Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Anglo American looks to Finland for more opportunities (JSE: AGL)

If this sounds familiar, it’s because Sibanye-Stillwater has been doing the same thing

Anglo American and Finnish Minerals Group have signed a memorandum of understanding to explore opportunities around Finland’s battery metals strategy. This reminds me of when the local property funds all ran off to Eastern Europe in search of deals. Our mining houses seem to be taking a similar route in Finland!

To be fair, Anglo American already has an investment in Finland in the form of the Sakatti project, so it becomes an interesting debate around who has been copying whose homework around here.

There are various metals that form part of the “green metals” or “transition metals” groupings that are frequently written about. These metals are just as exposed to cycles as other commodities, evidenced by the Glencore news further down in Ghost Bites.

At this stage, Anglo American hasn’t released any concrete details around this memorandum of understanding.

Calgro M3 released an encouraging trading statement (JSE: CGR)

Share buybacks do wonders for earnings growth

Calgro M3 has been a comeback kid of note on the local market, with a focused strategy and capital allocation discipline that is working out very nicely. The latest trading statement is further evidence of this, with the company expecting HEPS for the year ended 29 February 2024 to be at least 20% higher.

If you’re familiar with trading statements, you’ll know that this is the minimum required disclosure under JSE rules. In other words, the increase could be significantly higher. When you consider that the number of shares in issue has decreased by 21% over the past year, even a sideways move in headline earnings would look strong at HEPS level.

Given the recent positive trajectory in operating performance, it seems fairly likely that the earnings improvement is significantly more than 20%. We will know for sure as we move closer to results being released in early May, with an updated trading statement likely to be released between now and then.

The nickel market has claimed another scalp (JSE: GLN)

Glencore isn’t prepared to carry any further losses at Koniambo Nickel

The Koniambo Nickel joint venture between Société Minière du Sud Pacifique SA and Glencore can be found in New Caledonia, a French territory in the South Pacific. Glencore has been involved since the Xstrata transaction back in 2013 and has funded more than $4 billion over the past decade without realising a profit at any stage.

This is obviously a terrible outcome for shareholders and enough is enough at some point. The mine is very important to the local economy but is simply untenable in the current market conditions for nickel. This is despite the best efforts of the French government to try and support the ongoing operation of the mine.

The operation will be moved into a state of care and maintenance, with the furnaces to remain hot for six months. All local employees will be retained for that period. Glencore will try to find a new industrial partner for the mine in an effort to avoid the economic fallout for the region.

Sirius buys two business parks in Germany (JSE: SRE)

The acquisitions have been funded from the November capital raise

Sirius Real Estate is listed on the JSE, but you won’t find any of the fund’s money flowing into local opportunities. This is a perfect example of how you can invest on the JSE and give your money a passport in the process. The fund is focused firmly on business and industrial parks in Germany and the UK.

The latest deal is to acquire two business parks in Germany for €40 million. The deals have been funded by the proceeds of the €147 million capital raise that was concluded back in November. It’s been a busy time for Sirius, as the fund acquired three UK properties in North London for €33.5 million towards the end of 2023.

The two German properties are of very similar values. The first is in Köln and was acquired for €20.0 million, with an EPRA net initial yield of 7.3%. The occupancy rate is just over 89% and the weighted average lease expiry is 2.4 years. The second property is in Göppingen and was acquired for €19.8 million. It has been acquired on an EPRA net initial yield of 6.9%. Occupancy is at 86% and the weighted average lease expiry is 2.8 years.

In both cases, Sirius will look for value-add opportunities to improve the economics of the properties. Sirius already owns other properties in the areas and so there is familiarity with both regions.

From the capital raised in November, €78 million has been committed to legally binding acquisitions and Sirius is in discussions for opportunities related to the remaining €70 million or so.

Little Bites:

- Director dealings:

- The CEO of Invicta (JSE: IVT), Steven Joffe, as well as Dr. Christo Wiese have been at it again with buying up shares in the company. The latest purchase is to the value of R985k for each of them.

- The CEO of RH Bophelo (JSE: RHB) has bought shares in the company worth R401k.

- Associates of directors of Nictus (JSE: NCS) have bought shares worth just under R24k.

- This isn’t a director dealing in the usual sense as it relates to share options rather than an outright sale or purchase, but I simply had to mention a director of Naspers (JSE: NPN) selling shares worth a spectacular R79.8 million. Best of all, this only represents around 58% of the shares received under the share options that were exercised. It’s tough at the top, hey.

- Cognition Holdings (JSE: CGN) released a rather amusing trading statement, noting that HEPS for the six months to December 2023 will be up by between 260% and 280%. This is thanks to returns on cash balances held over the period after the disposal of the Private Property platform. The company also renewed the cautionary announcement related to ongoing discussions with Caxton and CTP Publishers and Printers (JSE: CAT), Cognition’s holding company.

- The chair of Sasfin (JSE: SFN), Deon de Kock, has unfortunately had to step down for medical reasons. Current lead independent director Richard Buchholz has been nominated as his replacement, subject to approval by the Prudential Authority.

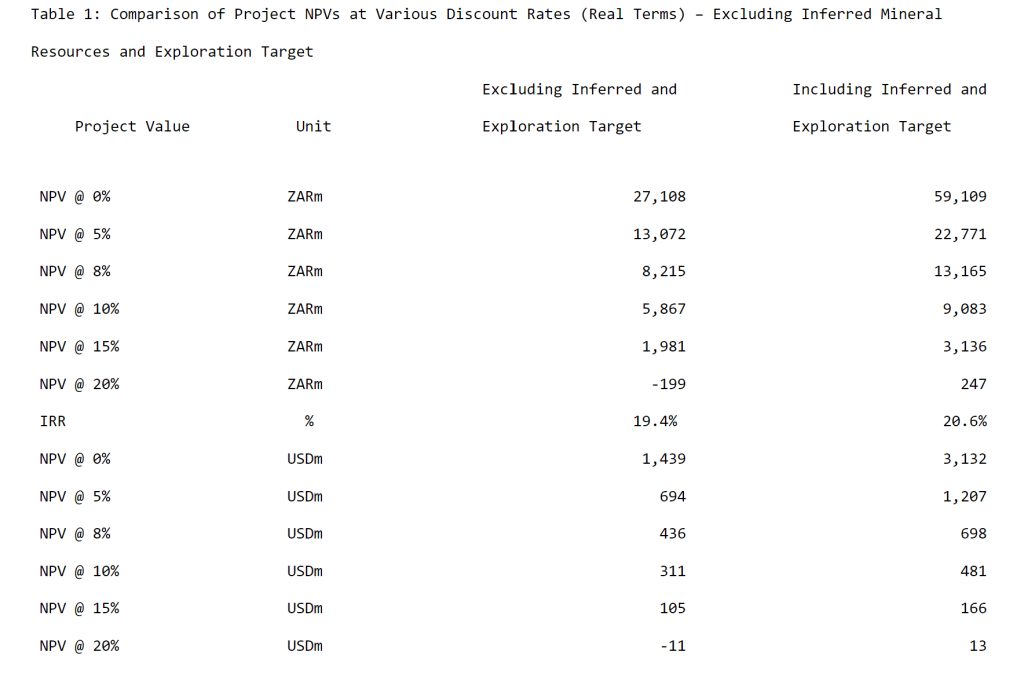

- Southern Palladium (JSE: SDL) released an addendum to the Bengwenyama project study. Perhaps I’m misreading it (and very happy to be corrected), but it suggests a project IRR of roughly 20% (see table below). That doesn’t sound like anywhere near enough to make junior mining appealing, especially in PGMs!