the price for a share purchase to R10.00 per share, with the value of the purchase being R354k.

- Associates of the CEO and CFO of Spear REIT (JSE: SEA) bought shares in the company with a total value of R234k.

- Not quite the standard type of update in this section, but a few non-executive directors of Orion Minerals (JSE: ORN) have elected to receive a portion of accrued director fees in shares in lieu of cash. This helps to preserve the company’s cash reserves.

- MTN Uganda is one of the better African subsidiaries in the MTN (JSE: MTN) stable. MTN is taking advantage of the recent positive momentum by selling down a portion of the stake while the going is good. A substantial 7.03% stake in the company is being made available for sale to retail and professional investors, thereby broadening local ownership and unlocking value on the MTN balance sheet.

- AYO Technology (JSE: AYO) released an updated circular dealing with the specific repurchase from the PIC. The independent expert has valued AYO’s shares at between R4.94 and R5.04. The repurchase is at R36 per share, so that’s clearly unfair to all other shareholders. The post-transaction fair value range is R3.30 to R3.40. The funny thing is that the current share price is R0.50, which is actually way below that fair value range. If you’re curious to read more, the circular is here.

- Gemfields (JSE: GML) confirmed that the currency conversion rate for the final dividend for the 2024 financial year equates to a dividend of R0.1574624 per share, payable on 24th June.

- Equites Property Fund (JSE: EQU) announced the dividend reinvestment price as being R12 per share, which is a 1.34% discount to the spot price per share on Friday 24th May, adjusted for the pending dividend. That’s not much of a discount to encourage investors to reinvest their dividends in the company.

- In the incredibly unlikely event that you are a shareholder in Cafca Limited (JSE: CAC), you should note that the company has released results for the six months to March 2024. They are in Zimbabwean Dollars, so prepare yourself for some truly gigantic numbers. I also couldn’t get their website to work, unfortunately.

Two lines from Pick ‘n Pay’s short form announcement:

– Implementation of CEO Sean Summers strategic plan is underway, with encouraging early results

– January 2024 launch of CEO Sean Summers’ strategic plan to return the Group’s Pick n Pay business to profitability.

Nick Badninton, Richard Brasher and Pieter Boone all had plans too.

The Board needs to own the plan