It turns out that diamonds aren’t necessarily forever (JSE: AGL)

Mining licences in Botswana need to be renewed – but luckily not very often

Anglo American announced that important subsidiary De Beers has reached an agreement with the Botswana government for a new 10-year sales agreement for rough diamond production at Debswana, as well as a 25-year extension of the mining licences through to 2054.

Before you think you just woke up from a coma, I know that 2054 – 25 = 2029. The current licence presumably expires in 2029 and extension negotiations are very proactive.

Debswana operates four diamond mines in Botswana and is a 50-50 joint venture between De Beers and the Botswana government.

AVI announces a new B-BBEE deal in I&J (JSE: AVI)

Significant value was created in the previous partnership

The B-BBEE structure in I&J (part of AVI) goes back to 2004. It was extended three times, with the 19-year partnership generating R202 million in net cash to the B-BBEE partner.

The old deal matured on 1 July 2023 and a new deal has now been announced, with Twincitiesworld acquiring 18.75% of the shares in I&J. Alongside I&J employees with 6.25%, this takes the total Black shareholding in I&J to 25%.

There isn’t much information available on Twincitiesworld, other than a note in the announcement that it has historic links to I&J and strong community ties. That makes it sound like a broad-based structure.

As the name implies, Brikor is now focused on bricks (JSE: BIK)

Brikor is completely changing its strategy with its coal assets

This wasn’t the simplest announcement to understand, I’ll tell you that much. In summary, Brikor has recognised that trying to row its own boat with its coal assets is a mistake, as the most important thing is actually to secure a supply of clay for the core business of brick-making. Beyond that, just making a profit from the coal operations would be nice.

To achieve that, Brikor has entered into a contract mining and coal purchase agreement with TCQ Mining. There’s quite a spider web here, as Brikor holds a stake in TCQ via a subsidiary, plus one of the other shareholders in TCQ is also a material shareholder in Brikor.

TCQ is going to buy all the coal mined in the defined areas from Brikor (and other owners of the mining rights) for a price equal to all contract mining costs plus R20 per ton. Clay is a by-product of the mining of coal and TCQ will deliver it to the existing rights holders on a monthly basis at no additional cost.

All of the details will be included in a Category 1 circular, so Brikor shareholders can fully understand the economics here. The summary is that the coal mining operations will now be profitable and cashflow positive for Brikor, with the supply of clay as a critical part of the deal.

While the deal goes through the motions, there is a three-month interim consulting agreement with TCQ at a cost of R13.7 million for the purposes of advising Brikor on improving current mining operations and getting them ready for a large upscaling after the transaction. This is expected to improve output by 80,000 tons over the three-month period.

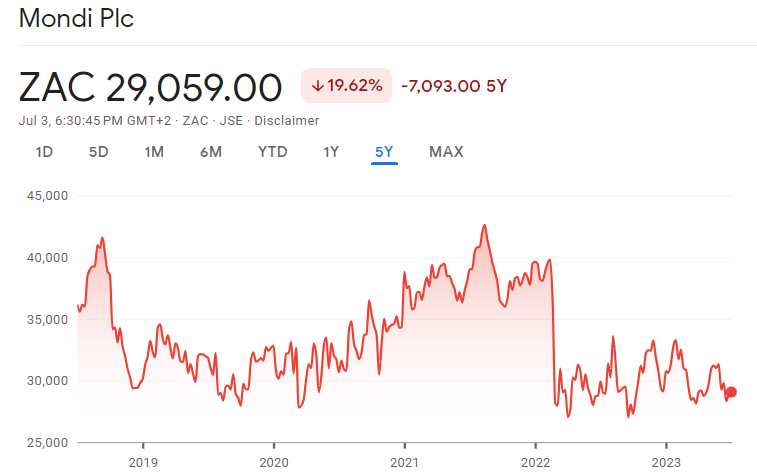

Mondi: one step closer to bye-buy, babushkas (JSE: HET)

The sale of three Russian packaging converting operations has been completed

Back in December 2022, Mondi announced that it had reached an agreement to sell three Russian packaging converting operations to Gotek Group for RUB1.6 billion. In a currency that will be a lot more familiar to you, this has equated to €30.4 million landing in the Mondi bank account.

The group will distribute the proceeds to shareholders once the full exit from Russia has been completed. This implies that there’s no special dividend until the disposal of Syktyvkar, the most significant facility in Russia owned by Mondi. Selling this asset has proven to be difficult.

It’s been a pretty wild ride for this stock, with a catastrophic drop when war broke out in Ukraine and some fun trading opportunities since then:

Montauk has been busy this year (JSE: MKR)

The latest project is at a landfill in California

Through its subsidiary Bowerman Power LFG, Montauk Renewables is planning to develop a renewable natural gas project at the Frank R. Bowerman Landfill in California. The target commissioning date is 2026 and the capital investment is expected to be between $85 million and $95 million.

