Anglo American’s EBITDA is 30% off its record year (JSE: AGL)

Despite this, return on capital employed is still way above the through-the-cycle target

In a year that Anglo American will probably remember for the commissioning of the Quellaveco copper project in Peru, profitability was still fantastic even if the year-on-year story is annoying for investors. Mining companies are cyclical and 2021 was a record year, so consecutive record years was probably too much to hope for.

With production challenges in 2022, the production cost per unit didn’t go in the right direction for several commodities. Compared with a decrease in commodity prices in some cases, earnings came under pressure.

Despite a 30% drop in EBITDA, return on capital employed of 30% is way above the through-the-cycle target of 15%.

Although net debt increased to $6.9 billion as the group invested in its operations, this is still less than 0.5x underlying EBITDA, which is a manageable level.

For fun, I decided to do a long-term chart of Anglo American against competing mining giants Glencore and South32:

Blue Label rallies 5.4% as the market unpacks the story (JSE: BLU)

These earnings are about as complicated as it gets

At varsity, I remember thinking to myself: “This scenario is ridiculous, this could never happen in real life, Wits is just trying to hurt us.”

Then along came Blue Label Telecoms, with numbers that are so complicated that even Wits lecturers would be impressed.

The problem is that the management team has historically been spectacularly good at losing money for shareholders through misguided and risky transactions. Instead of sticking to the core business, they do all kinds of crazy things. One such thing was to try and resurrect Cell C, which led to a recapitalisation of that company last year. If you truly understood that deal, hats off to you.

Although Cell C has been a financial disaster throughout its life, the current strategy is probably the most sensible we’ve seen. The company is focusing on being the technology that sits between the tower infrastructure (hellishly expensive to own) and companies like Capitec that want to act as Mobile Virtual Network Operators by selling Capitec-branded airtime etc.

If you think Discovery’s numbers are all over the place in terms of normalisation numbers, these are even more intense. Core headline earnings were 3.94 cents per share for the six months ended December, unless you exclude the Cell C recapitalisation, in which case that number would be 51.72 cents.

Likewise, if you ignore several of the matches along the way, the Proteas have been world cup champions several times. Sadly, that trophy cabinet is bare, much like the core headline earnings number at Blue Label.

Here is a short story about the company’s capital allocation track record:

Discovery: where “normalised” is a stretch (JSE: DSY)

Regular readers will already know where this is going…

You may recall a recent earnings update from Discovery that asked investors to casually ignore interest rates, as apparently they have no impact on operations. With the release of results for the six months ended December 2022, Discovery continues to push this narrative.

HEPS as reported fell by 9%. But if you “normalise” those earnings, they increase by 30%. Considering that HEPS is already designed to exclude most of the usual noise found in company earnings, a swing of that magnitude between reported earnings and normalised earnings is extraordinary.

For a company that isn’t affected by interest rates, the term is used no fewer than 53 times in the interim earnings booklet. As another fun statistic, “normalised” appears 51 times. I’ll leave it to you to make your mind up about this.

Distell earnings feel the pressure (JSE: DGH)

Heineken is buying a business that will need to watch its costs carefully

Inflationary environments are tricky things. Top line growth can look great, but profitability is what matters. Some companies can increase prices ahead of inflationary pressures and others simply can’t.

In the six months ended December, Distell’s revenue was up 15.9%. That sounds great, until you see that EBITDA only increased by 0.6% thanks to energy cost pressures and supply chain costs, among other things.

Forex movements had a significant impact here. For example, if you strip them out, headline earnings increased by 8.3% vs. 3.0% as reported.

The lesson here? Be careful of assuming that every industrial/FMCG company benefits from inflation. The analysis is far more complicated than that.

Gold Fields: thank goodness for that break fee (JSE: GFI)

Even the payout ratio is above the usual range thanks to that windfall

With gold production lower and revenue taking a knock as well, this should’ve been an unpleasant period for Gold Fields. Thanks to the gorgeous break fee of $267 million from Yamana though, it was far better than would otherwise have been the case.

The break fee was actually $300 million, but $33 million had been spent on transaction costs. If you’ve ever wondered why bankers fight to get advisory mandates, now you know.

The break fee was such a boost to the balance sheet that the dividend payout ratio for the period was 47%, which is higher than the usual range of 30% to 45%.

With the break fee now in the past, the group will have to focus on the far less lucrative business of trying to get gold out of the ground. With a gold price that appears to be fully committed to inflicting pain on investors, that’s not easy.

Harmony’s earnings are higher, but… (JSE: HAR)

Be careful of the base effect here

For the six months ended December, Harmony’s production costs were between 2% and 10% higher. I’m surprised that Harmony can’t give a tighter range than that, considering that this financial period closed nearly two months ago. Nevertheless, higher underground recovered grades and modest increases in the average gold price helped offset this.

HEPS is expected to be between 10% and 30% higher than the comparable period. Before you get too excited, I must remind you that HEPS in the six months ended December 2021 (i.e. the comparable period) had fallen by 65%. There’s definitely a base effect at play here.

