Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Anglo American reports a further drop in diamond sales (JSE: AGL)

The latest De Beers sales numbers are in

In and amongst all the noise around potential offers for the group, Anglo American has released the latest sales cycle numbers for De Beers. With $380 million in sales for cycle 4, the trend is firmly negative. Cycle 4 2023 was much higher at $479 million. Cycle 3 2024 was also significantly higher at $446 million.

Apart from the obvious issues of macroeconomic pressures, there was a quieter period of trading in India during the elections. The next sales event is in the US – and in Las Vegas, no less. The company has already tried to temper expectations by referencing macroeconomic issues and hoping for a recovery in coming years.

As a reminder, Anglo American’s current proposal to shareholders to unlock value involves a disposal of some kind of De Beers. Selling a business with falling sales isn’t straightforward – at least not for a decent price.

Bidcorp is still growing despite much lower inflation (JSE: BID)

This is one of the best rand hedges on the JSE

Bidcorp has updated the market on performance for the ten months to April. In case you aren’t familiar with the group, this is a global food services giant that is one of the genuine rand hedges on the JSE, as very little of its revenue is generated here.

A key feature of this result is that food inflation has come all the way down to 2.6% vs. 15.2% in the comparable period. They point out that food inflation is lower than core inflation for the first time in two years. Another important point is that rand weakness has delivered a 9% positive impact on the reported numbers, as much of the revenue is generated elsewhere.

The performance across Australasia, Europe and the United Kingdom looks solid, with sales growth and stable or improving margins. Emerging markets are more of a mixed bag, with China and Brazil of particular concern. South Africa is actually performing well despite the challenges here, with other highlights being Malaysia, Chile and the Middle East.

Group sales for the ten months increased by 8.8%, with the UK as the standout at 15.9% (rand weakness helps here). Gross margins are slightly ahead of the previous year, which is just as well because operating costs as a percentage of revenue deteriorated by 40 basis points to 18.9%.

The EBITDA before IFRS 16 margin of 5.6% of net revenue is in line with 2023 which was a strong year. This is a period of working capital absorption for the group, with the good news being that working capital is in line with management expectations and slightly better than the comparable period.

R4.4 billion has been invested by the group, which is well up on R2.0 billion in the comparable period. Aside from two bolt-on acquisitions (a small bakery in Germany and a seafood wholesaler in South Africa), the focus has been on vehicles. They are busy with a “couple” of potential deals in the UK and one in Europe, all expected to close early in the new financial year.

Bidcorp is a powerhouse of note. Like most of the really high quality businesses on the JSE, the multiple reflects that. Based on last reported earnings, the Price/Earnings multiple is roughly 19x.

Bytes is growing strongly, despite the ex-CEO mess (JSE: BYI)

If you bought the panic selling around the departure of Neil Murphy, you’re smiling

Disgraced ex-CEO Neil Murphy is no longer involved at Bytes, after it came out that he had executed many, many undisclosed trades over a few years. The share price reflected panic when the news broke and those who were smart enough to buy the panic have already locked in a roughly 20% return in the past month.

This is because the group is still doing well, although margin compression in the IT services industry continues. Gross invoiced income increased by 26.7% and revenue was up 12.3%, so they are having to work harder and harder for that revenue. Gross profit increased 12.5% and operating profit was up 11.4%. By the time we reach HEPS, growth has been leveraged up to 15.4% – a very presentable result, especially in GBP.

The final dividend is 17.6% and the board has decided to pay another special dividend like last year, with a 16% growth rate in the special dividend as well. The only reason why they call it a special dividend is because they don’t want to commit to the higher payout ratio forever, just in case they need the capital for something else.

Plenty of activity around Capital & Regional (JSE: CRP)

And a 19.7% increase in the share price on the day

Capital & Regional is suddenly the talk of the town, confirming that on 19 April it received a non-binding indicative proposal from Vukile Property Fund (JSE: VKE) regarding a possible cash and share offer for the share capital of the company. I’m surprised it was kept under wraps for this long.

There’s nothing binding at this stage, with Vukile facing a PUSU (Put Up or Shut Up) deadline of 20 June 2024. As the juicy name suggests, they need to announce a firm intention to make an offer by that date or they need to confirm that they won’t make an offer.