As my dad would likely point out: it’s a dirty job, but somebody has to do it.

Remgro confirms its stake in Heineken and Capevin (JSE: REM)

Unsurprisingly, Remgro has been mopping up unlisted shares in Heineken Beverages

After the Distell buyout and delisting was completed in April, Remgro was left with a stake in Heineken Beverages and Capevin. The group has now confirmed the extent of the shareholding in both companies.

Remgro initially held 15.50% in Heineken Beverages, but increased this to 18.80% through a series of off-market transactions with a cash cost of R926 million. This was based on R165 per share.

In Capevin, Remgro holds 31.46% of ordinary shares in issue and all of the B shares. The aggregate voting interest is 55.93%.

What’s going on at Salungano? (JSE: SLG)

A delay in publishing results is one thing, but this is quite another

Among the scrappier companies on the JSE, it’s not unusual to see a delay in the publishing of results. The market doesn’t like it, but deals with it. Hot on the heels of that delay at Salungano came far worse news, with the share price taking a 21% knock in response.

Three independent directors have resigned in one go, including the lead independent director and chairperson of the audit, risk and compliance committee. That is a picture perfect example of exactly the kind of thing that makes shareholders panic.

The company neglected to give a reason for the resignations.

Texton shareholders say yes to the PIC buyback (JSE: TEX)

The first thing to do is check the buyback price against the NAV per share

Local property funds tend to trade at a significant discount to the net asset value (NAV) per share. Texton is hardly a market darling, so the NAV from December 2022 of 609.51 cents is a whole lot higher than the current share price of R2.28.

The gap to the price at which the PIC is exiting is even bigger, with a repurchase price of R2.15 per share. It’s no wonder that shareholders said yes to this repurchase with an emphatic 99.98% approval at the general meeting. 19.8% of issued shares will be repurchased at a huge discount to NAV, which is theoretically good news for all other shareholders.

The bigger question is: does the market believe the NAV, or is the discount simply going to stay as large as it is now?

Little Bites:

- Director dealings:

- An independent director of Curro (JSE: COH) has bought shares worth R86k.

- An associate of the chairperson of Nictus (JSE: NCS) has sold shares worth R65k in an off-market trade.

- A prescribed officer of Gold Fields (JSE: GFI) has sold shares worth R26k.

- The spouse of a director of Afine Investments (JSE: ANI) has been doing some small-scale trading on EasyEquities, acquiring shares worth R4.5k.

- With no impact on any of the other terms of the debt, Northam Platinum (JSE: NPH) settled an existing term loan facility and extended the revolving credit facility. Total available facilities are now R11 billion, so the group is sitting on plenty of undrawn firepower.

- Although the announcement doesn’t make it quite as clear as I would’ve liked, it looks like the complaints by Northam Platinum (JSE: NPH) against Royal Bafokeng Platinum (JSE: RBP) regarding alleged frustrating actions related to executive remuneration have been sorted out. The compliance certificate required to make the Impala Platinum (JSE: IMP) offer unconditional has been issued, so we know the investigation is over. The announcement makes it sound like there was no further action against RB Platinum.

- Kibo Energy (JSE: KBO) has released a quarterly update dealing with the various projects in the group. The strange scenario around shareholders being unable to vote at the extraordinary general meeting caused delays to the funding activities for certain projects.

- Nedbank (JSE: NED) repurchased 0.55% of its total issued ordinary shares for R638 million, delivering a small risk-free profit to those who watched carefully and banked the difference between the market price and the odd-lot offer price. Most people simply don’t pay attention, with 2.375 million of the 2.72 million repurchased shares being repurchased by default due to shareholders not taking any action.

- DRA Global (JSE: DRA) has announced the appointment of Charles Pettit to the board, the CEO of largest shareholder Apex Partners. Charles was founder and CEO of Torre Industries and Stellar Capital, both of which aren’t listed anymore.

- AfroCentric (JSE: ACT) has announced a number of executive management changes now that the Sanlam (JSE: SLM) acquisition of a controlling stake has been concluded. This includes Gerald van Wyk as CEO Designate, due to take the reins from 1 November when current CEO Ahmed Banderker’s five-year term ends.

- In the naughty corner for late submission of financial statements, we find Acsion Limited (JSE: ACS), African Dawn Capital (JSE: ADW) and Copper 360 (JSE: CPR).

- Right at the bottom of the JSE dustbin, we find Afristrat (JSE: ATI) and its quarterly update. This company is so broken that they can’t even find an auditor willing to accept the appointment, as judgment was reserved in a recent liquidation application in the High Court. Aside from numerous other issues, another creditor has also launched a liquidation application.