Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Anglo American’s Q4 production met expectations (JSE: AGL)

Thank goodness for Quellaveco and Minas-Rio

At mothership Anglo American, there are loads of moving parts that come together to deliver a group result. These range from how listed subsidiaries like Amplats and Kumba Iron Ore are performing (see both further down) through to how the South American mines are doing. Of course, De Beers is also a factor here.

It’s not hard to see why capital allocators are ignoring South Africa. Kumba had to slow down production because Transnet is so useless, whereas the Minas-Rio mine delivered its highest quarterly volume of premium high grade iron ore.

Notably, diamond production fell by 3%, but this was due to Venetia (in South Africa) transitioning to underground operations. Production from Botswana picked up as diamond prices started to improve, but rough diamond sales volumes in the quarter were still way down year-on-year.

On the copper side, production was down 6% due to lower grades and harder ore at Los Bronces in Chile, partially offset by higher production at Quellaveco in Peru.

On a full-year basis, production volumes were up 2% across all commodities. That’s not the most useful statistic though, as there are so many underlying commodities that have vastly different values.

HEPS plummeted at Anglo American Platinum (JSE: AMS)

PGMs have been having a torrid time

Anglo American Platinum released a trading statement for the year ended December 2023. HEPS will decrease by between 67% and 77%, so that’s a rather revolting year.

There’s not much that the company can do when the US$ PGM basket price fell 35%. Although the average rand/dollar exchange rate weakened by 13% and gave a small amount of relief here, it was nowhere near enough. A 2% increase in sales volumes was also woefully inadequate in saving the situation.

On top of all of this, the company has had to contend with inflationary pressures on costs.

The share price has lost 42% of its value in the past 12 months.

In a separate announcement dealing with the fourth quarter production results, guidance for 2024 was given for production (3.3 – 3.7 million ounces) and cash operating unit costs of R16,500 – R17,500 per PGM ounce. For reference, the basket price per PGM ounce was R26,111 this quarter.

ArcelorMittal signs off on an ugly financial year (JSE: ACL)

The wind down of the Longs steel product operations has been deferred

The year ended December 2023 is one that ArcelorMittal will want to forget. Although revenue increased by 2.1%, EBITDA absolutely collapsed – down 98.7%. There’s debt on the balance sheet as well, so the losses by the bottom of the income statement are eye-watering. After making headline earnings of R2.6 billion in 2022, the company swung into a headline loss of R1.89 billion in 2023.

Net borrowings increased by 14.5% to R3.2 billion and the net asset value was slashed by 33% to R7.8 billion. It’s just hideous wherever you look.

Between poor local and Chinese demand for steel and higher energy costs, things were always going to be tough. Add in the local logistics failures and a ban on scrap steel exports (thereby increasing competition with steel manufacturers using scrap rather than iron ore as inputs) and you had a recipe for disaster.

After much consultation with government, ArcelorMittal has deferred the wind down of the Longs steel business for up to six months. A clear warning shot has been fired by the company, with substantial negative impact if the wind down goes ahead. Much depends on improvements at Transnet, so I wouldn’t hold my breath.

In the outlook sector, the company notes that the current low steel prices are unlikely to remain the case going forward as global manufacturers are under pressure. Ultimately, demand in China will also play a huge role in how the market performs in 2024.

Here’s another chart for the mountain biking enthusiasts among you:

British American Tobacco achieved profitability in New Categories (JSE: BTI)

The market seemed to like these numbers

For the year ended December 2023, British American Tobacco grew revenue by 3.1% on a constant currency basis. The reported number was down 1.3% though. The big story was in New Categories, which grew revenue by 21% and finally achieved profitability – two years ahead of schedule! Revenue from non-combustibles is now 16.5% of group revenue.

The company is aiming for the non-combustibles business to be over 50% of revenue by 2035.

On the combustibles side, revenue was up just 0.6% in constant currency. Price and mix benefits were 6.1%, so that tells you how volumes dropped off. British American Tobacco literally relies on being able to put price increases through on an ever-shrinking base of smokers, all while achieving great ESG scores. In fact, the company is proud to announce that the 2023 MSCI ESG rating was upgraded from BBB to A, achieving targets for water and waste. You can tell how much faith I have in the ESG industry.

The company recognised a gigantic impairment in its US business (£27.3 billion – and take careful note of the currency there). Without that, adjusted profit from operations was up 3.9% in constant currency and margin expanded 40 basis points to 45.6%.

As is the British American Tobacco brand promise to investors, operating cash flow conversion was 100%. This helped bring net debt to adjusted EBITDA down to 2.6x and drove a 2.0% increase in the dividend.