On top of all this, Capital & Regional announced that Growthpoint (JSE: GRT) (which holds 68.13% in the company) received a non-binding expression of interest from NewRiver REIT in relation to a potential offer for Capital & Regional. The board of Capital & Regional hasn’t received a proposal from NewRiver at this stage.

Of course, the outcome of all this was a significant jump in the Capital & Regional share price as punters hit the buy button in the hope of a juicy offer coming in.

The growth rate at Emira isn’t useful (JSE: EMI)

But the range for the distribution certainly is

Emira Property Fund released a trading statement for the year ended March. The challenge here is that the comparable period is only nine months long as there was a change of year-end, so the increase in distribution per share of between 19.86% and 21.93% isn’t a valid growth rate as the comparable period was shorter.

It does tell us that the range is 116 to 118 cents per share and that’s the useful bit of information. This puts the fund on a trailing yield of 11.7%.

These HCI group companies all released numbers: HCI, eMedia and Frontier Transport (JSE: HCI | JSE: EMH | JSE: FTH)

I’ll deal with them all in one place – and Tsogo Sun separately as it is much bigger

I’ll start with eMedia, which reported for the year ended March 2024. Load shedding doesn’t help TV viewership at all, with advertising down 1%. It’s worth highlighting that e.tv spends R600 million per year on local drama series. Media Film Service got hurt badly by the writer’s strike in Hollywood, with profit down R31.5 million year-on-year. They also spent R8.8 million in legal battles with MultiChoice related to channels being carried on that bouquet. Revenue in eMedia fell 2.1% and HEPS was down 11.7%. The dividend of 16 cents per share was 20% lower.

Moving on to Frontier Transport, a wonderful example of how to make money in an unsexy industry, revenue increased by 8.9% and HEPS was up 37.8%. This is because operating costs increased 6.3%, with the resultant margin expansion driving that juicy improvement in HEPS. In addition to the ordinary dividend of 48.4 cents, there was a special dividend in January of 137.38 cents.

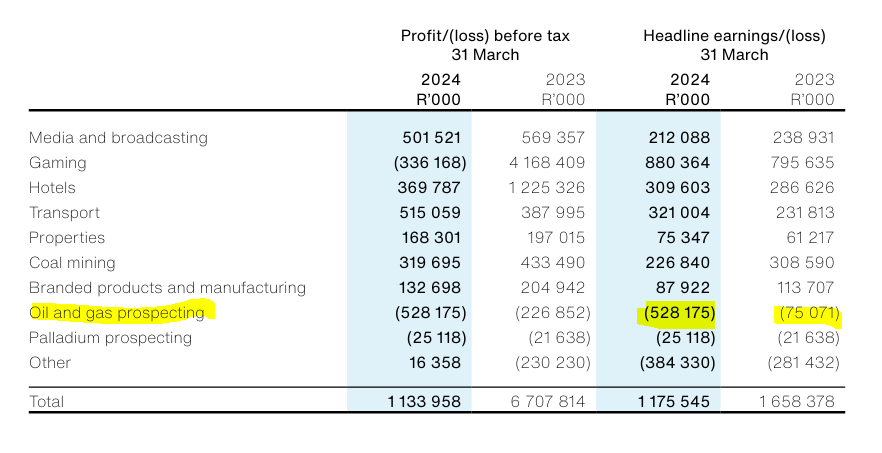

We now get to the mothership, Hosken Consolidated Investments (or HCI for short). We have an interesting scenario here where HEPS fell 29% and the dividend per share doubled to 100 cents. The major negative move was in oil and gas prospecting, where the headline loss jumped from R75 million to R528 million. That’s a very big move when total headline earnings came in at R1.18 billion. The reason why we can see negative moves of this side and yet a higher dividend is that the negative moves are non-cash in nature, with downward fair value adjustments recognised on the investment held by Africa Energy Corp.

Here’s what the total group looks like:

Although HCI controls Tsogo Sun, I’ve dealt with that company further down as the market cap is much larger than the likes of eMedia and Frontier. And in case you’re wondering, Deneb reported earlier in the week.

