Anglo American: news from the mothership

Copper, steelmaking coal and diamonds dominate the highlights reel

The Anglo companies release quarterly updates at the same time, so you’ll find news on Anglo American as well as Amplats and Kumba in Ghost Bites today. Anglo American sits at the top of the group structure, so it is impacted by the results of Amplats and Kumba as well as its own extensive operations.

The ramp-up of the Quellaveco copper mine in Peru is important news, increasing copper production by 52%. Other good news came from rough diamonds and steelmaking coal (both up 6%), with iron ore up by 4% despite challenges in Kumba. PGMS were 10% lower and nickel fell by 4%.

Over the full year, pricing for diamonds and steelmaking coal was significantly higher than the prior year. Pricing across the rest of the commodity basket was lower.

There is substantial progress being made in renewable energy, like 100% renewable energy supply for the Australian operations from 2025. In January, the transaction to combine First Mode and nuGen was completed, accelerating the development and commercialisation of the zero emissions haulage system that has generated much interest in the market.

Anglo American Platinum production drops 10%

Eskom is only partly to blame

The good news is that Anglo American Platinum’s (Amplats’) guidance for 2023 is unchanged. The bad news is that 2022 ended off with a quarter that was plagued with production issues, though the market response to this update was muted, so those issues were largely known by the market.

Total PGM production dropped by 10% year-on-year.

The mines managed by Amplats fell by 12% due to a combination of lower grades at some mines and an infrastructure closure at another. Due to the delay in the Polokwane smelter rebuild because of sub-standard materials being delivered to the company, refined PGM production fell by 37%. PGM sales volumes fell by 31%, driven by lower refined production.

The rebuild was completed at the end of the quarter and ramp-up was achieved by the end of January, so the first quarter of 2023 should look better. There has been a significant build up of work-in-progress inventory due to the delay in the smelter rebuild and the impact of load shedding.

At jointly-owned operations, production was flat year-on-year.

The share price is down nearly 30% over the past 12 months.

Production nosedived at Kumba thanks to Transnet

Will we ever stop scoring own-goals?

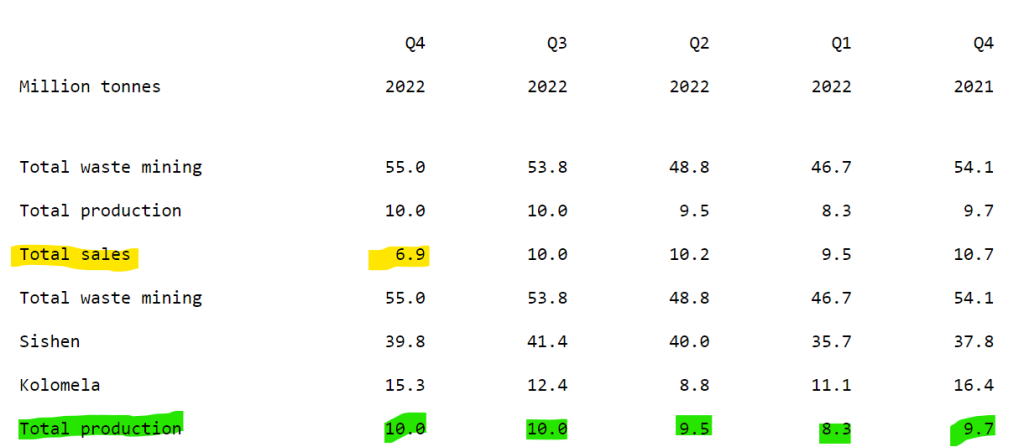

The green highlighted row deals with total production, which is relatively within Kumba’s control (subject to usual mining risks). The yellow deals with total sales, which is where Kumba becomes reliant on dear Transnet to provide infrastructure. Thanks to a wage strike in October and a maintenance shutdown in November, sales fell by 35% year-on-year:

For the full year, production was in line with revised guidance, dropping by 8%. Sales fell by 9% with the fourth quarter being a horror show, as indicated above. Stockpile levels at the mines have reached capacity, so throughput is desperately needed to get the product to the ports. If the stockpiles cannot be cleared, production will be curtailed and that won’t be good news for the cost per tonne.

Costs per tonne ended better than guidance, coming in at $40 vs. expected $44, but this was mainly driven by forex movements. The price achieved by Kumba for its products was $113 per wet metric tonne, higher than the benchmark price of $100 per wet metric tonne.

HEPS for the year is expected to drop by between 38% and 44%, which means a range of between R58.29 and R64.49. This was completely avoidable if Transnet was working properly.

