Anglo American is ready to demerge Anglo American Platinum (JSE: AGL | JSE: AMS)

And the name is going to change going forward

As part of Anglo American’s broader plan to simplify its group and focus on a smaller number of core assets (copper, premium iron ore and crop nutrients – note the lack of reference to diamonds), the controlling stake in Anglo American Platinum is being cut loose. As a sign of the severed ties between the groups, Anglo American Platinum is changing its name to Valterra Platinum as part of the process.

The renamed entity will be listed on the London Stock Exchange, thereby supporting a geographically diversified shareholder base.

Anglo American has already reduced its stake in Anglo American Platinum from 79% to around 67%. They plan to retain 19.9% after the demerger, which means that just over 47% of the total shares in Anglo American Platinum will be handed over (“demerged”) to Anglo American shareholders. Well, that’s what my maths says at least. The announcement says that 51% of the issued share capital will be demerged. Either I can’t do maths, or something isn’t adding up in the announcement.

The 19.9% will be retained for at least 90 days after the demerger, with Anglo eventually selling the entire stake down over time. They just need to do it slowly to avoid crashing the share price.

In more maths coming down the line, Anglo American is then planning a share consolidation that will provide consistency in the price before and after the demerger. Put simply, Anglo American is making its group smaller by handing a large asset to shareholders. A share consolidation would reduce the number of shares in issue on a proportionate basis, thereby increasing the price per share in order to achieve a comparable price to where it was trading before the demerger. They will work this out based on a three month VWAP for each company up until 20 May when the ratio is announced.

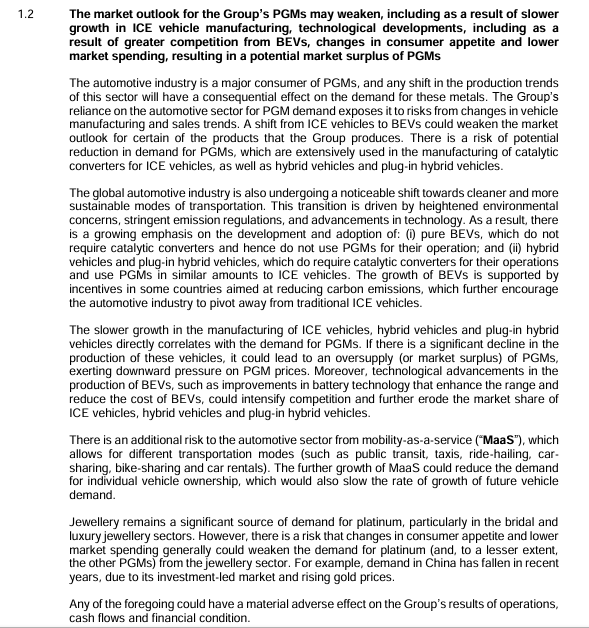

Due to the new listing on the London Stock Exchange for Anglo American Platinum (remember it will now be called Valterra), they’ve published a prospectus. I thought this this piece from the risk section is worth including here in full as it so succinctly describes the risk facing PGMs:

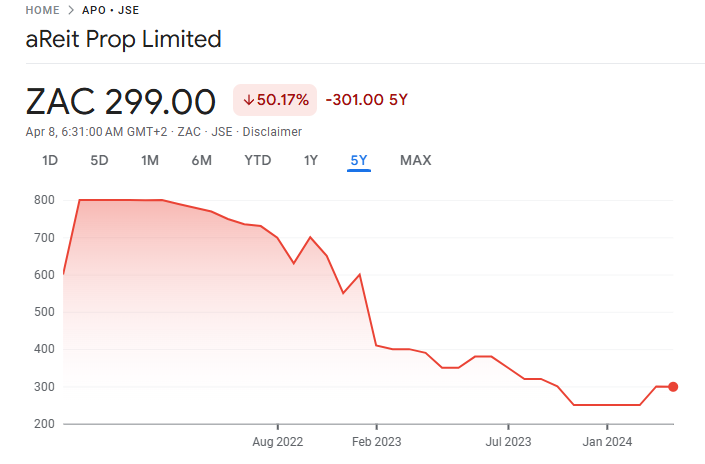

aReit’s impairments take it into a loss-making position (JSE: APO)

Surprise surprise: the NAV is coming down

When aReit listed, I made myself very popular with the company and its advisors by pointing out that the listing price was basically complete rubbish. Based on the yield being achieved by the assets, there was no way that the asking price was remotely fair.

Despite the protests at the time from those involved, it turns out that I wasn’t wrong:

Aside from the fact that they are currently suspended from trading because of how far behind they are on financial reporting, there’s now the additional pain of large impairments that need to be recognised to the assets. This is based on “a change to the discount rate and the variable income actually achieved” – in other words, both of the key ingredients in a property valuation.

The impairments are so large that the basic loss per share for the year ended December 2023 (yes, they are that far behind) was between 390 cents and 400 cents. The impairments don’t have an impact on HEPS, but they sure do bring the net asset value a lot closer to where the share price was trading.