Investec’s earnings moved higher in GBP – and thus much higher in ZAR (JSE: INL | JSE: INP)

Key metrics like Return on Equity (ROE) also moved higher

Investec has released results for the year ended March 2024. This was a period of significant corporate activity, like the major deal in the UK to combine Investec Wealth & Investment UK with the Rathbones Group. They also sold the property management company to Burstone Group for a small fortune.

To make the numbers more comparable, Investec has presented adjusted operating profit as though the abovementioned transactions took place at the start of the period. On that basis, adjusted operating profit is up 8% in GBP or 24.6% in ZAR. Return on Equity has moved higher, up from 13.7% to 14.6%.

The cost to income ratio improved from 54.7% to 53.8% as total operating costs increased by only 3.2%, an impressive show of discipline.

The full-year dividend increased by 11.1% to 34.5 pence for the year.

It’s interesting to note the revised through-the-cycle targets for the credit loss ratio. In Southern Africa, where the book is mainly high income private clients and large corporates, the range is 15 to 35 basis points. In the UK with more of a mid-market positioning, the range is 35 to 55 basis points. This tells you something about the economic resilience of the different books.

The share price closed 4.5% on the day of these results, taking the 12-month gain to 19%. Those who enjoy range trading strategies might want to take a look at this chart:

Kore Potash’s share price took off on a rocket (JSE: KP2)

The ASX has even queried the recent price action

The Australian Stock Exchange sent Kore Potash a price query, which means they noticed an unusual uptick in price and volume in the stock and wanted to understand if there is any information that should’ve been disclosed that could have leaked into the market.

Here’s the chart – and it’s not hard to see why the ASX took notice:

The company reiterated that no formal legal agreements have been entered into with PowerChina re: the all-important EPC contract for the development of the Kola Project. In other words, the last release from the company is still the latest news.

Speculators seem to be lining up for a release of good news and what that might do to the share price.

Winds of change at Mahube Infrastructure (JSE: MHB)

As in, literally

Mahube Infrastructure released a trading statement dealing with the year ended February 2024. There’s a huge swing in profitability and in the right direction. Compared to a headline loss per share of 53.68 cents, HEPS will come in at between 91.05 cents and 100.64 cents.

Aside from dividends received from investee companies (including special dividends), the earnings were driven by a favourable change in the fair value of financial assets due to a revision of wind forecasts an improvement in the macroeconomic indicators.

Strong momentum at Shaftesbury (JSE: SHC)

Things seem to be going well in this London-focused fund

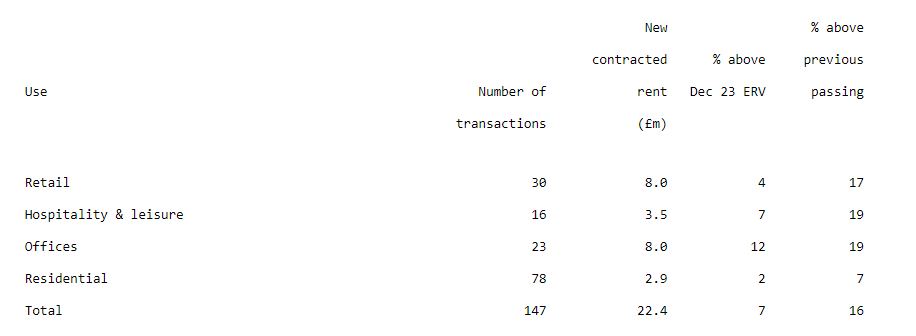

Shaftesbury has released a trading update that was presented at the company’s AGM. The highlight is that leasing demand is producing rents that are 7% ahead of 2023 numbers, with the company also enjoying the recycling of capital at a premium to the values at which the properties are held on the balance sheet.

They have completed £213 million in asset sales since the merger that created Shaftesbury as we know it today, with a premium of 3% to the valuation on the books. They have reinvested £83 million in target acquisitions.

The loan to value is at 30% which is a very healthy level for a property fund. The current weighted average cash cost of drawn debt is 4%.

Perhaps most interesting, the office portfolio is showing the best increase in contracted rent vs. 2023 levels, with the return to office trend gaining momentum:

Never a dull moment at Stefanutti Stocks (JSE: SSK)

The group is hoping that the Eskom claim will be finalised in Q3

Stefanutti Stocks is in the midst of a turnaround plan. If you aren’t sure why, a quick look at the balance sheet where liabilities exceed assets will dispel that uncertainty for you. The financials are still prepared on a going concern basis due to the expected cash flows under the restructuring plan.