In terms of outlook, pressures in the US (for various reasons) will impact 2024. with global tobacco industry volume expected to be down 3%. Thereafter, revenue should grow at 3% to 5%, which is all that South African investors want to see here. The only reason to buy British American Tobacco is to get a modestly growing hard currency dividend.

Oh, and to meet ESG investment requirements. I forgot.

15% of Curro’s schools are performing below expectations (JSE: COH)

This isn’t the report card that investors want to see

Curro is one of the best examples around of the exuberance on the JSE in the 2015 – 2017 period. Property companies were booming at around the same time, with Curro offering a hybrid of a real estate portfolio and the dream of filling those schools with a rising middle class over time.

Here’s how that chart panned out:

High growth expectations are dangerous in any company. As you can see, Curro shareholders were brought sharply down to earth by the realities of South Africa. Those realities are still kicking in, with the year ended December 2023 revealing that 28 of the 182 schools achieved lower than expected growth over the past two years, leading to impairments.

Impairments are non-cash charges that are excluded from HEPS but included in EPS. They are calculated with reference to the return on capital that the schools should be providing. Although it doesn’t help that Curro’s weighted average cost of capital moved from 14.5% in 2022 to 15.6% in 2023, the bigger issue is growth in the middle class in South Africa and Curro’s appeal to the people who have stayed behind in this country. The impairment for the year is between R340 million and R380 million.

The good news is that recurring HEPS moved firmly in the right direction, up between 26.3% and 37.2%. Dividends are considered based on recurring HEPS, so that’s the number to really focus on.

As a reminder of how important timing is when it comes to single stock exposure, look how different the 12-month chart looks to the longer term picture:

Impala Platinum lays bare the damage to HEPS (JSE: IMP)

The PGM sector is where dreams went to die in the past year

Impala Platinum has issued a further trading statement for the six months ended December. Nobody took the first one seriously anyway, which had the minimum required disclosure of HEPS differing by at least 20% to the prior period. Even a very quick calculation revealed a far worse scenario.

Sure enough, the company has issued a further trading statement that reflects HEPS down by between 76% and 82%. Although sales volumes were 12% higher from the interim consolidation of Impala Bafokeng and better operational performance, dollar revenue per 6E ounce sold fell by 37%.

A Q1 update at the KAL Group AGM (JSE: KAL)

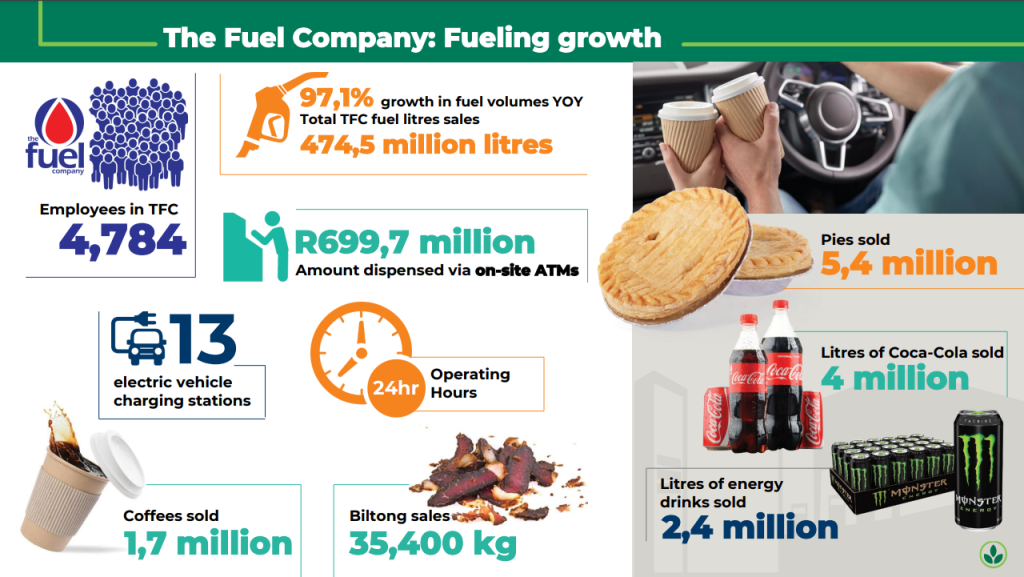

Fun fact: the group sold 2.4 million litres of energy drinks in 2023 – and 5.4 million pies!