Confusingly, the company has always announced a dividend for the 2024 financial year, which they reckon is 80% of distributable profit for that year – even though we are still waiting for 2023 financials. The dividend was 40 cents per share.

There are a zillion things you can invest your money in. Why this?

Cashbuild is clearly feeling more confident (JSE: CSB)

They are taking a controlling stake in a group of hardware stores

Cashbuild is subscribing for a 60% controlling interest in a company called Allbuildco Holdings. The gives them control of three hardware and building material stores in Pretoria and Limpopo. The total subscription price is R93 million, so this is a significant allocation of capital by a group that has been through some tough times.

Cashbuild describes this as an entry into a new customer base. Although they aren’t explicit on exactly how this is different, I Googled the stores and they seem to operate under the Mica brand. That seems very DIY-focused to me, so perhaps the idea is to go after more retail margins rather than selling to the trade?

Either way, they see this as a growth platform that they can grow alongside the existing shareholders, who will retain a 40% stake for now. Like all good listed company deals should include, there’s a pathway to control in the form of put and call options exercisable during the next five years. This will allow Cashbuild to pick up between 10% and 40% in the company i.e. it could lead to a 100% holding. The prices for the options have been capped.

Now, the post-money valuation of the business is R155 million (calculated as 93 divided by 0.6, as investing R93 million gets them a 60% stake). This means that the pre-money valuation was R62 million. This is because the R93 million is an injection of cash into the business, not a payment to the sellers.

Profit after tax for the year ended February 2024 was R12.8 million, so the Price/Earnings multiple here was 4.8x. This gives you an idea of the prices at which private companies change hands in South Africa. It’s actually much better once you work on adjusted net profit after tax, which comes in at R18.1 million and thus an implied multiple of just 3.4x!

That’s an appealing price in my books. Will it move the dial for the group? Probably not, since the market cap is R3.7 billion. If anything, it’s just good to see the management team feeling confident enough to pull the trigger on this.

Nibbles:

- Director dealings:

- Although the disclosure is a little odd vs. some of the other recent director dealings, it looks like Ivan Glasenberg bought shares in Glencore (JSE: GLN). At first I thought he crossed the 10% ownership threshold due to recent share buybacks, but other reports suggest he bought shares. Either way, directors at Glencore have been buying the dip like crazy. Do with that information what you will.

- Des de Beer really got the hammer down with the latest purchase: a meaty R27.3 million worth of Lighthouse Properties (JSE: LTE) shares.

- In a rather interesting transaction, the current CEO of Curro (JSE: COH) bought shares to the value of R5.85 million from the founder and ex-CEO. The deal was done at R9.40 per share, which is above the current price and way down from where it was trading at the end of 2024.

- An associate of a director of Ethos Capital (JSE: EPE) bought shares worth R1.55 million.

- There’s an unusual example of director dealings that has everything to do with a legal dispute and nothing to do with a view on the underlying share price, hence I’m including it here separately. An associated entity of Pieter Erasmus acquired shares worth R1.36 billion (not a typo) in Pepkor (JSE: PPH) through the exercise of rights under a pledge agreement related to how the Steinhoff mess was untangled. There is now a court battle between the legacy Steinhoff entity and the Erasmus entity related to the exercise of this pledge. I shudder to think of the sheer amount of money made by lawyers over the years in Steinhoff-related matters.

- Standard Bank (JSE: SBK) has a management gap to fill, with Kenny Fihla on his way out to become the CEO of Absa (JSE: ABG). Sim Tshabalala, CEO of Standard Bank Group, will also take on the role as CEO of Standard Bank South Africa on a temporary basis. In a sign of where the group’s succession planning might be heading, but with no guarantees at all, Lungisa Fuzile (current Regional Chief Execution of the South & Central Region) has been made Interim Chief Executive of Africa Regions & Offshore. Where will this all end up? For now, we just don’t know.

- MultiChoice (JSE: MGC) reminded the market that the long stop date for fulfilment of the please-save-us deal with Canal+ has been extended to 8 October 2025, hence all the dates in the previously issued circular will also be kicked out. At this stage, MultiChoice believes that the October deadline is still manageable.

- Cilo Cybin (JSE: CCC) recently announced that it was seeking dispensation from the JSE to extend the date of distribution of the circular related to the acquisition of Cilo Cybin Pharmaceutical as a viable asset. This is due to the timing of publishing of financial information. The date of distribution of the circular has been extended out to 28 July 2025.

- NEPI Rockcastle (JSE: NRP) announced that holders of 20.33% of shares chose the cash dividend election, while the other 79.67% went for the capital repayment (which was the default). There was no scrip distribution alternative on offer, as NEPI is trying to avoid having too many shares in issue.

- Grand Parade Investments (JSE: GPL) has taken the same route as a number of small- and mid-cap players by moving its listing to the General Segment of the JSE. As I’ve mentioned each time we’ve seen news along these lines, the idea is to match the regulatory requirements to the size of the company i.e. to avoid placing a huge burden on smaller listed companies.