For those punters willing to take a speculative position here, the key is the dispute with Eskom that is now with the Dispute Adjudication Board (DAB). This relates to contractual claims and compensation events at Kusile Power Project. Independent experts evaluate the delays and related numbers and the DAB then makes a decision that is binding on the parties. Stefanutti Stocks submitted a total claim of R1.6 billion to the experts and will now wait to see how much it gets. It is hoped that a binding decision will be issued in Q3 2024.

The rest of the group still has all the usual uncertainty and difficulty that seems to follow construction companies around. For example, Hyvec JV was previously shown as a discontinued operation. A change of plan means that it is back in continuing operations. Delays in on-boarding labour due to legislative changes led to the recognition of an onerous contract provision and a loss for the year there of R78 million.

Although the year-on-year swing in continuing and discontinued operations is rather wild, the combined operations managed to show what looks like a smooth result: growth in profit for the year of 9%.

HEPS tells a different story though, deteriorating by 44% to a loss of 55.73 cents.

Revenue up and HEPS down at Tharisa (JSE: THA)

Chrome prices helped mitigate the fall in PGM prices

Tharisa has announced results for the six months to March. They reflect a 9.9% increase in chrome production and a 7.7% decrease in PGM production. Chrome prices were 16.9% higher and PGM prices were 39.3% lower.

The net effect is that revenue was actually up 10.1%, with EBITDA slightly down and EBITDA margin contracting from 24.2% to 21.6%. Due to higher finance costs, HEPS fell sharply, down 25% to US 13.2 cents.

The interim dividend of US 1.5 cents per share is 50% lower than the prior year.

Tsogo Sun is facing pressure at casinos (JSE: TSG)

Adjusted HEPS has dipped

Tsogo Sun has released results for the year ended March 2024. Income is up 2% and operating costs increased 3%, with load shedding having an impact on both those metrics. This led to adjusted EBITDA decreasing by 2%.

When operating profits are going the wrong way, it’s hard for HEPS to avoid following suit. Due to the termination of hotel management contracts in the base year, it’s important to look at adjusted HEPS to see the impact of operational performance. This is down 5%.

Perhaps the final dividend tells the best story, down a substantial 30% after the interim dividend was flat year-on-year. There’s clearly uncertainty in this space and the group has also had to recognise impairments based on the financial performance.

It might help matters if exposure to the Western Cape can be increased. The casino footprint is heavily geared towards the northern parts of the country. The group notes a plan to develop a new casino and hotel precinct in Somerset West, as well as upgrades to the Caledon site.

Little Bites:

- Director dealings:

- Des de Beer has bought shares in Lighthouse Properties (JSE: LTE) worth R15.8 million.

- A non-executive director of WeBuyCars (JSE: WBC) bought shares in the company worth R506k.

- Spear REIT (JSE: SEA) is due to release the circular for the substantial acquisition of a Western Cape portfolio from Emira (EMI) by no later than 2 July. In the meantime, Spear has released the forecast financial information for the target portfolio on the assumption that the transfer date for the properties is 1 December 2024. It shows that the expected distributable income from the portfolio for the year ending February 2026 (the first full year) is R8.1 million, with net property income of R118.9 million and finance costs of R104 million due to the level of leverage. The release of the circular will give far more detail.

- Mondi (JSE: MNP) has launched a €500 million 8-year Eurobond. The issue will close on 31 May and the proceeds are for general corporate purposes. The bonds are due in 2032 and have a coupon of 3.75%, so that gives you an idea of where investment grade corporate credit in London is trading. The debt is rated Baa1 by Moody’s and A- by Standard and Poor’s.

- Ibex Investment Holdings (JSE: IBX) (formerly Steinhoff Investment Holdings) received almost unanimous approval from shareholders for the repurchase of the preference shares at R93.50 per share plus pro-rate preference dividends from 1 January 2024 until the scheme operative date. This isn’t a surprise, as there’s no other way for major holders to realise their investments.

- Chrometco (JSE: CMO) announced that the CEO is stepping down and will be replaced by William Yang. Greg Hunter will be appointed executive chairman of the company. The share price is still suspended from trading.