Still, the company expects to achieve its production and cost guidance for the full year. That’s a bit of good news.

Momentum Metropolitan lives up to the name (JSE: MTM)

Earnings look much better in the latest period

For the six months ended December, Momentum Metropolitan expects normalised HEPS to be between 40% and 55% higher.

This solid outcome was driven by the normalisation of the mortality experience in a post-COVID world, as well as improved investment returns. Most of the business operations were positive contributors in this period, other than Momentum Insure which the company notes had a challenging period.

Mondi signs off on a monster year (JSE: MNP)

Cyclical businesses print cash under the right conditions

In the year ended December, Mondi achieved incredible numbers if you exclude the Russian operations. That’s obviously a simplification of note, but you can’t exactly blame Mondi for what happened there.

Without Russia, group revenue increased by 28% and operating profit jumped by 85%. The numbers get even prettier the further down you look, with profit before tax up 119%.

Even including Russia, HEPS increased by 70% year-on-year. This was a massive year for Mondi.

The dividend is only 8% higher than last year, which tells you a lot about how cautious a cyclical business needs to be.

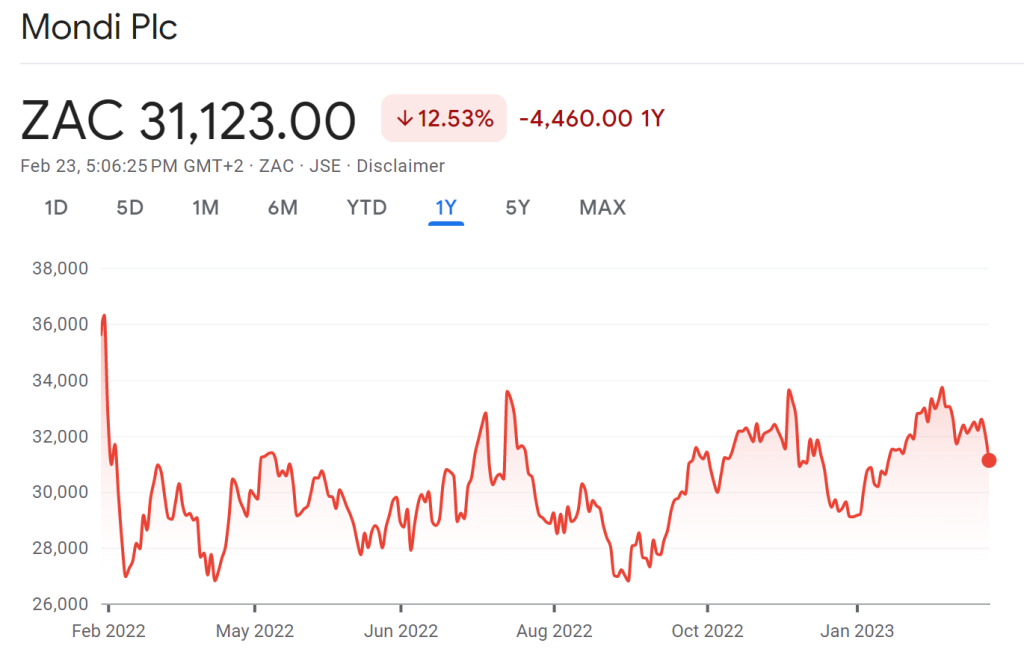

You can see the severe drop in the share price as the conflict broke out in Ukraine, a drop that Mondi is still trying to recover from:

Quantum Foods is now loss-making (JSE: QFH)

This environment is terrible for eggs

Here are the two numbers you need to know from Quantum Foods: in the four months ended January, egg selling prices increased by just 3.9% and feed costs were 25.7% higher. You don’t need an A for maths to realise that this is a major problem. The egg business is expected to report significant losses for the six months ending March.

Across the rest of the business, load shedding is a huge issue. Quantum’s energy costs are up by more than 42% thanks to the need for generators and associated diesel costs.

Probably the only good news at the moment is that Quantum didn’t have to deal with avian flu. We shouldn’t jinx it.

The balance sheet is healthy, which is just as well when the company expects to report a loss for this period. This is despite achieving positive EBITDA, although we don’t know how positive that line in the financials will be.

The net profit is what matters anyway. It will be burning bright red for the six months to March.

Deloitte settles with Tongaat Hulett (JSE: TON)

The auditors are making this problem go away

Without admitting any guilt, Deloitte has agreed to pay R260 million to Tongaat Hulett to settle claims linked to Deloitte’s audit of the company between 2012 and 2018.

The Business Rescue Practitioners have decided to accept the settlement and move on. This makes sense, given Tongaat’s broader balance sheet pressures.

I have no idea what Deloitte’s fees would’ve been over that period, but it would be fascinating to compare the two numbers.

Meanwhile, the date for the publication of the Business Rescue Plan has been extended to 28 February.

