Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

At Anglo American, Kabwe raises its head once more (JSE: AGL)

This is despite the High Court previously dismissing the claimants’ application

If you would like to read a particularly interesting sequence of events, then check out this link on the Anglo American website that sets out the company’s position on the Kabwe lead mine and the associated class action.

I quite enjoyed this paragraph:

“We strongly encourage careful consideration of the commercial motives of law firms and their funders in bringing a case like this, in singling out AASA as part of a major reputable mining company while completely ignoring the evidence and clear culpability of the actual responsible parties.”

The High Court previously dismissed the application by the claimants. They took almost a year to make that decision, highlighting multiple legal and factual flaws.

The High Court has now granted the claimants the right to appeal the judgment. Anglo American will obviously oppose any appeal that may now follow.

Cashbuild: is this finally the bottom? (JSE: CSB)

Volumes have finally stopped falling

Cashbuild has been really struggling to find any growth at all in this difficult environment in South Africa. Thanks to issues like load shedding and higher interest rates, it’s hard to find South Africans will to invest in their properties.

Perhaps assisted by the lack of load shedding, there are finally signs of life in the latest quarter. It really didn’t come a moment too soon, as the share price has seen a lot of pain:

Revenue for the third quarter of the year was up by 2% for existing stores. Importantly, sales volumes were flat in existing stores, which means that Cashbuild may finally have bottomed. Goodness knows 3% group revenue growth isn’t nearly enough to be exciting, but at least it’s heading in the right direction again. Selling inflation was 2.4% higher year-on-year.

Cashbuild South Africa (over 80% of group sales) was positive in terms of existing growth. Even P&L Hardware, which has really been suffering, managed to achieve a flat performance for the quarter. Pressure was mainly felt in Botswana and Malawi, which is the smallest segment in the group.

Merafe’s production was down sharply this quarter (JSE: MRF)

This is probably doing a few favours for Eskom as well

Merafe released its production report for the quarter ended March 2024. It reflects a 26% decrease in attributable ferrochrome production from the Glencore Merafe Chrome Venture in the period.

This is because of the Rustenburg smelter not operating in response to market conditions. Smelters use a lot of electricity, so Eskom is the one company in South Africa that probably didn’t mind Merafe allowing the smelter to get a few cobwebs.

A win for Murray & Roberts in Latin America (JSE: MUR)

This is a helpful shift in momentum for materials handling contracts

Murray & Roberts announced that Terra Nova Technologies has a 51% share in a joint venture that has been awarded an engineering, procurement and construction (EPC) contract with a large copper producer for a mine in South America. The total contract value is around $200 million.

Over 27 months, starting this month, the scope of work will include a primary crushing facility, an overland conveyor, a power transmission system and associated infrastructure.

This is great for Terra Nova, as the order book has been a struggle since the end of COVID. The business was acquired by Cementation Americas in 2019 and was a decent contributor to earnings in the year before COVID.

With a share price down 92% over five years, Murray & Roberts needs all the good news it can get.

Dear, oh dear – not the “hype” language at Orion Minerals (JSE: ORN)

Words like “spectacular” get me worried

Orion Minerals closed 26% higher on Monday as the market jumped at the headline of the SENS announcement, which talked about a “spectacular high-grade copper intercept” at the Okiep Copper Project. This is clearly exciting news, but I get worried as a matter of principle when I see stuff like this. When companies are trying to hype up a share price, investors are in danger of nasty corrections in value.

The saving grace here is that the findings are spectacular, with the CEO noting that this is one of the highest grade intercepts reported in South Africa for the past 40 years, adding significantly to Orion’s early production plan for the Okiep Copper Project.

The proud South African in me loves seeing news like this and of course I wish them nothing but success. I just hope they don’t get drawn into the trap of using flowery language and then disappointing investors down the line when something goes wrong or gets delayed. Having a highly volatile share price isn’t a good thing.

South32: all on track, other than Tropical Cyclone Megan (JSE: S32)

FY24 production and operating cost guidance is unchanged, other than Australia Manganese

There are a lot of variables when it comes to mining. Management can do their best, but there’s not much they can do about angry weather. At South32, Tropical Cyclone Megan negatively impacted the performance at Australia Manganese. Operations there were suspended in March, with a recovery plan underway.

For an indication of why diversification is helpful in this sector, South Africa Manganese (same metal, different weather) achieved record production for the quarter ended March.

The overall story is that FY24 production and operating cost guidance is unchanged for the full year, except for Australia Manganese due to the weather. Important strategic steps included the approval of the development of the Taylor zinc-lead-silver deposit at Hermosa, as well as the decision to sell Illawarra Metallurgical Coal for up to $1.65 billion. That deal is expected to be completed in H1 FY25.

Net debt decreased by $154 million to $937 million in the quarter, thanks to the operating performance and partial release of working capital tied up in inventory.

Telkom releases the Swiftnet disposal circular (JSE: TKG)

And the advisors on the deal must be itching to spend their fortunes

The Swiftnet deal is very important for Telkom. They have the opportunity to sell the business for a base purchase price of R6.75 billion. The terms make allowance for balance sheet adjustments up until the effective date of the deal.