In an incredibly fun presentation, KAL Group included slides like this absolute winner about forecourts business The Fuel Company:

These statistics don’t really mean anything to investors of course, but they make for interesting reading. I also found it quite fun to note that the retail outlets sold 6,400 tonnes of dog food and only 309 tonnes of cat food. Y’all need more cats out in the platteland!

The AGM deals with the full year 2023 numbers which were already known to the market. Recurring HEPS had increased 7.2% for the year and the dividend per share was 7.1% higher, so it was a solid performance.

The company used the AGM to give an update on the first quarter of the 2024 financial year, reflecting revenue growth of just 3.4% and deflation of 1.0%. You won’t see that every day! Recurring headline earnings per share is only up 5.7% for the quarter, which is a good reminder that retailers actually quite like a bit of inflation. It’s also worth highlighting that group fuel sales are down 0.8%, perhaps speaking to overall economic activity and consumers cutting back in general.

At Kumba, the Transnet issue is just getting worse (JSE: KIO)

This is the real State of the Nation – and there are no jets to make us feel better

Kumba Iron Ore has announced its production and sales report for the fourth quarter, as well as a trading statement for the year ended December 2023. Thanks to higher iron ore export prices and a weaker range, HEPS will be between 18% and 31% higher for the year. This is a lucky escape when you read about the underlying logistical challenges. We can only dream about what might have been for the company if the infrastructure was working.

Although there was a maintenance shutdown in October that obviously impacts this statistic, the decrease in ore railed to Saldanha Bay Port of 19% in Q4 2023 vs. Q3 2023 is just another example of the far bigger problems around our rail infrastructure. For the full year, ore railed improved by just 1.6% even though the base period included industrial action at Transnet.

In response to on-mine stockpiles that were far too high, production in Q4 2023 was 26% lower than in Q3 2023. Despite a 5% drop in full year production, full year unit costs actually improved to $41 per tonne, below revised guidance of $42 per tonne thanks to rand currency weakness and cost savings. They pulled off a proper performance here despite infrastructure letting them down.

Due to the extensive stockpiles, sales increased by 5% vs. Q3. Iron ore prices were higher in the fourth quarter, so this was a good time for sales to pick up. The problem is that the stockpiles are mainly at the mines rather than the Saldanha Bay Port, so there’s not much of a buffer to keep sales ticking over even when production dips.

Guidance for 2024 to 2026 has been revised to 35 – 37 Mtpa, with expected unit costs of $38 – $40 per tonne. This is the best that the company believes it can do in the context of the current Transnet rail issues, which aren’t expected to be resolved over the medium term.

Mondi has confirmed that it is sniffing around DS Smith (JSE: MNP)

Consolidation is a feature of tough industries

Mondi has announced that it is in the “early stages” of considering a merger with DS Smith, which would take the form of a share-for-share deal. The thesis here is that this would create an industry leader in European paper-based sustainable packaging solutions.

You only needed to read the Sappi results earlier this week to see how tough the paper and packaging sector can be. Consolidation makes sense in difficult industries.

If this deal were to go ahead, it would have benefits like vertical integration, enhanced security of paper supply, economies of scale (bigger businesses can sometimes be more profitable in terms of ratios) and complementary positions in products in the market.

At this point there is no guarantee that Mondi will make an offer. The company has until 5pm on 7 March 2024 to either announce a firm intention to make an offer or to confirm that it will not make an offer. This is how the UK takeover laws work.

MultiChoice settles with the Nigerian tax authorities (JSE: MCG)

South Africa vs. Nigeria is a common theme this week

Much like Bafana Bafana, a few local corporates haven’t had a happy time at the hands of Nigerians. One such example is MultiChoice, which has agreed to pay the Nigerian tax authorities a substantial $37.3 million in full and final settlement of all matters in dispute.

Interestingly, the announcement notes that this payment is offset against security deposits and “good faith payments” made to date.

Little Bites:

- Director dealings:

- The CEO of Invicta (JSE: IVT) bought shares worth R335k.

- A non-executive director of Collins Property Group (JSE: CPP) bought shares worth R138k.

- Jubilee Metals (JSE: JBL) updated the market on the progress made in the copper metals portfolio in Zambia. The goal is to reach 25,000 tonnes of copper per annum and they have a few projects underway. Aside from an unavoidable delay or two, the underlying narrative is positive.

- ISA Holdings (JSE: ISA) released a trading statement noting that HEPS is expected to increase by at least 20% for the year ending February 2024. This is the minimum level of disclosure permitted by the JSE, so the difference could technically be a lot more. We won’t know until results come out.

Entertaining