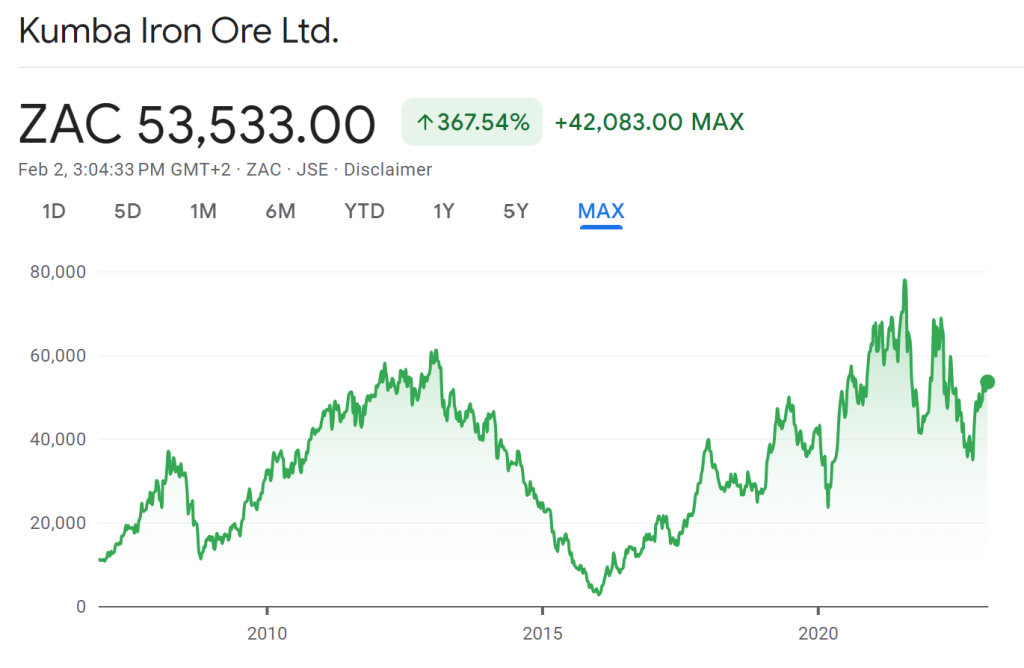

To finish off with Kumba, here’s a chart showing exactly why cyclical businesses are not buy-and-forget investments:

No rainbows at RCL

Both the poultry and baking businesses are under pressure

It’s really not easy to guess how the food producers might perform. RCL has released numbers that look like what I thought would happen to Tiger Brands last year. Instead, Tiger managed to pull off a small miracle (albeit at a different time during the year) and its share price chart reflects that. Of course, we will need to see how well Tiger is navigating current conditions, so perhaps put a pin in this.

The recent Astral Foods update gave us a strong clue that the poultry business within RCL cannot possibly be doing well. This has turned out to be the case, but RCL isn’t a pure-play on poultry, so the impact on group earnings is nowhere near as severe as at Astral.

The bakery business at RCL is struggling as well, with high commodity input costs, substantial cost pressures in energy and packaging costs and of course the impact on productivity of load shedding. With consumers suffering, it’s not easy to push through pricing increases without causing a problem for volumes.

For the six months ended December, HEPS fell by between 20.1% and 26.8%, which implies a range of 53.2 cents to 58.1 cents.

Super Group lives up to its name

HEPS is running way ahead of even pre-Covid levels

In the six months ended December 2022, Super Group had a lovely time. With commodities still doing well and strong demand for consumer goods over a busy Black Friday and festive trading period, the supply chain operator was kept busy.

Being busy means making money, with revenue up by between 30% and 40%. Profit before tax is up by between 25% and 35%, so there’s some margin compression but nothing major. In this environment, that’s an impressive display of cost management, especially given the pressure on fuel costs and all the issues around load shedding etc.

HEPS is also expected to be 25% to 35% higher.

It’s always nice to see a company quoting long-term value creation statistics. Over 10 years, Super Group has grown shareholder equity at a compound annual growth rate (CAGR) of 17.4%.

There are some other important points to note in this result.

One of them is that revenue growth was flattered by the consolidation of a full six months of revenue from LeasePlan in Australia, so this year-on-year growth rate isn’t an indication of sustainable growth. A large portion of the purchase price was paid for with cash rather than the issuance of shares, so this is accretive on a HEPS level (you’re buying more earnings that aren’t linked to the issuance of more shares).

Another point is that Super Group also owns a car dealership division that operates in the UK and South Africa. Improved availability of vehicles in both countries has been beneficial in this period.

In terms of capital allocation, Super Group repurchased 5.6% of its shares in issue over this period. This obviously helps boost HEPS and is generally seen as a positive move when a company trades at a modest multiple.

The share price jumped over 6% in response to this update.

Little Bites:

- Director dealings:

- An associate of a director of Salungano has bought shares worth R9.4m

- The CEO of Bytes Technology Group has acquired shares worth £200k

- The Finance Director of Tharisa sold shares worth R1.93m

- A director of Santova exercised share options and sold those shares and others for a total of R1.4m

- Novus has agreed to sell its surplus property in Linbro Park for R125 million. The property became surplus to requirements after rationalising the Novus Print production facilities in Johannesburg. The proceeds will be added to existing group cash resources.

- Accelerate Property Fund is in the news again, this time with the sale of the Ford dealership building near The Buzz in Fourways for R80 million. The property was valued as at 31 January at over R87 million, so that’s a disappointing sales price vs. the valuation. When property funds trade at a large discount to net asset value, it’s usually for a reason. The sales price represents a yield of 8.9%.

- Wesizwe Platinum announced that there have been deficiencies identified during the test run of the main system of the Bakubung Platinum Mine. The cold and hot commissioning of the processing plant is expected by March – April this year.