It’s worth noting that up to R225 million of the existing R360 million shareholder loan may remain outstanding, with interest payable at a rate equal to the rate paid by the purchasing consortium to its bankers for the deal, plus 200 basis points. It would need to be fully settled within a 30 month period.

The buyer is a private equity consortium led by Actis and including Royal Bafokeng Infrastructure, with the latter holding not less than 30% of the shares. Those buyers will be getting their hands on a business that owns 4,000 commercially viable masts and towers in South Africa.

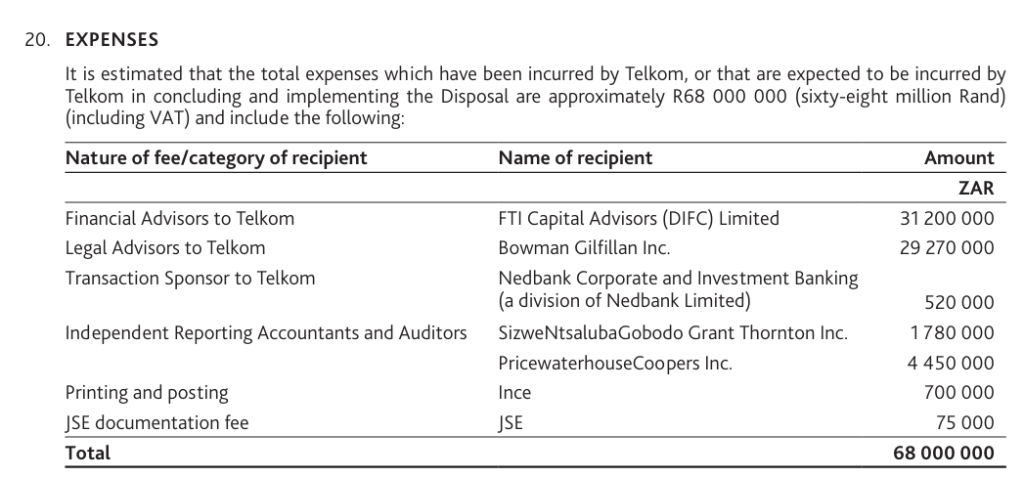

This deal is part of Telkom’s value unlocking strategy. We can’t be sure yet whether Telkom will deliver on that strategy, but we can certainly see the value unlocked by the financial and legal advisors in this deal:

If you ever wondered why corporate M&A is so lucrative for the advisors, it’s because percentage-based fees are accepted as the market norm. This is “only” 1% of deal value (roughly), but is still a vast sum overall.

Assuming Swiftnet will be sold, Telkom will primarily be left with Telkom Consumer, Openserve and Business Connexion. To give context to how big Swiftnet is within the group, the pro-forma financials for the six months to September 2023 (assuming Swiftnet had been sold at the start of the interim period) would’ve reflected HEPS that was 33% lower due to that business no longer being in the group.

Little Bites:

- I don’t usually bother with non-executive director changes in listed companies, but it’s worth noting that Warren Chapman has resigned as a non-executive director of enX (JSE: ENX).

- Ellies (JSE: ELI) has applied to the JSE for a voluntary suspension of trading of shares. There is no prospect of Ellies meeting the listings requirements given its current status. Interestingly, subsidiary Ellies Electronics (Pty) Limited continues to operate and the business rescue practitioner believes that it has a reasonable prospect of being saved. Perhaps only the listed structure will collapse and the Ellies name might live on. Only time will tell.

- I worry about how many shareholders actually read the odd-lot offer documentation at Coronation (JSE: CML) and considered the tax implications. Either way, holders of 65,699 shares sold their shares in the odd-lot offer and holders of 13,496 shares retained their shares. There were a further 141,105 shares sold in the specific offer. In total, Coronation mopped up 206,804 shares for a total investment of nearly R7 million. This is 0.05% of shares in issue.

- If you’re curious about how Anglo American (JSE: AGL) is thinking about sustainability and the projects they are delivering, then you’ll find the latest presentation on this topic at this link.

This really is some of the most insightful and entertaining reading

Thanks so much!

At a time when the SA mining industry, and juniors in particular, are desperate for investor support, your “Dear, oh dear – not the “hype” language at Orion Minerals (JSE: ORN) – Words like “spectacular” get me worried” is bound to put doubt in the minds of most. I understand you cannot be knowledgeable about all the listed companies making announcements, but a little homework would be preferable. By any global measure, some of the intersections are spectacular. The significant issues to focus on are mineralogy, impurities, depth and extent of the orebody, potential tonnage volumes and average grade, by-products, etc. Orion did quote an average grade figure to balance the ‘spectacular’. Give credit where credit is due and please come down hard on rogue explorers.

Hi Bruce! That’s fair comment – and hopefully in all my writing you see that I want to see great things out of South Africa. Having said that, I ultimately write for investors and especially retail investors who can so easily be swept away by hype. We’ve seen too many examples of this kind of thing locally. I do hold Orion in high regard and that’s why I wanted to raise this point actually. I personally am not sure that using a word like “spectacular” in an announcement heading is the best comms strategy, but there will be different views on this. Let’s hope they make money, create jobs and deliver shareholder returns! We want the same things.