Truworths’ earnings are higher, but watch the cash (JSE: TRU)

The dividend payout ratio has come down in this period

You can tell quite a lot from the dividend payout ratio, actually. When management is confident, they tend to pay higher dividends. When conditions are tricky or the business is proving to be cash hungry, the payout ratio is moderated.

In the 26 weeks ended 1 January 2023, the revenue and gross margin story at Truworths was very promising. At a time when some competitors went backwards, Truworths grew sales by 13.1% and maintained gross margin at around 53.5%.

Despite this, EBIT only increased by 5.6%. This tells us that there were pressures in operating costs, with operating margin falling from 26.5% to 24.7%. If you dig further into the results, you’ll see that bad debts were a contributor here, which is worrying for the credit retailers.

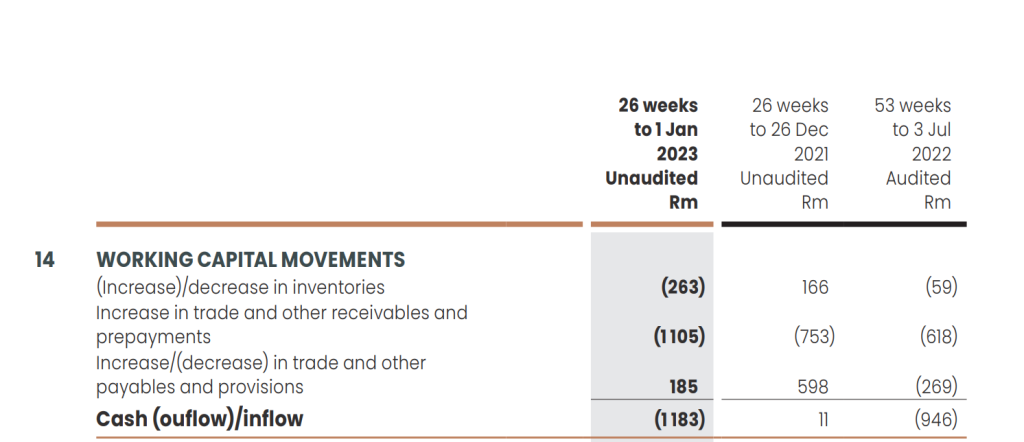

HEPS increased by 10.3% and the interim dividend was only 6.7% higher, which is where the lower payout ratio is visible. A driver of this might have been the sharp drop in cash generated from operations, which fell from R2.8 billion to R1.7 billion despite the increase in earnings.

To find the source of the cash pressure, you need to go to note 14 in the financials, where you’ll see that aside from investment in inventory, the pressure is from a higher investment in trade receivables i.e. credit sales to customers:

The Truworths share price is up 13.6% this year, as value investors climbed into this retailer that was trading on a modest multiple.

Little Bites:

- Director dealings:

- As a Transaction Capital (JSE: TCP) shareholder, it’s not great seeing David McAlpin (who runs the all-important Nutun business, previously called Transaction Capital Risk Services) selling shares worth over R5.2m.

- Adv. JD Wiese (a non-executive director of Invicta and Christo Wiese’s son) bought preference shares in the company worth R430k (JSE: IVTP),

- A director of British American Tobacco (JSE: BTI) has bought shares worth £12.4k.

- Family members of the CEO of Spear REIT (JSE: SEA) have acquired shares worth roughly R116k.

- A director of Dipula Income Fund (JSE: DIB) has acquired shares worth R82.4k.

- A director of Kaap Agri (JSE: KAL) has bought shares worth R76.6k.

- Directors of Nictus (JSE: NCS) have bought shares worth around R30k.

- As part of broader director appointments, the managing partner of Sanlam Private Equity (Paul Moeketsi) has been appointed to the board of Life Healthcare (JSE: LHC). I never ignore private equity appointments to a board.

- If you are a shareholder in Redefine Properties (JSE: RDF), you’ll want to flick through the pre-close presentation available at this link.

- Altron’s (JSE: AEL) sale of its ATM hardware and support business is taking longer than planned, with regulatory approval from the Namibia Competition Commission still outstanding.

- In bad news for Delta Property Fund (JSE: DLT), the intended sale of the Cape Road property for R38 million has been cancelled as the purchaser couldn’t put the money together.

- A director of Sable Exploration and Mining (JSE: SXM) has agreed to follow his rights for R3.67 million and underwrite a further R2.48 million worth of shares. The company is looking to raise R52.2 million in total.

- Choppies (JSE: CHP) renewed its cautionary announcement linked to the potential acquisition of 100% in a Botswana based FMCG company.

- Trematon’s (JSE: TMT) disposal of the Woodstock Hub property has been determined as fair by the independent expert, so the R16.25 million deal will go ahead.

- The plans by I Group Investments to use the Castleview Property Fund (JSE: CVW) vehicle as a listed shell are continuing, with a specific issue of shares to related parties of R310 million.

We won’t see you at Kyalami, you are a Ghost anyway.

Have a great weekend.